Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Arch Public!

The Bitcoin Algorithm has produced 1966% returns in the past four years. Yes, you read that right. Bitcoin is THE Alpha asset of finance. BlackRock and Larry Fink know that to be true. The Bitcoin Algorithm will be available to the public in partnership with Gemini on Monday, November 18th. Never miss an opportunity with Bitcoin again.

Try Arch Public now! You can even demo the platform, for free, to learn more.

In This Issue:

One Foot Out The Door

Bitcoin Thoughts And Analysis

Legacy Markets

Tether Is Ready To Tokenize Everything

Pennsylvania May Buy Bitcoin

Doodles Links Up With McDonalds

Polymarket CEO Raided By Authorities

Bitcoin Breakout Is Imminent | Institutions Are Getting Ready To Go All In On Crypto

One Foot Out The Door

Did Gary Gensler just say his final goodbyes—or at least hint at it?

Don’t tear up, clap, or even nod your head—none of that is warranted. Instead, grab a bottle of your favorite champagne or hard liquor and keep it close by. If you thought Trump’s return to office was good for crypto, just wait until Gensler is removed and squashed like a bug.

Yesterday, Gary delivered a speech in New York titled “Car Keys, Football, and Effective Administration” at PLI’s 56th Annual Institute on Securities Regulation. Naturally, there’s been some buzz about the speech sounding like a sappy farewell, so I had to dig in.

For context, Gary Gensler’s term officially ends on June 5, 2026—that’s 567 days from now. Decide for yourself, but what you’re about to read doesn’t exactly sound like something someone with 1.5 years left to serve would say.

Are we reading too much into this, or do these lines sound like something you’d say when you have one foot out the door?

“It’s been a great honor to serve with them, doing the people’s work, and ensuring that our capital markets remain the best in the world.”

“Sam and Jane Gensler, my mom and dad, never worked in finance or even completed college. When they invested their savings, our family benefited from the securities markets’ common-sense rules of the road.”

“I’ve been proud to serve with my colleagues at the SEC who, day in and day out, work to protect American families on the highways of finance.”

Why would the Chairman of the SEC start talking about what an honor it’s been, mention his parents, and reflect on how proud he is to serve with his colleagues if he still has 1.5 years left in his term? Long-time readers know I’m not one to wear a tinfoil hat, but this feels like a moment where we’re simply taking his words at face value. It sounds like he’s signaling his departure without outright saying, “I’m leaving.”

And when I say we shouldn’t cry, clap, or nod our heads, it’s not out of pettiness. It’s because Gary Gensler is still trying to trash the industry while his legacy is going up in flames.

“This is a field in which over the years there has been significant investor harm. Further, aside from speculative investing and possible use for illicit activities, the vast majority of crypto assets have yet to prove out sustainable use cases.”

This is coming from the Chairman of the SEC, the agency tasked with “facilitating capital formation,” who has completely and utterly failed at his job. And let’s not even get started on how he’s handling the protection of investors.

Is this really something he’s proud of?

“Our focus, rather, has been on some of the 10,000 or so other digital assets, many of which courts have ruled were offered or sold as securities. Putting this in context, aside from bitcoin, ether, and stablecoins, the rest of this market approximates $600 billion. That’s less than 20 percent of the whole crypto market and less than one quarter of one percent of the worldwide capital markets.”

Why would the SEC openly admit they’re focusing on the crypto market, which makes up less than 0.25% of worldwide markets, especially when they also acknowledged that “since 2018, this has represented generally between five-and-seven percent of our overall enforcement efforts”? Are you kidding me?

But there’s a silver lining: just yesterday, 18 U.S. states filed to sue the SEC.

“The lawsuit was jointly filed in a Kentucky district court by 18 Republican attorneys general from Kentucky, Nebraska, Tennessee, West Virginia, Iowa, Texas, Mississippi, Montana, Arkansas, Ohio, Kansas, Missouri, Indiana, Utah, Louisiana, South Carolina, Oklahoma, and Florida. The complaint was filed in collaboration with the crypto advocacy group DeFi Education Fund, which advocates for sound policy in the decentralized finance space.”

“The eighteen state AGs argue that by imposing penalties and restrictions on digital asset platforms without proper regulatory frameworks, the SEC’s actions have introduced ‘significant risks’ to one of America’s fastest-growing economic sectors. This approach, they claim, stifles innovation, disrupts the financial industry, and displaces state-led regulatory efforts better suited to protecting consumers and fostering economic growth.”

The crypto industry has been a massive thorn in Gary Gensler’s side over the past couple of years. From the countless dissents from the agency’s own commissioners to congressional testimonies that ripped apart Gensler’s ‘regulation by enforcement’ strategy, the resistance has been fierce. And let’s not forget how the ETH ETF was miraculously approved at the last minute, seemingly against his will.

