Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Arch Public!

Last week, in a display of pinpoint accuracy that many traders spend their entire careers trying to achieve, our algorithms once again demonstrated why they're at the forefront of algorithmic trading. What set yesterday’s performance apart is not just the profitable outcome, but the surgical precision of both the entry and exit points. The Wolf of All Streets $10K portfolio is now up +47.5% in five months.

Try Arch Public now! You can even demo the platform, for free, to learn more.

In This Issue:

SWIFT Has Entered The Chat

Bitcoin Thoughts And Analysis

Legacy Markets

Bitcoin + Ethereum Index ETFs Are Coming

Tokenized Shares Are Also Coming

HBO Doesn’t Know Who Satoshi Is

Larry Fink Said This…

How Low Can Bitcoin Go? Dan Held’s Top Reasons to Stay Bullish!

SWIFT Has Entered The Chat

How do I put this plainly… SWIFT IS F***ING HERE.

For those that don’t know what SWIFT is, allow me to briefly explain.

SWIFT, or the Society for Worldwide Interbank Financial Telecommunication, is the literal backbone of global finance. It’s a messaging network that connects over 11,000 financial institutions across more than 200 countries. Think of it as the highway for international money transfers, enabling banks to send and receive information about transactions securely and efficiently around the world.

On any given day, SWIFT processes 40 million messages (specific, structured communications sent through the SWIFT network to facilitate global financial transactions) handling everything from wire transfers to trade confirmations. Depending on who you ask and what exactly is being measured, SWIFT is believed to handle over 90% of cross-border payments.

90 freaking percent.

From an article this August, “Data compiled by Statista shows that in 2023, the total value of cross-border payments was $190.1 trillion.”

Starting to get the idea? I think for context, a little bit of history is important too.

From SWIFT":

“In 1973, 239 banks from 15 countries got together to solve a common problem: how to communicate about cross-border payments. The banks formed a cooperative utility, the Society for Worldwide Interbank Financial Telecommunication, headquartered in Belgium. Swift went live with its messaging services in 1977, replacing the Telex technology that was then in widespread use, and rapidly became the reliable, trusted global partner for institutions all around the world. The main components of the original services included a messaging platform, a computer system to validate and route messages, and a set of message standards. The standards were developed to allow for a common understanding of the data across linguistic and systems boundaries and to permit the seamless, automated transmission, receipt and processing of communications exchanged between users.”

Almost there, skip ahead if you have to, the crypto news is coming.

“Having disrupted the manual processes that were the norm of the past, Swift is now a global financial infrastructure that spans every continent, 200+ countries and territories, and services more than 11,000 institutions around the world. Our services are as relevant today as they were ground-breaking back at the time of their inception, but we do not stand still: we are about continuity and change. We still enable our users across the world to safely and securely communicate, but we invest continually in the platform that supports our messaging services and work persistently to improve the adoption of industry standards. At the same time we innovate to create value and to deliver efficiencies; we introduce new products and services to remedy common problems; and we watch relentlessly for external developments that can impact our community.”

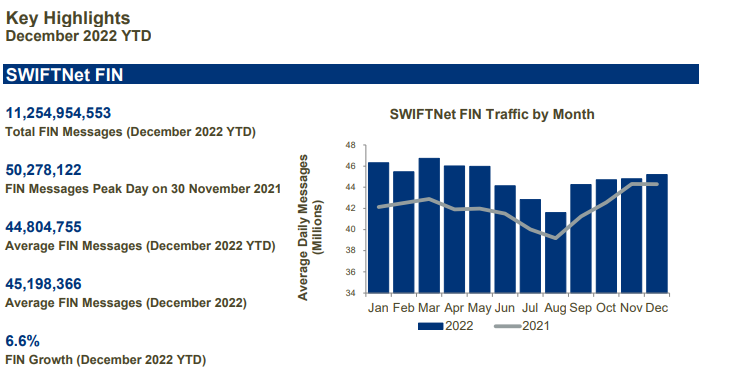

I wanted to provide all of you with the most up to date data from SWIFT, but it was a little tricky. SWIFT doesn’t release their data immediately. To look at “Swift FIN Traffic & Figures” on the monthly side, the most recent data available is from December 2022—which is still plenty helpful for gauging the size of this organization.

