Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Arch Public!

Arch Public Concierge Program clients are up +30.11% in the past 60 days. The foundation of returns like this is our commitment to daily liquidity and stop loss protection on every trade. Protection to the downside, and pinpoint accuracy for both entries and exits to the upside. Listen to one of our Concierge Program clients below.

Try Arch Public now! You can even demo the platform, for free, to learn more.

In This Issue:

MicroStrategy's Endgame

Bitcoin Thoughts And Analysis

Altcoin Charts

Legacy Markets

Hal Finney’s Thoughts On A Bitcoin Bank

Ethereum ETF Options Delayed Again

Base Is Still Growing

The WLF Token Sale Begins Tomorow

Why Democrats And Republicans Must Unite For Crypto’s Success | Anthony Scaramucci

MicroStrategy's Endgame

MicroStrategy’s performance over the past week, month, and year has been nothing short of remarkable.

In just five days, MSTR has surged 18%, climbed 50% in the last month, and posted an extraordinary 568% gain over the past year.

Without sounding overly optimistic, it’s hard to ignore the possibility that we’re seeing a fundamental transformation unfolding between new and old finance.

This quote from Michael Saylor will be studied for decades, “The endgame is to be the leading Bitcoin bank, or merchant bank, or you could call it a Bitcoin finance company.”

Before diving deeper into this topic, I want to make it clear that I’m not here to claim expertise as a corporate reserve strategist or any other title you'd assign to those debating whether MicroStrategy’s approach is groundbreaking genius or overhyped speculation. There are far more qualified individuals who can add depth and nuance to that conversation. My goal is to simply report the facts and provide an overview of what's happening so you can form your own opinion.

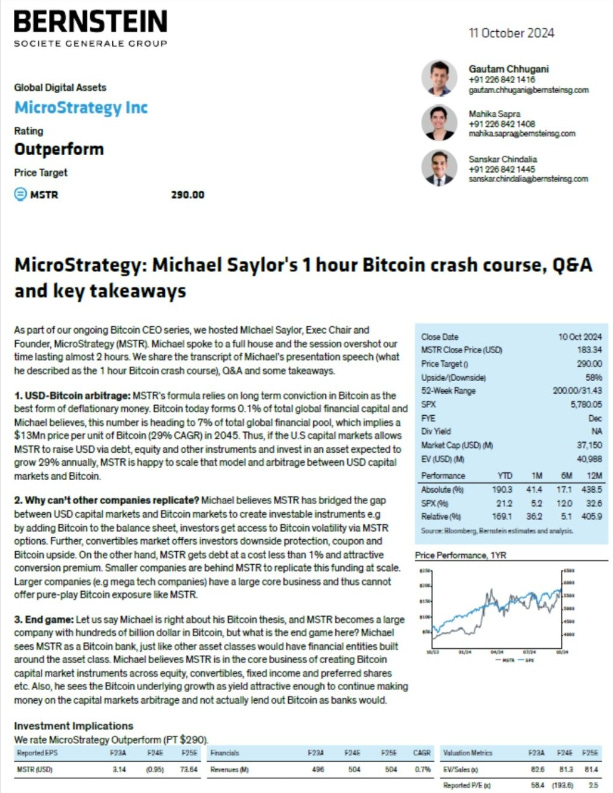

Here’s where it begins: On Friday of last week, Bernstein released analysis of an interview with Michael Saylor, in which was revealed his bold vision to turn the company into the world’s top Bitcoin bank, with aspirations of reaching a trillion-dollar valuation. Saylor outlined the strategy we are all familiar with of borrowing at low interest rates and aggressively investing in Bitcoin.

At this moment in time, MSTR holds more than 252,000 BTC, worth approximately $15 billion.

Out of the total supply of 21 million Bitcoin, 252,000 represents about 1.2%. If we consider that approximately 4 million BTC may be permanently lost, this figure rises to around 1.5%. Given that not all Bitcoin is actively circulating and that MicroStrategy is rapidly increasing its holdings, their ownership percentage could approach 2% sooner than we expect.

In any case, the Bernstein interview—which is currently the most significant topic of discussion in the space—has not yet been made public. The best I could retrieve was the first page of the report, which I’ve included below, along with direct quotes from the interview. No need to strain your eyes; I’ve transcribed all the key points for you below.