Now, imagine the challenges ahead for Gensler when the President of the United States openly calls for his firing. While Trump doesn’t have the direct authority to hand Gensler a box and tell him to pack up, he can make Gensler a political target by calling for investigations or pushing for his removal. This kind of pressure could cripple Gensler’s ability to lead the SEC effectively, making it nearly impossible for him to continue running things the way he has.

Love or hate Trump, you’ve got to admit he knows how to get rid of someone he wants gone. The guy has 14 seasons of experience firing people under his belt.

As an aside, perhaps my proudest moment in crypto will be starting the hashtag #FireGaryGensler on X and getting it repeatedly trending. My mother will be so proud.

I think the discussion now shifts to: who will the replacement be?

For those unfamiliar, Chris Giancarlo served as the 13th chairman of the CFTC, with his term ending on April 13, 2019. Based on this post, it appears he won’t be selected for the role.

That said, one of the top contenders for the position is believed to be this guy:

Dan Gallagher is currently the Chief Legal, Compliance, and Corporate Affairs Officer at Robinhood Markets. He previously served as a Commissioner of the SEC from 2011 to 2015 and held several other roles within the agency before his appointment. Dan’s work at Robinhood speaks for itself—he would be a solid choice to lead the SEC.

Other names being floated include Robert Stebbins, Heath Tarbert, Erica Williams, Paul Atkins, Chris Brummer, and of course, our favorite, Hester Peirce.

I won’t bore you with all the details about these individuals—especially since the final pick could be someone completely unexpected—but here’s the key takeaway: I’m confident anyone will be better than what we have now. With Trump taking crypto seriously, he’s unlikely to appoint someone who won’t treat the industry fairly.

Before I wrap up, there’s another rumor making the rounds that I want to touch on…

This move could drastically lower the barrier to entry in the crypto market, making it more accessible and attractive compared to all other financial markets. It would likely push other countries to follow suit, igniting an unprecedented wave of innovation in the U.S. If this happens, we could see a market pump unlike anything before—eclipsing even the buzz around ETF news or Trump’s presidency.

I’d have to move the goalposts if this were to become reality.

For Trump to make this happen, there would need to be a compelling reason for crypto to receive such preferential treatment. Could it be an attempt to compensate for the industry’s mistreatment over the past decade in the U.S.? Or is it a strategic play for the U.S. to cement itself as the global hub for crypto, with investment incentives as the pathway to that dominance?

This wouldn’t just be about tax policy—it would be about positioning the U.S. as the uncontested leader in the digital financial revolution.

That said, we have no evidence yet to suggest this is happening, so don’t get your hopes up. The Pennsylvania news we’ve already received is significant, and there’s plenty more to look forward to.

I hope you all have a great weekend, find time to step away from the screens, and enjoy life outside of crypto. The next few months promise to be one wild ride.

Bitcoin Thoughts And Analysis

DAILY CHART

Bitcoin is taking a quick breather and consolidating. Nothing to worry about here.

Legacy Markets

Global stocks fell as Federal Reserve Chair Jerome Powell signaled no urgency to cut interest rates, and unease grew over President-elect Donald Trump’s cabinet picks. Europe’s Stoxx 600 dropped 0.3%, with pharmaceutical stocks leading losses after Trump named a vaccine skeptic to a top health role, impacting companies like Sanofi, GSK, and AstraZeneca.

US equity futures pointed to a second day of declines, with Nasdaq 100 contracts down 0.9%. Moderna, Novavax, and BioNTech slid in premarket trading, while Domino’s Pizza rose after Berkshire Hathaway disclosed a stake. The S&P 500 has given up one-third of its post-election rally as optimism fades amid slower-than-expected rate cuts and persistent inflation concerns.

Powell’s comments reduced the odds of a December rate cut to below 60% from 80% earlier, stabilizing two-year Treasury yields. The dollar, supported by a “higher-for-longer” rate outlook, is set for its seventh consecutive weekly gain, while Bitcoin retreated from its $93,000 record as markets await concrete crypto-friendly actions from the Trump administration.

In Asia, MSCI’s regional index recorded its first weekly gain, though China’s CSI 300 dipped. Oil and gold are heading for weekly losses, weighed down by the strong dollar. Retail sales data and further Fed commentary expected later Friday may provide more clarity.

