Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Trading Alpha Released A Brand New Product!

One of the partners of this newsletter, Trading Alpha, my trusted indicator and trading community, has launched their proprietary Indicator Search Engine for All Markets. This custom Indicator Screener scans crypto, stocks, and forex markets for Trading Alpha indicator setups, eliminating the need for time-consuming manual analysis. It can simultaneously screen for multiple indicators, enhancing confluence and providing advanced analysis capabilities across different markets. This is cutting-edge technology for serious traders.

Make sure to use my link HERE if you plan on giving it a try.

In This Issue:

Blackjack Vs. Trading

Bitcoin Thoughts And Analysis

Altcoin Charts

Legacy Markets

Arthur Hayes Said Crypto Will Soon Be “Off To The Races.”

Robinhood Expands Its Overseas Offerings

Bitwise Files An XRP ETF!

Does The Crypto Bull Market Start Today?

Blackjack Vs. Trading

Blackjack can be a fun and entertaining break at the casino. There’s something thrilling about sitting down with friends, cheering on side bets, and holding your breath as the dealer slow rolls a soft 17 while the whole table clutches their chips, praying for a bust. It’s less intense than poker, and although it’s not a team game, it often feels like one when everyone’s in it together, sharing the same highs and lows.

But Blackjack isn’t quite what it seems. The moment you sit down, even if you’ve mastered the perfect strategy, you’re playing a game where the odds are stacked against you. With a 42.22% chance of winning, an 8.48% chance of pushing, and a 49.1% chance of losing, you’re facing a constant uphill battle. Sure, these numbers can vary depending on the game and number of decks, but at the end of the day, Blackjack is essentially a sucker’s tax.

I mention Blackjack because I had an epiphany recently—the game shares many similarities with trading. But how? Blackjack players lose over time because the odds are against them, while some traders can win consistently throughout their careers, with outcomes that go beyond pure luck. The difference? The best Blackjack players, like the best traders, don’t play by the same strategies as everyone else.

Enter card counting.

Card counting in Blackjack is similar to what makes traders successful—both rely on skill and strategy to gain an edge and shift the odds in their favor. For those unfamiliar, card counters are players who track the ratio of high to low cards left in the deck(s) to gain an advantage over the house. It sounds simple, just like trading, but both endeavors require precision, discipline, and expertise.

To be clear, I’ve never counted cards and don’t plan on doing so. While it’s not illegal, it’s certainly not as glamorous as the movies make it out to be. However, I understand enough about it to explain the basics and draw an analogy to trading.