This part at the top is funny because if you know Saylor, this is very accurate: “As part of our ongoing Bitcoin CEO series, we hosted Michael Saylor, Exec Chair and Founder, MicroStrategy (MSTR). Michael spoke to a full house and the session overshot our time lasting almost 2 hours.”

While you might be curious about the contents of this image, I’ve copied the third section for you. This may feel like jumping ahead, but it will all come full circle shortly.

“3. End game: Let us say Michael is right about his Bitcoin thesis, and MSTR becomes a large company with hundreds of billions of dollar in Bitcoin, but what is the endgame here? Michael sees MSTR as a Bitcoin bank, just like other asset classes would have financial entities built around the asset class. Michal believes MSTR is in the core business of creating Bitcoin capital market instruments across equality, convertibles, fixed income and preferred shares etc. Also, he sees the Bitcoin underlying growth as yield attractive enough to continue making money on the capital markets arbitrage and not actually lend out Bitcoin as banks would.”

By now you are starting to get the idea of where this major announcement is going, but let’s fill the rest of the gaps…

“[Bitcoin] is the most valuable asset in the world. I think it's infinitely scalable. I don't have any problem seeing how we could raise $100 billion more capital and then $200 billion after that. It's a trillion dollar asset class going to $10 trillion and then going to $100 trillion. The risk is very simple—it’s bitcoin. You either believe bitcoin is something, or you believe it's nothing.”

“We just keep buying more bitcoin. Bitcoin is going to go to millions a coin, you know, and then we create a trillion dollar company. Bitcoin price will hit $13 million by 2045 as it goes from 0.1% of global financial capital to 7%.”

Here’s the crucial details for how this bank will work:

“My view is that it’s much more intelligent to borrow a billion dollars from the fixed income market and lend it to bitcoin at a 50% ARR, with no counterparty risk, than to reverse that and find someone willing to pay me 12%-14%. Instead, we think it’s a better idea to borrow $10bn from people who would be eager to lend and give them a 100 basis point more yield, and then lend to Bitcoin for 30% to 50% interest with no counterparty risk. Once you get past the volatility and learn to manage it, the bear-case scenario I foresee is bitcoin increasing by only 22% a year over the next decade. Who would pay you 22% interest?”

Essentially, Saylor argues that it's more intelligent to borrow money at low interest rates and invest it in Bitcoin, which he expects will provide much higher returns compared to seeking out 12% to 14% interest elsewhere. AND he wants to do this at scale. This is pretty much exactly what MSTR is doing now, except he wants to do it bigger and better.

“If we end up with $20 billion of converts, $20 billion of preferred stock, $10 billion of debt and say $50 billion of some kind of debt instrument and structured instrument, we’ll have $100-$150 billion of Bitcoin. The company trades at a 50% premium, with more volatility and ARR, we can build a company that has a 100% premium to $150 billion worth of Bitcoin and build a $300-400 billion company with the biggest options market, the biggest equity market.”

This is a lot of numbers, but the idea is that Saylor is outlining a financial strategy to raise capital through instruments like convertible securities, preferred stock, and debt. He believes this will allow the company to accumulate a large Bitcoin holding, potentially leading to MSTR becoming a much more valuable company with a strong presence in the options and equity markets, despite the associated volatility and premiums in the stock.

“And then we basically start to chew into the fixed income markets, and we just keep buying more Bitcoin. Bitcoin is going to go to millions a coin, you know, and then we create a trillion dollar company.”

Now that we are aligned on the recent developments surrounding MicroStrategy, the next logical discussion is whether or not MicroStrategy is overvalued trading at a 50% premium to its Bitcoin holdings and 270% premium to net assets. On Friday alone, the company added close to half the value of the BTC holding in market cap—that’s jaw dropping.

As far as I’m aware, Michael Saylor hasn’t explicitly said MSTR is a speculative attack on the dollar, maybe for legal reasons, but that’s the essence of what’s going on. Just a refresher… a speculative attack refers to a situation where investors or traders aggressively sell off a currency or other asset that they believe is overvalued or at risk of losing value. Speculators and fans of the MSTR strategy have called it 'unlimited' and 'limitless' in the past and now we have Saylor saying it’s “infinitely scalable” on the record.

What we are witnessing is MSTR’s stock trading at a rising premium to the underlying Bitcoin it owns because investors are increasingly recognizing that their position represents future acquisitions. The idea is that if the stock is exposed to consistent passive boomer inflows (the S&P 500) that are forced to purchase the stock, Saylor can continue to buy more Bitcoin at a faster rate. This allows him to accelerate his dilution of shares, which already appreciate faster than the price of Bitcoin, buy more Bitcoin on debt, and crank up the leverage to an unfathomable degree.

