Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Arch Public!

Last week Arch Public’s Concierge Program clients had an incredible week. Trading both the ES and NQ profits were +13.03% for the week! In the past 70 days Concierge Program clients are up +49.3%. See one of last week’s trades below.

Try Arch Public now! You can even demo the platform, for free, to learn more.

In This Issue:

T-Minus 1 Day

Bitcoin Thoughts And Analysis

Legacy Markets

VanEck Shares Thoughts On Ethereum And More

This Trillion Dollar Asset Manager Is Using Ethereum

Tether Chain Isn’t Happening

Hacks Are Still A Thing

Wine On Chain: Tokenizing The Trillion Dollar Wine Market | David Garrett

T-Minus 1 Day

There's a common assumption that elections play a significant role in market cycles. But is this actually true, or is it a myth perpetuated to influence our votes in a particular direction?

In case you've missed the buzz, tomorrow is the final day to vote in the U.S. election. By late tomorrow night, we may know who the next president will be—former President Donald J. Trump or current Vice President Kamala Harris.

That said, the decision might stretch well beyond Tuesday night. In 2020, the Associated Press announced President Joe Biden’s win four days after Election Day. And in 2000, the outcome between George W. Bush and Al Gore took over a month to resolve, with the Supreme Court ultimately deciding the result in December.

Over the coming days, expect heightened political controversy and increased volatility across the markets.

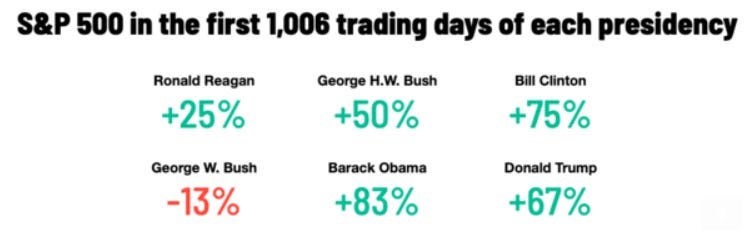

Now, onto markets—the main focus of today’s newsletter. As I’ve emphasized before, markets don’t inherently perform better or worse under any specific political party; that idea simply doesn’t hold up. While crypto may currently operate differently, it will eventually grow to a scale where party affiliation won’t matter, similar to legacy markets. Both parties have a vested interest in a strong market and are willing to print money to support it. Moreover, a thriving market is often seen as a hallmark of a "successful" administration.

For context, when Biden took office on January 20, 2021, the S&P 500 opened at $3,816.22. Since then, it has surged, showing an impressive 50% increase over the past 3.75 years. While it would be naive to ignore rampant inflation, the market has nonetheless performed well. The data suggests that markets tend to thrive regardless of whether a Democrat, Republican, or even a "confused geriatric" is in office. Ultimately, market performance often transcends party lines and political theatrics.

The larger factors influencing market performance are often cycles, geopolitical events like war, the housing market, black swans, recessions, interest rates, inflation, corporate earnings, technological advances, regulatory changes, and market sentiment. Notably, markets are already familiar with both of these candidates, and that familiarity can significantly shape market sentiment. Historical trends indicate that when investors feel comfortable with the political landscape, it often translates to increased confidence in market performance.

Here’s a brief summary of the S&P 500's performance over the past few years:

2013: The S&P 500 saw a substantial gain of approximately 29.6%. (Obama)

2014: The market had a positive return of around 11.4%. (Obama)

2015: The S&P 500 experienced a modest return of about -0.7%. (Obama)

2016: The market posted a positive return of approximately 9.5%. (Obama)

2017: The S&P 500 had a positive return of approximately 19.4%. (Trump)

2018: The market experienced a negative return of about -6.2%. (Trump)

2019: There was a strong rebound with a positive return of around 28.9%. (Trump)

2020: The year marked by the COVID-19 pandemic, resulting in a return of approximately 16.3%. (Trump)

2021: The market surged with a return of approximately 26.9%. (Biden)

2022: The S&P 500 faced significant challenges, resulting in a negative return of about -18.1%. (Biden)

2023: The index rebounded with a positive return of around 20.5%. (Biden)

2024: Year-to-date, the S&P 500 is up an impressive 20.79% going into Q4. (Biden)

If it were true that a Republican elected after a Democrat "lifts the market," everyone would know, and we’d all be rich. The same goes for a Democrat elected after a Republican.

