Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Trading Alpha Has A Black Friday Sale!

Trading Alpha, my go-to indicator site and trading community is having a massive Black Friday sale! 30% off both the Alpha Bundle and the Alpha Screener! If you have been thinking about gaining access to the proprietary Indicator Search Engine for All Markets, now is the time. This custom Indicator Screener scans crypto, stocks, and forex markets for Trading Alpha indicator setups, eliminating the need for time-consuming manual analysis.

Use code '30OFF' entered during checkout on left hand side for a 30% discount!

In This Issue:

Alt Season

Bitcoin Thoughts And Analysis

Legacy Markets

D.O.G.E.

Bitwise Is Making Moves And Predictions

Exchanges Are Gaining Confidence

BUIDL Goes Multichain

Gary Gensler’s Final Countdown | Bitcoin Hits The $90K Ceiling – Will It Soar Or Sink?

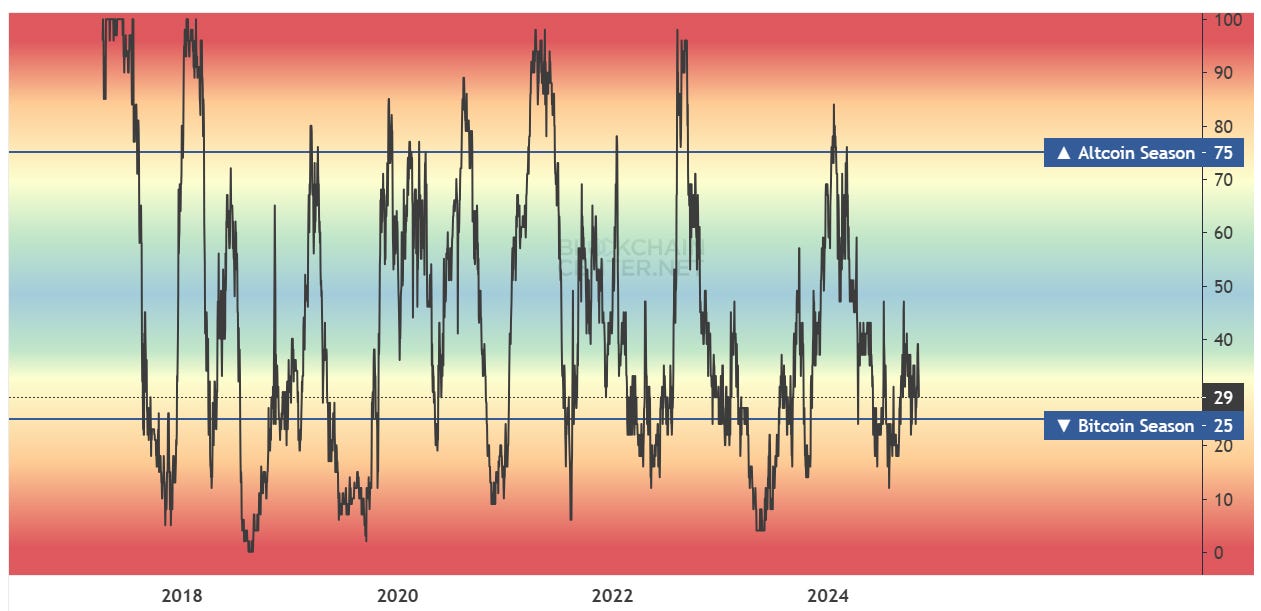

Alt Season

If we could chart news, its dominance would be at an all-time high. Excitement around the election results has faded, only to be replaced by an avalanche of fast-moving news—I can barely keep up.

For seasoned investors, traders, and newcomers alike, the big question on everyone’s mind is likely this:

“Where are we in this mini cycle right now?”

The past couple of weeks have been nothing short of wild. We’re flooded with Dennis Porter’s “Big news coming” posts (and yes, I’m intrigued). Alliance Bernstein is emphatically advising clients to buy crypto. Elon’s vision of DOGE as a government department is somehow unfolding. Mergers and acquisitions are heating up, MicroStrategy just hit an all-time high, and Coinbase has become the #1 finance app in the iOS store. Meanwhile, Bitcoin is racing toward $100,000 faster than expected, and meme coins are surging, with some already reaching new highs.

I could go on, but there’s just too much happening right now.

In the midst of all this, I want to draw your attention to an old tweet from September 11, 2023. In general, it still holds true.

Where do you think we are on this timeline right now?

We’ve definitely seen some things play out, while others haven’t yet. Just because BTC, ETH, alts, midcaps, microcaps, and meme coins have started pumping doesn’t mean we’re necessarily near the end of the run—though it *could* mean that!

If I wanted to, I could easily pick a point on the timeline and support it with plenty of evidence, but that would be shortsighted. We need to zoom out and view the bigger picture.

First, there are no strict rules for how capital flows through this space. There’s no committee of market makers deciding when Bitcoin has finished its run and it’s time for Ethereum to take over. Crypto is a free market like any other—the order book decides. This means the path won’t be perfect, and some coins and entire segments will inevitably get left behind.

