Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Arch Public!

Arch Public focuses on two guiding principles: liquidity and performance. Our customers have access to their funds 24/7. Our hands-free algorithmic portfolios produce alternative asset level returns (138% and 171% respectively). Take a look below and put a hedge fund in your pocket.

Try Arch Public now! You can even demo the platform, for free, to learn more.

In This Issue:

You Won’t Believe This Trade

Bitcoin Thoughts And Analysis

Legacy Markets

Bitcoin Has Its Sight Set On Silver

Saylor Delivers Again

“Add Crypto ASAP—Call Us If You Need Help”

The Bitcoin Industrial Complex

This May Cause Selling In January

Crypto Comeback! Are We In For A Massive Bitcoin Pump? | Macro Monday

You Won’t Believe This Trade

The results of election day have made us all winners.

Outside of crypto, all-time highs are everywhere.

The U.S. stock market has never looked better. The S&P 500 just surged past the 6,000-point mark. The Dow Jones is eyeing 45,000, and the Nasdaq just hit a solid 21,000. Even our old friend, gold, is having a stellar year, up nearly 27% year-to-date and flirting with all-time highs.

It’s winning season.

Housing prices are also rising, with the average now at $359,892. Household net worth has soared to $163.8 trillion, thanks to booming real estate and equities. Meanwhile, U.S. GDP has climbed to an impressive $29.35 trillion. Even the Washington Commanders are having a good year. Seriously, are we living in a simulation?

Each of these data points deserves a closer look, but I want to draw your attention to something else—a crypto company (and no, it’s not MicroStrategy) that may have just pulled off one of the most epic trades of the year. Strap in; it’s story time.

We all know Coinbase played a massive role in the election. Just look at what the Stand With Crypto Alliance—Coinbase’s advocacy organization, launched on August 14, 2023, exactly two months after the SEC charged Coinbase for operating as an unregistered securities exchange—has accomplished against all odds.

Despite facing intense scrutiny from the SEC and an administration aiming to dismantle it, Coinbase mobilized over a million people and built a war chest worth tens of millions to literally remove and replace the rule-makers working against them. A godsend for the industry and a genius move for self-preservation.

The night before the election, on November 4, Coinbase’s stock hit a low of $176.38. By November 6, after the results were in and the market was open, COIN reached a high of $257.68. Yesterday, it surpassed $300, and perhaps, by the time you read this, COIN could be closer to $400 than $300.

Some races are still TBD, but just look at these stats:

Coinbase's strategic political investments have yielded significant results. The company allocated approximately $40 million to support Bernie Moreno, a blockchain entrepreneur with limited prior name recognition, in his campaign against incumbent Senator Sherrod Brown, the chairman of the Senate Banking Committee. Brown had been a vocal critic of cryptocurrency, citing concerns related to entities like Hamas and FTX as reasons for increased regulation. Moreno's victory not only unseated Brown but also contributed to flipping a Senate seat, thereby aiding in securing a majority for the Republicans.

Did you know that despite all of Coinbase's efforts, it made this progress without getting involved in the presidential race? Coinbase played it smart—focusing on pro-crypto politicians who will be pushing legislation on both sides of the aisle while staying out of the presidential fight. The strategy? Minimize enemies, stay crypto-focused, and keep neutral. Let the biggest chips fall where they may.

Coinbase meticulously evaluated every race and candidate in the House and Senate, tagging each politician based on their stance on crypto. They ensured their support went to the right candidates, advancing the right agendas, all while staying under the radar enough to maintain broad backing. It was all about building relationships, not making headlines—laying the groundwork for long-term wins without drawing too much attention. Smart moves all the way.

This strategy paid off, with Coinbase nearly doubling its market cap since October 31, jumping from $45 billion to over $80 billion and climbing. Coinbase didn’t just wait for regulators to come around, hoping the stock price would follow. Instead, it became a political powerhouse, overcoming anyone standing in its way—all within the bounds of the law.

