The Wolf Den #1085 - Keep It Simple, Stupid

Don't make this bull market harder than it needs to be.

Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Arch Public!

Arch Public is thrilled to announce that The Bitcoin Algorithm™️ is live!

In partnership with Gemini the pursuit of #Bitcoin should be devoid of time/price FOMO!

And to put our money where our mouth is, it is free for the first 90 days. Buy Bitcoin with intelligence (and at a discount).

Try Arch Public now! You can even demo the platform, for free, to learn more.

In This Issue:

Keep It Simple, Stupid

Bitcoin Thoughts And Analysis

Altcoin Charts

Legacy Markets

Trump Is Making Strategic Crypto Moves

Bitcoin ETF Options Are Coming Today!

Michael F*cking Saylor!

Ethereum Escapes Outflow Hell

Bitcoin Bears: Prepare To Suffer, Bitcoin To Reach $200K This Cycle | Macro Monday

Keep It Simple, Stupid

Occam's Razor is one of my favorite principles to apply when I feel stuck in the mud over investment decisions. The principle suggests that when faced with competing explanations, the simplest one—requiring the fewest assumptions—is usually the best. By avoiding unnecessary complexity, Occam's Razor helps guide decision-making with clarity and simplicity. This principle is widely used in science, philosophy, and logic, and it’s equally valuable in the world of investing.

Today, I want to apply the principles of Occam’s Razor and highlight some of the common mistakes I see in this space—mistakes the so-called “gurus” often gloss over.

The Allure of Complexity

Complexity is often used to project sophistication and status, especially in crypto investment strategies. I used to be the guy obsessing over advanced technical analysis (TA) strategies until I realized I was overcomplicating things without actually improving my results. My timeline is constantly flooded with intricate charts and strategies that may look impressive but don’t necessarily deliver better outcomes.

Even institutional investors fall into the trap of embracing complexity—not because it’s more effective, but because it looks more impressive. The market doesn’t care how difficult your strategy is, but egos do. Crypto is already confusing enough to outsiders, and we don’t need to make it harder just to show off. Remember: Keep it simple, stupid—KISS.

The Illusion of Control

Investors are often drawn to complexity because it gives them a false sense of control. In the face of uncertainty, it’s natural to crave reassurance. However, that feeling of control is often an illusion. Many investors chase elaborate strategies simply to feel like they’re managing uncertainty, even if those strategies are flawed. Embracing simplicity means focusing on what you can actually control and letting go of the need to micromanage everything. It’s not about mastering every detail; it’s about understanding the bigger picture.

The Myth of Working Harder

The idea that working harder or spending more time will guarantee better investment results is a myth. Success isn’t about outworking everyone—it’s about making fewer, more deliberate decisions. A small number of high-quality trades over the course of a year often outperforms a high-volume, scattershot approach. For instance, Bill Ackman’s Pershing Square Capital focuses on just a few assets at a time, prioritizing quality over quantity. Investing isn’t about how much you do; it’s about doing the right things.

Complexity Breeds Deception

The more complex a system, the easier it becomes to be misled by randomness. Nicholas Taleb’s *Fooled by Randomness* is one of my favorite works on this topic. Overcomplicating your approach can lead to data-mining, over-optimization, and mistaking correlation for causation. Complexity invites bias and makes it easier to see patterns that don’t actually exist. Simplicity, on the other hand, minimizes these risks, helping you focus on what truly matters without falling into traps of false signals or misguided conclusions.

Conviction Should Be The Hardest Part

The toughest challenges in investing should revolve around building conviction, managing emotions, and practicing patience—not mastering technical analysis or timing trades. The real differentiator between successful investors and everyone else is emotional discipline and the ability to stick to your strategy through market noise and volatility. Tools like charts and TA are useful, but the real work lies in staying calm when others are panicking and maintaining focus when hype takes over.

This doesn’t mean investing is easy—it never will be. But the goal is to eliminate unnecessary difficulties, like overanalyzing technical details, and instead focus on mastering your mindset. The real challenges are building conviction, managing emotions, and staying patient. By cutting through complexity and embracing simplicity, you’ll be better equipped to handle market turbulence and achieve long-term success.