Second, we haven’t seen a true altcoin pump yet. This might sound obvious, but we know this because the major altcoins aren’t near their all-time highs, while Bitcoin is already about 30% above its previous peak. Those 20-30% jumps we’re seeing across the board aren’t real capital rotations from Bitcoin to alts—they’re just rising tides lifting a few boats that haven’t even left the dock yet.

Third, neither Ethereum nor Solana have entered price discovery, and they’re not going to hit their cycle highs in the first week or two of reaching new territory. Reaching new all-time highs is a process, just like finding a bottom. There are still several altcoin legs left to play out in this cycle, which suggests Bitcoin has 1 to 3 big legs left as well.

Fourth, let’s talk about Bitcoin dominance. The last time it was this high—over 60%—was in March 2021, coming down from its previous peak of 70% in September 2019. Since January 2023, Bitcoin’s dominance over both Ethereum and other altcoins has been diverging, with a steady growth in dominance since December 2022.

My biggest takeaway from this chart is that there’s still plenty of time left in this cycle. If history is any indication, we should see Bitcoin dominance cross, touch, or at least approach the gray and blue trend lines before the cycle wraps up. Unless we just hit a peak in Bitcoin dominance (perhaps yesterday or today), we’re still diverging further apart, which extends the length of the larger cycle.

Another major takeaway from this chart is that prolonged Bitcoin dominance at these elevated levels is priming the market for an even more intense and extended alt season when it finally arrives. Having experienced multiple alt seasons before, I genuinely don’t think we’re there yet. This is just the appetizer—a rising tide lifting all boats, but not the massive groundswell that’s still ahead.

Altcoin holders can rest easy knowing that a delayed alt season is setting the stage for something bigger. If Bitcoin hadn’t pumped so hard and alt season came sooner, the performance would have been weaker. Alt season is like a spring: the longer it’s wound up, the stronger it will bounce when it finally takes off.

If you need more proof, take a look at the collection of charts below:

Long story short, we’re likely in a mini-cycle that falls somewhere in the middle of the flow chart above (I’ll share it again below). But if we zoom out, we’re still in the “BTC pumps” phase—which is literally step one.

I could throw a bunch of tips your way on maximizing profits from here, but instead, I’ll give you just one—because I want this to stick and not get lost in the noise. The gains you don’t want to miss are the ones that come when the rotation first kicks off. Not necessarily because they’re the biggest moves, but because you want to capture as much size as possible before we reach the point where selling becomes the responsible move.

To do this successfully, you’ve got to pick a horse and commit, even if it starts out slow. It takes guts—there’s no other way to put it. If you’re still sorting through your bags halfway through the run, you’ll get tossed around like a rag doll and miss out on massive gains. Pick one, two, or three solid coins, size your positions according to your risk tolerance, and hold tight. Nobody knows exactly when the groundswell is coming, but it *will* come.

Alt season is the best season. Bitcoin may be king, but there’s nothing like watching your bags take you straight to the moon.

Cheers to everyone who’s been waiting—it’s almost our time.

Bitcoin Thoughts And Analysis

Bitcoin began election night just below $70,000, only nine days ago. Since then, it’s hit a new all-time high every single day except Saturday. Astounding price action.

This move is due for a breather, but good luck guessing if that pause comes now or further down the road.

There’s no reason to do *anything* in this market right now besides hold your spot Bitcoin and chill. Once the dust settles, there’s likely to be opportunity everywhere.

Legacy Markets

Stocks rose on Thursday, driven by a positive outlook from ASML Holding NV and expectations of upcoming rate cuts. The Stoxx 600 index increased by 0.6%, led by ASML and Siemens AG, while US futures edged up 0.1%. The dollar extended its rally to a two-year high, weighing on assets like gold and the yen.

Euro-area data showed 0.9% annual economic growth, fueling hopes for a European Central Bank rate cut in December. In the US, inflation data also supported expectations of a potential Fed rate cut next month, though investors are weighing these against potential inflationary policies under President-elect Trump. His expected “America-First” policies have strengthened the dollar and may influence inflation next year. Traders now await US producer price data and a speech from Fed Chair Jerome Powell.