Coinbase’s stock performance demonstrates that we can control our own destiny—that we can bet on ourselves and beat the competition at their own game.

By the way, Coinbase’s Stand With Crypto launched in Australia yesterday, but the news got overshadowed by all the talk about price action. Coinbase isn’t just focused on winning on the main stage in the U.S.—they’re aiming to dominate every market they enter.

That wraps up what I wanted to share on Coinbase, but I can’t sign off without briefly mentioning MicroStrategy. I’ve got a segment below on their latest Bitcoin purchase, but I had to show you this first…

It was 24 years and 8 months to be exact, but who’s counting—I'm floored.

Last but not least, let’s talk about how this rally might end—with a blow-off top.

A "blow-off top" is a rapid, unsustainable surge in an asset’s price, driven purely by euphoria and FOMO. During this phase, buying pressure reaches a peak, sparking a vertical rally that eventually exhausts itself, followed by a swift and steep decline as investors rush to sell off. Since I don’t believe this is the final leg of the bull market, this burst of optimism will likely lead to a correction—but not a bear market this time.

I recommend keeping a close eye on how this unfolds—it’s a valuable preview of what we might see at the end of the bull market, just on a smaller scale for now. To be honest, I have no idea how much momentum Bitcoin has left right now. But if we get confirmation that a nation-state (or a few) is buying, that changes everything—especially depending on who they are and their intentions. That could easily refuel us for an even bigger move, making the current price action look tiny by comparison.

Fingers crossed this is true—I know as much as you do.

One last thing: $100,000 is a significant psychological resistance, and I expect profit-taking to kick in around that level. It’s going to take some serious momentum for Bitcoin to break cleanly past it and shake off the selling pressure from fair-weather investors.

FYI: $100,000 isn’t the cycle top—think bigger.