With that in mind, let's pivot to crypto, where this election presents a different set of rules. I’ve been emphasizing that Bitcoin’s performance this cycle is likely to remain strong regardless of the winning candidate, as both present limited downside risk. However, if Trump wins and delivers on his promises, the cycle high’s upside potential for Bitcoin could be significantly greater.

Our potential range of outcomes are somewhere between these:

A president who actively promotes Bitcoin, commits to not selling holdings, removes Gary Gensler from the SEC, endorses a strategic reserve bill, ends Operation Choke Point 2.0, frees Ross Ulbricht, establishes a Bitcoin and crypto Presidential Advisory Council, and encourages domestic mining. This scenario could significantly influence Bitcoin’s price trajectory. (Assuming promises are kept.)

A president who has enabled Operation Choke Point 2.0, supports stringent regulation through Gary Gensler’s leadership at the SEC, promotes Central Bank Digital Currencies as a government-controlled alternative to decentralized cryptocurrencies, raises concerns about selling Bitcoin holdings, and fosters a climate of skepticism toward crypto investments. This creates significant uncertainty for the market. (Assuming her mind isn’t changed.)

Before critics chime in, I know Kamala wasn’t the president, but she served as VP to a president currently deemed unfit to run again. Can we realistically expect a change in the crypto landscape if she didn’t take positive steps over the past four years? I have my doubts, but remain open minded.

The performance of Bitcoin under different candidates is one narrative, but how everything else will perform is another story.

Bitcoin Under Trump:

If Trump follows through on his promises, the cycle peak has the highest potential.

If Trump doesn’t follow through, the cycle peak still has high potential.

Bitcoin Under Kamala:

The cycle peak is likely to be somewhat muted compared to the Trump conditions above.

Everything Else Under Trump:

If Trump follows through on his promises, quality altcoins have strong potential.

If Trump doesn’t follow through, quality altcoins have slightly less potential.

Everything Else Under Kamala:

This is the worst-case scenario for everything outside of Bitcoin. Altcoins could face a long road ahead.

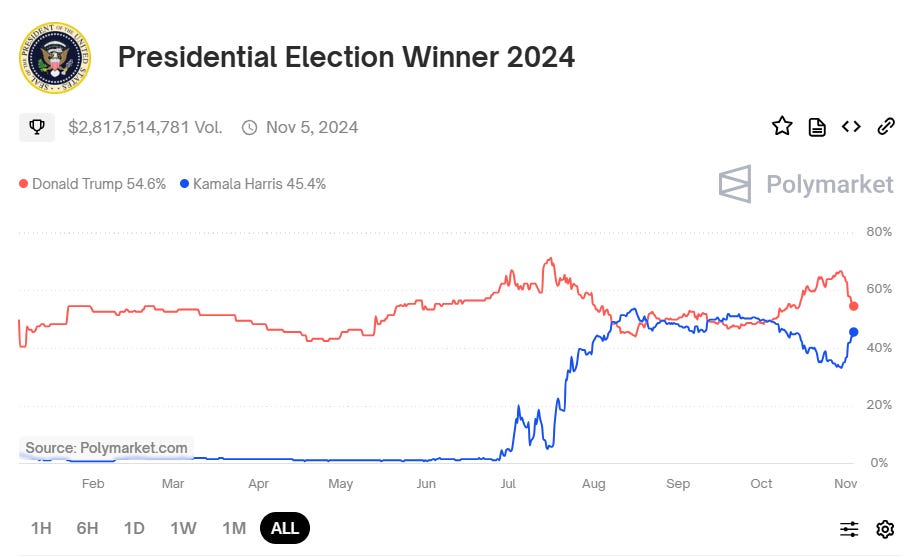

While we're on this dichotomy, let’s take a brief look at some major developments on Polymarket and Kalshi over the weekend.