These numbers are no joke.

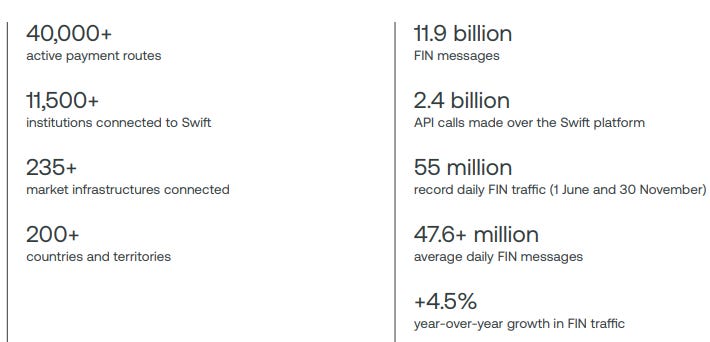

I did manage to find these figures from the 2023 Annual Review:

Alright, the case is closed. Now, let’s dive into the crypto news. I’ll paraphrase where it makes sense, but I’ll mostly be directly quoting for what follows next. This is definitely worth our time to read in full.

The statement “from experimentation to reality” is in reference to this, “In March 2023, we successfully tested our CBDC solution in a phase one sandbox environment with 18 central and commercial banks.” That statement came from the 2023 Annual Review.

And here’s where it gets really interesting. This isn’t just about CBDCs, it’s also about tokenization…

Whether we like it or not, SWIFT is forcing the industry to start writing its next chapter now. CBDCs and tokenization are the future, and SWIFT will play a part.

So that wraps up the crypto announcement. SWIFT is making its second big move into the crypto space, transitioning from experimentation to live trials that global institutions are expected to tap into by 2025. My prediction? By 2030, CBDCs will be seamlessly running on SWIFT’s infrastructure worldwide. As for stablecoins, they’re here to stay, but I’m not convinced they’ll be using the same rails as CBDCs. We’re looking at two competing forms of money—a battle for control over global, dollar-denominated finance.

Now, I know what some of you are thinking… SWIFT represents the opposite of what this industry stands for. It’s centralized, a single organization collaborating with banks and global regulators—many of whom either stifle progress or actively compete against us. SWIFT works for the very institutions that crypto aims to dismantle. It’s WRONG, WRONG, WRONG...AHHHHHHH.

If that’s how you feel, that’s fine—I’m not here to debate the nuances. What I do want to emphasize is that SWIFT will do what SWIFT wants (it’s that powerful), and if we want crypto to scale to the next billion users and grow at the pace we expect, parts of this industry will need to meet traditional systems halfway. This isn’t about total disruption—it’s about adaptation and collaboration to achieve the growth we’re projecting. Like it or not, SWIFT’s involvement will bring attention to Bitcoin, and that’s a net positive.

Global finance, banking, international payments, investment management, stock markets, bond markets, foreign exchange, derivatives, and commodities markets aren’t going to disappear just because digital assets, crypto exchanges, and blockchain are now part of the conversation. These existing systems will need to coexist with the innovations this technology brings—that’s the reality. The transition will take time, probably longer than we expect, but it’s inevitable.

Crypto isn’t going to disrupt SWIFT; rather, SWIFT is poised to disrupt parts of crypto—for the better.

Some people will feel frustrated hearing that, but that’s the reality. The old guard and new players will meet somewhere in the middle, creating a more advanced and integrated financial system. Devout crypto believers might resist this, but fighting it won’t change the outcome. Our focus should be on building, delivering high-quality solutions, and bridging the gap between traditional finance and emerging tech. In doing so, we’ll bring our ethos into the mix—and that’s how we slowly and ultimately win.

