Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Trading Alpha Has A Black Friday Sale!

Trading Alpha, my go-to indicator site and trading community is having a massive Black Friday sale! 30% off both the Alpha Bundle and the Alpha Screener! If you have been thinking about gaining access to the proprietary Indicator Search Engine for All Markets, now is the time. This custom Indicator Screener scans crypto, stocks, and forex markets for Trading Alpha indicator setups, eliminating the need for time-consuming manual analysis.

Use code '30OFF' entered during checkout on left hand side for a 30% discount!

In This Issue:

Reality Check

Bitcoin Thoughts And Analysis

Altcoin Charts

Legacy Markets

Will Polymarket Stay After The Election?

Crypto Has Already Won

Bitcoin Mining Difficulty Hits All-Time High

Coinbase Is A Serious Player

D-Day: The Moment That Will Make or Break Crypto's Future | US Elections Showdown

Reality Check

I wrote a long newsletter intro last night, shared below. I opted not to discuss the election, as I wasn’t sure we’d have a clear outcome in time to share any informed thoughts. I’ll compile a more detailed analysis in the coming days.

Here are some initial quick takes before diving into the original intro:

Throughout the race, I worked hard to stay unbiased and to analyze the candidates and news through a crypto enthusiast’s perspective. This wasn’t always easy, given that many issues extend beyond our asset class. But for crypto, this election was a clear win in the United States.

The optimistic view is that Trump and his party will fully embrace crypto and deliver on their promises. Even the pessimistic view—if Trump acts out of self-interest—still bodes well for crypto. With four NFT projects and an altcoin launch under his belt, it’s safe to say that these won’t be outlawed under his watch. American altcoin investors are the real winners here.

As for democracy, it’s alive and well. In 2020, Biden won the popular vote by a landslide. And now, after four years of knowing exactly who Donald Trump is, the people have chosen him again. There’s no need to make excuses; the American people were dissatisfied with the last four years and made their choice. And they chose red across the board.

On another note, John Deaton lost to Elizabeth Warren, a race I was deeply invested in. It’s a disappointing outcome personally and for the industry. However, Warren now stands alone—diminished by the red wave, while her ally Sherrod Brown was defeated by Bernie Moreno. The “anti-crypto army” is effectively dismantled.

Gary Gensler is fucked and is likely to face serious challenges now. For Democrat crypto supporters, if there’s any silver lining here, that’s it.

Ross Ulbricht will go free.

The war on crypto seems to be over. Lawsuits may dwindle, and we’re likely to see more legislative and regulatory clarity.

As for the mainstream media, it’s a reminder not to trust everything you read or hear. There was no major fraud; the left will pass the torch, and the country will move forward. The pendulum swings.

Maybe democracy isn’t dead, and perhaps social media has been a bit hyperbolic?

To my Republican friends, congratulations—your team has two years to prove it can govern effectively. To my Democrat friends, take a deep breath; everything will be fine. It always is.

And finally, Bitcoin reached an all-time high on election night. The whales that move the market are artists in their own right.

Poetic.

In the end, Bitcoin is the real winner here—likely reaching this point in the cycle regardless of the election, the Fed, China, Ukraine, Israel, or any other external issue. The cycle is real.

Now, onto the original newsletter.

I quickly compiled a list of major investors who confidently predicted that by now, we’d already be deep into, or emerging from, a recession. Spoiler alert (in case you’ve been living under a rock): that recession never came, and the S&P 500 is up +1,025.83 (21.63%) year-to-date.

The CEO of JPMorgan Chase and the CIO of Bridgewater Associates.

The former chairman and president of Duquesne Capital.

The founder and CEO of Citadel.

Even the IMF thought shit was going to hit the fan.

Make no mistake: these figures (excluding the IMF) rank among the greatest investors of our time. Take Stanley Druckenmiller, for example—a Bitcoiner I deeply admire—who reportedly achieved an incredible 30% annual return over a 30-year career without a single losing year. To put this in perspective, compounding just $1,000 at that rate would yield $2.6 million after 30 years. Most investors spend twice as long in the market and never come close to returns like these.

