Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Phemex!

Phemex is the most efficient crypto trading and investment platform. Phemex offers over 293 spot trading pairs, minimal fees, peer-to-peer trading, derivatives, up to 100x leverage, and $8,800 welcome rewards up for grabs! Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Make sure to check if Phemex is available in your jurisdiction.

In This Issue:

Signs Of Life

Bitcoin Thoughts And Analysis

Legacy Markets

Pump.Fun Plans To Launch A Token

Probably Not

Coinbase Wants Answers

This Is Why Trump Turned Pro-Crypto

Risk On: Will Bitcoin Break $70K? | Macro Monday

Signs Of Life

Now that we're finally seeing signs of life—Bitcoin and the broader market starting to break out—I want to keep building on the mindset we need heading into the next phase of the bull market, especially as we prepare for consistent gains or even potential parabolic moves. On that note, I want to address some of the major questions that naturally arise as the market shifts.

Without further ado:

Am I smart or am I lucky?

I can’t provide a definitive answer unless I see your portfolio and all of your previous decisions, and even then, it probably won’t be entirely clear. Anyone who has achieved any level of success should acknowledge that luck has played at least some role in their journey. The real question to consider is: *how lucky am I?*

If you've been in crypto for years, riding out the highs and lows, and buying the dips, it's safe to say you’ve got some smarts. But if you just jumped in at the beginning of this year to catch Bitcoin's big move without much prior knowledge and are still here, it might be time to admit there was a bit of luck involved.

Other points to consider are what your portfolio is composed of, how diversified it is, and whether you’ve been strategic in your choices. Are you investing in established assets, or are you chasing after the latest trends? Each decision shapes your overall experience and outcomes. Ultimately, reflecting on your journey—balancing both your intelligence and the role of chance—can provide valuable insights into where your portfolio is headed.

If you realize that luck has played a bigger role in your success than your own intelligence, take a moment to acknowledge it—it’s a sign that it’s time to stop relying solely on chance. It takes humility to admit this and wisdom to act on it. In a market as tough as this one, skill will beat luck 99 times out of 100 in the long run.

How disciplined has my approach been?

If you’re expecting smooth sailing for the rest of this bull market but haven't had a steady course to get here, then I’ve got a bridge to sell you. If your buying has been random, your trades inconsistent, you haven’t done your homework on the assets you’re investing in, ignored basic risk management, failed to track your performance, kept repeating the same mistakes, and fallen for hype—do you really think things will suddenly improve? The answer is no.

Sure, in a bullish market, everyone is likely to make gains, but simple mistakes can be the difference between maximizing your profits and settling for minimal returns. Discipline starts with something as basic as reading this newsletter every day and applying the insights shared here. For example, yesterday’s edition was a masterclass on a critical skill many struggle with: how to sell effectively. Staying disciplined is a choice you make, and if you don't, you're essentially gambling.

Can I mentally sustain a large pullback?

Let’s say Uptober delivers and Bitcoin hits $100,000 by the end of the month. Are you comfortable enough with your position to watch it give up most of those gains during a retest? It’s essential to evaluate your mental resilience in the face of volatility, especially in a bull market where sudden 30% pullbacks are the norm. Knowing how you'll react when the market turns will help you stay grounded and make smarter decisions.

At some point, the answer to that question has to become ‘no’ if you plan to take profits and avoid riding out a pullback through an entire new bear cycle. Thankfully, there’s still plenty of upward price movement ahead, so that moment isn’t now. But if you're holding, you need to be prepared to weather the volatility and stay the course until the right time comes. Trust me, I’ll be sharing all of my thoughts as the time approaches.

The other component to answering this question involves considering your personal financial situation. If your crypto portfolio is overshadowing your debts—such as student loans, mortgages, or healthcare costs—it may be time to take profits. After all, there’s more to life than simply holding onto crypto forever. Enjoy life a little; it’s more finite and precious than digital coins.