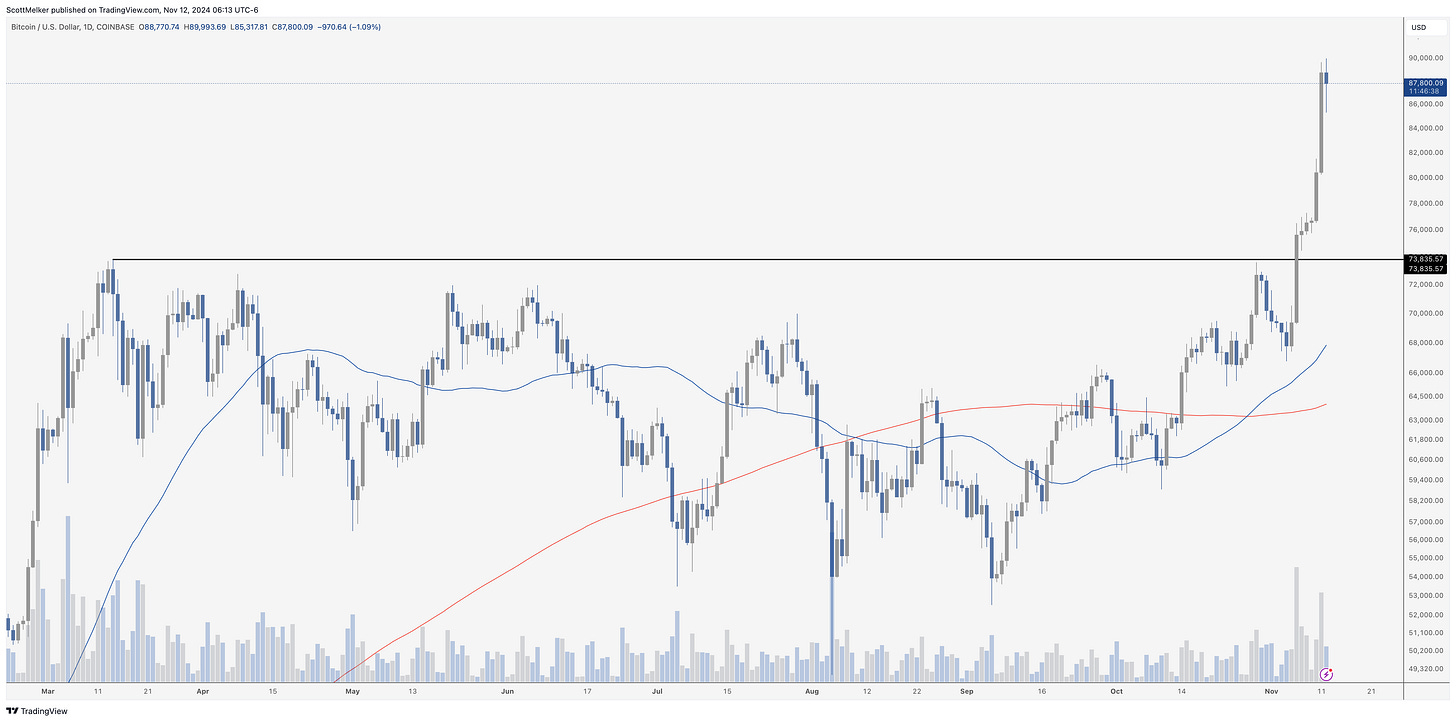

Bitcoin Thoughts And Analysis

Charting Bitcoin has become difficult. Like any asset in price discovery, there are really no levels of resistance that are clear on the chart. That said, price almost reached $90,000 before a nice leverage flush down to nearly $85,000. The market is in a euphoric state, so I expect a ton of volatility. That said, there’s little reason to believe that Bitcoin is done, as the cycle should just be getting started.

Just keep this in mind. The previous all time high around $74,000 has not been tested as support. It is HIGHLY likely that it eventually will be.

Legacy Markets

Stocks paused their rally on Tuesday as investors awaited details on President-elect Donald Trump’s cabinet picks and questioned whether recent gains might lead to profit-taking. The European Stoxx 600 dropped 1.1%, reversing Monday’s gains, while U.S. futures slipped slightly after a strong five-day run for the S&P 500. Despite the pause, other "Trump trades" continued, with the dollar reaching a one-year high and Bitcoin nearing $90,000.

Analysts at Citigroup noted that S&P 500 exposure has reached a three-year high, hinting that the rally could lose momentum. Investors are also considering the inflationary impact of Trump’s potential policies, such as tariffs and immigration crackdowns, which could lead to higher bond yields.

Concerns over Trump’s possible appointments of China hawks, like Senator Marco Rubio as Secretary of State and Representative Mike Waltz as National Security Advisor, led Hong Kong’s Hang Seng Index to drop 3.3% earlier.

Additionally, the upcoming U.S. inflation data release on Wednesday may influence the Federal Reserve's interest rate decisions, with expectations that the core consumer price index has remained stable since September. Among individual stocks, Bayer AG dropped sharply after cutting profit forecasts, while Live Nation and Grab Holdings saw premarket gains.

Key events this week:

Fed speakers include Christopher Waller, Patrick Harker and Neel Kashkari, Tuesday

Fed issues survey of senior bank loan officers, Tuesday

Eurozone industrial production, Wednesday

US CPI, Wednesday

Fed speakers include Jeffrey Schmid, Lorie Logan, Neel Kashkari and Alberto Musalem, Wednesday

Eurozone GDP, Thursday

US PPI, jobless claims, Thursday

Walt Disney earnings, Thursday

Fed speakers include Jerome Powell, John Williams and Adriana Kugler, Thursday

China retail sales, industrial production, Friday

US retail sales, Empire manufacturing, industrial production, Friday

Some of the main moves in markets:

Stocks

The Stoxx Europe 600 fell 1.1% as of 10:40 a.m. London time

S&P 500 futures fell 0.3%

Nasdaq 100 futures fell 0.3%

Futures on the Dow Jones Industrial Average fell 0.2%

The MSCI Asia Pacific Index fell 1.4%

The MSCI Emerging Markets Index fell 2%

Currencies

The Bloomberg Dollar Spot Index rose 0.4%

The euro fell 0.4% to $1.0612

The Japanese yen fell 0.2% to 154.10 per dollar

The offshore yuan fell 0.3% to 7.2514 per dollar

The British pound fell 0.4% to $1.2813

Cryptocurrencies

Bitcoin fell 1.3% to $86,840.98

Ether fell 0.9% to $3,296.41

Bonds

The yield on 10-year Treasuries advanced five basis points to 4.36%

Germany’s 10-year yield declined one basis point to 2.31%

Britain’s 10-year yield advanced two basis points to 4.45%

Commodities

Brent crude rose 0.8% to $72.38 a barrel

Spot gold fell 1.1% to $2,591.19 an ounce

Bitcoin Has Its Sight Set On Silver

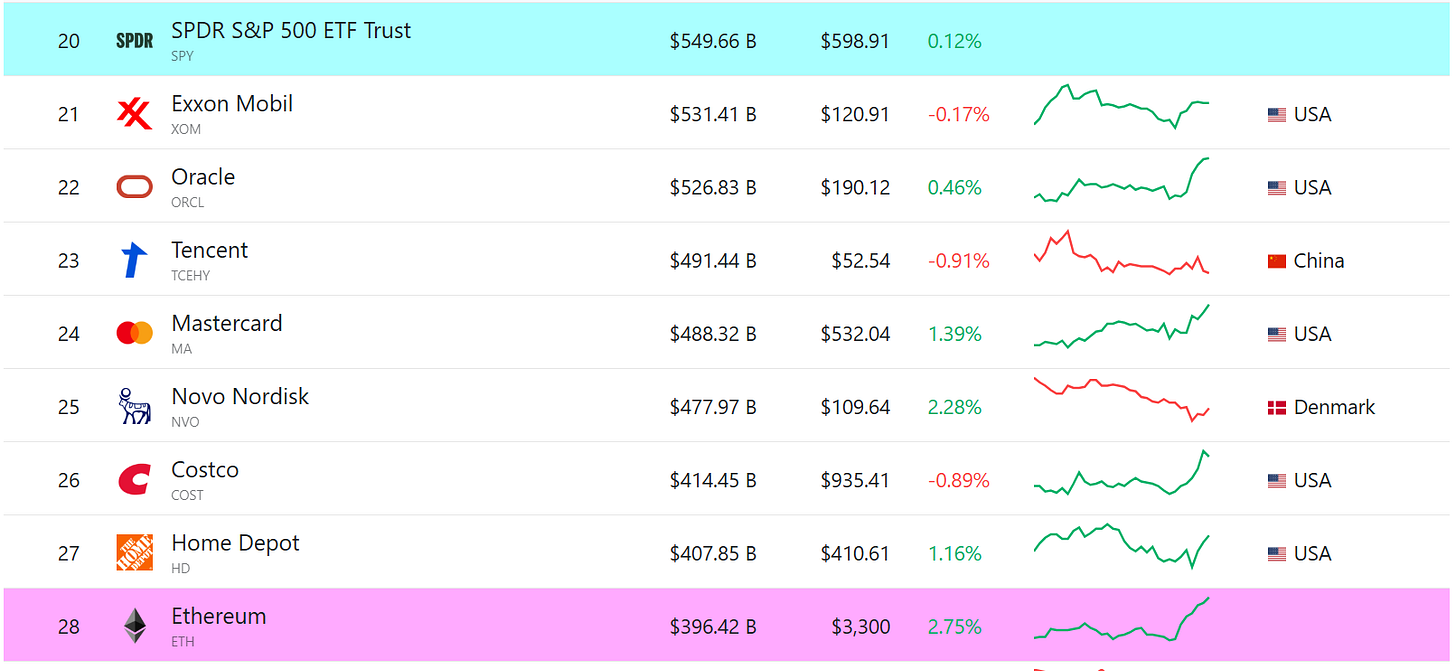

Bitcoin's market cap is on the verge of surpassing silver. If it’s already flipped silver by the time you’re reading this, consider this your official news update—because let’s be real, it was always inevitable, especially in this highly volatile market. Meanwhile, Ethereum, currently ranked #28, still has ground to cover before breaking into the top ten. For now, the next major milestone is the SPDR S&P 500 ETF Trust. With a roughly 30% price increase, Ethereum would enter the top 20 global assets, surpassing this ETF.

Saylor Delivers Again

I mentioned yesterday that it wouldn't be long until we heard more from MicroStrategy, and less than 24 hours later, Saylor delivered. Here are the details on that purchase:

“The Company today announced that, during the period between October 31, 2024, and November 10, 2024, the Company acquired approximately 27,200 bitcoins for approximately $2.03 billion in cash, at an average price of approximately $74,463 per bitcoin, inclusive of fees and expenses. The bitcoin purchases were made using proceeds from the issuance and sale of Shares (defined below) under the Sales Agreements (defined below).

As of November 10, 2024, the Company, together with its subsidiaries, held an aggregate of approximately 279,420 bitcoins, acquired at an aggregate purchase price of approximately $11.9 billion and an average purchase price of approximately $42,692 per bitcoin, inclusive of fees and expenses.”

