Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Phemex!

Phemex is the most efficient crypto trading and investment platform. Phemex offers over 293 spot trading pairs, minimal fees, peer-to-peer trading, derivatives, up to 100x leverage, and $8,800 welcome rewards up for grabs! Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Make sure to check if Phemex is available in your jurisdiction.

In This Issue:

Think Even Bigger

Bitcoin Thoughts And Analysis

Altcoin Charts

Legacy Markets

Donald Trump Selects Howard Lutnick To Serve As Commerce Secretary

Coinbase Makes Room For cbBTC

Grayscale Continues To Innovate

Saylor Takes On Microsoft

Trump Goes All-In Crypto | Bitcoin To Break All Time High

Think Even Bigger

Earlier this year, in mid-July, I wrote a newsletter titled *“Think Bigger.”*

At the time, Bitcoin was trading at $65,000, requiring a 53.85% increase to reach the milestone of $100,000.

This is how I began that letter:

Let me put this as plainly as I can: “I’m STILL incredibly bullish on this market.”

But Scott, we’re up 43.8% since you said that last time, and Bitcoin is almost at $100,000—shouldn’t you be taking profits or dialing back your bullishness? My response? “Hell no.”

Since July, a lot has materially changed in this space. If there’s ever been a moment when tangible narratives are starting to take shape, it’s now. Sure, Bitcoin is beginning to price in catalysts like Trump’s election and growing interest from national governments, but let’s be honest—we’ve barely scratched the surface.

Today, I want to revisit some of the big narratives I highlighted back in July, while adding a few new ones to frame where this cycle might take us next. Because let’s face it—$100,000 isn’t a big enough target for what’s at stake.

Spot Bitcoin and Ethereum ETFs

Back in July, these were at the top of my list, and they remain there today. Spot Bitcoin and Ethereum ETFs are driving significant momentum in global crypto markets—from the U.S. and Canada to Brazil, Germany, and Switzerland. In the U.S., Bitcoin ETFs have far exceeded expectations, with IBIT hitting a record $4 billion in a single day this month and total spot volume across all funds reaching $6 billion on that same day. We’re likely just days away from spot Bitcoin ETFs crossing $100 billion in total net assets.

And this is happening without major wealth managers like Wells Fargo and Vanguard embracing these products yet. Ethereum, while not seeing the same level of success, is finally breaking free from outflow struggles. With staking on the rise and a potential new SEC chair, I’m still optimistic about Ethereum catching up, especially as Wall Street begins diversifying into ETH.

A New SEC Chair

We’re just starting to price in what this could mean for the industry. Trump could announce his pick any day, and given his serious approach to crypto, I expect him to choose someone pro-crypto. While crypto won’t be the primary focus of the new chair—given its relatively small size compared to other industries—a pro-crypto leader who provides clarity, ends the relentless attacks, and avoids micromanagement would be a game changer.

The biggest winners? Projects unfairly targeted by the SEC and the DeFi space, which has been stifled in the U.S. by fear of fines, lawsuits, and even jail time. A pro-crypto chair could unleash a wave of DeFi activity, making the U.S. a hub for innovation instead of a place to avoid.

Tokenization and RWAs

Tokenization and Real-World Assets (RWAs) may not dominate headlines right now, but the builders are hard at work. The convergence of traditional and digital finance is closer than ever, with tokenized equities poised to revolutionize global investing. Larry Fink put it best: *“ETFs are step one in the technological revolution in financial markets. Step two will be the tokenization of every financial asset.”* Combined, crypto treasury products already total $2.4 billion and continue to grow.

Stablecoins

Stablecoins remain a quiet yet critical force in the market. Tether’s market cap rose from $100 billion in March to $128 billion today, a remarkable achievement. Stablecoin issuers are also expanding their treasuries and diversifying their business models in creative ways. Last week, Robinhood, Galaxy, Kraken, Paxos, Nuvei, and Bullish launched the Global Dollar Network, introducing USDG to compete with USDT and USDC. A trillion-dollar stablecoin market cap could easily be in play by 2030—or sooner.

Nation-States Buying Bitcoin

This is the ultimate game changer. If nation-states begin aggressively buying Bitcoin in 2025, competing to build reserves, every prediction we’ve made so far will go out the window. While I initially thought $150,000–$250,000 was a reasonable target for this cycle, the entrance of nation-states could propel Bitcoin far beyond those numbers.

