Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Phemex!

Phemex is the most efficient crypto trading and investment platform. Phemex offers over 293 spot trading pairs, minimal fees, peer-to-peer trading, derivatives, up to 100x leverage, and $8,800 welcome rewards up for grabs! Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Make sure to check if Phemex is available in your jurisdiction.

In This Issue:

Trump Wins

Bitcoin Thoughts And Analysis

Altcoin Charts

Legacy Markets

Here is What You Should Be Trading | Trading Alpha

Will Gensler Leave Early?

Polymarket Has Spoken

Tether Is Consolidating Issuance To Ethereum

Massive Win For Bitcoin! Why The New All-Time High Is Just the Beginning!

Trump Wins

On the count of three, let’s all take a deep breath.

One, two, three… inhale… exhale…

The election season is finally over—we made it, we survived. The United States may be far from perfect, but here we are: alive, together, and with much to be grateful for.

I don’t know where each of you stands politically; frankly, it doesn’t matter for this publication. I sincerely wish each of you happiness, health, and prosperity. At the very least, we have crypto bringing us together—and it undeniably secured a major win.

In this newsletter—and many to come—I’ll be diving into political discussions, but always with a focus on how they intersect with markets and crypto. That’s my lane, and I have no interest in discussing politics outside this context. Some of you may disagree with my views, and that’s perfectly fine; today’s edition is intended to analyze the political impact on the crypto landscape. My goal is to keep investors informed, so let’s get right into it.

Yesterday marked the end of one chapter and the start of a new era for crypto.

Former President Donald J. Trump has achieved a decisive victory, winning both the popular vote and the Electoral College—a result that most mainstream polls missed. While votes are still being counted, it’s evident that Republicans now control both the House and Senate, setting the stage for a major shift in U.S. policy and governance for the digital asset industry.

Love Trump or hate him, this is a *massive* win for crypto. For the past four years under the Biden administration, this industry felt like it was playing with a stacked deck: down players, bought refs, and a rigged scoreboard. For the first time, it feels like we’re finally getting a fair shot.

For over a decade, we endured SEC lawsuits, investigations, and aggressive moves from regulators across national and international bodies. What’s baffling is that the core values crypto represents—financial freedom and equal access—were often ignored. Crypto isn’t just an asset class; it’s a lifeline for millions seeking autonomy in a system that can feel rigged against them.

The old guard did everything to stifle progress, erecting barriers and pushing heavy regulations to protect the status quo. But they couldn’t kill the movement, and today, we declare a significant victory. Now, with the election behind us, we’re left with two crucial questions: What’s already priced in, and what can we reasonably expect going forward?

We’re just beginning to see the market price in a pro-crypto president, but that’s only part of the story. I still believe we’re a long way from Wall Street—particularly the boomer generation—fully realizing that Trump will be *very* bullish for crypto. While some may be talking about it behind closed doors, they haven’t grasped its full implications yet—and that’s definitely not priced in.

What’s still up in the air is how much Trump will actually follow through on his promises. Some moves we can be fairly confident about, while others call for cautious optimism. This brings us to the second question: What can we reasonably expect? Let’s dive in.

We can be pretty confident that Trump will fire Gary Gensler on day one—he’s made this clear repeatedly. Over the coming months, as this news spreads, the crypto market will start to price in what this really means. (Wall Street seems to have figured out what this might mean for Coinbase.) Crypto investors currently have a huge knowledge advantage here, one that will slowly become evident to the rest of the country and the world.

What’s also not yet priced in is whether Trump will choose a well-known pro-crypto replacement—*cough* Hester Pierce—or someone less involved in crypto but who won’t target it. Either outcome would be a vast improvement from where we are.

We can also be quite sure that the crackdown of Operation Chokepoint 2.0 is about to end swiftly. The anti-crypto army has taken a hit—Elizabeth Warren may have won her re-election, but the morale in that camp is all but dead. Crypto voters have sent a clear message: being anti-crypto in politics is a losing game. There’s never been a better time in U.S. history to support crypto, and the upcoming legislation will reflect that shift.

Remember when Biden vetoed SAB121? That won’t be happening again. This time, the bill could pass with even better outcomes for banks and their ability to custody Bitcoin and crypto. Wall Street hasn’t grasped this yet; you can bet on that. Below, I’ve included some stats from the House and Senate races—Wall Street has no idea that crypto is winning this big in our legislative branch.

