Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Phemex!

Phemex is the most efficient crypto trading and investment platform. Phemex offers over 293 spot trading pairs, minimal fees, peer-to-peer trading, derivatives, up to 100x leverage, and $8,800 welcome rewards up for grabs! Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Make sure to check if Phemex is available in your jurisdiction.

In This Issue:

How Worried Should We Be?

Bitcoin Thoughts And Analysis

Legacy Markets

Stablecoins On Ethereum Continue To Grow

Brian Armstrong Is Improving His Base Pitch

I Never Saw This Coming…

Unlock Massive Profits In The Next Bull Market! Join The Wolf Pack And Win Big!

How Worried Should We Be?

Public Service Announcement!

Make sure to check out the very bottom of this newsletter—the WOAS podcast section. Yesterday morning, I brought on the analysts who have been working alongside me building out TheWolfOfAllStreets.com who are responsible for delivering exclusive, next-level content for Wolf Pack members. If you haven’t watched this video yet, do it now. We dive into current price action, talk about where we are in the bull market, and drop some alpha finds that have never been shared on this platform before.

Now for the newsletter!

I came across an interesting article online: “Coinbase Holds 11% of Bitcoin’s Total Supply – How Worried Should We Be?”

The article is packed with valuable insights for anyone trying to answer this question, and today, I’m going to share my own perspective. You don’t have to agree with me—in fact, you might think I’m crazy—but honestly, my answer is simple: I’m not that worried.

But Scott, we all trusted FTX and look what happened, how can you fall for the same story over again?

If that was your initial thought, I commend you for your concern and skepticism—it's a valid question. After all, we all trusted FTX, and look where that led us.

Perhaps I haven’t learned my lesson, but I don’t believe Coinbase is the next FTX. However, that doesn’t mean Coinbase is immune to hacks, which is why some people find the 11% figure concerning. Let’s review the numbers.

Coinbase is the fourth largest exchange in the world. It has 73 million verified customers and a market cap of $38 billion. According to the article, Coinbase controls 11% of the Bitcoin supply, “which translates to 2.275 million BTC or a whopping $129 billion.” Unfortunately, I don’t have Brian Armstrong on speed dial to confirm this number, but I will take it at face value and share the source here. I don’t doubt that Coinbase controls a meaningful amount of the supply.

Allow me to explain why this doesn’t worry me.

Centralization, not necessarily bad, is everywhere.

I probably just got canceled by some readers for such a blasphemous statement but give me a moment here.

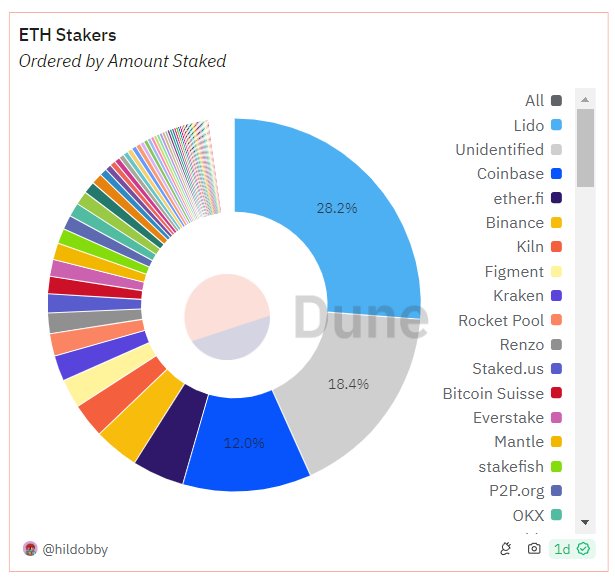

Coinbase also holds 11% of staked ETH. Lido holds 28.2%!

Coinbase is the selected custodian of 9 of the 12 Bitcoin ETFs.

Foundry USA accounts for 29% of blocks mined on a 24-hour basis.

BlackRock’s IBIT controls about 37% of all Bitcoin in ETFs.