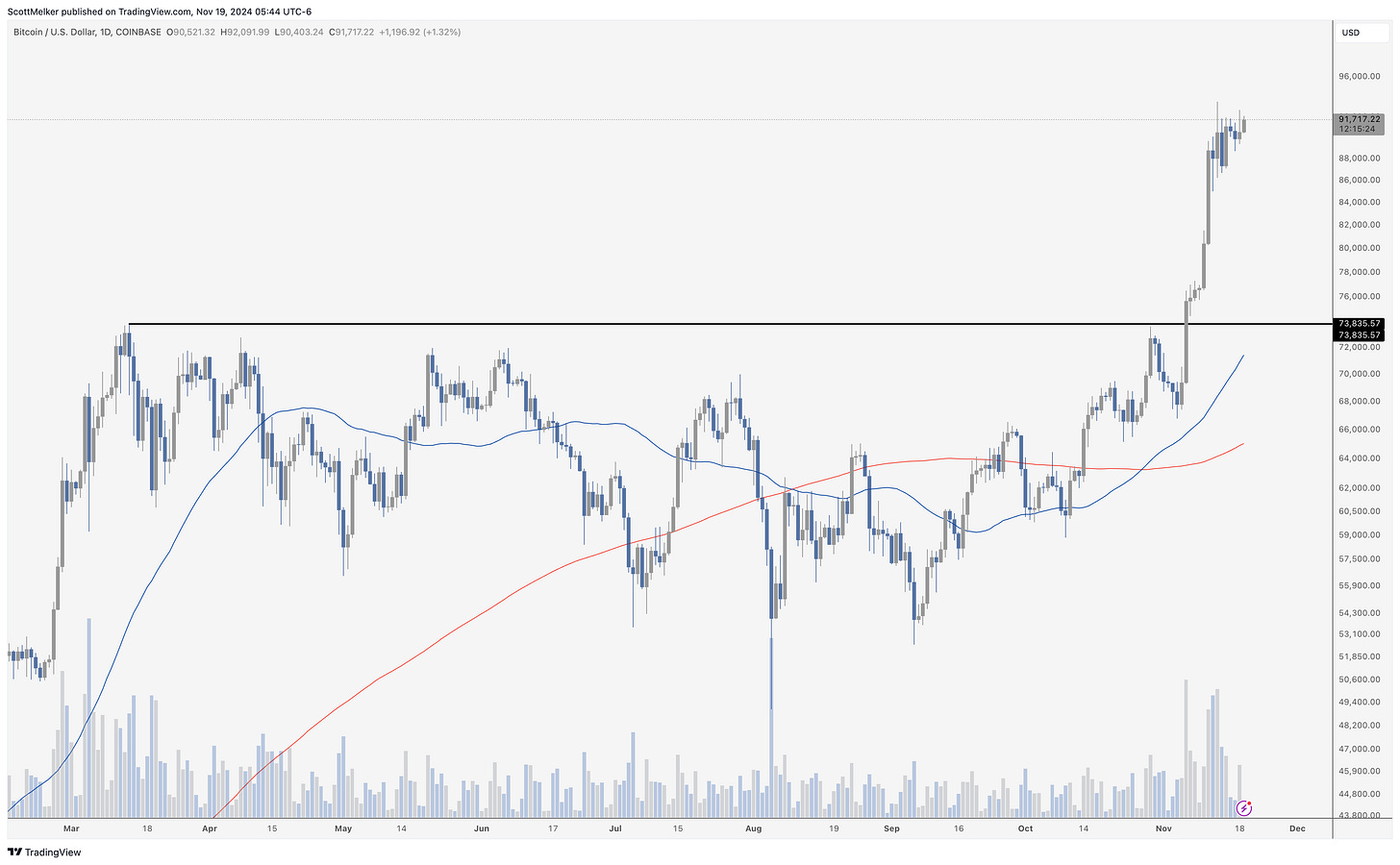

Bitcoin Thoughts And Analysis

There is so little to report - Bitcoin looks great and there is little to do but enjoy the ride.