Trump has also pledged to commute Ross Ulbricht’s sentence, setting a defined term for his release. While this move may not directly impact crypto prices, it sends a powerful message to innovators in the industry: You’re not a criminal anymore. To clarify, a commutation wouldn’t mean Ross walks free immediately—his sentence would be significantly reduced, but he likely won’t be released on Inauguration Day.

We can also be fairly certain that Trump will push to bring Bitcoin mining back to the U.S. It’s right up his alley to build a domestic mining industry and revitalize the sector. After all, he did say he wants it “mined, minted, and made in the USA.” Will these miners contribute to a strategic stockpile? That’s unclear, but I do expect a strong push to expand mining operations domestically, which could have a profound impact on both energy infrastructure and crypto’s role in the U.S. economy. This, of course, isn’t priced in yet either.

Regarding the strategic reserve, it’s wise to stay cautiously optimistic. At the Bitcoin conference, Trump explicitly stated, “But for too long, our government has violated the cardinal rule that every Bitcoiner knows by heart: never sell your Bitcoin. And so, as the final part of my plan today, I am announcing that if I am elected, it will be the policy of my administration, the United States of America, to keep 100% of all the Bitcoin the U.S. Government currently holds or acquires into the future. We'll keep 100%. I hope you do well, please. This will serve, in effect, as the core of the strategic national Bitcoin stockpile.”

Trump’s stance on holding U.S. Bitcoin reserves seems clear, but it remains a question whether he’ll allocate U.S. dollars to acquire more. Do I want to believe it? Absolutely. But it would be imprudent to take a candidate’s promises at face value, especially concerning crypto. I’ll remain cautiously optimistic here—and the market hasn’t even begun to price this in.

Other areas for cautious optimism include in-kind ETFs getting approved, staking being added to Ethereum ETFs, a Solana ETF, the unwinding of frivolous lawsuits, more ETF approvals, the end of unrealized gains tax discussions, and the creation of D.O.G.E. (The Department of Government Efficiency). Many of these possibilities rely on securing the right leadership at the SEC, so they’re certainly not priced in yet. As sentiment shifts, we’re likely to see both new and established TradFi institutions dive into crypto ETFs, and state pension funds increase allocations to Bitcoin and Ethereum.

In the coming months, I expect this to unfold step-by-step, with each development building on the last. This momentum will spark global institutional and retail FOMO, adding pressure on Trump to consider—and perhaps even sign—a Strategic Reserve Bill. That said, Trump’s loyalty to the dollar is strong, and he’ll need to balance supporting both Bitcoin and the dollar. Both objectives can coexist within reason, but this may not yield the most bullish outcome imaginable—though it will still be very bullish, without question.

For balance, let’s remember that Trump’s pro-crypto stance is a recent strategic pivot. Maybe he sees an opportunity to profit in this new industry, evidenced by his NFTs and World Liberty Financial—but he no longer needs the presidency. Now, we need him more than he needs us. So before we assume he’ll follow through on every promise, let’s temper our expectations and be pleasantly surprised if he delivers. We’ve won a major battle, and the tide has shifted heavily in our favor, but the war isn’t over.

On that note, I couldn’t be more fired up!

We’ve won this fight with loud voices, but now we need to keep that energy going and carry it forward. It’s crucial to ensure that the administration, along with both the House and Senate, stay aligned with us to turn major legislation like this into reality. The battle isn’t over, but the momentum is on our side—we just have to keep pushing.

In the coming days, I’m excited to shift the focus back to pure crypto news, and we’re almost there. With the election behind us and Bitcoin at an all-time high, the stage is set for major crypto announcements to start rolling in. And for the altcoin holders out there—when Bitcoin cools off, you’re in for a fabulous time.

We’ve worked hard for this, and we made it—congratulations to all of you!

Let’s make the most of this new chapter—it’s ours to write.

One last point: Wall Street is fired up too!

Bitcoin Thoughts And Analysis

Things continue to look generally bullish, with Bitcoin closing well above its previous all-time high yesterday. The day also saw the largest bullish volume since that previous high, which confirms the breakout.