A slow, steady climb toward $1 million seems more likely, but if we take the elevator instead of the stairs, many will be left behind—and it will hurt. Factor in Wall Street warming up, individual U.S. states buying in, and major corporations joining the movement, and the potential becomes astronomical.

The Long-Term Goal: Bitcoin Surpassing Gold

Here’s the other secret: Bitcoin will surpass gold in market cap. With gold sitting at $17.7 trillion and Bitcoin at $1.8 trillion, Bitcoin would need to hit roughly $850,000 to overtake gold—if my napkin math is correct. This milestone should be every long-term investor’s north star. It’s the “final boss” of financial markets—at least for now.

I said it in July, and I’m saying it again now in November—I’ve never been this bullish. While there’s a chance the U.S. delays its Bitcoin purchases, leading to a gradual climb, there’s also a chance they go all in, triggering a massive buy wall that propels Bitcoin to $300,000, $500,000, or even higher.

Alt season hasn’t even started yet—Valhalla awaits.

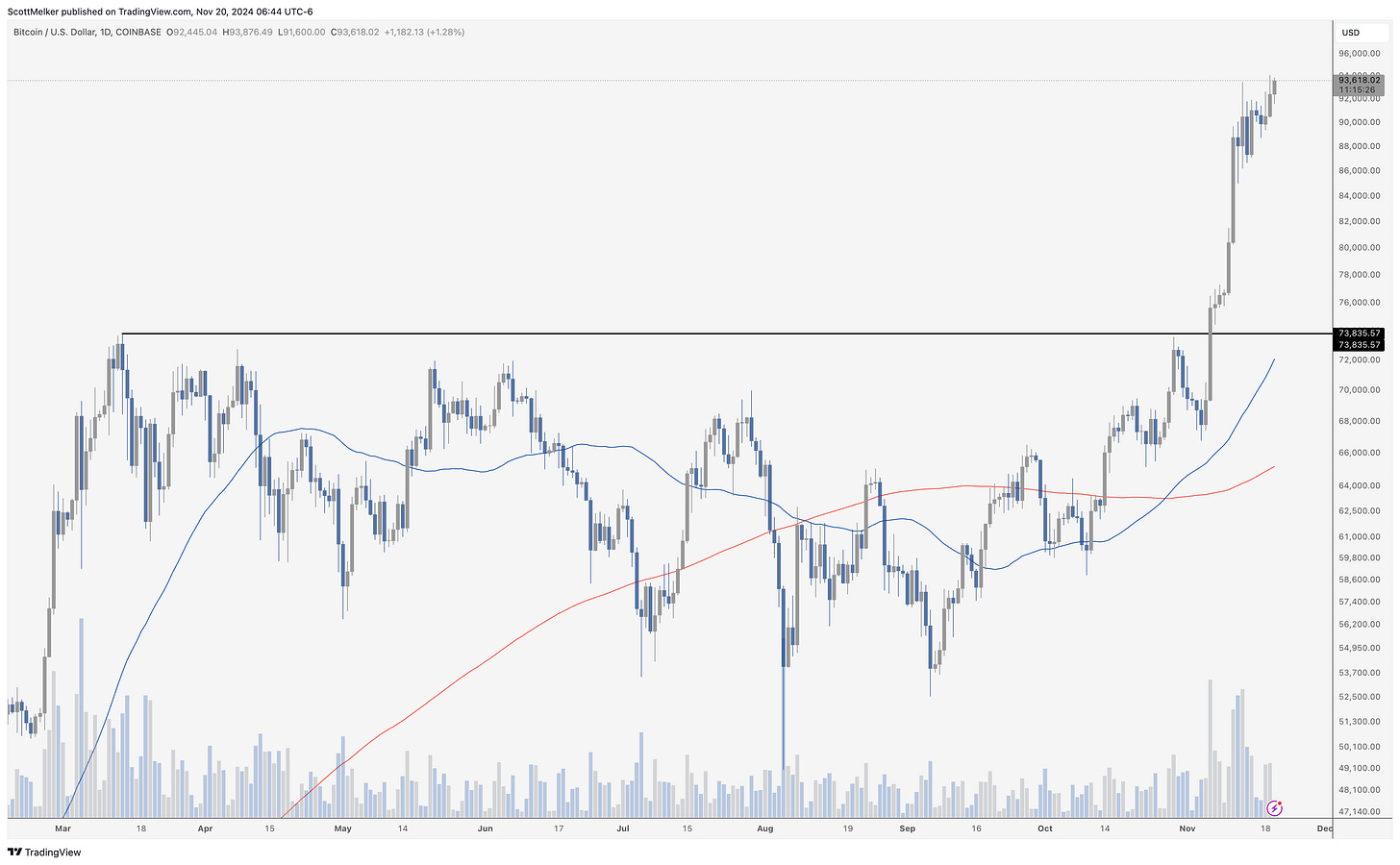

Bitcoin Thoughts And Analysis

Bitcoin is back to making new all time highs on a regular basis after a short period of consolidation.

