Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Phemex!

Phemex is the most efficient crypto trading and investment platform. Phemex offers over 293 spot trading pairs, minimal fees, peer-to-peer trading, derivatives, up to 100x leverage, and $8,800 welcome rewards up for grabs! Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Make sure to check if Phemex is available in your jurisdiction.

In This Issue:

The Bitcoin Bill

Legacy Markets

Crypto.com Fights Back

MicroStrategy Is On The Move

ETH ETF Yet To Flip Positive

Bitcoin Stuck In Limbo! Here’s Why It’s Struggling To Break Through

The Bitcoin Bill

Seventy-four days ago, one of the most significant announcements in Bitcoin's nearly 16-year history was made—and yet, the world seems to have already forgotten.

Today, I want to revisit this monumental moment. If you remember it, kudos to you, because in this space, short-term memory loss is real. Fighting it can be very profitable.

On July 27, 2024, presidential candidate Donald Trump took the stage at the Bitcoin conference in Nashville, Tennessee. He delivered a 50-minute speech clarifying and solidifying his stance on the issue.

Most of the speech had little to do with crypto, but there were several highlights directly addressing what this industry desperately needs. Here are the best quotes:

“If crypto is going to define the future, I want it to be mined, minted, and made in the USA. It's not going to be made anywhere else.”

“The reason could not be more clear because Bitcoin stands for freedom, sovereignty, and independence from government coercion and control.”

“The moment I'm sworn in, the persecution stops and the weaponization ends against your industry.”

“On day one, I will fire Gary Gensler and appoint a new SEC chair. I didn't know he was that unpopular. Wow. I didn't know he was that unpopular. Let me say it again. On day one, I will fire Gary Gensler.”

“As President, I will immediately shut down Operation Choke Point 2.0.”

“Upon taking office, I will immediately appoint a Bitcoin and crypto Presidential Advisory Council.”

“We will have regulations, but from now on, the rules will be written by people who love your industry, not hate your industry.”

“There will never be a CBDC while I'm President of the United States.”

“Bitcoin is not threatening the dollar. The behavior of the current U.S. government is really threatening the dollar.”

“And Bitcoin and crypto will skyrocket like never before, even beyond your expectations.”

“America will become the world's undisputed Bitcoin mining powerhouse.”

“And so, as the final part of my plan today, I am announcing that if I am elected, it will be the policy of my administration, the United States of America, to keep 100% of all the Bitcoin the U.S. Government currently holds or acquires into the future. We'll keep 100%. I hope you do well, please. This will serve, in effect, as the core of the strategic national Bitcoin stockpile.”

“I repeat my pledge to commute the sentence of Ross Ulbricht to a set time.”

“Have a good time with your Bitcoin and your crypto and everything else that you're playing with.”

I’ll be the first to admit there were some cringeworthy moments in the speech, but I have to give credit where it's due. While Trump isn’t the most informed voice on crypto, his speech made it clear he has our industry’s interests in mind.

What the market isn't factoring in is the possibility of these major developments becoming reality soon: Gary Gensler being fired, the end of Operation Choke Point, no CBDC, the establishment of a "Bitcoin and Crypto Presidential Advisory Council," the passing of a Bitcoin reserve bill, and the U.S. emerging as a Bitcoin mining powerhouse. As a potential bonus for morale, there’s even the chance of Ross Ulbricht’s sentence being commuted.

Unfortunately, the details of Trump’s promises have largely been lost in translation, and the market’s takeaway has boiled down to two basic standpoints:

Trump = good for Bitcoin + crypto

Kamala = bad for Bitcoin + crypto

We have a clearer grasp of the negative side of the equation, constantly reminded of the challenges under Biden and Kamala. In contrast, the market is undervaluing the potential upside of a Trump win, as it doesn't reflect our current lived experiences.

Before diving further into politics, it's crucial to remember that either party can change its mind and easily backtrack on promises. Trusting that a candidate will always follow through is like trusting someone across the poker table when they say they’ll never bluff.