Altcoin Charts

Be patient - alt season is coming…

Legacy Markets

Global markets took a hit as escalating tensions in the Russia-Ukraine conflict rattled traders. European equities fell nearly 1%, with Poland’s stock index dropping 2.5%, while S&P 500 futures dipped 0.4%. Bond yields declined globally, with German yields hitting their lowest since October and 10-year U.S. Treasury yields falling to 4.36%. Reports of Ukraine's first missile strike on Russian territory using Western-supplied weapons, coupled with President Putin’s approval of an updated nuclear doctrine, heightened geopolitical concerns. Safe-haven assets like gold, the yen, and the Swiss franc saw gains, with gold rising 0.9% to $2,635 an ounce. In commodities, natural gas climbed to near year-highs, while oil prices fell following the gradual restart of Europe’s largest oil field after a power outage. Meanwhile, Bitcoin surged above $91,000, nearing an all-time high, buoyed by growing institutional adoption, including Nasdaq's plan to list options on the iShares Bitcoin Trust. Investors are also watching Trump’s Treasury secretary nominations, which could shape financial policy and boost market confidence.

Key events this week:

Eurozone CPI, Tuesday

US housing starts, Tuesday

Fed’s Jeff Schmid speaks, Tuesday

China loan prime rates, Wednesday

Nvidia earnings, Wednesday

Fed’s Lisa Cook and Michelle Bowman speak, Wednesday

Eurozone consumer confidence, Thursday

US existing home sales, initial jobless claims, Philadelphia Fed factory index, Thursday

Eurozone HCOB Manufacturing & Services PMI, Friday

US University of Michigan consumer sentiment, S&P Global Manufacturing & Services PMI, Friday

Some of the main moves in markets:

Stocks

S&P 500 futures fell 0.4% as of 6:13 a.m. New York time

Nasdaq 100 futures fell 0.3%

Futures on the Dow Jones Industrial Average fell 0.6%

The Stoxx Europe 600 fell 0.9%

The MSCI World Index was little changed

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro fell 0.4% to $1.0559

The British pound fell 0.3% to $1.2638

The Japanese yen rose 0.5% to 153.81 per dollar

Cryptocurrencies

Bitcoin rose 0.4% to $91,756.14

Ether fell 0.6% to $3,130.59

Bonds

The yield on 10-year Treasuries declined five basis points to 4.37%

Germany’s 10-year yield declined six basis points to 2.31%

Britain’s 10-year yield declined four basis points to 4.42%

Commodities

West Texas Intermediate crude fell 0.6% to $68.72 a barrel

Spot gold rose 0.9% to $2,634.71 an ounce

Trump Is Making Strategic Crypto Moves

We may never know the exact details of these discussions, but it’s becoming increasingly clear that Trump wasn’t just using crypto as a campaign talking point. With 62 days until he takes office, it’s a promising sign that he’s actively engaging with key players in the crypto space to shape cabinet positions and explore opportunities. By taking these steps to understand the landscape before assuming the role, Trump is demonstrating that his interest in crypto goes beyond mere campaign rhetoric.

Also, Polymarket has the odds of a national Bitcoin reserve at 35%!

Bitcoin ETF Options Are Coming Today!

Last Friday, the CFTC announced the approval of Bitcoin ETF options for listing. Yesterday, the OCC followed up with their own green light, clearing the way for Bitcoin ETF options to officially launch. As a result, trading begins today, marking a significant milestone for Bitcoin and its expanding financial ecosystem.

Institutional investors and major asset management firms are positioned to benefit significantly from the introduction of spot Bitcoin ETF options. These players, experienced in leveraging derivatives, will gain access to new strategies for managing a volatile asset like Bitcoin. The availability of options also opens the door for more conservative asset managers, who may have previously hesitated to enter the market due to a lack of effective hedging tools. Furthermore, market makers and trading firms stand to profit from increased trading volumes and arbitrage opportunities, which in turn enhance liquidity and stability in the broader Bitcoin market.

Michael F*cking Saylor!

The buys keep getting bigger.