Once again, don’t get cute. Just enjoy this ride.

Altcoin Charts

For those who are new here, I share SETUPS and not SIGNALS. These are ideas that I am watching - if a certain thing happens, then the trade triggers. I am not telling you what to buy or when. I am showing you how I am watching certain charts and what has to happen for me to take a trade.

I know, I know—Ethereum is dead. It’s a dinosaur. It’s been replaced by Solana. Nobody needs it. L2s are clunky and stealing all the gas fees.

It’s over—pack it in.

Except, it’s not. Ethereum has an ETF seeing net inflows, Larry Fink from BlackRock is actively proselytizing about using it to tokenize the world, and it’s beaten down—just as it is at this point in every cycle.

Maybe I’ll go down as a donkey, but every bottom signal I track in sentiment is beginning to show up.

The blue zone, around 0.031–0.029, is my high-conviction buy zone. I’m not sure the price will reach that level, but if it does, I’ll be buying aggressively. By then, we’ll likely see oversold RSI conditions on both the daily and weekly charts, along with more bullish divergence.

I remain confident that Ethereum will have its moment—and when it comes, it will be fast and furious.

Legacy Markets

US futures rose as traders focused on Nvidia's earnings, seen as the year's most critical remaining catalyst. S&P 500 futures climbed 0.2%, and Nasdaq 100 futures gained 0.3%, as Wall Street rebounded from recent volatility tied to the Russia-Ukraine conflict. Nvidia shares edged higher in premarket trading after a 4.9% gain, with investors watching whether its AI hardware-fueled growth can sustain its impressive run. Meanwhile, Target's shares plunged 20% in premarket after slashing its full-year outlook due to weak sales, contrasting with Walmart's stronger performance.

The dollar rebounded 0.3% after three days of losses, while 10-year Treasury yields rose slightly as risk sentiment improved. In Europe, the Stoxx 600 rose 0.3%, though the UK FTSE 100 lagged after a hotter-than-expected inflation reading reduced hopes for Bank of England rate cuts. Sage Group surged 22% on record intraday gains after announcing a buyback and strong revenue, while La Française de Jeux fell nearly 7% after a discounted share sale.

Bitcoin set another all-time high, fueled by growing acceptance of digital assets in the US, with crypto-friendly policies gaining traction under Trump. Meanwhile, traders kept a close eye on Trump’s Cabinet picks, including key roles like Treasury secretary, which could shape economic and monetary policy.

Key events this week:

Nvidia earnings, Wednesday

Fed’s Lisa Cook and Michelle Bowman speak, Wednesday

Eurozone consumer confidence, Thursday

US existing home sales, initial jobless claims, Philadelphia Fed factory index, Thursday

Eurozone HCOB Manufacturing & Services PMI, Friday

US University of Michigan consumer sentiment, S&P Global Manufacturing & Services PMI, Friday

Some of the main moves in markets:

Stocks

S&P 500 futures rose 0.2% as of 7:24 a.m. New York time

Nasdaq 100 futures rose 0.2%

Futures on the Dow Jones Industrial Average rose 0.2%

The Stoxx Europe 600 rose 0.3%

The MSCI World Index fell 0.1%

Currencies

The Bloomberg Dollar Spot Index rose 0.3%

The euro fell 0.4% to $1.0556

The British pound fell 0.1% to $1.2667

The Japanese yen fell 0.8% to 155.86 per dollar

Cryptocurrencies

Bitcoin rose 1.5% to $93,672.56

Ether was little changed at $3,094.6

Bonds

The yield on 10-year Treasuries advanced three basis points to 4.43%

Germany’s 10-year yield advanced four basis points to 2.38%

Britain’s 10-year yield advanced six basis points to 4.50%

Commodities

West Texas Intermediate crude rose 0.7% to $69.85 a barrel

Spot gold fell 0.2% to $2,627.98 an ounce

Donald Trump Selects Howard Lutnick To Serve As Commerce Secretary

Howard Lutnick, CEO of Cantor Fitzgerald—who spoke at the Bitcoin conference earlier this year and has been assisting Tether since 2021—has been selected to serve as Commerce Secretary, though not in the more influential Treasury Secretary role. Still, this is undeniably a win for Bitcoin. That said, Lutnick has been clear about the limits of his support. “I am a fan of crypto, but let me be very specific: Bitcoin, just Bitcoin. These other coins, they are just not a thing. I’m a big fan of this stablecoin called Tether.”