With that in mind, here’s my simplified mental map of where things could go:

Kamala wins – 50% odds:

Bitcoin will NOT become a strategic reserve asset anytime soon.

Gary Gensler serves the remainder of his term until June 5, 2026.

Operation Choke Point continues unchecked.

Lawsuit, lawsuit, lawsuit, lawsuit.

Trump wins – 50% odds:

33% chance we see the Bitcoin Strategic Reserve Bill as proposed.

33% chance we see the Bitcoin Strategic Reserve Bill amended.

33% chance we don’t see the Bitcoin Strategic Reserve Bill signed.

Using this mental model, there’s a 33% chance of a Bitcoin reserve bill being passed in the next few months (50% odds of Trump winning × 66% chance of the bill or a variation being signed).

Immediately after Trump’s speech, Senator Cynthia Lummis took the stage to share this news:

“You know, before you all leave, have we got a present for President Donald Trump. Here it is, this is the Bitcoin Reserve Bill.” If you Google the speech, you’ll see the crowd leaving as she briskly walks to the stage, waving the bill in the air.

The passage of this bill would drive Bitcoin prices to unimaginable heights, yet the market seems to have forgotten it.

Senator Lummis read from the text:

“In the Senate of the United States, to establish a Bitcoin strategic reserve, a network of secure storage vaults, a purchase program, and other programs to ensure the transparent management of Bitcoin holdings of the federal government.”

The bill promises four key things:

Establish a Bitcoin strategic reserve.

Create a network of secure storage vaults.

Initiate a purchase program.

Implement programs to ensure transparent management of the federal government’s Bitcoin holdings.

“This Bitcoin Reserve will start with the 200,000 Bitcoin that President Trump just mentioned, pooled into a reserve stored in geographically diverse vaults. And that’s just the beginning. Over five years, the United States will assemble 1 million Bitcoin—5% of the world’s supply. It will be held for a minimum of 20 years and used for one purpose: to reduce our debt.”

The bill also provides for transferring asset forfeiture money into the Reserve and converting excess reserves at the 12 Federal Reserve Banks into Bitcoin over five years.

“This is our Louisiana Purchase moment,” Lummis said.

Oddly, Senator Lummis made the announcement that Trump was supposed to make himself. The crowd’s disappointment was palpable—Trump didn’t deliver it personally.

Whether it was intentional, a result of poor preparation, a logistical error, or indecisiveness, we may never know. But that's what we got.

If Trump takes office and the bill passes as written, the U.S. government plans to purchase around 800,000 BTC over five years—about 160,000 BTC per year or 13,333 BTC per month—to reach the goal of 1 million Bitcoin. It's worth noting that 5% of Bitcoin's total 21 million supply is actually 1.05 million, not exactly 1 million.

A few days after the speech, the bill was released. You can read it here, and the language does indeed confirm everything Senator Lummis said.

“This Act may be cited as the ‘Boosting Innovation, Technology, and Competitiveness through Optimized Investment Nationwide Act of 2024,’ or the ‘BITCOIN Act of 2024.’”

It specifies that the Secretary shall establish a Bitcoin Purchase Program to acquire up to 200,000 Bitcoins per year over five years, totaling 1 million Bitcoins.

If you have time, I recommend reading the bill. It’s quick, easy, and has some interesting nuances I unraveled when I first covered it.

So, here’s a quick recap of what everyone seems to be forgetting: In just a few months, if a few key variables align, extraordinary things could happen for Bitcoin. Major countries would likely rush to buy Bitcoin as well. Of course, we know that things rarely play out exactly as expected, but this scenario is a real possibility—and it has me feeling VERY bullish.

At the end of the day, just buy Bitcoin and remember what’s truly at stake. It’s easy to get distracted by the headlines and lose sight of the bigger picture—especially when the media isn't covering it. They forget just as much as we do.

On a side note, the HBO documentary came out last night, so I’ll share any worthwhile coverage if something catches my attention.

