Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Phemex!

Phemex is the most efficient crypto trading and investment platform. Phemex offers over 293 spot trading pairs, minimal fees, peer-to-peer trading, derivatives, up to 100x leverage, and $8,800 welcome rewards up for grabs! Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Make sure to check if Phemex is available in your jurisdiction.

In This Issue:

SOL/ETH

Bitcoin Thoughts And Analysis

Altcoin Charts

Legacy Markets

Poland May Implement A Bitcoin Strategic Reserve

Memecoin Interest Is At An All-Time High

Saylor Hints At Buying More BTC

Is It Time For NFTs To Return?

Crypto In The Trump Era | The New World Order Is Coming

SOL/ETH

The two most high-profile charts in crypto, outside of BTC/USD, are SOL/ETH and ETH/BTC.

You may have noticed I left out SOL/BTC, and there's a good reason for that. Solana holders tend to care more about how their investment performs against Ethereum than against Bitcoin. It’s no secret that Solana investors aren’t just aiming for gains in dollar terms or relative to Bitcoin. Their primary focus is whether Solana can outperform Ethereum, the leading smart contract platform. As long as Solana shows strength against ETH, its holders feel confident they’re on the right side of the trade. If ETH also happens to be weakening against Bitcoin, that’s just the cherry on top.

Before diving deeper into this discussion, I want to take a moment to share my perspective on analyzing assets through this lens. If you're already an experienced trader, feel free to skip ahead as I quickly cover some basics on how this strategy works.

The standard way to evaluate any asset is by examining its performance against the dollar. This method determines the price of assets like Bitcoin, Ethereum, Solana, or gold. Since cryptocurrencies are not yet widely used as a means of payment, comparing them solely against each other would be impractical and confusing. Using the dollar as a universal reference point provides a consistent framework to assess their value across the market, helping traders make more informed decisions when managing their portfolios.

Once traders grasp the broader market context, they often delve deeper by comparing one crypto asset to another, such as the ETH/BTC pair, which reflects Ethereum’s performance relative to Bitcoin. This approach allows traders to evaluate an asset’s performance not just in dollar terms but within the crypto ecosystem itself. By analyzing pairs like SOL/BTC, traders can assess the relative strength of two distinct assets, each influenced by unique factors, narratives, and market dynamics.

One popular strategy in crypto—trading altcoins to accumulate Bitcoin—benefits from monitoring charts like ETH/BTC or SOL/ETH. These charts help identify when Ethereum is outperforming Bitcoin or Solana is outperforming Ethereum. Recognizing these trends enables traders to make informed decisions about portfolio weight management and rotations. For example, when Ethereum is outperforming Bitcoin (as seen in the ETH/BTC chart), you can sell Ethereum for Bitcoin at a favorable rate, increasing your Bitcoin holdings. Additionally, tracking these ratios allows traders to capitalize on various altcoin bull and bear cycles, taking profits from specific coins and reinvesting them into Bitcoin once the trend shifts, optimizing asset rotation.

Before discussing the downsides of this strategy, it’s worth noting that comparing assets directly against each other lets traders move between positions more efficiently without converting to USD. By staying within the crypto ecosystem and using pairs like ETH/BTC, traders avoid the fees, delays, and market volatility associated with fiat conversions. This approach enhances portfolio management, enabling smoother rotations between assets based on performance while continuously accumulating Bitcoin—all without stepping into USD positions.

Now, let’s talk about the disadvantages.

You might be wondering why I haven’t touched on measuring the historical patterns of ETH/BTC or SOL/ETH yet—that’s because I saved it for the ‘disadvantages.’ While there’s some value for traders in examining these charts, I’m not a big fan of this approach. The primary issue is that crypto is still relatively young, and there’s not enough historical data to form strong convictions about medium- to long-term trends through this lens. There’s already considerable uncertainty in assessing assets historically against USD, so charts like ETH/BTC feel even less reliable. And don’t even get me started on comparing SOL to other assets.

Every few years, a new shiny object inevitably emerges, capturing the narrative and outshining, disrupting, or even displacing current leaders. Right now, it’s Solana and SUI. But if we wanted to analyze Solana historically and make assumptions without relying on hindsight, would charts like SOL/BTC or SOL/ETH have pointed us toward Solana as a potential winner? Would they have helped us see its rise to prominence? The reality is, probably not.Let me bring in the SOL/USD chart here for context.

Post-FTX, Solana was widely considered dead based on the charts. If an investor had relied solely on those charts, thinking, "Oh boy, this is the next big thing," then by that logic, they should now be buying XRP, ADA, XLM, BCH, and LTC with their profits from Solana. But they’re not.

Informed investors who bought Solana at its bottom didn’t do so just because it was cheap or relatively weak—they did it because Solana, fundamentally, made sense. At the time, it wasn’t obvious, and anyone claiming otherwise is likely lying to themselves. That said, many savvy investors saw potential in Solana’s technology and were rewarded for their conviction. However, luck also played a role, as a significant part of Solana’s success this cycle has been driven by memes. Predicting where the next retail meme frenzy will land is anyone’s guess—Solana just happened to catch the wave at the right time.