To better understand the role of Commerce Secretary, I asked ChatGPT for an explanation. Here’s what it provided:

“The U.S. Commerce Secretary leads the Department of Commerce, focusing on promoting economic growth, job creation, and sustainable development. They oversee trade policies, support U.S. businesses domestically and internationally, and encourage innovation through agencies like the Patent and Trademark Office and the National Institute of Standards and Technology. The Secretary also manages vital data collection through the Census Bureau and the Bureau of Economic Analysis, providing insights to guide economic policy and strategy.”

While Lutnick’s appointment is noteworthy, the most critical decisions for Bitcoin and crypto will come from the Treasury Secretary and SEC Chair. Either of these roles can significantly move the market.

Speaking of which, here’s what was trending yesterday evening:

Coinbase Makes Room For cbBTC

Coinbase announced it will end support for Wrapped Bitcoin (WBTC) across all platforms on December 19, 2024. While no specific reasons were provided, the decision follows the platform's latest review. WBTC order books have been switched to limit-only mode, but users will still be able to access and withdraw their funds after the suspension.

This move aligns with Coinbase’s recent launch of Coinbase Wrapped Bitcoin (cbBTC), an ERC-20 token backed 1:1 by Bitcoin held in Coinbase custody. Designed to integrate seamlessly with dApps, cbBTC is gaining traction. As of November 19, cbBTC boasts a $1.3 billion market cap and 15,070 tokens in circulation, predominantly on Base and Ethereum. While WBTC currently dominates the DeFi ecosystem, cbBTC may soon emerge as a formidable competitor.

Grayscale Continues To Innovate

Grayscale is introducing a Bitcoin Covered Call ETF, blending Bitcoin exposure with options trading to generate additional income. This aligns with the company's broader strategy to grow its Bitcoin Trust. Initially proposed in January, the ETF still lacks a trading ticker but reflects the SEC’s recent rule changes, which simplify the process of listing spot Bitcoin ETFs on U.S. exchanges. This development signals a growing array of alternative crypto investment options. Grayscale is also partnering with NYSE Arca to expand its ETF offerings beyond Bitcoin, further diversifying its portfolio in the crypto space.

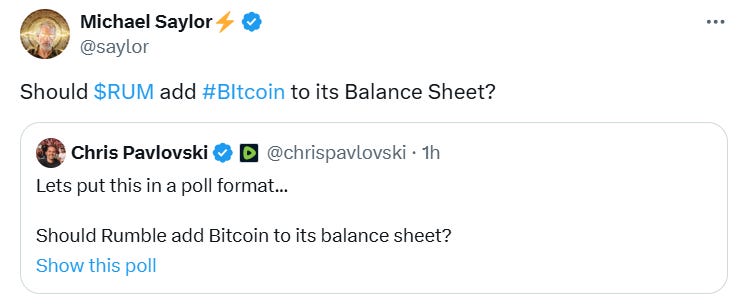

Saylor Takes On Microsoft

Two key thoughts: First, Michael Saylor was way ahead of the curve. Even now, we haven’t seen many major companies fully commit to Bitcoin. Second, imagine the ripple effect when we have 3, 5, or even 10 more “Saylors” out there—evangelizing not just companies, but potentially entire nations, into adopting a Bitcoin standard.

It’s clear that other companies and boards are closely watching what Saylor is doing, but the full “Saylor effect” hasn’t even begun to play out. I won’t be satisfied until the likes of Nvidia, Microsoft, Apple, and Amazon are stacking Bitcoin on their balance sheets. The true impact of this shift is still ahead of us, and it could redefine corporate finance on a global scale.

Trump Goes All-In Crypto | Bitcoin To Break All Time High

I am joined by Hailey Lennon, a crypto and fintech lawyer and Partner at BrownRudnickLLP, and Andrew Parish from The Arch Public.

My Recommended Platforms And Tools

Phemex - Exclusive for new users, earn up to 8800 USDT. Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '30OFF' for a 30% Black Friday discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.