Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Phemex!

Phemex is the most efficient crypto trading and investment platform. Phemex offers over 293 spot trading pairs, minimal fees, peer-to-peer trading, derivatives, up to 100x leverage, and $8,800 welcome rewards up for grabs! Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Make sure to check if Phemex is available in your jurisdiction.

In This Issue:

Uptober Is Here, Do This Now!

Bitcoin Thoughts And Analysis

Altcoin Charts

Legacy Markets

Polymarket Keeps Growing

The Ethereum Foundation Is Selling

World Liberty Financial is Almost Here

Eigen Is Unlocking

Bitcoin Enters Uptober, Will It Make A New All Time High?

Uptober Is Here, Do This Now!

There’s no better time than now to learn how self-custody works or to go through your security setup step-by-step and ensure everything is in order.

If we’re truly entering the second half of the bull market in Q4, ask yourself: are you really comfortable with how your crypto is stored if its value were to 3x, 5x, or even 10x, depending on what you hold? Are you at ease knowing that 40% of your net worth is on a Ledger in your desk drawer or sitting on an exchange without 2FA, let alone a vault? And what about the crypto on your laptop or the crypto connected to your phone? If you lose that phone…. you get the idea.

Chances are, many of you fall into one of the security traps I just mentioned, and if not, there are probably some major flaws in your setup that you haven’t noticed. If prices start running up again, people are going to be way more interested in the fact that you own crypto, making it more important than ever to tighten up your security. With that in mind, I’m going to walk you through a quick process you should follow as you read this letter.

First, I want each of you to ask yourself this: Can I access my crypto? And what steps do I need to take to ensure I can access it?

If you aren't 100% confident that you can access your crypto or if you're unsure about the steps involved, stop reading this newsletter and take the time to figure it out. I’m assuming most of you are good in this area. However, it’s worth considering the time locks on your assets. Do you have a 24-hour or 48-hour withdrawal lock? Are you staking some of your assets, which might take a few days or even weeks to unlock? Are any of your funds held with a multi-sig company that has a waiting period for withdrawals? You should know exactly how long it would take to access and sell your funds.

Second, if you haven’t logged into your Ledger, Trezor, or other cold wallet in a few months, do it now. It’s always wise to develop the habit of plugging it in safely and reviewing the assets you have stored. You don’t want to discover that your screen is off or that a cord is missing when you need to sell—routine checks are essential.

Third, now that you’ve completed your routine check and have everything fresh in your mind, ask yourself: if I were to try to steal from myself, would it be easy? Be honest with yourself—this exercise can be challenging. What systems do you have in place to secure your assets? For example, does Coinbase remember you when you log in, and do you lack whitelisted addresses? This leaves few barriers for a potential thief to bypass.

Fourth, take a moment to specifically assess the physical location of your keys and what is required to access them. Do you have only one copy stored in a safe, at a bank, or tucked away in your dresser drawer? Consider what would happen if that copy went missing, if the text became smudged, or if something were to happen to your home. Recent events, like the massive hurricane that disrupted tens of thousands of lives in the southeastern U.S., serve as a stark reminder of the importance of having secure and accessible backups.

When it comes to private keys, I recommend storing them in multiple places, but only after really thinking through the risks of each location. Handing a copy to a cousin you don’t always get along with or a girlfriend you’re not planning to marry is obviously a terrible idea. Instead, stick to a close relative, spouse, or a super professional company to hold onto your keys. These are serious decisions that shouldn’t be taken lightly.

Also, on the topic of keys, here are some advanced tips that don’t get enough attention. Simply putting them in a safe isn’t enough unless it’s both fireproof and waterproof. And even then, consider hiding them in a less obvious spot—maybe within your favorite chapter of a book no one reads, or inside an old, boring document no one would ever look through. Remember, your safe isn’t really ‘safe’ if it’s light enough for someone to just pick up and walk out with, or if it could be swept away in a storm.

Getting back on track, the fifth and final aspect of proper cold storage is making lifestyle changes. This means not discussing your cold wallet with anyone you wouldn't trust with your life. It also means never plugging it into someone else’s device or allowing it to leave its secure location. Additionally, never connect it to DeFi applications, always enable 2FA, and use a VPN for added security. These habits will go a long way in protecting your assets.

I can keep going on this point: never tell anyone how much crypto you own—or that you own any at all. True crypto investors understand this unspoken rule and won’t ask such questions, but outsiders might not get it. When pressed, I usually just mention the assets I like and say I wish I owned more—it always works. Also, I have a second phone strictly for accessing funds, and it’s never on me. So, if my phone gets lost or someone tries to take it, I’m only out a phone—not my crypto.

It’s easy to do this, just buy an old phone or use an old one you never got rid of.

I know there are so many people out there who would be royally f**ked if they lost their phone or had it stolen. People without backups for 2FA, relying entirely on their phones for account access... bad idea. Don’t wait until you drop your phone in a pool in the middle of the bull market to wonder if you can still access your crypto. If we want to cash out this cycle, prices need to go up AND we have to act responsible.