The endgame gets pretty speculative from here, but I lean toward thinking the government would attempt to shut it down before MSTR could swallow the S&P 500 or bring down the dollar. Here’s an opinion from Jeff Park at Bitwise.

I'm seeing a lot of exuberance on the timeline, but keep in mind: MSTR can stay irrational longer than you can stay solvent. If BTC melts up before MSTR cools off, this stock could attract attention to GameStop levels or higher. Personally, I prefer Bitcoin for my risk-appetite, but I won’t be betting against Saylor at any point this cycle.

This stock isn’t included in any major indices, has more skeptics than Bitcoin, and lags far behind Bitcoin in terms of search interest and inquiries. If the epic face-melting run-up isn’t happening right now, the conditions are in place for it to unfold later this cycle, likely on a scale no one will see coming.

If I had to pick a few things in the space with real ‘it’ potential, MSTR is on my list. The significance of this company rivals other major variables, among the likes of the election, Wall Street’s adoption of crypto, and even nation-state adoption. Let’s have a killer week. Every day Bitcoin doesn’t break to the upside, the spring’s winding tighter—don’t forget that.

Bitcoin Thoughts And Analysis

Is Uptober finally upon us? Bitcoin has taken a huge step forward today, rising from the 62Ks to the 65ks. Nice move - but still below the $70,000 level that we really need to see broken for bulls to celebrate a new high.

Things are looking good, but too soon to celebrate.

Altcoin Charts

For those who are new here, I share SETUPS and not SIGNALS. These are ideas that I am watching - if a certain thing happens, then the trade triggers. I am not telling you what to buy or when. I am showing you how I am watching certain charts and what has to happen for me to take a trade.

BITCOIN DOMINANCE

Altcoins are looking good… but Bitcoin is still looking “better” as Bitcoin Dominance rises on this move. Once Bitcoin breaks above $70,000 and settles in, I expect even more action in the altcoin market. That said, I am confident that altcoins will continue to perform well. Select altcoins will continue to outperform Bitcoin, but we are not at a point yet where ALL altcoins outperform.

Legacy Markets

Global markets are treading water as investors await key corporate earnings, particularly from major US banks, to gauge the strength of the stock rally and assess the broader economic outlook. Futures for the S&P 500 and European stocks, including the Stoxx 600, are largely unchanged. Investors are anticipating earnings reports from Citigroup, Goldman Sachs, and Bank of America on Tuesday, which will serve as an early indicator of how the recent interest rate environment has impacted corporate profits. This follows last week's strong performance, where several banks like JPMorgan Chase, Wells Fargo, and Bank of New York Mellon exceeded expectations.

In Europe, economic growth remains sluggish, with concerns over weaker activity in major economies like Germany, which is currently facing a mild recession. The outlook is compounded by a stalled recovery in China, which could particularly affect luxury goods manufacturers like LVMH. This overall weakness in the region's economic performance is expected to push the European Central Bank (ECB) toward an interest rate cut at its upcoming meeting, a move that was largely ruled out just a month ago.

The potential ECB rate cut comes in response to softer economic data and quicker disinflation, with markets now pricing in a 95% probability of a 25-basis-point reduction. Meanwhile, the euro has weakened against the dollar, reflecting concerns about the broader eurozone economy, particularly the fiscal challenges in France and the ongoing malaise in Germany.

Overall, investors are closely watching corporate earnings and monetary policy decisions as key factors that could determine whether the stock market finishes the year on a strong note or faces further volatility. The current environment is marked by high valuations and uncertainty over how effective the easing cycle will be in providing further momentum to equities.

