Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Phemex!

Phemex is the most efficient crypto trading and investment platform. Phemex offers over 293 spot trading pairs, minimal fees, peer-to-peer trading, derivatives, up to 100x leverage, and $8,800 welcome rewards up for grabs! Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Make sure to check if Phemex is available in your jurisdiction.

In This Issue:

The World Is About To Change

Bitcoin Thoughts And Analysis

Altcoin Charts

Legacy Markets

The Coinbase 50 Index

Another Company Adds Bitcoin To Its Reserves

Bitcoin Had Its Biggest Gain, Ever

Justin Drake Made A Big Announcement

I Guess Everything Will Get An ETF Proposal

Bitcoin To $100,000? Crypto Hits $3 Trillion Market Cap - Should You Buy More?

The World Is About To Change

I’ve been thinking a lot about the U.S. Bitcoin Strategic Reserve that’s up for grabs in 2025. This could be monumental for the future of the United States—not only for easing or even eliminating some of our debt but also for shaping Bitcoin’s trajectory. The idea feels more tangible than ever, yet I have to remind myself that these things take time, and unexpected events could easily delay or even derail it.

Just imagine: another pandemic, a conflict, or some other crisis could push this bill off the table entirely. While the concept seems within reach, the reality is far from certain, especially in the unpredictable world of crypto.

Today, November 13th, we may be just over two months away from Trump potentially signing a Bitcoin strategic reserve into law. But here’s another path to consider: what if individual U.S. states adopt their own Bitcoin standards independently? It might not sound as dramatic, but let’s be clear—this approach could be a game changer in the long run.

Perhaps we’ll see both the federal government and states buying Bitcoin, or maybe the nation will hold off, encouraging states to take the lead. There’s also the possibility that only the states move forward. It’s easy to get locked into binary thinking, but there are so many ways this could play out.

Just a couple of weeks ago, as we all focused on the election, Florida’s Chief Financial Officer, Jimmy Patronis, sent a letter to the State Board of Administration recommending they consider a position in Bitcoin. Now, to some of you, this may seem like a “nice step forward”—a casual, “Good for Florida” moment. But that misses the bigger picture entirely. As I share the details of the letter, I’ll break down why this move is far more significant than it seems.

“Florida’s economy is in its prime, with a Triple A bond rating for the fifth year in a row, record reserves, and we are outpacing the country in nearly every key economic metric. If Florida were its own sovereign nation, it would be the 16th largest economy globally. For generations, many states and countries have viewed Florida as an economic leader and innovator, given its impressive track record and pioneering spirit in various fields, including space travel and FinTech.”

Below is a self-explanatory chart of the four largest states in the U.S. by GDP.

If these four states—California, Texas, New York, and Florida—experience even a bit of outsized growth in 2024, they would collectively account for around 40% of the United States GDP. But let’s dive further into the contents of this letter, and I’ll explore this in more detail in just a moment.

“I am writing to you today with that same innovative spirit in mind. In a recent speech at the Bitcoin 2024 convention, President Donald Trump proposed the idea of a national stockpile of cryptocurrency, vowing to make the U.S. the world's cryptocurrency leader. This comes as the Communist Party of China makes inroads every day into the crypto world to grab control over this emerging currency. Trump said he would establish a crypto presidential advisory council and create a national "stockpile" of bitcoin using cryptocurrency the U.S. government currently holds, mostly seized in law enforcement actions. I believe this forethought and innovative thinking from a successful businessman like President Trump must not be taken for granted.

Recently, Governor Ron DeSantis also leaned forward to protect the personal finances of Floridians from government overreach and woke corporate monitoring by signing legislation to fight back against Central Bank Digital Currencies (CBDC). His leadership in this area protects consumers against globalist efforts to adopt a worldwide digital currency. Likewise, on its face, crypto is the antithesis of a central currency, providing decentralized digital currencies managed on blockchain technology, not issued or controlled by any government agency.”

The above isn’t part of the letter, but here’s a snapshot of countries ranked by GDP in 2024: Depending on how the numbers settle this year, California, if it were a nation, would have a GDP surpassing India’s and potentially even Japan’s. Texas’s GDP aligns closely with Brazil’s, New York’s is comparable to Canada’s, and Florida’s is on par with Spain’s.