And Kalshi (Polymarket’s competitor):

It’s fair to say that the crypto pullback we’re witnessing is closely tied to betting markets converging to show a much tighter race. While Kamala hasn’t overtaken Trump on Polymarket, she briefly held the lead on Kalshi before Trump regained a few percentage points. Clearly, the crypto market favors Trump over Kamala.

For some historical context on price action: back in 2020, when Bitcoin retested its all-time high of around $20,000, it saw a sharp pullback of roughly 18%. This correction recovered within about 30 days, after which Bitcoin went on to establish a new all-time high. Crypto investors appear wary of a Kamala win, perhaps tracing a similar price pattern.

Moreover, it wouldn’t be surprising if some major market participants are betting on Kamala’s victory while simultaneously shorting Bitcoin. In hindsight, this approach seems strategic, especially given Trump’s previous strong lead on Polymarket and the recent surge in Bitcoin’s price from $59,500 to $73,500 in just 20 days.

This is purely speculative, and I don’t place much weight on it—I have no more insight than anyone else. However, I’ve heard from lower-risk-tolerance crypto investors who are waiting for the election results before re-entering the market. Regardless of the outcome, we’re likely to see investors return to crypto, though the effects could vary significantly: a Trump victory might ignite a market-wide buying spree, while a Harris win could lead to a more gradual inflow, primarily concentrated on Bitcoin.

Here we are, t-minus one day away from a critical outcome. So, make your voice heard, cast your vote, and keep Bitcoin in mind as you do.

*As an aside - this is a Bitcoin focused newsletter, and I view it as my job to lay out the realistic political outcomes specific to our industry without bias. I am more than aware that there are other important issues that are the focus of most voters.