Another side note - we are in the early innings of a hurricane striking Florida, so content may be sporadic in the coming days. No charts today, as we are prepping!

Legacy Markets

Key events this week:

Fed minutes, Wednesday

Fed’s Lorie Logan, Raphael Bostic, Austan Goolsbee and Mary Daly speak, Wednesday

US CPI, initial jobless claims, Thursday

Fed’s John Williams and Thomas Barkin speak, Thursday

JPMorgan, Wells Fargo kick off earnings season for the big Wall Street banks, Friday

US PPI, University of Michigan consumer sentiment, Friday

Fed’s Lorie Logan, Austan Goolsbee and Michelle Bowman speak, Friday

Some of the main moves in markets:

Stocks

The Stoxx Europe 600 rose 0.2% as of 12:19 p.m. London time

S&P 500 futures were little changed

Nasdaq 100 futures were little changed

Futures on the Dow Jones Industrial Average were little changed

The MSCI Asia Pacific Index fell 0.3%

The MSCI Emerging Markets Index fell 0.5%

Currencies

The Bloomberg Dollar Spot Index rose 0.1%

The euro fell 0.1% to $1.0966

The Japanese yen fell 0.3% to 148.58 per dollar

The offshore yuan was little changed at 7.0734 per dollar

The British pound was little changed at $1.3092

Cryptocurrencies

Bitcoin fell 0.4% to $62,111.6

Ether fell 0.3% to $2,434.37

Bonds

The yield on 10-year Treasuries advanced one basis point to 4.02%

Germany’s 10-year yield declined one basis point to 2.23%

Britain’s 10-year yield declined one basis point to 4.17%

Commodities

Brent crude fell 0.7% to $76.64 a barrel

Spot gold was little changed

Crypto.com Fights Back

Does a Wells Notice still hold any weight when nearly every major crypto company has received one? And can the SEC realistically follow through on all these investigations, especially if there’s a regime change—like Trump being elected? At this point, Crypto.com joining the ranks of Robinhood, ConsenSys, OpenSea, Coinbase, Binance, and Kraken feels more like a formality than a shock.

The key difference this time is that Crypto.com has chosen to preemptively sue the SEC.

Here’s what the CEO of Crypto.com had to say about the lawsuit:

“And to use all regulatory tools available to bring certainty to the industry through proper rulemaking, Crypto.com has also filed a petition with the CFTC and SEC to confirm crypto derivative products categorization.”

“While we welcome recent bipartisan support for the industry, that message has not been received by current SEC leadership that issued us a Wells notice. The SEC’s unauthorized overreach and unlawful rulemaking regarding crypto must stop.”

“Recent rulings have made clear that crypto is not itself a security and thus is not an investment contract simply because it changes hands. For this reason, and many others, we continue to be very bullish on the U.S. crypto market and our imminent plans to expand our offerings to U.S. customers.”

“Specifically, our lawsuit contends that the SEC has unilaterally expanded its jurisdiction beyond statutory limits and separately that the SEC has established an unlawful rule that trades in nearly all crypto assets are securities transactions no matter how they are sold, whereas identical transactions in bitcoin (BTC) and ether (ETH) are somehow not.”

The bottom line is that the outcome of this case, and all the others the SEC has initiated in the crypto industry, is heavily dependent on who is elected president. If Gary Gensler remains protected under a Kamala administration, we can expect these cases to play out slowly, with many ultimately ending in small wins and compromises that stifle innovation. On the other hand, if Trump wins and leadership changes, I anticipate most of these investigations will be dropped.

My final thoughts are that Crypto.com, along with many other companies facing similar challenges, are operating with integrity. The Wells Notices and enforcement actions lose their impact when they’re handed out so freely. I’m confident Crypto.com will come out fine; there’s still plenty of progress to be made.

Everything might change though in a few months—fingers crossed.

You can read the complaint for declaratory and injunctive relief HERE.

You can read the Crypto.com press release HERE.