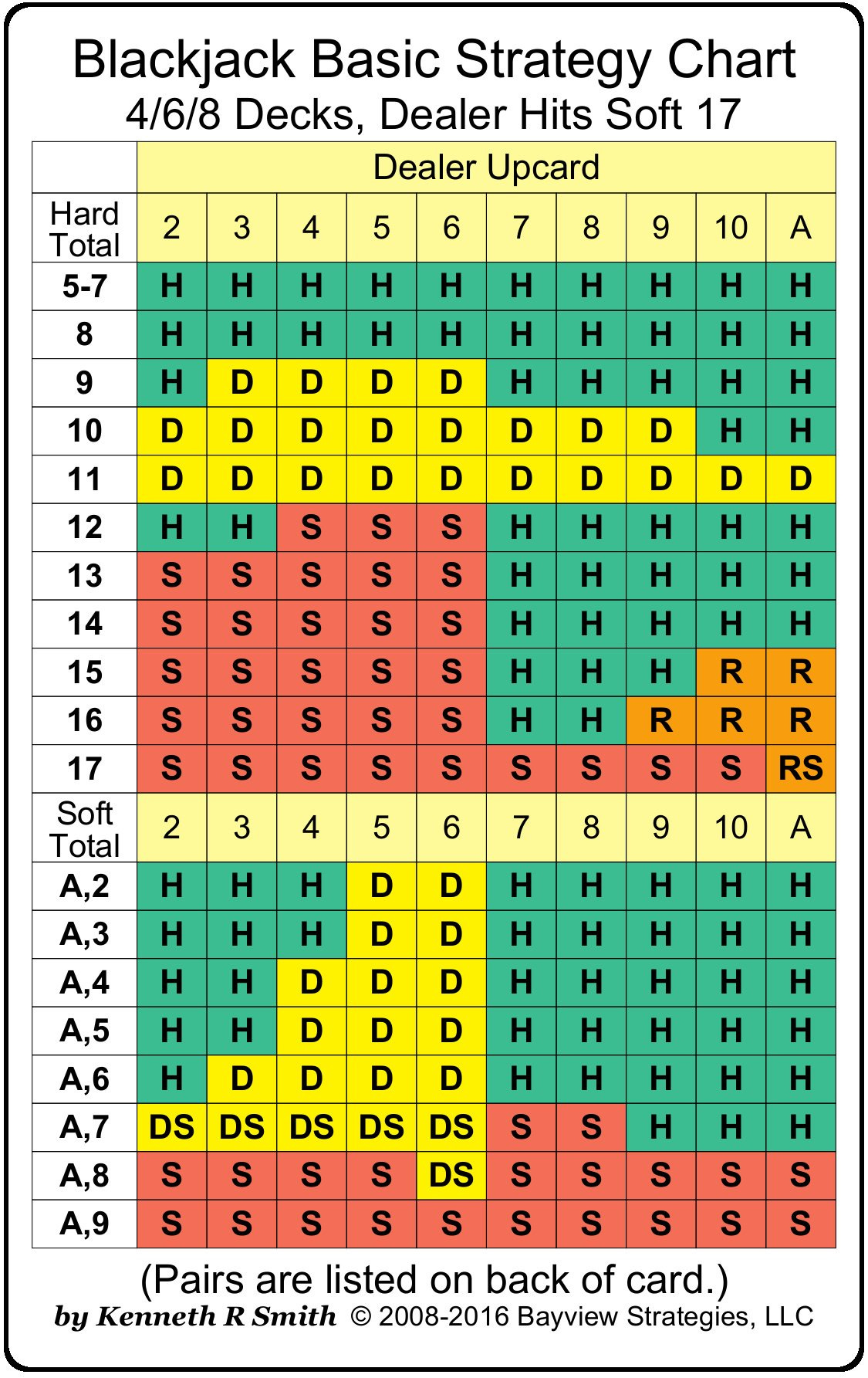

The first step to becoming a card counter is to learn the rules of Blackjack and perfect basic strategy. All players know the rules, but most don’t know the optimal basic strategy. For example, perfect strategy dictates that you should hit on a soft 17 when the dealer is showing a 7 or higher. Many casual players ‘feel’ like they shouldn’t, when in reality, they’re just lowering their odds by not doing so.

Memorizing this strategy is the first hurdle for card counters.

Next, you need to learn and practice maintaining a running count. This involves tracking the ratio of high to low cards that have been dealt. As cards are revealed, you assign values to them—low cards (2-6) are counted as +1, high cards (10-Ace) as -1, and neutral cards (7-9) as 0. By keeping this count, you can get a sense of whether the remaining deck is favorable for the player or the dealer. A higher positive count suggests more high cards are left, which benefits the player, while a negative count means the dealer has the advantage.

If you sit down and practice keeping a running count, you’ll likely get the hang of it pretty quickly. While it can get tricky when the deck is moving fast, the concept is straightforward. The real challenge comes when you’re surrounded by distractions—people drinking, cheering, touching the cards—making it harder to track the count without being obvious.

But that’s just the beginning. Since Blackjack is usually played with multiple decks, the running count alone isn’t enough to give you an edge. Card counters convert the running count into the true count, which is calculated by dividing the running count by the number of decks remaining. This is where it gets tricky, as it involves estimating how many cards have been dealt versus how many remain. Most counters gauge this estimation rather than tracking it exactly.

It doesn’t stop there. The true count is essential for determining bet sizing. Once you have the true count, you can adjust your bets according to the advantage it represents. Players typically use a system of betting units, where each unit is a fixed amount of money, such as $10. When the true count is high, you might double or triple your bet, while a lower count would have you betting the minimum. Counters have specific bet sizes assigned to particular true counts.