At what point will I turn emotional?

Does Bitcoin at $100,000 excite you? How about $125,000, $150,000, $200,000, or $250,000?

Everyone has a tipping point where they go from being cool, calm, and collected to feeling that rush of excitement and urgency. For some, this shift will happen this cycle, while for the more extreme maxis, it might not kick in until Bitcoin hits $500,000 or even $1,000,000 much later on. If your target falls within the range of that first group—potential numbers we could see this cycle—it’s time to start formulating a strategy before your emotions cloud your decision-making.

If Bitcoin doesn’t excite you until it hits those higher numbers, does it scare you to think it might spend a couple of years trending down before it finally starts to climb? And then, it could take another year or two before reaching a new cycle high. If your answer is 'yes,' then it might be time to adjust your goalposts a bit and consider taking some size off the table at more reasonable levels.

If you are human, there will be a point in which cycle FOMO will get to you—plan accordingly.

Where am I most likely wrong?

Create a list right now of your various convictions with two columns: *‘Things I Am Sure Of’* and *‘Things I Am Not Sure Of.’* Be critical when filling in the *‘Sure Of’* column, as these represent the areas where you’re willing to take significant risks. Remember, being wrong in this category isn’t an option.

Now, turn your attention to the *‘Things I Am Not Sure Of’* column. This is where you can explore uncertainties without the pressure of having to commit. Identify what makes you hesitate or feel ambiguous. Consider whether these uncertainties stem from a lack of information, personal biases, or market volatility.

The *‘Not Sure Of’* column should have some depth to it. If it doesn’t, then you might be overly confident, or perhaps you’re one in a million—a genius, and I’m envious of you. The goal for this category is to find 1 or 2 ‘big ticket’ items that can be moved to the other column because you put in the proper amount of work.

Your goal for the “Not Sure Of” column is to ensure that the risks you identify here don’t outweigh those in the *‘Sure Of’* column. If you find yourself more concerned about the uncertainties, it may be a sign that you’re overexposed to assets or positions that carry too much risk. Use this column to evaluate the potential downsides and consider whether your exposure aligns with your risk tolerance.

It can be incredibly insightful to weigh different assets against each other in this format to assess where you might be under or overexposed. For instance, consider an asset you expect to have a 10x upside with a 50% chance of success. This is much more appealing than an asset with a 20x upside but only a 10% chance of success.

My goal with this newsletter is to help you transition into bull market mode, where you’re asking the right questions and making sound decisions. A bull market can be just as challenging as a bear market; the key difference is that everyone is winning, which can make it harder to spot common pitfalls.

Before I wrap up, I want to address the growing belief that if Trump is elected, Bitcoin will skyrocket to $100,000:

First, let’s be conservative and assume Bitcoin is at $70,000 on election day, with the results not dragging out for weeks with recounts. For Bitcoin to jump from $70,000 to $100,000, it would require a 42% increase. Is that possible within a week? Sure, especially if Trump wins and signals he’ll follow through on his crypto promises. If Bitcoin reaches $80,000, it only needs a 25% increase to hit $100,000—definitely attainable. The real question isn’t whether it can happen, but whether Trump would truly be the catalyst. Those claiming he will drive Bitcoin to $100,000 want it to be true, and it serves their political and financial interests to say so.

Keep this in mind as the election approaches and your favorite X personality is saying, “Trump wins = Bitcoin $100,000.” I want to see a pro-crypto president as much as anyone, and of course, I’d love to see Bitcoin over $100,000. But be cautious about what people are saying—we're about to enter a very divisive and emotional period. Don’t let chaos cloud your judgment.

Bitcoin Thoughts And Analysis

In yesterday’s analysis, I said that I was looking for a retest of $66,550 as support. We got that almost to the penny. Nothing alarming here at all, just a bit of retracement after a big move to the upside.

