The Wolf Den #1079 - Eighty-Two Thousand United States Dollars

All time high after all time high.

Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Phemex!

Phemex is the most efficient crypto trading and investment platform. Phemex offers over 293 spot trading pairs, minimal fees, peer-to-peer trading, derivatives, up to 100x leverage, and $8,800 welcome rewards up for grabs! Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Make sure to check if Phemex is available in your jurisdiction.

In This Issue:

Eighty-Two Thousand United States Dollars

Bitcoin Thoughts And Analysis

Altcoin Charts

Legacy Markets

Bitcoin vs. Nvidia

Did Solana Go Down?

This Is Art

OKX & The Future of Crypto | Hong Fang & Gracie Lin Reveal What’s Next For The Industry

Eighty-Two Thousand United States Dollars

When I wrote my last newsletter on Friday, Bitcoin was at $76,000, Ethereum at $2,900, and Solana at $204. Fast forward to today, and Bitcoin has pushed past $82,000, Ethereum past $3,200, and Solana past $212. The market is so volatile right now that even rounding to whole numbers can be misleading—prices are shifting by the minute.

It's "No Sell November"—write it down, tell a friend.

The market has spoken, and since there are no major breaking news stories beyond price, let's focus on that. To start, we'll cover where major assets stand in relation to their all-time highs. Since Bitcoin is the only major asset reaching new peaks, I’ll measure its progress against key targets of $100,000, $150,000, and $200,000, which are reasonable goals for this cycle.

Bitcoin is currently trading at $81,000

For a target of $100,000, it needs a gain of 23.5%

For a target of $150,000, it needs a gain of 85%

For a target of $200,000, it needs a gain of 147%

Ethereum is currently trading at $3,200.

Ethereum’s all-time high is $4,878

To reach the all-time high, Ethereum needs 52%.

To reach $10,000, Ethereum needs 212%.

Solana is currently trading at $218.

Solana’s all-time high is $260

To reach the all-time high, Solana needs 21%.

To reach $500, Solana needs 134%.

Now for a random assortment of other assets.

SUI is currently trading at an all-time high $3.25!

Ripple is currently trading at $0.59.

Ripple’s all-time high is $3.31

To reach the all-time high, Ripple needs 461%.

Cardano is currently trading at $0.59.

Cardano’s all-time high is $3.10

To reach the all-time high, Cardano needs 425%.

BNB is currently trading at $628.

BNB’s all-time high is $724

To reach the all-time high, BNB needs 15%.

Doge is currently trading at $0.29.

Doge’s all-time high is $0.73.

To reach the all-time high, Doge needs ~170%.

As you can see from the list, nearly all assets outside the big three still have a way to go—some more than others. Sui stands out as a notable outlier this cycle, and I've heard promising things about it from sources I trust. That said, I’m not the expert you should turn to on this one. I did some quick research, so here’s what I know so far. I do own the token.

The core pitch behind Sui is that it's aiming to be the next Solana. This idea gives me pause because I’m not entirely convinced the crypto space needs another Layer 1, especially with so many already competing for attention. Sui is positioned as a fast, retail-friendly alternative to Ethereum and Solana, and that’s the premise they’re banking on.

From CoinMarketCap, “Sui is a groundbreaking layer-1 blockchain platform designed to support the needs of global adoption by offering a secure, powerful, and scalable development platform. At its core, Sui leverages a novel object-centric data model and the secure Move programming language to address inefficiencies prevalent in existing blockchain architectures.”

From Sui Docs, “The total supply of SUI is capped at 10,000,000,000 (ten billion coins). A share of SUI total supply became liquid at Mainnet launch, with the remaining coins vesting over the coming years, or distributed as future stake reward subsidies.”

Raoul Pal is very bullish on Sui—look up his commentary if you want a positive perspective on it!

Now, getting back on track: we've reached a stage where nearly every coin is pumping. But don’t be fooled—just because prices are rising doesn’t mean every asset was simply underperforming. Many coins died ages ago and won’t make a real comeback. There’s a big difference between an asset that’s underperformed and one that’s just plain irrelevant. The idea that 99% of coins will ultimately fail is as true in a bull market as it is in a bear market.