If traders made decisions solely based on these charts, they’d risk buying coins when their dominance is high and trending up and selling when their dominance is low and trending down. This is the exact opposite of how OG Solana investors made their profits. Those early investors didn’t buy Solana because it was dominating or trending upwards—they bought when it was undervalued and facing relative weakness. They understood the potential for growth long before the coin’s dominance surged, realizing that buying when sentiment was low, fundamentals were solid, and others were hesitant was the path to significant returns.

Of course, pulling this off isn’t easy. Being contrarian and wrong can be a death sentence in this space, where markets shift rapidly and the intensity of "cult-like" behavior can drain anyone who refuses to adapt. The pressure of being "wrong" as the market moves in the opposite direction can be brutal.

This dynamic feels similar to what ETH spot holders are experiencing right now—caught in a tough position as a vocal minority piles on ETH’s underperformance, criticizing holders to push their narrative. Meanwhile, Solana holders are well aware that their market cap is less than a third of Ethereum’s, leaving significant room for gains if value rotates from ETH to SOL.

Full disclaimer: I own ETH, and there’s definitely a part of me that wants to pull my hair out—because, well, I’m human. But there’s another part of me laughing comfortably because, A) the dogma around this debate is absurd, and B) Ethereum has done fine and will continue to do fine.

Hate can act like pure nitrous when paired with the right narrative and the right assets.

To all crypto investors: does Ethereum lose if Solana and Bitcoin outperform it? If your answer is "yes," I wish you the best of luck in your investing career. If you define yourself or your holdings as "winners" or "losers" based on how one well-performing asset compares to another, you’re setting yourself up for a lifetime of frustration. And if that’s the case, we’re all losers—thanks to NVIDIA. The market is much broader, and fixating on a single comparison won’t lead to long-term success.

This brings up another key point: sticking to your area of expertise. If you’ve spent years studying the fundamentals of an asset and building conviction, don’t abandon your circle of competence unless there’s an exceptionally good reason. Jumping ship just because another asset is outperforming doesn’t make sense unless you’ve got solid, rational grounds for doing so.

Unless you’re a highly skilled chartist, my advice is to take comparative charts with a grain of salt. They’re just one lens for assessing an asset. While they can provide some insight, they shouldn’t be the sole factor in your decision-making process, nor should they derail a course you carefully developed long ago.

Let’s have a killer week—there’s plenty of news to keep up with.

And to the haters who think I’m short on Solana: I’m not. I own some and enjoy watching it go up.

Bitcoin Thoughts And Analysis

Bitcoin appears to be consolidating after the major move up. Volume is slowly dropping and price is chopping. This usually is considered bullish and is the calm before the next storm. I have no concerns right now with Bitcoin.

Legacy Markets

Markets are off to an eventful start this week. US stock futures edged higher, with S&P 500 contracts showing small gains and Nasdaq 100 futures rising 0.4%, driven by Tesla’s premarket rally on speculation that the Trump administration might ease self-driving car regulations. Bitcoin rebounded to surpass $90,000 after recovering from its largest two-day retreat since the US election. Gold also climbed over 1%, with Goldman Sachs projecting it could hit a record $3,000 per ounce by December 2025, supported by central-bank buying and potential US interest rate cuts.

Investors are focusing on key developments, including Trump’s pick for Treasury Secretary and Nvidia’s earnings report on Wednesday, which will test the sustainability of AI-driven stock gains. Morgan Stanley’s Mike Wilson predicts the S&P 500 could rise 11% by the end of 2025, citing improved economic growth and further Federal Reserve rate cuts. Meanwhile, Europe’s Stoxx 600 fell 0.2% amid concerns over potential US tariffs and ongoing economic weakness in China. Inflation data from the Eurozone and the UK, due Tuesday and Wednesday respectively, will provide further insights into ECB and BOE policy directions.

In Asia, traders are closely watching a speech by Bank of Japan Governor Kazuo Ueda for hints about potential interest rate adjustments, especially as the yen weakened to 155.14 against the dollar. With inflation concerns, geopolitical uncertainty, and fluctuating market dynamics, this week’s developments across regions are likely to play a pivotal role in shaping investor sentiment.

Key events this week:

Group of 20 Summit in Brazil begins, Monday

European Union foreign ministers meet in Brussels, Monday

RBA meeting minutes, Tuesday

Eurozone CPI, Tuesday

Canada CPI, Tuesday

China loan prime rates, Wednesday

Indonesia rate decision, Wednesday

South Africa retail sales, CPI, Wednesday

UK CPI, Wednesday

Nvidia earnings, Wednesday

ECB President Christine Lagarde and Vice President Luis De Guindos speak, Wednesday

ECB issues financial stability review, Wednesday

Fed Governor Lisa Cook, Fed Governor Michelle Bowman speak, Wednesday

BOE Deputy Governor Dave Ramsden speaks, Wednesday

RBA Governor Michele Bullock speaks, Thursday

Japan CPI, Friday

India HSBC Manufacturing & Services PMI, Friday

Eurozone HCOB Manufacturing & Services PMI, Friday

UK retail sales, S&P Global Manufacturing & Services PMI, Friday

US University of Michigan consumer sentiment, S&P Global Manufacturing & Services PMI, Friday