Now you’re beginning to see just how complex this can get. Skilled card counters master all these elements—the calculations, betting strategies, and counting become second nature. Instead, they focus their mental energy on maintaining a disguise, staying calm, effectively playing with a team, managing variance, signaling to teammates, handling their bankroll, choosing the right casinos, tracking profit-per-hour, avoiding backoffs, and minimizing expenses. Ultimately, successful card counters treat their work like a business, balancing all these factors to maximize their edge and minimize risk.

Remember how I always say to treat trading like a business? This is just one of the parallels I’m trying to illustrate. But here’s where it gets interesting: how much do you think card counting shifts the odds in the player’s favor? You might guess a 20% or 30% swing, but if that’s your assumption, I’ve got a bridge to sell you. In reality, even the best card counters—those who execute everything perfectly—only shift the odds a few percentage points over time. Sure, when the true count is extremely high, the odds are in their favor for that hand or the next, but overall, the advantage is modest.

Trading is similar. The best traders have a solid grasp of their win rate after collecting extensive data, understanding that even a small edge can have a huge impact on their performance over time. It’s a tough process, but any time your odds exceed 50%, you have a profitable strategy in the long run. Unfortunately, most people trade like they play Blackjack, relying on ‘feelings’ and luck rather than informed decisions, often unaware of basic optimal strategies.

The reason I’ve gone into such detail about card counting is to show the parallels with what’s required to trade at a high level. You need to be familiar with trading platforms and their intricacies, have a deep understanding of the assets you trade, and develop a strong sense of market trends. Mastering your emotions is crucial, as is minimizing fees, managing risk, and treating the entire process like a business. Trading isn’t just about technical analysis—that’s like thinking you can win in Blackjack just by keeping a running count.

This is why I often emphasize investing over trading in this newsletter. While both are challenging, mastering investing typically leads to consistent, long-term success, whereas trading requires far more time, energy, and skill. I don’t say this to discourage anyone from trading, but to help you understand the road ahead—it’s winding, unpredictable, and always ready to test you.

Anyway, I hope you enjoyed this. If I had to give a count of where the crypto market stands, I’d say it’s climbing—hence the title of this newsletter. Now’s the time to sit down, if you haven’t already, and put your chips into play. Sure, we might face some bad variance, but I don’t think this October will disappoint. Have a great day, wolf out.