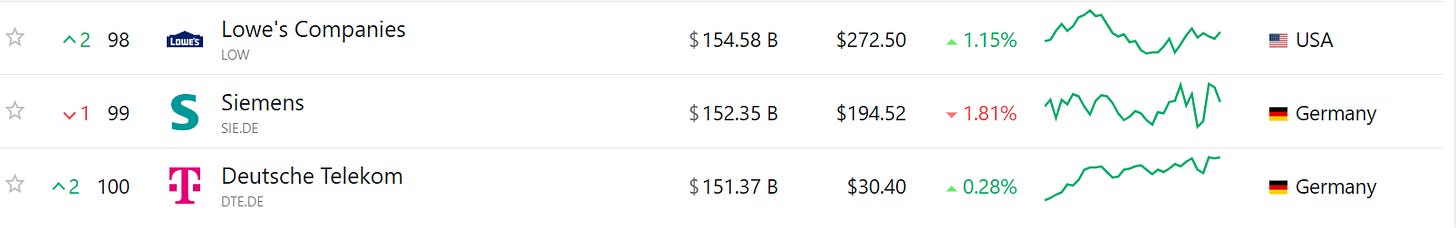

MicroStrategy (MSTR) is on an absolute tear right now, but here’s the kicker—its market cap is still just $75 billion. To break into the top 100 companies by market cap and claim the 100th spot, MicroStrategy would need to essentially double its current valuation. If some of the wild theories about Bitcoin’s future price come true and it surges beyond expectations, MicroStrategy could be positioned to shock the world. While crypto enthusiasts are well aware of MicroStrategy, its $75 billion valuation keeps it largely under the radar in the broader financial world. This company has a real shot at making waves and surprising everyone.

Before the day even ended, Michael Saylor managed to announce a private offering of $1.75 billion in convertible senior notes—unbelievable.

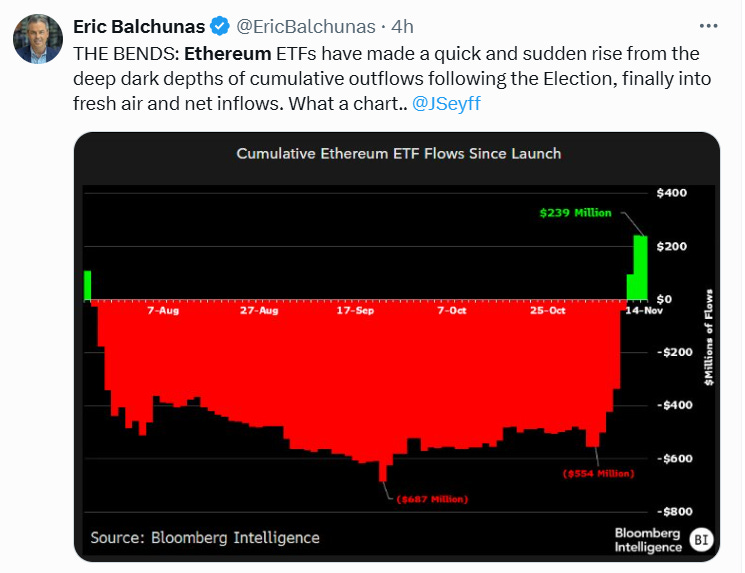

Ethereum Escapes Outflow Hell

Since July 23rd, Ethereum has been under relentless selling pressure, largely due to the massive $9 billion supply overhang from Grayscale’s Ethereum Trust (ETHE). Months of heavy outflows muted price action, but ETH has finally broken free, printing a strong green candle and hinting at a potential trend reversal. If this easing of selling pressure continues, we could be witnessing the beginning of a much-needed recovery.

Meanwhile, $1 billion USDT was just minted on Ethereum for a mere $5.39 in fees. Seriously, how can Ethereum not be the future of finance? Billions are moving seamlessly through its network, and the transaction fees remain astonishingly low. The case for Ethereum as the backbone of the financial future continues to strengthen.

I checked Grayscale's website and found that the Solana Trust holds just $113 million in assets under management (AUM)—a far cry from Ethereum's AUM at the time of its conversion. The upside? This lower AUM could mean significantly less selling pressure when a SOL ETF finally launches. The downside, however, is that the smaller AUM might reflect limited interest from Wall Street, potentially reducing the immediate market impact and adoption of a Solana ETF compared to Ethereum's.

Bitcoin Bears: Prepare To Suffer, Bitcoin To Reach $200K This Cycle | Macro Monday

Join Dave Weisberger, Mike McGlone, and James Lavish as we break down what's happening in macro and crypto!

My Recommended Platforms And Tools

Phemex - Exclusive for new users, earn up to 8800 USDT. Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '30OFF' for a 30% Black Friday discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.