That said, there are signs we could see a pause. The 12-hour chart just confirmed overbought bearish divergence, which may also appear on the daily chart. However, it’s not confirmed yet; we’ll need a close with a lower high on the RSI, which is about 12 hours away.

No one should be surprised if we take a breather after such a huge move.

Altcoin Charts

For those who are new here, I share SETUPS and not SIGNALS. These are ideas that I am watching - if a certain thing happens, then the trade triggers. I am not telling you what to buy or when. I am showing you how I am watching certain charts and what has to happen for me to take a trade.

Want some altcoin alpha? Just watch this…

Bitcoin & Crypto Skyrocket, Here is What You Should Be Trading | Trading Alpha

I don’t normally include YouTube livestreams here in the altcoin section, but this one was too good not to share. For those that don’t know, Trading Alpha is a show with John Wick, an anonymous options trader, where we analyze the market and give setups. Make sure to check out this link HERE for elite-level trading tools and indicators. Use code '30OFF' entered during checkout on left hand side for a 30% discount!

Legacy Markets

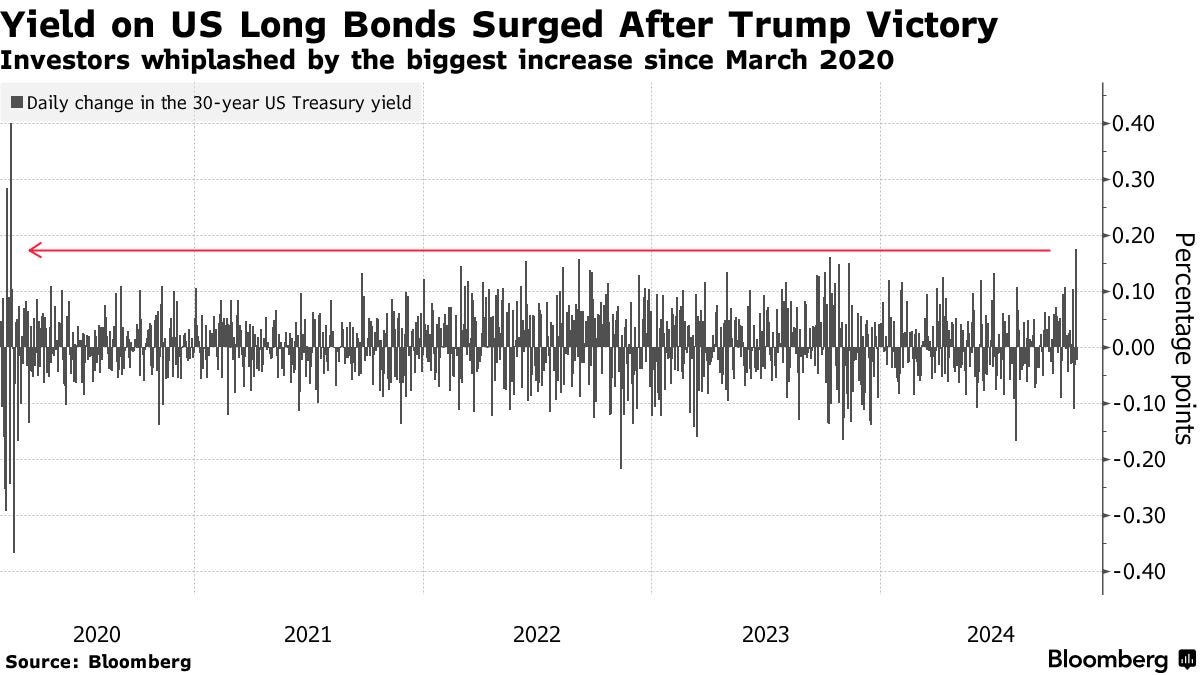

U.S. equity futures held onto Election Day gains, while the dollar eased as investors assessed Donald Trump’s return to the White House and its implications for Federal Reserve policy. S&P 500 futures edged higher, and the dollar dropped 0.3% following its best day since 2022. Treasury yields steadied after a sharp selloff on Wednesday, with markets pausing to digest the economic impact of a Trump presidency and potential fiscal expansion under a Republican-led Congress.