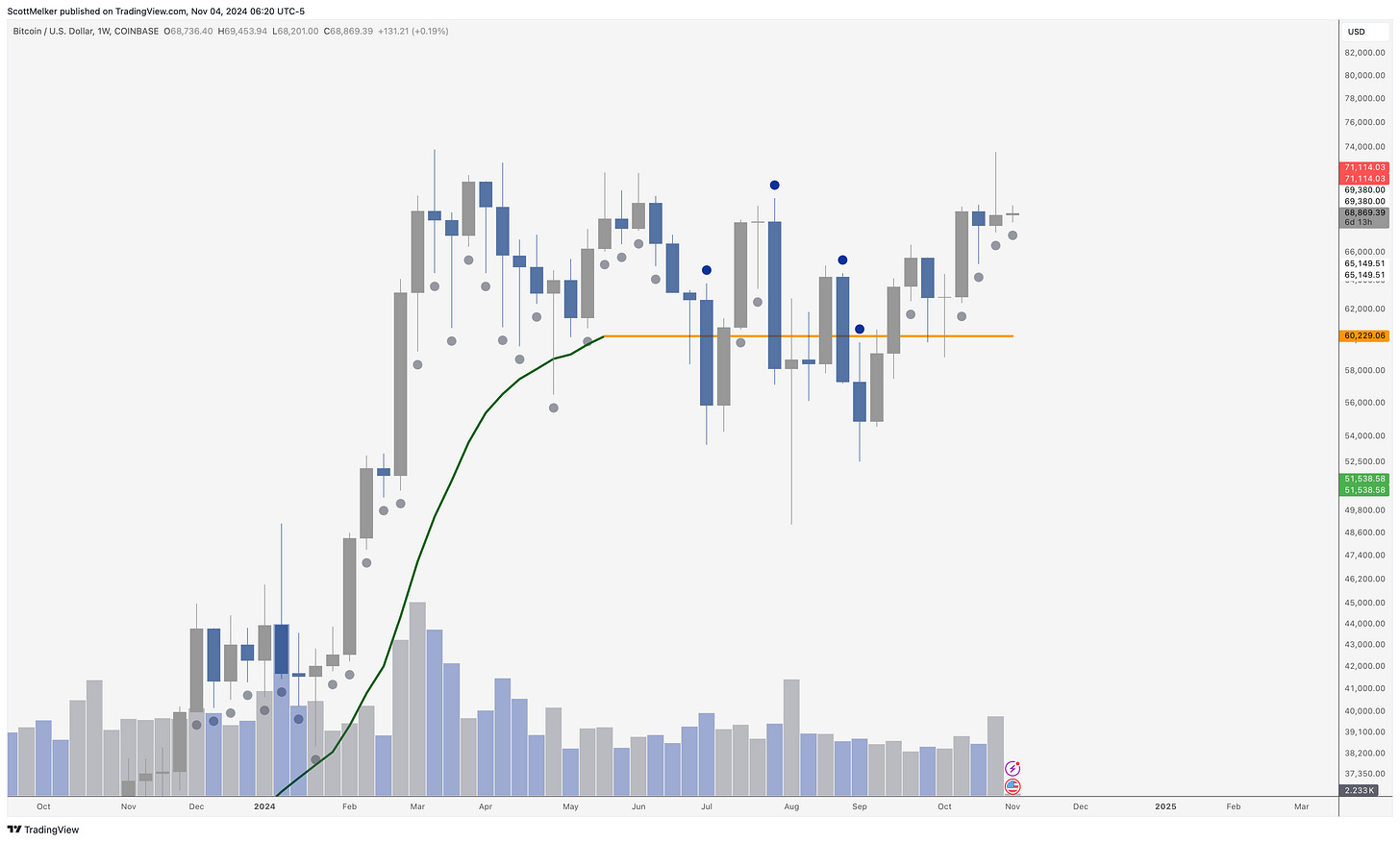

Bitcoin Thoughts And Analysis

Last week’s candle had an ugly close, with a small body and large wick up. This is a sign of sellers stepping in and pushing price down - not a surprise on the first attempt at breaking all time high resistance. Trading Alpha is still showing grey dots, meaning the bullish trend is intact.

I am not worried here at all, just waiting for the election to pass to really analyze markets.

Legacy Markets

The dollar dropped as some U.S. polls shifted in favor of Kamala Harris over Donald Trump, prompting investors to adjust their bets on the election outcome. Oil prices rose after OPEC+ postponed an output hike and amid rising tensions with Iran.

Key highlights:

- The dollar index saw its largest decline in over a month, while the Mexican peso rallied.

- U.S. Treasuries and European stocks gained as investors reacted to election polls showing Harris with slight leads in key states, although within the margin of error.

- U.S. stock futures edged higher, and Nvidia rose on news it would replace Intel in the Dow Jones Industrial Average.

- Central banks, including the U.S. Federal Reserve, are expected to make rate cuts this week, with the Fed anticipated to lower rates by 25 basis points.

- Oil climbed nearly 3% as OPEC+ delayed a production hike and Iran intensified its rhetoric against Israel.

- In China, investors are watching for fiscal stimulus announcements from the National People’s Congress to support the slowing economy.

Markets remain volatile, with the election and central bank decisions shaping the trading landscape for the week.

Key events this week:

India HSBC Manufacturing PMI, Monday

US factory orders, Monday

Eurozone HCOB Manufacturing PMI, Monday

China’s Standing Committee of National People’s Congress meets through Nov. 8, Monday

Australia rate decision, Tuesday

China Caixin Services PMI, Tuesday

Indonesia GDP, Tuesday

Philippines CPI, Tuesday

South Korea CPI, Tuesday

US trade, ISM Services index, Tuesday

US Presidential Election, Tuesday

Brazil rate decision, Wednesday

New Zealand unemployment, Wednesday

Poland rate decision, Wednesday

Taiwan CPI, Wednesday

Vietnam CPI, trade, industrial production, Wednesday

ECB President Christine Lagarde speaks, Wednesday

China trade, forex reserves, Thursday

Eurozone retail sales, Thursday

Mexico CPI, Thursday

Norway rate decision, Thursday

Peru rate decision, Thursday

Sweden rate decision, CPI, Thursday

UK BOE rate decision, Thursday

US Fed rate decision, initial jobless claims, productivity, Thursday

Brazil inflation, Friday

Canada employment, Friday

Chile CPI, Friday

Taiwan trade, Friday

US University of Michigan consumer sentiment, Friday

Fed Governor Michelle Bowman speaks, Friday

Some of the main moves in markets:

Stocks

The Stoxx Europe 600 rose 0.2% as of 10:32 a.m. London time

S&P 500 futures rose 0.2%

Nasdaq 100 futures rose 0.1%

Futures on the Dow Jones Industrial Average were little changed

The MSCI Asia Pacific Index rose 0.6%

The MSCI Emerging Markets Index rose 0.4%

Currencies

The Bloomberg Dollar Spot Index fell 0.5%

The euro rose 0.6% to $1.0899

The Japanese yen rose 0.7% to 151.88 per dollar

The offshore yuan rose 0.5% to 7.0970 per dollar

The British pound rose 0.4% to $1.2974

Cryptocurrencies

Bitcoin fell 0.6% to $68,714.13

Ether fell 0.1% to $2,465.36

Bonds

The yield on 10-year Treasuries declined nine basis points to 4.29%

Germany’s 10-year yield advanced two basis points to 2.42%

Britain’s 10-year yield advanced two basis points to 4.47%

Commodities

Brent crude rose 2.7% to $75.04 a barrel

Spot gold rose 0.2% to $2,741.06 an ounce

VanEck Shares Thoughts On Ethereum And More

For anyone holding Ethereum or wanting a clearer view on its underperformance, VanEck provides valuable insights. They argue that ETH's lag behind BTC and SOL this cycle boils down to a structural shift in its economic model that prioritized Layer 2 solutions, ultimately cannibalizing ETH's growth. While this decision has led to short-term challenges, VanEck notes that “Ethereum’s long-term vision still holds potential,” and that “Ethereum can still control its own destiny.”

Personally, I find VanEck’s report to be pretty balanced. What do you think?

“ETH is up (+14%) YTD, but it’s trailing behind BTC (+49%) and SOL (+52%). The catalyst? EIP-4844, implemented on March 13, 2024, which shifted Ethereum's economic model. EIP-4844 created a separate transaction layer for Layer-2 (L2) blockchains to post data cheaply, drastically reducing their demand for Ethereum’s blockspace. Previously, L2s accounted for 20% of Ethereum’s blockspace usage—now, that demand has evaporated.

The result? A collapse in Ethereum’s transaction prices. Annual revenues plummeted from $7.2B in March to just $1.2B in September. Net ETH emissions flipped from deflationary (-1.15%) to inflationary (+0.34%)—more supply, less demand. This shift is directly tied to ETH’s underperformance.

Ethereum made this move to expand its blockspace capacity for mass adoption, following a strategy similar to Solana’s low-cost blockspace model. But for short-term investors, reducing Ethereum’s “take rate” killed the narrative of ETH as a deflationary, dividend-like asset.

EIP-4844 isn’t just a tactical shift; it fundamentally alters Ethereum’s business model. Before, ETH generated revenue by monetizing transaction activity (base fees, priority fees, MEV fees). It charged users to access blockspace and positioned transactions within each block. Now, Ethereum aims to become a settlement and data availability layer for its L2s.

Ethereum’s long-term vision assumes that L2s will scale to millions of users, paying ETH for settlement. This creates a system where L2s charge their customers in ETH, fueling the asset’s value. Ethereum’s core believers argue that this makes ETH “money.” While ETH can be money within Ethereum’s ecosystem, it only holds value if L2s remain “Ethereum aligned.” So far, Ethereum hasn’t enforced any real alignment, making this framework feel more like a loose confederacy.

The pact between Ethereum and its L2s could break if the economics shift. L2s are closer to end users, and historically, the closer you are to the user, the more valuable the business. If L2 ecosystems gain enough momentum and applications, they might leave Ethereum altogether to capture the monetary premium for themselves.”