Bitcoin Thoughts And Analysis

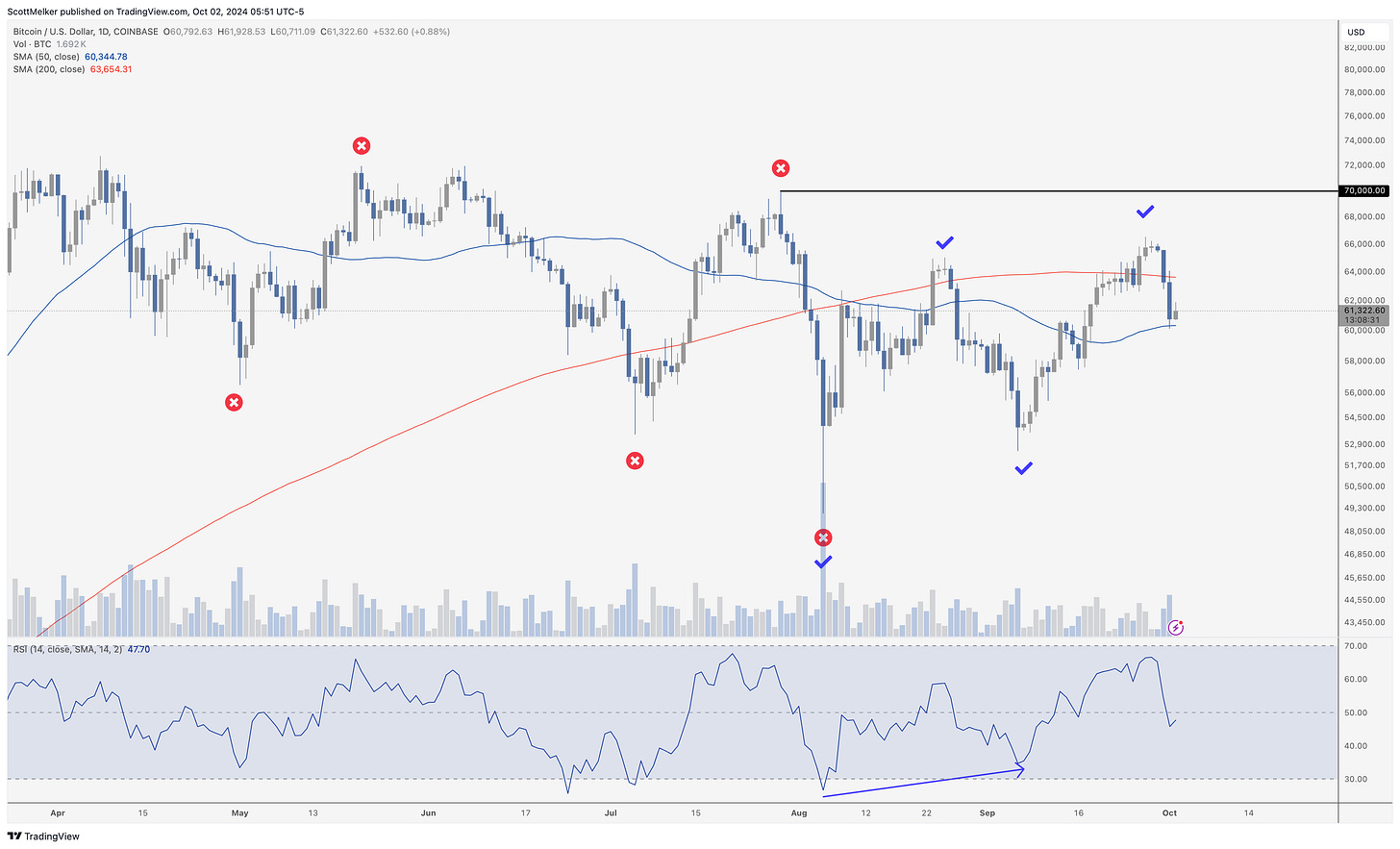

The market has a way of humbling you, keeping you on your toes. I’ve spoken at length about "Uptober" and past bullish trends as the month began. However, instead of following that pattern, we saw a bullish end to September followed by a downturn to kick off October. Admittedly, this was largely due to temporary risk aversion sparked by the Israel/Iran escalation, but that shouldn’t matter in the bigger picture. In fact, geopolitical conflict could be positive for Bitcoin if it evolves into the safe-haven asset we hope it becomes.

Similarly, September started with poor, downward price action but ended as the best-performing September on record. I’m not concerned about October, but it’s crucial to stay cautious, especially when everyone seems to expect the same outcome.

Additionally, I’ve gained a new perspective on the chart, shared directly by trading legend Peter Brandt. I was wrong, and I’m not sure why I didn’t see it sooner.

While $65,000 was a higher high for Bitcoin in the short term, to make a true higher high, we need a break above the July peak of $70,000. Since Bitcoin didn’t make a lower low after reaching $65,000, the real previous higher high remains $70,000.

I’ve updated the chart accordingly.

That said, this move was simply a backtest of the 50 MA for now, not a big deal. We are also way oversold on lower time frames, so bullish divergence is now very much in play on any future dip. Here is the idea on the 4-hour to illustrate.

Legacy Markets

U.S. futures dropped as markets awaited Israel's response to a missile attack from Iran, shifting focus from central bank policy to escalating tensions in the Middle East. Brent crude surged above $75 a barrel, reflecting concerns over potential broader conflict in the region. This geopolitical uncertainty led to a flight to safe assets like Treasuries, though yields on 10-year notes edged higher. The VIX, Wall Street’s fear gauge, hit a critical level indicating likely future market volatility.

The S&P 500 futures slipped 0.2%, while European stocks reversed earlier gains. Despite the geopolitical risks, market sentiment remains cautiously hopeful that the conflict won’t escalate into full-scale war. Oil producers benefited from rising crude prices, while JD Sports Fashion Plc fell following weak results.

Meanwhile, Chinese stocks surged, particularly those listed in Hong Kong, as Beijing relaxed home purchase rules, continuing efforts to boost its economy.