Federal Reserve Chair Jerome Powell faces challenges ahead, with a rate cut of 25 basis points expected today, following a half-point reduction in September. Market focus will be on Powell’s guidance for December and beyond, as traders anticipate about 100 basis points of cuts by September 2025, slightly down from Tuesday’s projections of 110 basis points. In the U.K., the Bank of England is also set to reduce rates by 25 basis points, with Governor Andrew Bailey expected to address how recent government spending might affect future easing prospects.

European stocks rose 0.4% as traders considered potential German elections, which could bolster growth in Europe’s largest economy. A stronger dollar under Trump’s presidency offers a silver lining for major exporters in the region. In Asia, Chinese stocks led gains on stimulus optimism and positive export data, while the yen strengthened after Japanese officials signaled potential action against excessive currency moves.

Bitcoin slipped 1.4% on Thursday, a day after hitting a record high, as Trump’s campaign support for digital assets drove increased interest. Oil extended losses following a volatile Wednesday, as traders weighed Trump’s potential impact on the crude market.

In corporate news, Lyft Inc. surged 22% in premarket trading after exceeding Q4 forecasts, while SolarEdge Technologies Inc. dropped 21% due to a $1 billion writedown and weak fourth-quarter guidance. Arm Holdings Plc shares fell 6%, impacted by lower-than-expected royalties. Nissan Motor Co. reduced its annual profit outlook and announced plans to cut thousands of jobs globally in response to weakening sales in major markets. Finally, activist investor Elliott Investment Management acquired a substantial stake in German utility RWE AG, urging the company to consider a share buyback.

Key events this week:

UK BOE rate decision, Thursday

Fed rate decision, Thursday

US University of Michigan consumer sentiment, Friday

Some of the main moves in markets:

Stocks

S&P 500 futures rose 0.2% as of 5:29 a.m. New York time

Nasdaq 100 futures rose 0.3%

Futures on the Dow Jones Industrial Average rose 0.2%

The Stoxx Europe 600 rose 0.4%

The MSCI World Index rose 0.2%

Currencies

The Bloomberg Dollar Spot Index fell 0.3%

The euro rose 0.3% to $1.0758

The British pound rose 0.2% to $1.2910

The Japanese yen rose 0.4% to 153.95 per dollar

Cryptocurrencies

Bitcoin fell 1.4% to $74,911.73

Ether rose 4.6% to $2,813.77

Bonds

The yield on 10-year Treasuries was little changed at 4.42%

Germany’s 10-year yield advanced eight basis points to 2.48%

Britain’s 10-year yield declined three basis points to 4.53%

Commodities

West Texas Intermediate crude fell 0.7% to $71.16 a barrel

Spot gold rose 0.3% to $2,666.13 an ounce

Will Gensler Leave Early?

Crypto analyst, Markus Thielen, CEO of 10x Research, is suggesting based on historical evidence that the SEC could soon have a new chairman following Donald Trump's projected election win. Thielen noted that, based on precedent, Gary Gensler is likely to resign with the change in administration, as SEC chairmen typically step down to align with the preferences of the incoming president.

I asked ChatGPT to fill me in on the recent history to confirm or deny this argument and this was the response I received:

Gary Gensler (2021-Present): Gensler was appointed by President Joe Biden in April 2021. He succeeded Jay Clayton, who had resigned in December 2020, following the election of Biden.

Jay Clayton (2017-2020): Clayton was appointed by President Donald Trump and served as SEC chairman until December 2020. He resigned early, paving the way for an appointment by the incoming president. This was seen as a move to align with the new administration's policies.

Mary Jo White (2013-2017): White was appointed by President Barack Obama. She served a full term before resigning in January 2017, when Donald Trump took office. She stepped down to allow for a new chair to be appointed under the Trump administration.

Elisse Walter (2012-2013): Walter served as acting SEC chair from December 2012 to April 2013 following the resignation of Chairman Mary Schapiro, who stepped down as President Obama’s second term began.

Mary Schapiro (2009-2012): Schapiro was appointed by President Obama and served through most of his first term. She stepped down in December 2012, allowing the new administration to select a new chair.

According to Markus Theilen, “This practice allows the new president to appoint a chair who aligns with their policy objectives. If these historical patterns hold, Gary Gensler may resign in December or January, with a new SEC chair potentially confirmed by April or May.”