Key events this week:

Eurozone GDP, Thursday

US PPI, jobless claims, Thursday

Fed speakers include Jerome Powell, John Williams and Adriana Kugler, Thursday

China retail sales, industrial production, Friday

US retail sales, Empire manufacturing, industrial production, Friday

Some of the main moves in markets:

Stocks

The Stoxx Europe 600 rose 0.6% as of 11 a.m. London time

S&P 500 futures were little changed

Nasdaq 100 futures were little changed

Futures on the Dow Jones Industrial Average were little changed

The MSCI Asia Pacific Index fell 0.8%

The MSCI Emerging Markets Index fell 0.9%

Currencies

The Bloomberg Dollar Spot Index rose 0.3%

The euro fell 0.5% to $1.0512

The Japanese yen fell 0.4% to 156.04 per dollar

The offshore yuan fell 0.2% to 7.2592 per dollar

The British pound fell 0.5% to $1.2642

Cryptocurrencies

Bitcoin rose 2.9% to $91,203.79

Ether rose 0.9% to $3,184.33

Bonds

The yield on 10-year Treasuries was little changed at 4.45%

Germany’s 10-year yield declined two basis points to 2.37%

Britain’s 10-year yield was little changed at 4.53%

Commodities

Brent crude rose 0.4% to $72.56 a barrel

Spot gold fell 1% to $2,547.55 an ounce

D.O.G.E.

I’m guessing most of you have seen this Trump announcement already. Also, it’s pretty hilarious to see a serious politician casually drop ‘DOGE’ while discussing Supreme Court precedent.

Here's what I want to highlight: if Trump is willing to create a Department of Government Efficiency, why wouldn’t he consider a Bitcoin Strategic Reserve? Sure, they’re two entirely different concepts, but it’s clear he’s leaning into crypto. In my view, this news definitely improves the chances of the bill getting signed. Now, the only real question is *if* Trump will sign it, because I’m confident it’s already being drafted by the right people.

Bitwise Is Making Moves And Predictions

This segment is a two-for-one special. First up, we have Matt Hougan’s latest Bitwise Memo titled, *“Bitcoin to $500K.”* As a reminder, these memos are free to the public, and you can subscribe to receive one each week. In this memo, Matt argues, “But in my view, $500K per coin is the correct demarcation between early and late, for a very simple reason: It marks the point where bitcoin would be ‘mature.’”

The key point here is that at $500K per Bitcoin, its market cap would theoretically match gold’s—assuming gold’s market cap declines as Bitcoin’s grows. However, this dynamic will likely unfold differently. I believe true parity might be closer to $1 million per Bitcoin rather than $500K. Either way, Bitcoin is still early in its journey.

In other Bitwise news, the asset manager has acquired Attestant, as shown below. Bitwise isn’t just speculating on Ethereum’s potential this cycle—they’re acting on it, which signals a strong level of conviction. I read through the press release to check for any mention of ETH ETF staking, but found none. Still, I wouldn’t be surprised if this move is part of preparing for it.

From Attestant’s CEO and co-founder, Dr. Sreejith Das, PhD: “Many on our team at Attestant have backgrounds managing money and building institutional-grade technology infrastructure at large banks and financial institutions. We started Attestant in 2019 out of deep conviction that Ethereum and public blockchains are the future, and our DNA of capital preservation, compliance, and reporting has always remained core to what we’ve built. As we got to know Bitwise, we found a firm with those same values and found ourselves excited by the opportunity to do even more for clients as part of a larger firm.”

Crypto investors are seriously overlooking how much Wall Street will love earning yield on the ETH ETF once it launches. ETH ETF inflows are going to look entirely different when yield gets added to the equation.

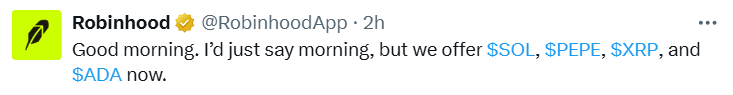

Exchanges Are Gaining Confidence

“As part of an effort to increase transparency by providing as much information symmetry as possible, Coinbase will be using this blog post to communicate when we have made a decision to list an asset.”

It appears that crypto exchanges are getting ahead of a potential Trump-led SEC regime change by listing assets they might have avoided otherwise. There’s no chance we’d be seeing these listings if Kamala Harris had won. Let’s call it the Trump Effect.

BUIDL Goes Multichain

BlackRock has announced an expansion of its USD Institutional Digital Liquidity Fund (BUIDL) with new share classes on multiple blockchain ecosystems, including Aptos (L1), Arbitrum (ETH L2), Avalanche (L1), Optimism’s OP Mainnet (ETH L2), and Polygon (ETH L2). Just as a reminder, BUIDL initially launched on Ethereum in March 2024. This move marks a significant step forward in the tokenization market, broadening access for investors, DAOs, and digital asset firms, while enabling developers to integrate the BlackRock fund within their preferred ecosystems. BUIDL quickly became the largest tokenized fund by AUM in under 40 days, underscoring its potential for scaling real-world asset tokenization. Notably, while BlackRock is branching into other chains and ETH L2s, there’s no mention of Solana.

Gary Gensler’s Final Countdown | Bitcoin Hits The $90K Ceiling – Will It Soar Or Sink?

I am joined by James Murphy aka the MetaLawMan as we break down the latest in crypto, regulation, politics and Gary Gensler's future.

Chris Inks will join us in the second part to share some interesting trades in crypto and beyond.

My Recommended Platforms And Tools

Phemex - Exclusive for new users, earn up to 8800 USDT. Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '30OFF' for a 30% Black Friday discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.