But here’s the catch: we’re not Stanley Druckenmiller, Ray Dalio, or Ken Griffin. Most of us simply don’t have the expertise, resources, or experience these investing legends bring to the table. While they’re equipped to make bold predictions, 99% of people reading this newsletter aren’t positioned to act on these forecasts effectively. Many might hear these recession warnings and think, “These men are brilliant; I should follow their lead.” However, without a deep understanding of their strategies and the risks involved, attempting to mirror their moves will almost certainly lead to missteps.

These investors can change their minds on a dime, executing 180-degree turns with their entire portfolios overnight. Unlike Warren Buffett, known for his long-term macro bets and buy-and-hold strategy, these traders thrive on market volatility and rapid shifts in sentiment. They react to real-time data, global events, and emerging trends, allowing them to capitalize on short-term opportunities. Every decision they make is about staying ahead of the curve, anticipating market movements well before the average investor, and backed by teams of world-class experts providing insights at a moment’s notice.

Subscribing to Bloomberg and reading public opinion pieces is a far cry from being Michael R. Bloomberg himself in Midtown Manhattan. The reality is that these elite investors possess an unshakeable temperament and confidence. Their success comes from the ability to endure significant losses on high-stakes bets while staying forward-focused, unemotional, and undeterred by setbacks.

Many of us are confident in our investments, but would we maintain that same confidence if the stakes were tens of thousands of times larger, with others' life savings hanging in the balance? Probably not. This level of decision-making is a skill that very few people on the planet can execute successfully, not just once or twice, but consistently over decades.

In many cases, these legendary investors can afford to be wrong; their missteps are factored into their overall strategy and don’t impact their personal livelihoods. While they might face scrutiny or be asked to step down after a series of poor decisions, their basic financial security remains intact for generations. They are playing an entirely different game than we are.

My point isn’t that these investors aren’t brilliant thinkers or shouldn’t be taken seriously; rather, following them blindly is a perilous path for the average investor. For us, the risks are already substantial in a nascent industry like cryptocurrency, and while the potential rewards for our conviction can be significant, it’s essential to navigate this landscape and other markets with caution.

Average and skilled investors alike should focus on saving consistently, increasing their monthly and annual contributions, investing in indexes, selecting a few quality assets, and holding for the long term. This disciplined approach not only helps build wealth over time but also reduces the stress of trying to time the market. We are not built to time the market—they are.

By the time you read this, we will likely know who the president is or at least have a clearer picture, even if the results are close. Below, I’ve included a segment titled “Crypto Has Already Won,” a memo from Matt Hougan, which I wholeheartedly agree with. In four years’ time, yesterday, today, and tomorrow will be mere blips in crypto’s timeline. While much is at stake for crypto in the short run, we’ve weathered far worse and come out stronger. Our history proves our resilience and determination. One election cycle, or one candidate, won’t define or end this industry—far from it.

Bitcoin is destined for $1,000,000, and neither candidate will change that trajectory.

Bitcoin Thoughts And Analysis

Blue skies.

Bitcoin made a new all time high, smashing through $73,800 and hitting $75,000. What is there to say? The bull market is in full swing.

Altcoin Charts

For those who are new here, I share SETUPS and not SIGNALS. These are ideas that I am watching - if a certain thing happens, then the trade triggers. I am not telling you what to buy or when. I am showing you how I am watching certain charts and what has to happen for me to take a trade.

Altcoins are flying - throw a dart, it is likely that time. I will dig into more charts in the coming days, but it’s likely safe to start trading again in the coming months.

Legacy Markets

Donald Trump’s presidential victory led to a rally in global markets, with U.S. stock futures climbing, Treasury yields rising, and the dollar experiencing its largest surge since 2022. S&P 500 futures rose 2.3%, 10-year Treasury yields hit a four-month high at 4.42%, and Bitcoin spiked to a record. Trump’s win, along with Republican control of the Senate, boosted investor sentiment for stocks and crypto due to expectations of relaxed regulations.

Key market moves included a 15% jump for Tesla and a 25% rise for Trump Media & Technology Group, while major U.S. banks like JPMorgan and Bank of America gained on hopes of a looser regulatory environment. The Bloomberg Dollar Spot Index increased 1.3%, while the Mexican peso and the euro saw losses. Smaller, domestically-focused companies on the Russell 2000 index surged 6.1% amid expectations of protectionist policies.