Legacy Markets

US stock futures dipped and Treasuries steadied after Monday’s selloff as traders speculated over the direction of US interest rates. Contracts on the S&P 500 retreated, and European stocks dropped 0.7%, with real estate and utilities sectors hit hardest due to the rising borrowing costs. The yield on 10-year Treasuries edged up by one basis point to 4.21%, following a surge of 11 basis points earlier in the week.

Investors are scaling back expectations for Fed rate cuts after central bank officials signaled a slower pace of reduction. The potential inflationary effects of a Donald Trump presidential win, with promises of tax cuts and trade tariffs, also weigh on the market, leading to higher rates. Christopher Dembik of Pictet Asset Management noted that the rise in yields is starting to threaten equity markets, with bonds selling off globally.

Gold rose amid increased haven demand driven by the Middle East conflict and the upcoming US election. Despite risks, US stocks have maintained a strong winning streak, one of the best since 1928. However, if the S&P 500 posts a loss on Tuesday, it would mark the first back-to-back decline in 30 sessions. Citigroup strategists warn of a potential 10% slump, given the current high exposure to the S&P 500.

Even though US equities remain expensive, going underweight is challenging, especially in a year where the S&P has hit 47 record highs. European equities, by contrast, appear cheaper, though many European companies have missed earnings expectations.

In corporate news, Germany’s SAP saw a 5.6% rise after beating key metrics and raising guidance for the year. Meanwhile, Hyundai Motor India shares dropped after the country’s largest IPO raised $3.3 billion. Tokyo Metro Co. and Horizon Robotics Inc. IPOs were met with strong demand.

Key events this week:

ECB’s Christine Lagarde is interviewed by Bloomberg Television, Tuesday

BOE’s Andrew Bailey as well as ECB’s Klaas Knot and Robert Holzmann to speak at Bloomberg Global Regulatory Forum in New York, Tuesday

Philadelphia Fed President Patrick Harker speaks, Tuesday

Canada rate decision, Wednesday

Eurozone consumer confidence, Wednesday

US existing home sales, Wednesday

Boeing, Tesla, Deutsche Bank earnings, Wednesday

Fed’s Beige Book, Wednesday

US new home sales, jobless claims, S&P Global Manufacturing and Services PMI, Thursday

UPS, Barclays earnings, Thursday

Fed’s Beth Hammack speaks, Thursday

US durable goods, University of Michigan consumer sentiment, Friday

Some of the main moves in markets:

Stocks

S&P 500 futures fell 0.5% as of 6:17 a.m. New York time

Nasdaq 100 futures fell 0.6%

Futures on the Dow Jones Industrial Average fell 0.5%

The Stoxx Europe 600 fell 0.7%

The MSCI World Index fell 0.2%

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro was little changed at $1.0818

The British pound was little changed at $1.2980

The Japanese yen was little changed at 150.83 per dollar

Cryptocurrencies

Bitcoin fell 1.2% to $66,887.98

Ether fell 1.9% to $2,622.97

Bonds

The yield on 10-year Treasuries was little changed at 4.20%

Germany’s 10-year yield advanced four basis points to 2.32%

Britain’s 10-year yield advanced three basis points to 4.17%

Commodities

West Texas Intermediate crude rose 0.8% to $71.12 a barrel

Spot gold rose 0.5% to $2,734.67 an ounce

Pump.Fun Plans To Launch A Token

During a recent X Space, members of the Pump.Fun team revealed that significant changes are coming to the platform, although they didn’t specify a timeline for their most substantial update. The highlight of the event was the announcement: “We are definitely planning on launching a token at some point in the future. We want to ensure our early users are rewarded... Our airdrop will likely be much more lucrative than anything else in the space.”

I have to admit, I’m naturally a bit skeptical about a token launch from a platform known for meme launches. Based on the quote—though I wasn’t in the Space—it seems the primary focus is on rewarding users and ensuring the launch is "lucrative." If those are the main objectives, the token may succeed in that regard, but it likely won’t hold long-term value. Of course, without full details, this remains speculative on my part.