“When managing state pensions for firefighters, teachers, and police officers, it's also essential to prioritize the bottom line and ensure the best return on investment for Floridians. This is where the potential of investing in a cryptocurrency, like Bitcoin, becomes particularly compelling. Bitcoin is often called “digital gold,” and it could help diversify the state’s portfolio and provide a secure hedge against the volatility of other major asset classes. The State Board of Administration maintains a Florida Growth Fund that allows for more innovative and emerging investments, and a Digital Currency Investment Pilot Program could be a perfect fit, offering potential benefits we cannot afford to overlook.

Two other states, Wisconsin and Michigan, have seen it wise to invest a small portion of their pension funds into cryptocurrency. In March, Arizona’s state Senate advanced efforts to add crypto to state retirement funds to encourage pension fund managers to consider crypto in their allocations. Moreover, Wyoming and Nebraska are leaders in crypto mining and have enacted dozens of laws to attract the industry, including a framework for chartering crypto banks.”

Now, consider this: what do you think would go more viral—Spain creating a Bitcoin reserve or Florida? In theory, if both bought the same amount of Bitcoin, they should attract similar attention. But realistically, Florida would likely generate more buzz. As a state with significant influence, Florida could easily inspire other states—and potentially the entire nation—to follow its lead.

“As a Trustee over the State Board of Administration, please consider this letter as a request to the SBA to provide a report on the feasibility, risk, and potential benefits of directing a portion of state retirement system monies into digital asset classes. This report should be provided to the Board of Trustees to better arm the Board and lawmakers with information before the next legislative session. There’s no telling what the future of cryptocurrency will be, but it’s important that the State of Florida stays ahead of the curve when considering new investments and providing the best returns for Floridians.”

The possibility of states buying Bitcoin for various reasons needs to be taken seriously, yet it’s barely being considered. Everyone in crypto is focused on the U.S. Bitcoin Strategic Reserve, but we’re overlooking an important fact—we live in a nation of 50 states, and any one of them could independently decide to adopt Bitcoin. A move like that would be equivalent to a major nation stepping into the Bitcoin arena.

I still have my doubts about the bill being signed and implemented within Trump’s first 100 days in office—mainly because I’d rather be pleasantly surprised than unpleasantly disappointed. But I firmly believe it will happen eventually. The U.S. is one of the few entities on Earth that can announce an intention to buy Bitcoin, take months to execute, and still have it not matter. Even if Bitcoin doubles or triples in price from when we first heard about the bill, it would hardly affect the U.S. at all—barely registering as a rounding error on the national balance sheet.

This is the luxury of a nation whose currency and debt structure serve as the global standard, with other countries effectively basing their financial systems on the U.S. dollar. Isn’t it ironic that printing more fiat dollars—the very thing Bitcoin was created to escape—will be what ultimately propels us higher?

The future is hilarious, poetic, and enormously transformative—and it’s all within reach. The world is about to change.

Bitcoin Thoughts And Analysis

Bitcoin has taken a slight breather after setting consecutive new highs, reaching an impressive peak of $89,993.69 on Coinbase—almost $90K. Incredible.

Over the past two days, we’ve seen some significant dips, liquidating both longs and shorts. Yet, these dips are being aggressively bought up, as shown by the long wicks down.

Interestingly, the liquidations have been almost evenly split between longs and shorts. This means that even those betting on the correct direction (up) are getting wiped out by the volatility due to leverage.

Don’t be one of those people.

This is only the beginning.

Altcoin Charts

For those who are new here, I share SETUPS and not SIGNALS. These are ideas that I am watching - if a certain thing happens, then the trade triggers. I am not telling you what to buy or when. I am showing you how I am watching certain charts and what has to happen for me to take a trade.

CRYPTO TOTAL MARKET CAP (TOTAL)

This is not an altcoin chart, per se, but it is very telling. This is the Total Marketcap of Crypto, including both Bitcoin and Ethereum. As you can see, this reached the all time high from the previous bull market, which was hit in November of 2021 - right around $3T.

We have not even STARTED this cycle yet (assuming we get one), and the entire market size is already equivalent to that peak. Imagine what happens when this breaks out…

Be patient, it is coming.

Legacy Markets

US stock futures dipped on Wednesday as investors awaited critical US inflation data, with concerns that President-elect Donald Trump's "America-First" policies could drive price growth. Nasdaq 100 futures fell 0.2%, while Treasuries steadied after a selloff on Tuesday. Tesla and Roivant Sciences saw gains in premarket trading following Musk and Ramaswamy's appointments to lead a new Department of Government Efficiency.