MicroStrategy Is On The Move

It feels almost routine to mention MicroStrategy without reporting another Bitcoin purchase, but miraculously, the company’s stock has reached an all-time high—even while Bitcoin is about 16% below its peak. That’s pretty impressive.

In addition to this, MicroStrategy still has potential inclusion in the S&P 500 on the horizon, which requires about a quarter and a half of profitability. However, the company reported a net loss of $102 million in the second quarter of 2024, so inclusion might still be a ways off, despite meeting the size requirements.

This may seem obvious, but once Bitcoin finally breaks out, MSTR is going to soar.

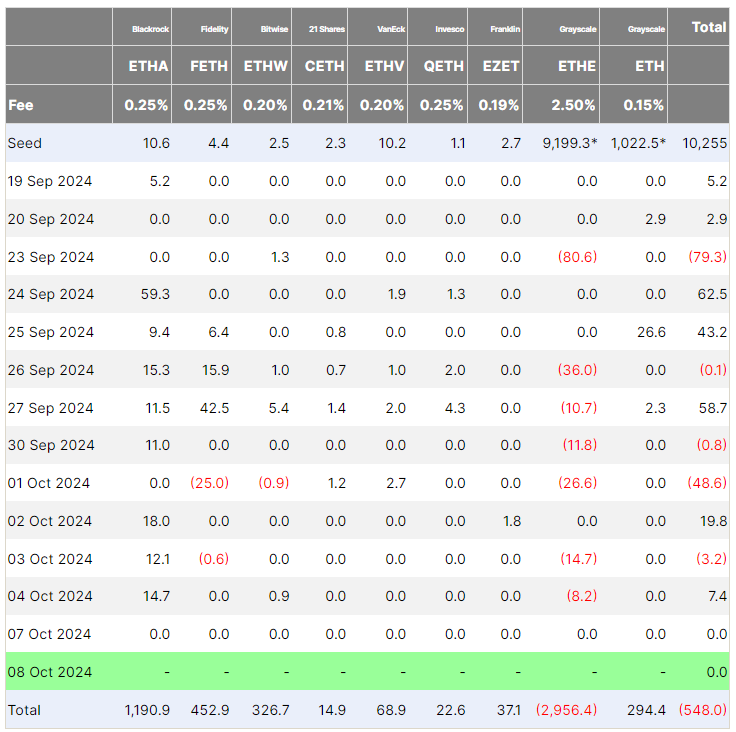

ETH ETF Yet To Flip Positive

Spot Ether ETFs have seen $548 million in net outflows since their U.S. listings, despite being seeded with $10.2 billion, largely from Grayscale’s Ether trust. While the pace of outflows is slowing, the absence of staking yield in these ETFs remains a key issue. Once staking yield is approved for these products, we can expect a significant influx of assets migrating from both Bitcoin and staked ETH. For investors willing to take on slightly more risk, the 3% staking yield is a tempting option—and Wall Street will likely jump at the chance once they can access it.

Another XRP ETF Is Filed

I wouldn’t have predicted XRP to be next in line for ETF attention, but now two issuers have filed for an XRP ETF. Just a heads-up: Grayscale already has an XRP Trust with around $2 billion in assets under management, which could be significant if they eventually file for an ETF—something that seems likely at some point.

“We're seeing encouraging signs of a more progressive regulatory environment coupled with growing demand from investors for sophisticated access to cryptocurrencies beyond Bitcoin and Ethereum - specifically investors seeking access to enterprise-grade blockchain solutions and their native tokens such as XRP,” a spokesperson of Canary told FOX

Bitcoin Stuck In Limbo! Here’s Why It’s Struggling To Break Through

I am joined by Joshua Frank, the CEO and co-founder of The Tie, a leading information services provider for digital assets, as we try to uncover what is holding Bitcoin back from a breakthrough!

Andrew Parish from The Arch Public joins in the second part of the stream to provide an update on the $10K algorithmic portfolio.

My Recommended Platforms And Tools

Phemex - Exclusive for new users, earn up to 8800 USDT. Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '10OFF' for a 10% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.