Furthermore, as I always say, there’s no better time than now to reassess your portfolio. Move away from poorly performing assets and into those with strong fundamentals this cycle. While altcoins will likely continue to outperform Bitcoin once it cools off, choosing wisely is essential—only the strongest will thrive.

The takeaway: don’t mistake a coin turning over in its grave for signs of life.

Speaking of performance, let’s talk about Ethereum. Over the past seven months or so, Ethereum has certainly underperformed but hasn’t performed poorly, and this distinction is key. Underperformance often sets the stage for a significant comeback, while poor performance usually indicates limited recovery potential. Anyone claiming Ethereum has performed poorly likely hasn’t looked at the asset critically or may be spreading misinformation.

It’s time to move past the negativity surrounding ETH - as I have been saying for ages.

I posted this back when Ethereum tagged a low of $2,366, and the optics were atrocious. It’s pretty remarkable how quickly sentiment, attitude, and perception can shift—literally in just a week—driven entirely by price.

Trump’s election doesn’t favor Ethereum any more than it does Bitcoin or Solana. Over the past week, absolutely nothing has fundamentally changed with Ethereum, *yet poof*—all the negative sentiment has vanished, replaced by renewed optimism. Funny how that works.

Here’s my non-professional (but pretty accurate) take on this: if Ethereum starts to outperform—which it’s well-positioned to do—expect the narrative to leverage old criticisms against its competitors. Here’s what that might look like:

Ethereum was being cannibalized by L2’s. That’s absurd—L2’s have only breathed new life into Ethereum.

Ethereum was getting beat on both sides by Bitcoin’s monetary properties and Solana’s DeFi/retail appeal. That’s laughable—Ethereum was just as sound as Bitcoin when it came to money, and outperformed Solana in DeFi from the start.

Ethereum was outdated and out of touch. Absolutely not—it was quietly preparing for mass adoption, solving specific challenges along the way.

The Ethereum ETF was a failure. Far from it. Wall Street just needed time to wrap their heads around a viable alternative to Bitcoin.

These takes will come in every shape, size, and intensity. Just remember, most of the investors pushing these narratives are blinded by their own bags and can’t see the bigger picture. Ethereum isn’t perfect, and it’s faced real challenges this cycle with legitimate competition, but I’m not worried in the slightest. We’re seeing real upticks in ETF interest, and any investigations or lawsuits against ETH will likely be dropped. Base is a powerful ETH Layer 2, tokenization is happening on ETH, stablecoins operate on ETH, DeFi runs on ETH, and the president-elect is using blockchain. What more can Ethereum investors ask for?

It’s almost comedic to watch the timeline scramble for reasons to buy ETH now—reasons we’ve known about for a long time.

Now, let’s pivot to Solana. If you’ve been a long-time Solana holder, congratulations—you deserve this success. Solana is on the verge of crossing the $100B market cap mark and may already have done so by the time you read this. This is an all-time high for market cap, though not yet for price. Any doubt from the haters about Solana’s place among the winners with Bitcoin and Ethereum? The market cap speaks for itself.

Like Ethereum, nothing has fundamentally changed for Solana in recent weeks—aside from Trump being elected. In fact, Solana could benefit even more than Ethereum from this, given it was named a security in the SEC’s lawsuit against Binance, along with Cardano, Polygon, Cosmos, and others. A favorable SEC ruling clarifying that Solana isn’t a security would remove a major hurdle. Solana has been pushing through resistance with tremendous force, but removing it entirely could propel it to extended cycle highs.

Solana’s success this cycle has been remarkable, capturing retail interest and real-world use cases in DeFi and stablecoins. However, it still faces the regulatory gauntlet. If Trump opens the doors, Solana will have the chance to gain ground on Ethereum in terms of regulatory approval—think an ETF, which essentially acknowledges that it’s not a security, even if Gensler isn’t openly saying it (LOL).

Ethereum has already paved the way, building trust and establishing relationships, while Solana will have to start from scratch. Still, Solana will make progress, whether later in this cycle or during the next bear market. Keep in mind, Trump’s primary focus has been on Bitcoin, so any major regulatory developments or ETF approvals will likely hit Bitcoin first, with Solana ETFs or Ethereum staking additions coming after.

TL;DR: I’m bullish on Solana for the rest of this cycle—enjoy the ride.