Some of the main moves in markets:

Stocks

S&P 500 futures were little changed as of 6:15 a.m. New York time

Nasdaq 100 futures rose 0.4%

Futures on the Dow Jones Industrial Average fell 0.2%

The Stoxx Europe 600 fell 0.2%

The MSCI World Index was little changed

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro was little changed at $1.0539

The British pound was little changed at $1.2622

The Japanese yen fell 0.4% to 154.97 per dollar

Cryptocurrencies

Bitcoin rose 2.3% to $91,177.1

Ether rose 0.8% to $3,087.97

Bonds

The yield on 10-year Treasuries advanced two basis points to 4.46%

Germany’s 10-year yield advanced two basis points to 2.38%

Britain’s 10-year yield advanced one basis point to 4.49%

Commodities

West Texas Intermediate crude rose 0.6% to $67.39 a barrel

Spot gold rose 1.2% to $2,592.93 an ounce

Poland May Implement A Strategic Bitcoin Reserve

Polish presidential candidate Sławomir Mentzen has pledged to establish a Strategic Bitcoin Reserve if elected in May 2025. This initiative aligns with similar proposals from U.S. President-elect Donald Trump and El Salvador's President Nayib Bukele, who has already implemented a national Bitcoin reserve. If these plans proceed, 2025 could see three sitting presidents embracing Bitcoin reserves.

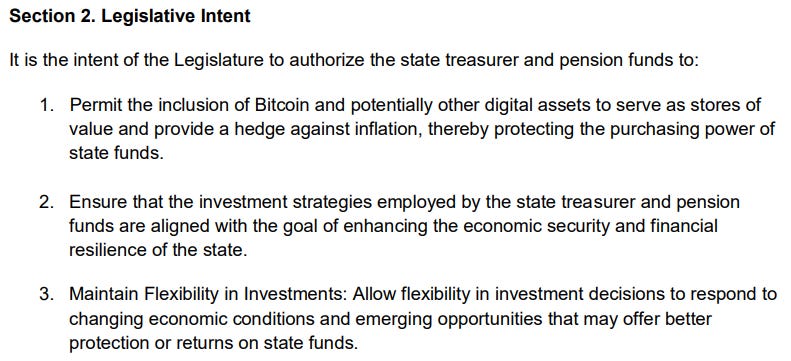

The Satoshi Action Fund has published an open-source 'Strategic Bitcoin Reserve' framework for lawmakers, states, and nations to use as a policy starting point. With this clear language now available and multiple countries signaling interest in purchasing Bitcoin, 2025 is shaping up to be a very exciting year.

I found it interesting that the language includes “potentially other digital assets.” Maybe a country adopts Bitcoin plus a basket of other cryptocurrencies, who knows?

Memecoin Interest Is At An All-Time High

The chart above shows Google searches for the term “memecoins” hitting a peak score of 100, indicating searches have never been higher. For me, this raises some red flags. My expectation is that we’ll see a pullback in meme interest across the board within the next couple of weeks, at most.

This could lead to a slowdown in the number of new memes entering the market, a sell-off from early holders to newer ones, and panic among less experienced entrants. Just this past week, we saw Robinhood and Coinbase jump into the meme game, which certainly feels like a "toppish" signal.

While meme mania has had an impressive run, history shows that every trend reaches a point where the music either stops or pauses. It’s hard to imagine this momentum sustaining indefinitely without a reset.

Saylor Hints At Buying More BTC

Michael Saylor shared this exact chart and commentary on November 11th, just a day before announcing that MicroStrategy had acquired 27,200 BTC for approximately $2.03 billion. With Bitcoin’s clean breakout to a new all-time high, it seems likely that MicroStrategy has even more runway to continue accumulating—a promising way to start the week.

Is It Time For NFTs To Return?

It feels like a lifetime since there was any real momentum in the NFT market, but things finally seem to be turning a corner.

“Ethereum led all blockchains with $67 million in NFT sales for the week, marking a 111% increase from the previous week. Bitcoin wasn’t far behind, recording $60 million in NFT sales—a 115% week-over-week surge.

Meanwhile, Solana, Mythos Chain, Immutable, Polygon, and BNB Chain collectively generated a weekly sales volume of $45.5 million.

Adding to the excitement, the average value of an NFT transaction grew significantly. Over the past week, the average NFT sale hit $133.08, an 87% jump from the previous week’s $71.11.”

It’s a refreshing change of pace for the NFT space, hinting at renewed interest and activity.

Crypto In The Trump Era | The New World Order Is Coming

I recorded this show last Friday, but didn’t get a chance to share it here, hope you enjoy. Friday Five is THE show about the main news in crypto. Join me and Nathaniel Whittemore as we delve into the main topics that moved the markets.

My Recommended Platforms And Tools

Phemex - Exclusive for new users, earn up to 8800 USDT. Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '30OFF' for a 30% Black Friday discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.