With inflation risk rising, traders are adding hedges and expecting fewer rate cuts next year, while today’s CPI data is anticipated to show a 0.2% increase for the fourth consecutive month. US yields remained stable after a 10 basis point jump Tuesday, and the odds of a December rate cut are now roughly 50%.

Trump’s anti-trade stance has also impacted emerging markets, with a drop in MSCI's non-US equity gauge and the yuan hitting a three-month low. The strong dollar pushed the yen to its lowest level since July, risking Japanese intervention. Bitcoin, which recently neared $90,000, also saw a slight decline. In other movements, Rocket Lab USA surged 26% in premarket trading on a strong revenue forecast, while ZoomInfo fell due to disappointing revenue projections.

Key events this week:

Eurozone industrial production, Wednesday

US CPI, Wednesday

Fed speakers include Jeffrey Schmid, Lorie Logan, Neel Kashkari and Alberto Musalem, Wednesday

Eurozone GDP, Thursday

US PPI, jobless claims, Thursday

Walt Disney earnings, Thursday

Fed speakers include Jerome Powell, John Williams and Adriana Kugler, Thursday

China retail sales, industrial production, Friday

US retail sales, Empire manufacturing, industrial production, Friday

Some of the main moves in markets:

Stocks

S&P 500 futures fell 0.1% as of 7:23 a.m. New York time

Nasdaq 100 futures fell 0.2%

Futures on the Dow Jones Industrial Average fell 0.2%

The Stoxx Europe 600 fell 0.3%

The MSCI World Index fell 0.1%

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro was little changed at $1.0628

The British pound was unchanged at $1.2748

The Japanese yen fell 0.2% to 154.87 per dollar

Cryptocurrencies

Bitcoin fell 0.6% to $87,820.51

Ether fell 3.5% to $3,166.59

Bonds

The yield on 10-year Treasuries declined two basis points to 4.41%

Germany’s 10-year yield advanced two basis points to 2.38%

Britain’s 10-year yield was little changed at 4.51%

Commodities

West Texas Intermediate crude was little changed

Spot gold rose 0.5% to $2,610.80 an ounce

The Coinbase 50 Index

“Instead of picking individual tokens, an investor can own the index, which automatically and dynamically selects the top 50 crypto assets based on clear rules. With one simple step, they can gain diversified exposure to the growing crypto market, giving them confidence and peace of mind.”

There’s a plethora of information available about COIN50, but some of the most important things you need to know are that:

“Eligible traders can trade this index via a COIN50 perpetual future (COIN50-PERP) with up to 20x leverage on Coinbase International Exchange and Coinbase Advanced.”

COIN50 is made in partnership with Coinbase Asset Management and Market Vector Indexes.

The index is rebalanced quarterly.

“The Coinbase 50 Index currently covers ~80% of the total crypto market cap.”

You can read the COIN50 White paper HERE.

Another Company Adds Bitcoin To Its Reserves

MicroStrategy’s influence is spreading, as it’s now been announced that Genius Group (GNS), a Singapore-based AI company, has adopted Bitcoin as its primary treasury asset, committing 90% of its current and future reserves to Bitcoin. The company plans an initial acquisition of $120 million worth of Bitcoin (about 1,380 BTC) and will enable Bitcoin payments on its Edtech platform. Following a board restructuring with crypto experts, Genius Group aims to emulate MicroStrategy's approach of using Bitcoin as a treasury reserve. This move is in line with recent decisions by other companies like Semler Scientific and Metaplanet, which have also added Bitcoin to their reserves.

“Genius Group is focused on educating students for the exponential technologies of the future. We see Bitcoin as being the primary store of value that will power these exponential technologies. The compelling case that we believe Michael Saylor and Microstrategy have made for public companies to invest in Bitcoin as their primary treasury reserve asset is one that we fully endorse. We believe with our Bitcoin-first strategy, we will be among the first NYSE American listed companies to fully embrace Microstrategy’s Bitcoin strategy, for the benefit of our shareholders.”

Bitcoin Had Its Biggest Gain, Ever

On my livestream yesterday morning, I shared this table and wanted to highlight it here. The largest dollar move Bitcoin has ever seen in a single day was $8,343, yet that day only ranked 49th in terms of percentage gain—a reminder of how much Bitcoin has grown. As Bitcoin continues to mature as an asset, these dollar gain records are bound to be shattered. When Bitcoin reaches $500,000 or even over $1 million, we might see daily swings of $50,000—or even $100,000.