“Despite its current struggles, Ethereum’s long-term vision still holds potential. Ethereum’s robust censorship resistance (liveness) and security provide stronger property rights than Solana, making it a more permissionless and secure platform. Ethereum can still outcompete Web2 platforms that take massive fees (30%+).

Most importantly, Ethereum can still control its own destiny. Developers could force L2s to implement “based sequencers,” requiring validators to hold ETH for transaction sequencing. Ethereum could offer stronger guarantees like faster finality for L2s that remit more value to the main chain or even require L2s to collateralize ETH to use Ethereum’s blob transaction layer. There is talk of implementing ETH’s next fork in a way that minimizes excess supply.

If Ethereum makes these moves, it could regain lost economic value and stave off competition from its L2s or even Solana. Like with corporations and their stock price, an underperforming token can often trigger a pivot. Ethereum might be nearing that inflection point.”

This Trillion Dollar Asset Manager Is Using Ethereum

I'm about to sound a bit bipolar here—I've just finished breaking down the VanEck report, which offers constructive criticism of Ethereum, and now I’m pivoting to a bullish post about this latest news—but who cares? UBS, one of the largest banks in the world, based out of Switzerland and responsible for over $5 billion in AUM, has joined the ranks of major institutions launching money market investments built on Ethereum.

I like Mario Nawful's statement about what this news means: “This move is like putting ETH right into the heart of traditional finance.” While the crypto space is buzzing with meme coins, the future of Layer 2s, and competition from other chains, Ethereum continues to embed itself deeper into traditional finance, steadily solidifying its position as the premier platform for tokenization—a narrative with serious long-term staying power. Sure, tokenizing treasuries and money markets may not sound thrilling, but it’s only the beginning. The logical next steps include tokenizing everything from equities to mutual funds and beyond. Also, take notice on how long these things take. UBS piloted this technology for a year, total tokenization won’t happen overnight, it’s going to come in slow phases.

Tether Chain Isn’t Happening

This post speaks for itself, but Ardoino also shared an insight that hadn’t crossed my mind until I read it from him: “Any product / announcement done this coming week would end up likely obliterated by the election noise. Gotta push back new product release by 7 days.” Trump winning would be the perfect time for companies to release new news, as they’d benefit from quieter post-election noise and potentially favorable market conditions. Good news will still follow a Kamala win, but companies might be more hesitant, knowing the reception probably won’t be the same.

Also TogETHER isn’t a nod to Ethereum, it’s ‘TETHER’ put inside the word “together”

Hacks Are Still A Thing

A sophisticated exploiter targeted crypto casino Metawin's Ethereum and Solana hot wallets, stealing over $4 million by exploiting a “frictionless withdrawal system,” according to Metawin CEO Richard "Skel" Skelhorn. Apparently, 115 addresses were tied to the exploit, with stolen funds transferred to KuCoin and a HitBTC nested service. Skelhorn assured users that withdrawals, initially disabled, have since been re-enabled, and authorities are now involved. He also noted he personally covered the losses to maintain user confidence, stating, “We keep building.” Moral of the story: avoid gambling your coins and, more importantly, be cautious about connecting your wallet to unsecure platforms.

Wine On Chain: Tokenizing The Trillion Dollar Wine Market | David Garrett

In this exclusive episode of The Wolf of All Streets, we're diving deep into a world-first innovation: bringing the entire wine industry on-chain! From tokenized bottles to decentralized wine assets, David Garrett, Co-Founder of dVIN Labs, explains how he’s transforming wine as we know it with blockchain technology. Join us as we explore how this evolution could reshape investment, data, and wine experiences forever!

My Recommended Platforms And Tools

Phemex - Exclusive for new users, earn up to 8800 USDT. Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Black Friday sale (largest discount Trading Alpha has ever done) -30% off both the Alpha Bundle and the Alpha Screener. -30% off code = 30OFF entered during checkout on left hand side

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.