Key events this week:

US retail sales, Empire manufacturing, industrial production, Friday

Some of the main moves in markets:

Stocks

The Stoxx Europe 600 fell 0.7% as of 8:19 a.m. London time

S&P 500 futures fell 0.6%

Nasdaq 100 futures fell 0.9%

Futures on the Dow Jones Industrial Average fell 0.6%

The MSCI Asia Pacific Index rose 0.3%

The MSCI Emerging Markets Index rose 0.1%

Currencies

The Bloomberg Dollar Spot Index fell 0.2%

The euro rose 0.2% to $1.0556

The Japanese yen rose 0.3% to 155.75 per dollar

The offshore yuan rose 0.2% to 7.2379 per dollar

The British pound was little changed at $1.2661

Cryptocurrencies

Bitcoin fell 0.6% to $87,685.14

Ether fell 2.6% to $3,038.95

Bonds

The yield on 10-year Treasuries advanced one basis point to 4.45%

Germany’s 10-year yield advanced one basis point to 2.35%

Britain’s 10-year yield advanced two basis points to 4.50%

Commodities

Brent crude fell 1.5% to $71.47 a barrel

Spot gold was little changed

Tether Is Ready To Tokenize Everything

Tether’s CEO, Paolo Ardoino, hinted not long ago that the company had some announcements lined up for after the election buzz died down. This is likely one of those updates they’ve been holding back. Tether’s ambitions clearly extend beyond being just a stablecoin company, as demonstrated by its diverse range of initiatives this year, including ventures in mining, gold, technology, and education.

While details about *Hadron* remain limited and it isn’t available for use yet, a statement I came across suggests users will likely have access to multiple popular blockchains. According to the statement: “Connect your non-custodial wallet, select your preferred blockchain, choose a KYC template, and set up access, controls, blockchain key management, and create your first tokenized...”asset.”

Pennsylvania May Buy Bitcoin

A few days ago, I explained why it’s significant if individual U.S. states start buying Bitcoin—primarily because U.S. states are economic powerhouses. Take Pennsylvania, for example: it’s the 6th largest state by GDP and has now surpassed the $1 trillion mark, a milestone achieved by only six states in the country. If Pennsylvania were a country, its GDP would rank between Saudi Arabia’s $1.11 trillion and Switzerland’s $938 billion.

Here’s what we know so far: “With inflation eroding the purchasing power of state-managed assets, the act authorizes up to 10% of state funds in select accounts to be invested in Bitcoin. This initiative aligns Pennsylvania’s financial strategy with a growing number of entities recognizing Bitcoin’s potential as a stable, long-term hedge.”

If Pennsylvania manages $7 billion in state funds, investing 10% in Bitcoin would equate to $700 million. For context, El Salvador’s Bitcoin holdings are valued at about $500 million. This comparison underscores how transformative such a move could be.

If you want to reach out to your lawmakers and ask them to sponsor “Strategic Bitcoin Reserve” legislation, you can easily do it using this preset template HERE (this is a much easier method than doing it on your own.)

Doodles Links Up With McDonalds

In just a few days, the holiday partnership between Doodles and McDonald’s goes live, featuring “over 100 million limited-edition McCafé x Doodles Holiday cups” at participating McDonald’s locations across the U.S. The collaboration includes an impressive array of branded content, from wearable merch and digital collectibles to original music and even a “pilot episode.”

For NFT holders and McDonald’s enthusiasts alike, this partnership is a win. I checked OpenSea to see how Doodles have been performing since the recent ETH pump and the announcement of this collaboration, and it appears the news has been well received.

Polymarket CEO Raided By Authorities

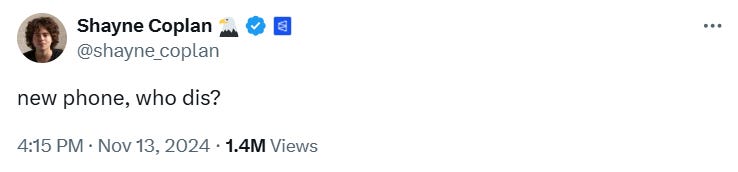

Federal law enforcement agents raided the New York home of Polymarket CEO Shayne Coplan on Wednesday, seizing his phone and electronics—hence the now-legendary tweet above. The early-morning raid followed the recent presidential election, during which Polymarket’s odds strongly favored Donald Trump over Vice President Kamala Harris, diverging sharply from mainstream opinion polls. Remarkably, Polymarket practically predicted the race’s outcome with high certainty hours before even right-leaning media broadcasts.

The DOJ is investigating Polymarket for allegedly allowing U.S. users to place bets on the platform. Polymarket called the raid “obvious political retribution” but confirmed that Coplan was not arrested. So far, the FBI, DOJ, and White House have declined to comment on the incident.

Bitcoin Breakout Is Imminent | Institutions Are Getting Ready To Go All In On Crypto

Mike Alfred, one of Bitcoin's most ardent bulls, joins me today to share his insights into the volatile crypto market. Wondering what's next for Bitcoin? Tune in to find out!

In the second part of the show, Dan from The Chart Guys will share his market analysis and some trades.

My Recommended Platforms And Tools

Phemex - Exclusive for new users, earn up to 8800 USDT. Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '30OFF' for a 30% Black Friday discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.