Key events this week:

S&P Global Manufacturing PMI on Wednesday

Fed speakers include Richmond’s Thomas Barkin, Cleveland’s Beth Hammack, St. Louis’s Alberto Musalem and Fed Governor Michelle Bowman on Wednesday

US nonfarm payrolls, Friday

Some of the main moves in markets:

Stocks

S&P 500 futures fell 0.2% as of 6:32 a.m. New York time

Nasdaq 100 futures fell 0.2%

Futures on the Dow Jones Industrial Average fell 0.4%

The Stoxx Europe 600 was little changed

The MSCI World Index was little changed

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro was little changed at $1.1071

The British pound was little changed at $1.3287

The Japanese yen fell 0.4% to 144.18 per dollar

Cryptocurrencies

Bitcoin rose 1.1% to $61,437.53

Ether rose 0.5% to $2,462.46

Bonds

The yield on 10-year Treasuries advanced three basis points to 3.76%

Germany’s 10-year yield advanced six basis points to 2.09%

Britain’s 10-year yield advanced eight basis points to 4.02%

Commodities

West Texas Intermediate crude rose 3.2% to $72.05 a barrel

Spot gold fell 0.4% to $2,653.50 an ounce

Arthur Hayes Said Crypto Will Soon Be “Off To The Races.”

In a recent interview, Arthur Hayes succinctly summarized his thoughts on the current state of the crypto market in relation to the upcoming bull cycle and the U.S. election. I tend to agree with his insights, which I’ve outlined below. Hayes highlights that while there are compelling reasons to be bullish on crypto, the uncertainty surrounding the election—both before and immediately after—can lead to unwanted volatility. This mixed outlook suggests that while there’s potential for growth, caution is warranted as we navigate this pivotal period.

“So, the liquidity environment is very positive right now. I am very bullish from now until the US election in early November. And at that point, I believe until the president is known – and I don’t think it’s going to be known on election day, I think it’s going to take 3 to 6 months until the president is chosen in the United States – I don’t want to be adding more risk into the markets.

So, if I’m putting on risk now, I’m probably going to look to take it off a week or two before the US election because I believe that whether it’s Kamala Harris or Donald Trump, the person who loses is not going to accept the result, and neither will those who supported them.

They will agitate via legal means, they will agitate via violent means in the streets, and any adversary of the United States who wishes to exploit a power vacuum because the president’s stance isn’t known, is going to engage in military actions against targets that they otherwise wouldn’t have done because there’s a power vacuum in the US.

Once that’s settled, then it’s off to the races. Whoever wins the election is going to print money.

Donald Trump’s going to cut taxes, Kamala Harris is going to increase welfare payments, but both sides are in agreement that the government’s role in terms of how much it spends needs to expand, regardless of where that expansion is. So as crypto holders we don’t really care what they spend the money on…”

Robinhood Expands Its Overseas Offerings

On Tuesday, Robinhood’s crypto unit announced that it has enabled European customers to deposit and withdraw over 20 digital assets, including Bitcoin, Ethereum, Solana, and USD Coin following increased demand. Johann Kerbrat, vice president and general manager of Robinhood Crypto, noted that this feature was one of the top requests from customers. In December, Robinhood launched its cryptocurrency service in the European Union, allowing users to trade over 25 digital currencies to capture significant revenue in this large market.

Bitwise Files An XRP ETF!

To be honest, I was surprised to see Bitwise file an ETF for XRP. I would’ve expected them to prioritize a Solana ETF, given Solana's relevance and its market size, which is nearly double that of XRP. That said, XRP might be the safer choice due to the regulatory clarity it enjoys—something Solana is still lacking. Now, I might catch some flak for saying this, but XRP isn't the crypto community’s favorite anymore; it still faces criticism for being seen as centralized, outdated, and lacking utility. However, Bitwise must see profit potential here, and if we end up in a scenario where every major coin gets an ETF, then kudos to them for being early. The market should decide what it wants, not the issuers. Also, it’s hard to say if this will spark a wave of XRP filings in the short term, but my gut says probably not. Still, you can bet this move will be a talking point among every filer.

If Trump wins, expect the ETF floodgates to open wide.

Does The Crypto Bull Market Start Today?

James Butterfill, the Head of Research at CoinShares, joins me to review the latest in crypto and to share his insights from his crypto research.

My Recommended Platforms And Tools

Phemex - Exclusive for new users, earn up to 8800 USDT. Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '10OFF' for a 10% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.