I’m optimistic and excited about this news—you should be too.

SWIFT has entered the chat.

If you’re feeling down about October, don’t be. The crypto market is going to take off when the most traders are caught offside. Everyone was expecting "Uptober," so naturally, we got a slow start. But I’m still confident that the market is on the verge of a breakout. We’ve been trending sideways/down for way too long.

When the move finally comes, it’s going to be magical.

Bitcoin Thoughts And Analysis

Bitcoin is all over the place. October has had a weak start, to be frank, but most October gains have traditionally come in the back half of the month. Bitcoin continues to range above $60,000, with little more to report. The real party should start above $70,000.

For now, the 50 MA has held as support from last week, and the 200 MA is acting as resistance.

Legacy Markets

Stocks dropped and bond yields rose after strong US jobs data caused traders to reduce expectations of significant Federal Reserve interest rate cuts. The S&P 500 futures fell 0.6%, and Nasdaq 100 futures dropped 0.8%, while the 10-year US Treasury yield hit 4% for the first time since August. This reflects a shift in market sentiment, with fewer expectations of a substantial rate cut in November. European stocks also dipped amid concerns about the domestic economy, particularly after a decline in German factory orders.

Oil prices rose above $79 per barrel due to concerns over a potential Israeli strike on Iran, while notable stock moves included Heidelberg Materials AG, Richemont, Pfizer, and Arcadium Lithium Plc. The dollar remained steady, and investors are now awaiting US inflation data and earnings reports from major banks later in the week.

Here are some key events this week:

Euro-area finance ministers meet in Luxembourg on Monday. ECB President Christine Lagarde will participate

Minneapolis Fed President Neel Kashkari, Atlanta Fed President Raphael Bostic, St. Louis Fed President Alberto Musalem and Fed Board member Michele Bowman speak at different events on Monday as investors listen for any clues to policymakers’ thinking ahead of next month’s meeting

Brazil and Mexico publish CPI data, New Zealand, Israel and India hold interest rate decisions

US CPI for September, the final inflation print before the presidential election, is due Thursday

President Biden embarks on a trip to Germany and Angola, through Oct. 15, his first trip abroad since withdrawing from the presidential race, on Thursday

New York Fed President John Williams gives keynote remarks at Binghamton University in New York. Richmond Fed President Thomas Barkin speaks in a fireside chat on the economic outlook on Thursday

Some of the main moves in markets:

Stocks

The Stoxx Europe 600 fell 0.3% as of 10:18 a.m. London time

S&P 500 futures fell 0.5%

Nasdaq 100 futures fell 0.7%

Futures on the Dow Jones Industrial Average fell 0.4%

The MSCI Asia Pacific Index rose 0.9%

The MSCI Emerging Markets Index rose 0.4%

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro fell 0.1% to $1.0963

The Japanese yen rose 0.1% to 148.49 per dollar

The offshore yuan rose 0.3% to 7.0740 per dollar

The British pound fell 0.4% to $1.3073

Cryptocurrencies

Bitcoin rose 1.1% to $63,290.57

Ether rose 1.3% to $2,469.5

Bonds

The yield on 10-year Treasuries advanced four basis points to 4.01%

Germany’s 10-year yield advanced five basis points to 2.26%

Britain’s 10-year yield advanced six basis points to 4.19%

Commodities

Brent crude rose 1.9% to $79.53 a barrel

Spot gold was little changed

Bitcoin + Ethereum Index ETFs Are Coming

Within a few months, it’s likely that every major crypto ETF issuer will have submitted a proposal for a Bitcoin + Ethereum index ETF, shifting the conversation from if these vehicles will be approved to when. Franklin Templeton has positioned itself as a leader in this space, being one of the first to file for such a product with the SEC.