Now, let’s move on to this:

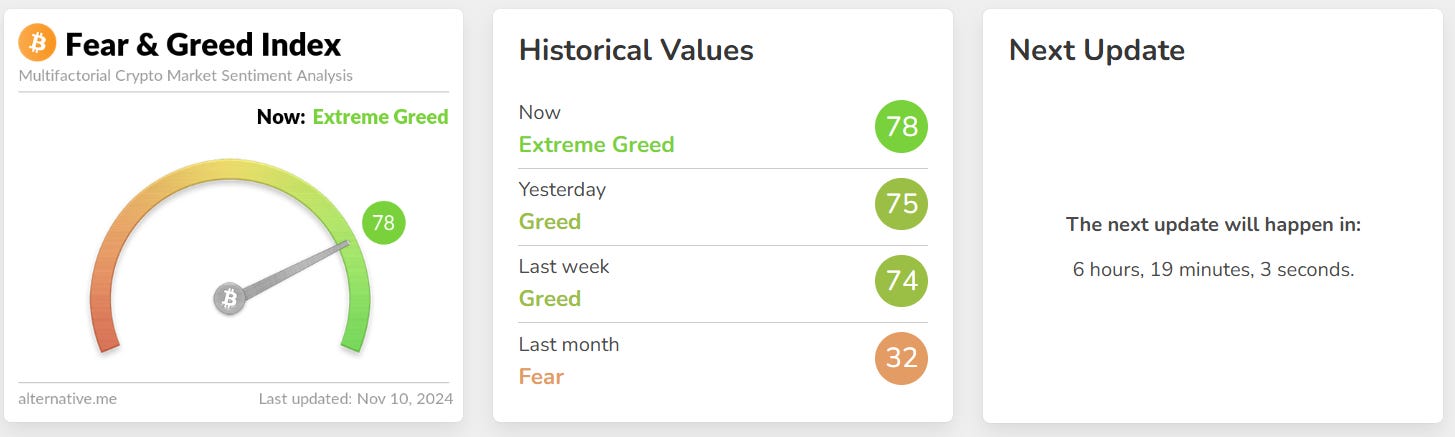

No surprises here—it’s right where we expected it to be. That said, “The market can remain irrational longer than you can remain solvent.” If we linger in this greed/extreme greed zone for another week—or even a month—I won’t be fazed. Will I expect a pullback eventually? Absolutely. And seeing dead alts suddenly surge with 20% pumps definitely raises the hairs on the back of my neck. But let’s be honest—alts have struggled for a *very* long time. Relief rallies can be powerful and often last much longer than anticipated.

If you have limited exposure to crypto right now, my advice is simple: you’ve got some soul-searching to do before diving into research. Leading up to the election, there was significant de-risking, and with Trump winning, sidelined capital is now being forced back in by FOMO. This is why, as long-term holders who believe in the fundamentals, trying to outsmart the market isn’t the strategy. Sure, if Kamala had won, the sidelined capital might have seemed “smart” for a moment, but the larger trend is still upward. Their reckoning would’ve only been delayed.