Don’t f**k up the second half of that equation, it’s literally a freebie if we simply do the work.

Let’s have a great month, Uptober is finally here.

Bitcoin Thoughts And Analysis

Bitcoin just closed it’s best September ever. As you can see from the chart above, Bitcoin saw a gain of 7.29%, surpassing 2016 when price rose 6.04% in the same month.

A green September has always been followed by a green October. Not only that the “worst” October following a green September was 14.71%. There have only been 2 red Octobers, ever. That does not include the Hunt For Red October.

Things are shaping up nicely.

Altcoin Charts

For those who are new here, I share SETUPS and not SIGNALS. These are ideas that I am watching - if a certain thing happens, then the trade triggers. I am not telling you what to buy or when. I am showing you how I am watching certain charts and what has to happen for me to take a trade.

Here are two layer 1s that have the “right” setup that I was discussing yesterday. And I shared these last week on my website. Both APT and NEAR have made a new higher high and have just tested that level perfectly as support. Backtests of key resistance as support are the best possible entries for risk/reward.

APT/USDT

NEAR/USDT

Legacy Markets

European bonds rallied and equities rose on Tuesday as inflation data fueled expectations of accelerated interest rate cuts by central banks. Yields on 10-year German bonds dropped to their lowest level since January after euro-area inflation fell below the ECB’s 2% target for the first time since 2021, increasing the likelihood of a 25 basis point rate cut in October.

European Central Bank President Christine Lagarde expressed optimism about controlling inflation, while U.S. Federal Reserve Chair Jerome Powell indicated that U.S. rates would be lowered “over time.” The Stoxx 600 added 0.3%, and S&P 500 futures were steady after the index hit a new record on Monday.

Traders now see a one-in-three chance of a half-point Fed rate cut in November, though BlackRock CEO Larry Fink cautioned that the extent of anticipated rate cuts is “crazy,” suggesting more moderate easing is likely.

Meanwhile, geopolitical concerns escalated as Israel began targeted ground raids in Lebanon, while oil prices dropped due to potential increases in Libyan supply. Shipping firm ZIM fell 4.9% amid a strike by dockworkers on the U.S. East and Gulf coasts, benefiting companies like FedEx and UPS.

Key events this week:

Atlanta Fed President Raphael Bostic, Fed Governor Lisa Cook, Richmond Fed President Thomas Barkin and Boston Fed President Susan Collins speak Tuesday

ECB policy makers speaking include Olli Rehn, Luis de Guindos, Isabel Schnabel and Joachim Nagel on Tuesday

BOE chief economist Huw Pill speaks Tuesday

South Korea CPI, S&P Global Manufacturing PMI on Wednesday

Fed speakers include Richmond’s Thomas Barkin, Cleveland’s Beth Hammack, St. Louis’s Alberto Musalem and Fed Governor Michelle Bowman on Wednesday

US nonfarm payrolls, Friday

Some of the main moves in markets:

Stocks

The Stoxx Europe 600 rose 0.3% as of 10:52 a.m. London time

S&P 500 futures were little changed

Nasdaq 100 futures were little changed

Futures on the Dow Jones Industrial Average fell 0.3%

The MSCI Asia Pacific Index rose 0.3%

The MSCI Emerging Markets Index was little changed

Currencies

The Bloomberg Dollar Spot Index rose 0.2%

The euro fell 0.4% to $1.1094

The Japanese yen was little changed at 143.70 per dollar

The offshore yuan fell 0.2% to 7.0221 per dollar

The British pound fell 0.4% to $1.3327

Cryptocurrencies

Bitcoin rose 0.2% to $63,929.96

Ether rose 0.9% to $2,637.05

Bonds

The yield on 10-year Treasuries declined four basis points to 3.74%

Germany’s 10-year yield declined seven basis points to 2.06%

Britain’s 10-year yield declined six basis points to 3.95%

Commodities

Brent crude fell 1.6% to $70.53 a barrel

Spot gold rose 0.5% to $2,648.02 an ounce

Polymarket Keeps Growing

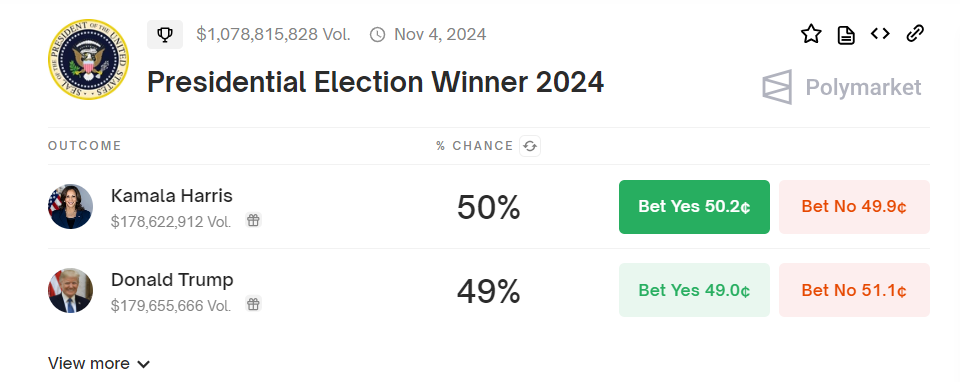

Imagine the floodgates that would open if Polymarket became accessible to U.S. residents. In the ‘Presidential Election Winner 2024’ market alone, bettors have already placed $1.1 billion in volume. Interestingly, D.C. District Court Judge Jia Cobb recently ruled in favor of Kalshi, a similar platform, in its lawsuit against the Commodity Futures Trading Commission. This case revolved around the CFTC's ban on Kalshi contracts that pay out based on which party controls Congress after the upcoming November elections—a major win for prediction markets overall.

Did you know Polymarket also faced a battle with the CFTC, resulting in a 2022 settlement where it paid $1.4 million in civil penalties for allegedly running an unregistered platform for trading options contracts? While Polymarket did not confirm or deny the allegations, they agreed to restrict U.S. users from the platform. If Trump wins the upcoming election, it’s easy to imagine the potential for Polymarket to make a comeback in the U.S., especially given its connection to crypto. I would love to see what Polymarket can grow to if U.S. degens got to use the platform.

The Ethereum Foundation Is Selling

According to blockchain analytics platform Lookonchain, the Ethereum Foundation has crossed the $10 million mark in Ethereum sold this year, totaling 3,766 ETH, which has sparked some controversy. First, if Ethereum was outperforming, nobody would bat an eye at this decision—in fact, the community and critics would likely be perfectly content. Second, $10 million isn't much for a foundation that's building and supporting a $300 billion ecosystem. To address concerns, Justin Drake mentioned earlier this month that the Foundation would release financial statements covering its spending, probably to appease critics. He also noted that the EF holds about $650 million and plans to spend around $100 million a year, which should last about 10 years. This approach is possible because, A) the EF receives donations, and B) ETH will likely rise in value. Regarding the budget, Vitalik Buterin recently said on Reddit, “The current approximate budget strategy is to spend 15% of our remaining money every year. This implies a default path where the EF lasts forever but gets smaller and smaller (as a share of the ecosystem) over time.”

World Liberty Financial is Almost Here

I’m eagerly awaiting the day I can do a full write-up on Trump’s crypto project, World Liberty Financial, but so far, details remain scarce, and the platform still hasn’t launched. However, they’ve opened a whitelist requiring KYC verification and wallet connection—hard pass for me.

From the latest Twitter Space and various launch articles, we know World Liberty Financial plans to include a governance token called WLFI. This token won’t carry any financial rights, will be nontransferable, won’t earn yield, and will only be available to accredited investors.

During the X Space, we also got some insight into the project’s tokenomics: 63% of the tokens will be sold to the public, 20% will go to the team, and 17% is set aside for user rewards. And, unsurprisingly, the team made it clear that WLFI is not a security (of course they said that).

My gut reaction is a mix of skepticism and cautious optimism. A lot of this project’s success will depend on who’s calling the shots. That said, the tokenomics distribution already looks better than 95% of what I usually cover, so that’s a plus.

How ironic would it be if World Liberty Financial launches and the SEC goes after it? My guess is Trump will need to win the election, and fire Gensler for his DeFi project to actually be successful.

Eigen Is Unlocking

Ethereum restaking protocol EigenLayer’s token, EIGEN, has been unlocked for trading, nearly five months after its initial airdrop. The token’s trading started last night, Monday at 9pm PT. Major exchanges like Binance, Coinbase, and Bitfinex have announced plans to list EIGEN, with trading pairs including Bitcoin and Tether. The token will launch with a supply of over 1.67 billion tokens, though the supply is dynamic and will grow over time. Futures contracts are currently priced at $4.03, valuing the token at over $6.7 billion fully diluted. It's generally a good time to buy when assets dump after release, but this strategy only works with quality coins, of course. That’s the hard part.

Bitcoin Enters Uptober, Will It Make A New All Time High?

Join Dave Weisberger, Mike McGlone, and James Lavish as we break down what's happening in macro and crypto!

My Recommended Platforms And Tools

The Wolf Pack - A cutting-edge platform designed to transform your engagement with high-level content and industry leaders. Join The Wolf Pack now!

Phemex - Exclusive for new users, earn up to 8800 USDT. Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '10OFF' for a 10% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.

your remarks concerning BTC October performance as related to the immediately prior September performance probably should have been qualified by noting that the October following positive September results referred to only 3 prior examples in your table. A sample size of 3 is hardly a large enough sample size to conclude anything