In other Pump.Fun news, the team also announced the release of Pump Advance, which is indeed a step in the right direction. “We wanted to… provide an additional experience for people that wanted additional filtering, wanted a more advanced view, wanted to trade really quickly, but at the same time wanted low fees. Our goal with Pump Advance is to give traders better tools to filter these coins.” For the first month of Pump Advance, users won't be charged any fees.

Meme season is still very much alive.

Probably Not

Oh boy, where do I even begin with this one? Criticism won’t get me anywhere—those who agree are already on board, and those who don’t will just unsubscribe. So, I’ll simply present the story as it is and let you make up your own mind.

“In seven years’ time, since Cardano launched, we went from nothing to an 11-figure network with millions of people and the largest research group in the world and the passion of the young people. In another decade’s time we will be larger than Ethereum, and in another decade’s time we will be larger than Bitcoin, and in another decade’s time, the majority of the world’s governments will run on Cardano because they trust it. That is what thinking in decades gives you.”

If you do want my opinion, keep reading. If you don’t, well… skip ahead.

I’m not convinced that Cardano will overtake Ethereum or Bitcoin, or see widespread government adoption. A couple of cycles ago, Cardano was one of the standout projects, but in the circles where I gather my opinions, beliefs, and data, it’s no longer part of the conversation. I’m sharing this to pass along what I know, in the hope that it helps you make informed decisions that align with your goals.

Coinbase Wants Answers

Coinbase has filed two Freedom of Information Act (FOIA) requests against U.S. regulators, seeking transparency on the cryptocurrency crackdown among U.S. banks, according to Paul Grewal, Coinbase's chief legal officer. One FOIA request aims to uncover details about the Federal Deposit Insurance Corporation (FDIC) reportedly asking banks to limit crypto company deposits to 15% of their total. The second request seeks information on how regulators have responded to past crypto-related FOIA requests. One important point of clarification is, “Each [FOIA request] is separate from our FOIA filings from over a year ago that are now the subject of federal lawsuits,” Grewal said.

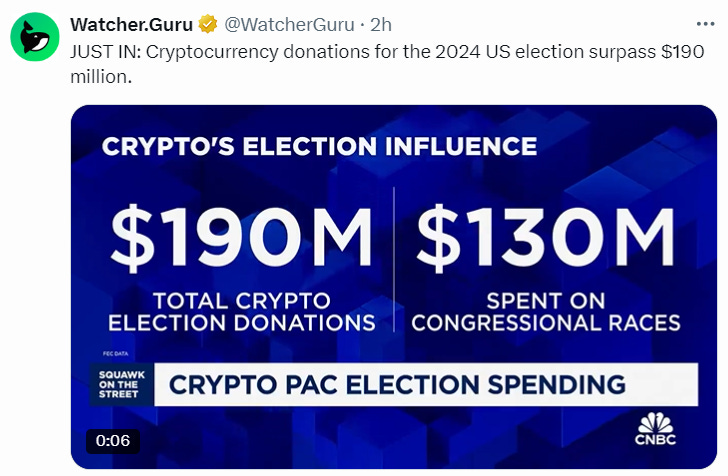

This Is Why Trump Turned Pro-Crypto

The numbers don’t lie—money talks—and these statistics are pretty wild. The title of this segment might be half-joking, but for many politicians, it makes sense to support crypto now and figure out the details later. We can’t really fault them for that, considering most of us got into this space because we saw the potential to make money. Either way, crypto is here to stay.

Risk On: Will Bitcoin Break $70K? | Macro Monday

Join Dave Weisberger, Mike McGlone, and James Lavish as we break down what's happening in macro and crypto!

My Recommended Platforms And Tools

Phemex - Exclusive for new users, earn up to 8800 USDT. Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '10OFF' for a 10% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.