Key events this week:

China trade balance, Monday

India CPI, Monday

UK unemployment rate and average weekly earnings, Tuesday

Eurozone industrial production, Tuesday

Canada CPI, Tuesday

Goldman Sachs, Bank of America, Citigroup earnings, Tuesday

Republican presidential candidate Donald Trump will be interviewed by Bloomberg editor-in-chief John Micklethwait at the Economic Club of Chicago, Tuesday

New Zealand CPI, Wednesday

Thailand, Philippines and Indonesia central bank interest-rate decisions, Wednesday

UK CPI, PPI, RPI and house price index, Wednesday

ASML, Morgan Stanley earnings, Wednesday

Australia unemployment, Thursday

Eurozone CPI, ECB rate decision, Thursday

US retail sales, jobless claims, industrial production, business inventories, Thursday

TSMC, Netflix earnings, Thursday

Japan CPI, Friday

China GDP, retail sales, industrial production, home prices, Friday

UK retail sales, Friday

Some of the main moves in markets:

Stocks

The Stoxx Europe 600 was little changed as of 10:31 a.m. London time

S&P 500 futures rose 0.1%

Nasdaq 100 futures rose 0.2%

Futures on the Dow Jones Industrial Average were little changed

The MSCI Asia Pacific Index was little changed

The MSCI Emerging Markets Index was little changed

Currencies

The Bloomberg Dollar Spot Index rose 0.1%

The euro was little changed at $1.0933

The Japanese yen fell 0.2% to 149.37 per dollar

The offshore yuan fell 0.2% to 7.0866 per dollar

The British pound was little changed at $1.3061

Cryptocurrencies

Bitcoin rose 3% to $64,594.43

Ether rose 2.6% to $2,525.05

Bonds

The yield on 10-year Treasuries was little changed at 4.10%

Germany’s 10-year yield was little changed at 2.27%

Britain’s 10-year yield advanced two basis points to 4.22%

Commodities

Brent crude fell 2.1% to $77.36 a barrel

Spot gold was little changed

Hal Finney’s Thoughts On A Bitcoin Bank

Hal Finney’s commentary provides a fascinating historical perspective on the MicroStrategy discussion. No company has yet had the courage to rival MicroStrategy by purchasing Bitcoin on a large scale, but that moment is coming. Strategists worldwide are closely observing this game theory unfold, contemplating whether they should take similar action.

Ethereum ETF Options Delayed Again

The SEC has once again delayed its decision on whether to allow the Cboe Exchange to list options linked to spot Ether ETFs, pushing the ruling deadline from October 19 to December 3. Cboe’s request includes options for several notable funds, such as BlackRock’s iShares Ethereum Trust and Fidelity Ethereum Fund. This follows a similar postponement for Nasdaq's proposal regarding options on the iShares Ethereum Trust. While these are on the back burner, the SEC has approved Nasdaq to list options for BlackRock's Bitcoin ETF, with those options expected to launch in the U.S. by early 2025. Analyst James Seyffart suggests that while options for Ether could potentially be approved by year-end, they are more likely to come in the first quarter of 2025.

Base Is Still Growing

There's a lot happening with Base: a new webpage has been launched at Base.org, Base has surpassed Arbitrum in total value locked (TVL), and the Layer 2 solution achieved over 6 million daily transactions for the first time. One important point to clarify regarding TVL is that Base is leading Arbitrum in TVL according to DeFillama but on L2Beats, Arbitrum has nearly double Bases’s TVL. The reason for this is that Defillama’s TVL reflects the total value of assets locked in protocols on the network, while L2Beat’s TVL measures the AOP, which includes both native and bridged assets across each network.

The WLF Token Sale Begins Tomorow

No, this is not an advertisement, endorsement, or financial advice. I have no idea how Trump’s token will perform. That said, its tokenomics do seem better than many other distributions I’ve covered here—though that’s no guarantee of success.

63% of the tokens will be sold to the public, 20% allocated to the team, and 17% reserved for user rewards. I wouldn’t be shocked if the SEC cracks down on the token, just as I wouldn’t be surprised if a major issuer attempts to list it as an ETF.

FYI, the countdown is now much lower, and the tokens will be non-transferable for the first 12 months. The target for the sale is $300 million, with the project’s roadmap valuing the protocol at $1.5 billion.

Why Democrats And Republicans Must Unite For Crypto’s Success | Anthony Scaramucci

In this episode of The Wolf Of All Streets, Anthony Scaramucci, Former White House Communications Director and Founder & Managing Partner at SkyBridge Capital, joins me live from Singapore’s Token 2049 conference to dive into the big topics shaking the crypto world and the 2024 U.S. election. Together, we unpack the hurdles crypto faces with regulation, the power of Asia’s tech scene, and how U.S. politics could shape the future of digital assets. Join us as we explore where crypto is heading and why it’s not just about politics—it’s about progress.

My Recommended Platforms And Tools

Phemex - Exclusive for new users, earn up to 8800 USDT. Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '10OFF' for a 10% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.