One last thing…

Polymarket Has Spoken

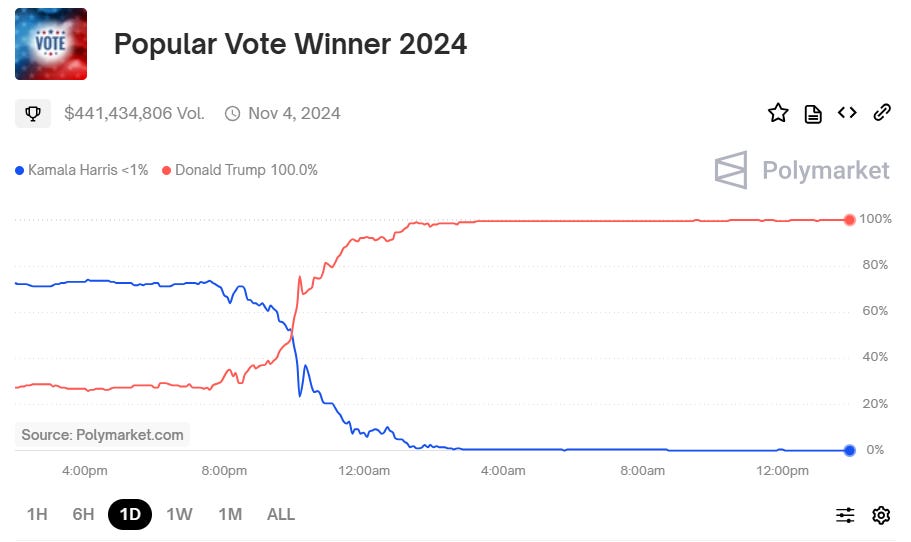

It’s time to wrap up this election saga with a conversation on Polymarket. As I mentioned yesterday, Donald Trump’s decisive victory was an ideal outcome for Polymarket to solidify its credibility as a predictive platform. Long before even the most conservative mainstream broadcasters were calling it for Trump, his odds on Polymarket had surged to 70%, 80%, and eventually exceeded 90%.

By 10:00 PM EST, Trump’s odds were above 90%, while Kamala Harris’s had fallen below 10%. This level of predictive accuracy is quite remarkable.

Polymarket missed the mark on predicting the popular vote winner, with its markets being off on this one for a considerable time. Granted, no mainstream polls got it right either.

It wasn’t until 10:00 PM EST that the odds flipped from Kamala Harris being projected to win the popular vote to Donald Trump taking a sharp lead. This market was only about 12% the size of the presidential winner market, so it didn’t get as much attention. However, it’s essential to consider this for historical context and to properly assess whether Polymarket truly “got it right.”

I might not win any popularity contests for saying this, but I believe Polymarket had some degree of luck on its side. Had Polymarket accurately predicted both the popular vote and the presidential winner, I’d have no reservations about giving it my full endorsement. While most polls indicated a close race, Polymarket put Trump at 60/40. Statistically, that’s a difference, but not a dramatic one.

That said, Polymarket deserves a lot of credit for how well it performed across other markets, particularly in swing states. While not flawless, it clearly demonstrated a strong ability to capture dynamics no one else predicted, and that’s worth acknowledging. Polymarket earned this win!

Tether Is Consolidating Issuance To Ethereum

Tether plans to retire USDT from several low-activity chains, consolidating them on Ethereum. The largest transfer will involve 1 billion USDT from TRON, aligning with authorized but unissued stablecoins. Other chain swaps will impact networks like Avalanche, NEAR, CELO, and EOS. Due to reduced activity, EOS will be phased out entirely, with 60 million tokens moving to Ethereum. Avalanche will see a shift of 600 million tokens, while NEAR and CELO will also experience reductions. Tether's goal is to streamline its USDT supply on Ethereum, aiming to minimize market disruptions.

Massive Win For Bitcoin! Why The New All-Time High Is Just the Beginning!

I am joined by Mark Yusko, founder, CEO & CIO of Morgan Creek Capital, as we dive into the impact of Donald Trump’s second presidential victory and what it means for Bitcoin’s future!

Chris Inks will join us in the second part to share some interesting trades in crypto and beyond.

My Recommended Platforms And Tools

Phemex - Exclusive for new users, earn up to 8800 USDT. Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '30OFF' for a 30% Black Friday discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.