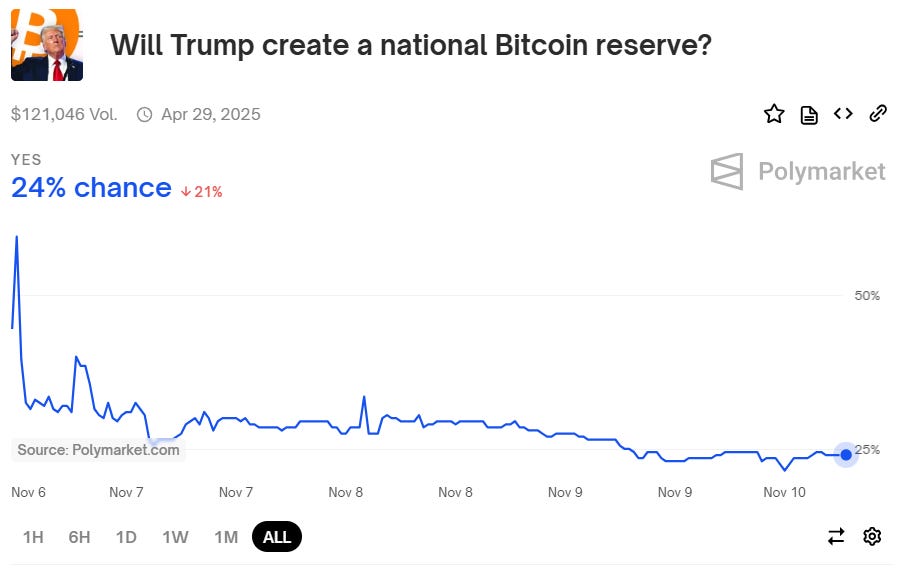

On that note, let’s turn to Polymarket and assess the odds of a national Bitcoin reserve under Trump.

If you are confused why the odds may be lower than you were anticipating, it’s because of the specifics of the rules:

Cynthia Lummis has shared that the goal is to acquire 1 million BTC over five years. Currently, the U.S. government holds 208,109 BTC. Could they start buying more in Trump’s first year in office? Absolutely. But they might also hold off on new purchases, opting instead to convert their existing Bitcoin into a reserve asset, which wouldn’t meet Polymarket’s conditions to resolve as ‘yes.’ Plus, there’s a chance the bill doesn’t pass on the first attempt. As this unfolds, I expect Polymarket to stay closely tuned to how it all plays out.

I know this is getting lengthy, but I want to address one more topic: our echo chamber.

The echo chamber we inhabit on X doesn’t reflect the entire crypto community. Wall Street isn’t exactly broadcasting its thoughts on a platform filled with farm animals, trolls, and armchair experts. We’re also missing perspectives from the other side of the world. While we get some Wall Street input and a bit of diversity in thought, we need to think beyond X. While we debate plenty of noise there, the real action is happening on-chain. The reason I write this newsletter is to look beyond the chatter and keep us all aligned.

I ended last week’s newsletter with “$80,000 soon,” so it only feels right to start this week with “$100,000 soon.” And no, this isn’t just bull posting or euphoria—it’s simply in the cards. Here’s to a great week and even better news ahead. Rumors are growing that some states may be planning to buy Bitcoin; perhaps we see that unfold this week?

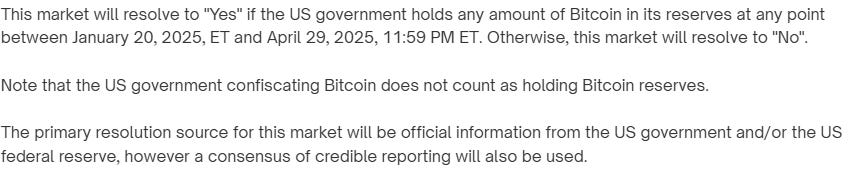

Bitcoin Thoughts And Analysis

Bears are in disbelief.

The halving cycle is once again playing out EXACTLY the same as in the past. Roughly 6 months after the halving, Bitcoin breaks consolidation and pushed parabolically to new highs.

This was my base case, so it is nice to see it confirmed. All we had to do was wait a bit.

Enjoy the ride.

Altcoin Charts

For those who are new here, I share SETUPS and not SIGNALS. These are ideas that I am watching - if a certain thing happens, then the trade triggers. I am not telling you what to buy or when. I am showing you how I am watching certain charts and what has to happen for me to take a trade.

It is alt season - almost everything is going up at once. Enjoy the ride.

Legacy Markets

US stocks are set to extend their rally following Donald Trump's presidential victory, which has boosted investor interest in US assets. Futures indicate a 0.3% rise in the S&P 500, marking continued record highs, while the Nasdaq 100 is expected to see similar gains. Tesla rose 7.3% in premarket trading, surpassing a $1 trillion valuation as investors anticipate a Trump presidency to benefit the company. Crypto-linked stocks also gained as Bitcoin surged past $81,000, fueled by the possibility of a pro-crypto Republican Congress. The dollar strengthened, adding to a six-week rally.

European stocks also rebounded, with the Stoxx 600 index up 0.9%, aided by robust earnings reports from companies like Continental AG and Hannover Re. Markets are now focused on upcoming US inflation data and the Federal Reserve's interest-rate outlook, especially after comments from Fed officials hinting at a potential slowdown in rate cuts. Meanwhile, China’s CSI 300 fluctuated, oil prices stabilized, and iron ore prices fell.