Here are some key details on how Franklin’s Crypto Index ETF will function: If approved, the ETF will issue shares in blocks of 50,000, with their value tied to the net asset value (NAV) of the Bitcoin and Ethereum held by the fund. Notably, the fund will not offer any staking options. The index will mature within three months, and its performance will be benchmarked against the CF Institutional Digital Asset Index, which tracks the largest digital assets and aligns with broader capital market trends.

In terms of institutional involvement, BNY Mellon will serve as the fund’s custodian and transfer agent, overseeing the operational aspects, while Coinbase Custody will manage the digital assets.

It’s worth noting other developments in this early-stage space. Bitwise offers BTOP, an ETF that provides exposure to both Bitcoin and Ethereum by investing in regulated CME futures contracts, though it doesn’t directly invest in the underlying assets.

Additionally, Hashdex, a popular asset manager, has updated its registration for a proposed cryptocurrency ETF. As of an October 1 regulatory filing, the SEC is still reviewing the ETF after previously delaying its decision in August. Initially, the Hashdex Nasdaq Crypto Index US ETF will include Bitcoin and Ethereum, but it has plans to expand to include additional digital currencies in the future. Hashdex has been actively working toward approval for this product since July.

Tokenized Shares Are Also Coming

This is major news: BlackRock and Franklin Templeton may soon see tokenized shares of their money-market funds traded, following the approval of guidelines by a CFTC subcommittee. A subcommittee of the CFTC’s Global Markets Advisory Committee has passed recommendations to the full committee, which is expected to vote later this year. While the specific recommendations haven’t been disclosed, this marks significant progress in the realm of tokenization.

Juan Leon, an analyst at Bitwise, shared his outlook on the development: “Implementation could boost the use of tokenization, as many companies want to pledge tokenized collateral to gain capital efficiencies. McKinsey estimates that the total tokenized market could reach around $2 trillion by 2030, driven by usage in mutual funds, bonds and exchange-traded notes, loans and securitizations, and alternative funds.”

HBO Doesn’t Know Who Satoshi Is

Newsflash: HBO doesn’t have some hidden insight that we don’t already know, and Bitcoin certainly doesn’t care about what’s in this documentary. Sure, if Satoshi’s identity were revealed and they were still alive, that would be a huge deal. But my gut says this is more hype than substance. I’m sure the film will be entertaining, but it’s not worth panicking or obsessing over when it comes to Satoshi. For some free drama, just check out the post below...

Also, this is developing…

Len Sassaman is currently the frontrunner among those speculated to be identified as Satoshi in the upcoming documentary set to release on Tuesday. For those unfamiliar, Leonard Harris Sassaman (April 9, 1980 – July 3, 2011) was a prominent American technologist, cypherpunk, and cryptographer. Interestingly, Bitcoin.com published an article back in 2021, suggesting Sassaman as a potential candidate for Satoshi Nakamoto.

Here are the key rules for the market:

Larry Fink Said This…

Here’s Larry Fink making the case that blockchain will indeed disrupt and replace some of the traditional systems and processes we rely on today. This segment provides a compelling counterpoint to the earlier discussion.

“I actually believe the underlying technology is fantastic. The blockchain will help you accelerate the process of transactions and help you identify. If you have a pure blockchain and have knowledge of who the buyers and sellers are, then we don’t need custodians anymore.”

While Larry isn’t looking for crypto to replace BlackRock, he clearly acknowledges its potential to upend the traditional financial system.

Is Aptos The Next Big Crypto Revolution? | Exclusive With Mo Shaikh

Join us on The Wolf Of All Streets podcast as Mo Shaikh, the founder of Aptos, reveals how his team is revolutionizing the crypto industry with seamless blockchain integration. From their innovative Aptos Card to insights on stablecoins and payments, Mo breaks down how Web3 is evolving to make crypto adoption mainstream. If you're excited about the future of digital assets, payments, and the power of blockchain, this is the episode to watch!

My Recommended Platforms And Tools

Phemex - Exclusive for new users, earn up to 8800 USDT. Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '10OFF' for a 10% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.