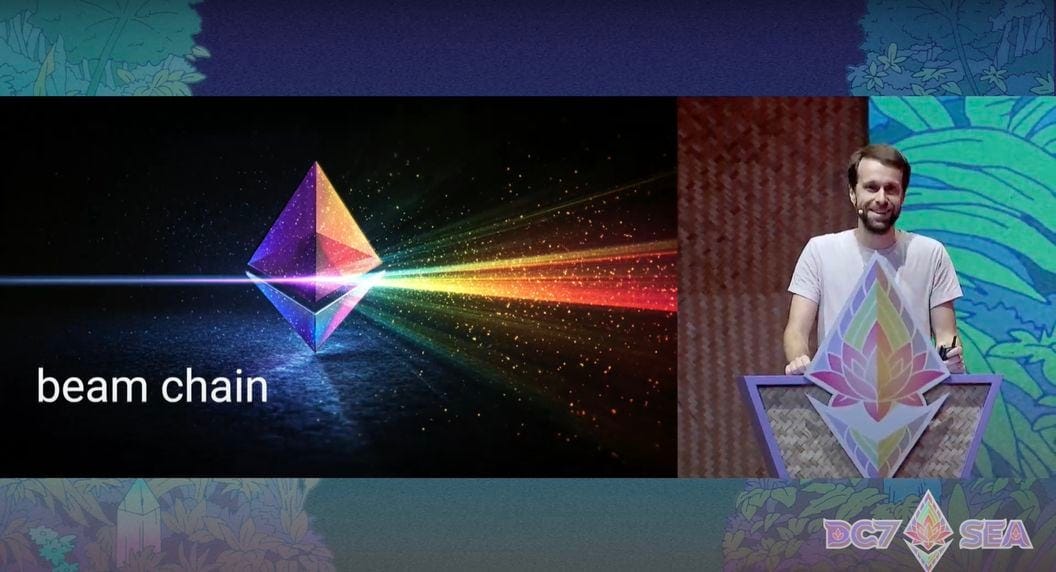

Justin Drake Made A Big Announcement

At Ethereum's Devcon conference in Bangkok, researcher Justin Drake introduced “Beam Chain,” a proposal for a major overhaul of Ethereum's consensus layer. Beam Chain aims to consolidate multiple upgrades into a single package, focusing on improving block production, staking mechanisms, and integrating zero-knowledge cryptography. This redesign targets Ethereum's Beacon Chain—the core of transaction processing, which has largely remained unchanged for five years. Although Beam Chain doesn’t propose immediate changes, it seeks to streamline future upgrades, moving away from annual incremental updates and instead bundling significant enhancements every few years. This approach has rekindled excitement in the Ethereum community, reminiscent of the enthusiasm seen during the 2022 Merge.

If you’re interested in watching the full presentation, you can do so HERE.

I noticed varied reactions on Twitter regarding Drake’s Beam Chain proposal, and a couple of points stood out. First, it’s key to remember that Drake is not a decision-maker in the Ethereum ecosystem; he’s a developer sharing ideas, not making final decisions. The primary concerns were the lengthy timeline and complexity of the proposal. Bitcoin’s simplicity makes it easier to follow, while other Layer 1s have a more centralized approach, making upgrades faster and more straightforward. Ethereum, however, is in a unique position—highly decentralized and complex. While this may ultimately work to Ethereum’s advantage, it’s likely a significant factor in its recent underperformance.

I Guess Everything Will Get An ETF Proposal

I don’t know much about Hedera (HBAR), but it seems we’ve hit a point where ETF issuers are ready to file applications for just about anything with a blockchain. It reminds me of the Coinbase listing pumps we saw years ago. So, does that mean ETF listing pumps are the new trend? Who knows, but the chart for this asset doesn’t look too promising.

Bitcoin To $100,000? Crypto Hits $3 Trillion Market Cap - Should You Buy More?

Bitcoin and crypto are going parabolic! My friends from The Arch Public, Andrew Parish and Tillman Holloway, are joining me to discuss the craziest crypto rally!

Unleash algorithmic trading with The Arch Public: https://thearchpublic.com/

My Recommended Platforms And Tools

Phemex - Exclusive for new users, earn up to 8800 USDT. Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '30OFF' for a 30% Black Friday discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.