Wall Street analysts anticipate short-term volatility in bond markets, driven by inflation expectations due to Trump’s fiscal policies. Goldman Sachs projected a potential 3% rise in the S&P 500 under a Republican sweep, while Morgan Stanley warned of potential caution in risk-taking due to fiscal concerns. Analysts also predict U.S. equities will continue to outperform global indexes, with possible impacts on interest rate policy and a shift in trade dynamics.

Key events this week:

China trade, forex reserves, Thursday

UK BOE rate decision, Thursday

US Fed rate decision, Thursday

US University of Michigan consumer sentiment, Friday

Some of the main moves in markets:

Stocks

S&P 500 futures rose 2.3% as of 5:35 a.m. New York time

Nasdaq 100 futures rose 1.8%

Futures on the Dow Jones Industrial Average rose 2.9%

The Stoxx Europe 600 rose 1.5%

The MSCI World Index was little changed

E-Mini Russ 2000 Dec24 rose 6.1%

Currencies

The Bloomberg Dollar Spot Index rose 1.3%

The euro fell 1.6% to $1.0751

The British pound fell 1.1% to $1.2896

The Japanese yen fell 1.5% to 153.96 per dollar

Cryptocurrencies

Bitcoin rose 6.7% to $73,769.37

Ether rose 8.5% to $2,620.55

Bonds

The yield on 10-year Treasuries advanced 15 basis points to 4.42%

Germany’s 10-year yield declined four basis points to 2.38%

Britain’s 10-year yield declined three basis points to 4.50%

Commodities

West Texas Intermediate crude fell 1.6% to $70.85 a barrel

Spot gold fell 0.6% to $2,726.25 an ounce

Crypto Has Already Won

Matt Hougan from Bitwise Investments shared his final thoughts before the election. By the time you are reading this, we will potentially decidedly know who won but to Matt’s point, crypto wins either way.

Will Polymarket Last After The Election?

While the founders of Polymarket may not have a personal stake in the election outcome, a decisive Trump victory would likely boost the platform’s credibility, validating its predictions over competing polls and drawing substantial media attention. On the other hand, if Harris were to win by a landslide, it could raise questions about why Trump was heavily favored on Polymarket.

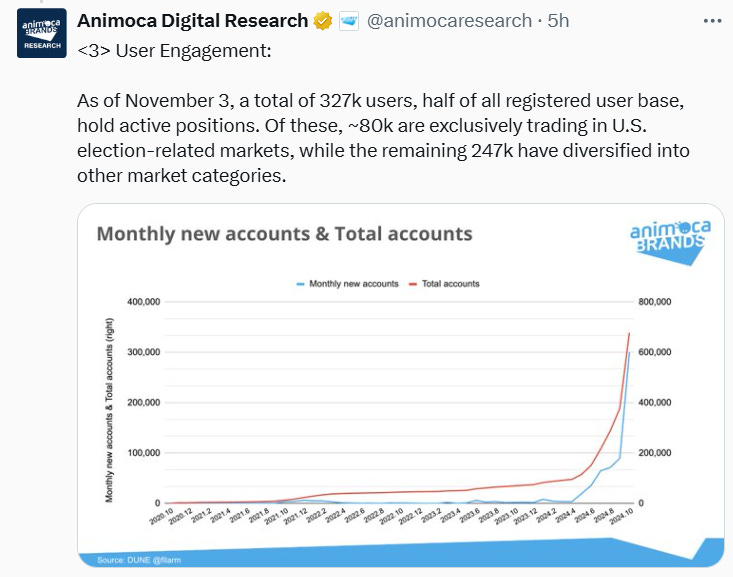

Looking ahead, I fully believe Polymarket will continue beyond the election, though interest and trading volume will likely dip in the short term. The election has been an incredible driver of user growth. Additionally, Polymarket hasn’t yet opened to U.S. residents, where there’s massive interest in gambling. Animoca Brands recently released a report with some interesting stats, which I’ve included below.

“From 2024.4 to 2024.10, monthly trading volumes surged from $40m to $2.5b, while open interest climbed from $20m to $400m.”

“Polymarket has evolved into a platform that reaches mainstream audiences and is frequently quoted by major media like the Wall Street Journal and Bloomberg.”

“Users who have joined Polymarket are likely to continue engaging: 3/4 of users with positions trade on non-election related topics, indicating sustained interest across diverse topics.”

Polymarket has proven to be one of the standout applications of this cycle, and the conclusion of the election won’t diminish its value.