Key events this week:

Japan current account, Monday

Denmark CPI, Monday

Norway CPI, Monday

United Nations climate change conference, COP29 begins, Monday

Germany CPI, Tuesday

UK jobless claims, unemployment, Tuesday

Fed speakers including Christopher Waller, Tuesday

Japan PPI, Wednesday

Eurozone industrial production, Wednesday

US CPI, Wednesday

Australia unemployment, Thursday

Eurozone GDP, Thursday

US PPI, jobless claims, Thursday

Reserve Bank of Australia Governor Michele Bullock speaks, Thursday

Fed Chair Jerome Powell speaks, Thursday

ECB President Christine Lagarde speaks, Thursday

BOE Governor Andrew Bailey speaks, Thursday

Japan GDP, industrial production, Friday

China retail sales, industrial production, fixed-asset investment, Friday

UK GDP, industrial production, trade balance, Friday

US retail sales, Friday

Alibaba earnings, Friday

Some of the major moves in markets:

Stocks

The Stoxx Europe 600 rose 1.2% as of 10:26 a.m. London time

S&P 500 futures rose 0.3%

Nasdaq 100 futures rose 0.3%

Futures on the Dow Jones Industrial Average rose 0.3%

The MSCI Asia Pacific Index fell 0.9%

The MSCI Emerging Markets Index fell 0.8%

Currencies

The Bloomberg Dollar Spot Index rose 0.3%

The euro fell 0.3% to $1.0685

The Japanese yen fell 0.7% to 153.65 per dollar

The offshore yuan fell 0.1% to 7.2098 per dollar

The British pound fell 0.1% to $1.2902

Cryptocurrencies

Bitcoin rose 2.7% to $82,057.85

Ether rose 0.9% to $3,200.09

Bonds

The yield on 10-year Treasuries was little changed at 4.30%

Germany’s 10-year yield declined three basis points to 2.33%

Britain’s 10-year yield was little changed at 4.43%

Commodities

Brent crude fell 1.1% to $73.03 a barrel

Spot gold fell 0.5% to $2,671.85 an ounce

Bitcoin vs Nvidia

Back in May, I wrote a full newsletter on this topic, tracking the performance of these two powerhouse assets and comparing them to King Kong and Godzilla. A lot has changed since then, so I may revisit this topic soon, but for now, I have two questions for you: Which of these assets has more room to grow over the next 5 to 10 years? And what’s stopping Bitcoin from doing something similar to Nvidia’s performance earlier this year? Year-to-date, Nvidia is up 206%, while Bitcoin is up 83%—not even half of Nvidia’s gain, despite Bitcoin being less than half the size. This comparison highlights why Bitcoin may soar much higher than any of us are anticipating this cycle.

Did Solana’s Blockchain Go Down?

I think the answer is ‘no.’ On Saturday, I saw a handful of large accounts spamming “Solana is down,” but no major news outlets picked up the story and the evidence refuting the claims appears to be stronger than those making them.

This Is Art

The chart below will be studied for decades to come. It won’t be long before MicroStrategy announces plans to raise capital or reveals recent purchases—either way, it’s a win. The lead Saylor is establishing is getting steeper and steeper by the day. I can’t wait until other major companies take Bitcoin seriously and things get really crazy.

In other news that’s practically a masterpiece, El Salvador is close to achieving a 100% gain on its Bitcoin position. With an average cost basis of around $45,223 per BTC, the country is sitting on an unrealized profit of about $203.1 million. El Salvador holds a total of 5,930.77 BTC—you love to see it.

OKX & The Future of Crypto | Hong Fang & Gracie Lin Reveal What’s Next For The Industry

In this episode of The Wolf of All Streets, we dive deep into the world of OKX with Hong Fang and Gracie Lin, exploring their global approach to crypto regulation and innovation. We discuss what’s new in OKX’s Web3 wallet, their focus on decentralized self-custody, and what it all means for the future of digital assets. Join us for insights into the global crypto landscape and OKX's bold vision!

My Recommended Platforms And Tools

Phemex - Exclusive for new users, earn up to 8800 USDT. Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '30OFF' for a 30% Black Friday discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.