It’s wild to consider that MicroStrategy—just one company—buying Bitcoin can push the price up by a few thousand dollars. Now imagine five major companies competing with five states, going up against five major hedge funds, who are in turn battling with five nations—all vying to buy Bitcoin. Suddenly, $1 million per Bitcoin starts to look pretty attainable.

Saylor proves you can be late to a bull market and still make money.

“Add Crypto ASAP—Call Us If You Need Help”

This memo from Bernstein cracked me up: “Bitcoin is at $80k. We will keep it simple. Don’t fight this - add crypto exposure asap. Call if you need help.” All I can picture is a bunch of headless chickens running around with phones ringing non-stop, 24/7. We’re so far ahead of the boomers—it’s hilarious. Plus, the ETFs have a lot of buying to do to keep up.

The Bitcoin Industrial Complex

Just leaving this here without comment.

This May Cause Selling In January

“Reduced Selling Pressure: When fewer investors sell, there’s less selling pressure in the market, which can support or lift stock prices as demand exceeds supply.

Santa Claus Rally” Effect: The phenomenon of a year-end rally, often called the "Santa Claus Rally," may be partially attributed to this. While there are other contributing factors, such as optimism for the coming year and portfolio adjustments by institutions, tax-driven behavior adds to the lower selling volume.

January Effect: In many years, there’s a surge in selling in early January, known as the ‘January Effect,’ as investors start realizing gains they delayed in December. This can create early-year volatility after the year-end rally.

However, this effect isn’t guaranteed every year. It’s more likely when markets are already on a strong upward trend, as investors are more motivated to hold off realizing gains in a profitable year.”

I expect there will be a lot more commentary on this once the hysteria settles. Investors will play a mind game—anticipating selling in January, so they sell in December—but also looking to front-run the buying post-January and even considering a move around inauguration. Long story short, we’re in for some serious volatility as the year wraps up.

Crypto Comeback! Are We In For A Massive Bitcoin Pump? | Macro Monday

Join Dave Weisberger, Mike McGlone, and James Lavish as we break down what's happening in macro and crypto!

My Recommended Platforms And Tools

Phemex - Exclusive for new users, earn up to 8800 USDT. Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '30OFF' for a 30% Black Friday discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.

Loved it