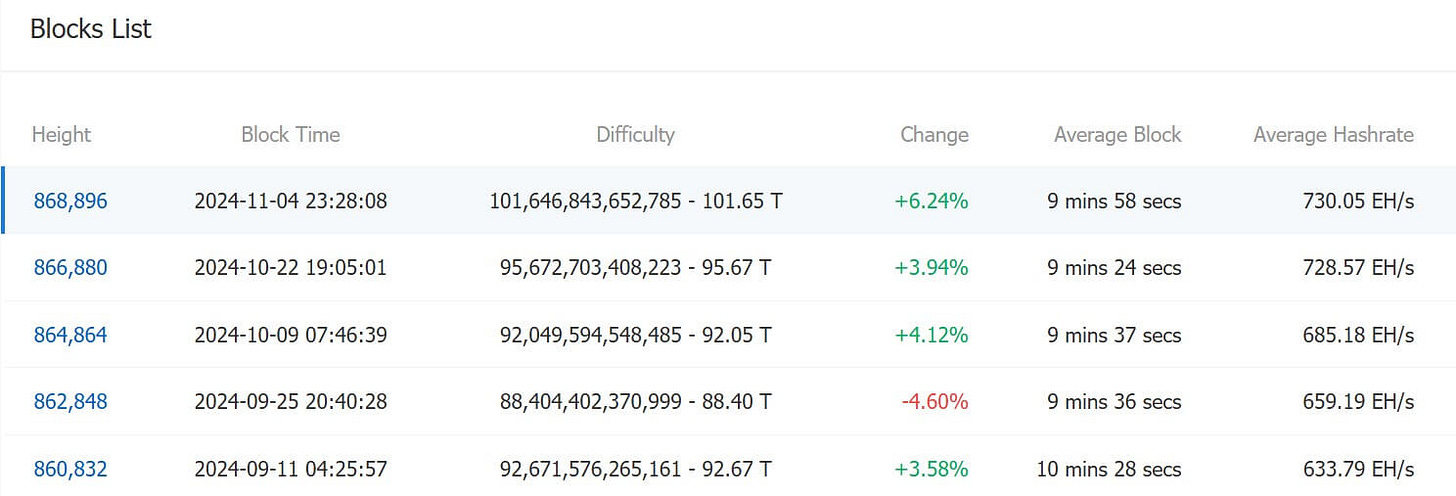

Bitcoin Mining Difficulty Hits All-Time High

Bitcoin mining difficulty reached a historic peak on Nov. 5, surpassing 100 trillion just as U.S. elections were underway, making the mining landscape more competitive than ever. The difficulty rose by 6.24% to 101.65 trillion at block height 868,896, marking the 23rd adjustment of 2024 and a 40% increase in difficulty this year. Additionally, the network’s hashrate set records, with a seven-day average of approximately 730 EH/s.

While higher difficulty and hashrate strengthen the network, they also push mining companies to invest in more efficient equipment to remain profitable. CoinShares reports that the average cost of producing one Bitcoin for public mining firms increased to $49,500 in Q2 from $47,200 in Q1. However, with Bitcoin’s price around $69,000, many miners are still profitable.

Coinbase Is A Serious Player

Props to Coinbase for their hard work this election cycle. Regardless of the outcome in the presidential race—which will undoubtedly dominate conversations—Coinbase has made a real impact by helping the public understand where their politicians stand on crypto issues.

Brian Armstrong recently tweeted that this will be the most pro-crypto Congress in history. He announced Coinbase’s commitment of an additional $25 million to the Fairshake PAC to support pro-crypto candidates leading up to the 2026 midterms. Notably, Coinbase contributed $75 million this election cycle, with Armstrong personally adding $1.3 million. He emphasized that the "crypto voter" is already a force to be reckoned with—and it’s only going to grow.

D-Day: The Moment That Will Make or Break Crypto's Future | US Elections Showdown

Joining me today are Matt Hougan, CIO of Bitwise, and Andrew Parish, co-founder of The Arch Public, as we approach one of the most pivotal days for cryptocurrencies in the U.S.: Election Day. The outcome will shape the future of crypto for years to come. You don't wanna miss this stream!

Unleash algorithmic trading with The Arch Public: https://thearchpublic.com/

My Recommended Platforms And Tools

Phemex - Exclusive for new users, earn up to 8800 USDT. Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '30OFF' for a 30% Black Friday discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.