Of the companies who own Bitcoin, it’s almost entirely MicroStrategy—nothing comes close.

Here's something else that's surprising and rarely mentioned: over 20% of all crypto is held on Ledger devices. You can verify this HERE—Pascal Gauthier, the CEO of Ledger, personally confirmed this to me at the Bitcoin conference in Nashville. He might have even said it was more than 20% now.

I can keep going…

Over half of stablecoins are issued on Ethereum, 69% of all stablecoins are in Tether, and 29% of all DeFi TVL is in Lido.

It doesn’t really matter where you look, the numbers are always going to be concentrated in the most popular places.

Going back to the original article, there is an interesting quote worth sharing regarding a theoretical Coinbase hack: “In a Coinbase disaster scenario (coins stolen or lost), we might see a massive consortium of powerful interests clamoring for a Bitcoin fork to somehow ‘recover’ their loss. This would effectively create a new altcoin which they would claim is ‘the real Bitcoin.’”

I have no idea what would happen if 11% of the world’s Bitcoin ended up in the hands of North Korea or some random genius teen in a basement, but it definitely wouldn’t be a pretty sight. Would the Bitcoin network roll back the transaction? Probably not, but I can’t say for sure. This is all just speculation—high-level stuff beyond my ability to predict.

Another interesting quote: “In the case of a hack regarding coins with someone with influence, like BlackRock, they will try to force a rollback of the chain,” he told The Defiant. “Since they will agree, they might force U.S. miners to do so since they are in their jurisdiction, which will cause a chain split and a new Bitcoin fork. It will have an effect on the price but nothing long term. Another fork will die like Bitcoin Cash and Bitcoin Satoshi’s Vision (BSV).”

I'm just presenting ideas here, so don’t shoot the messenger.

Just to ease some nerves, allow me to explain how complicated it would be to roll back the Bitcoin blockchain. A rollback would require both miners and nodes to agree. Miners, who validate transactions and create new blocks, would need to use at least 51% of the network's hash power to reorganize the blockchain and reverse transactions. However, even if miners were to do this, full nodes— which store the blockchain and independently verify transactions—would also need to accept the revised chain. If nodes reject the rollback, it could lead to a network fork.

Moreover, initiating such an idea would require the backing of extremely powerful and influential players. A proposal from just a few developers or a single entity would be met with ridicule, and their credibility would plummet instantly.

If you’re connecting the dots, this is essentially what happened with Ethereum’s DAO hack. It’s not out of the question that we could see a similar scenario in the future or at least be faced with that possibility. If that worries you, then sure, take your funds off Coinbase—but then you’ll need to find another way to store them, because Ledger won’t resolve all of your concerns either. You could create a paper wallet, but are you really prepared to take on the full responsibility of self-custody?

What I’m getting at is that I’m not overly concerned. Am I ignoring these stats like they don’t matter? No, but they’re not keeping me up at night. I’ve distributed my Bitcoin in places I feel are secure and out of reach, and I recommend you do the same. As the space matures, the stakes for hacks will rise, but so will the security. I expect the amount stolen will decrease over time as people get smarter and security continues to improve—it’s a natural progression.

The week’s almost over, and after a couple more newsletters, I’ll be heading to Singapore for Token 2049. If you see me there, feel free to say hi, take a selfie, and meet some of my friends! Crypto is better at conferences and I expect that excitement to spill over to the masses soon.

Bitcoin Thoughts And Analysis

It continues to look more likely that Bitcoin has put in a higher low at $52,500, although this will not be confirmed until we break above $65,000. There is nothing meaningful on the chart, but it is encouraging to see price back in the range and continuing to head up.

September is almost halfway over!

Legacy Markets

A tech-driven rally in the US extended to Asia and Europe, with major indices like the MSCI Asia Pacific and Stoxx 600 seeing significant gains. The rally was led by major technology firms, particularly Dutch chip-equipment maker ASML Holding NV. Traders are closely watching inflation data, with the producer price index (PPI) expected to show moderate wholesale price increases. The European Central Bank (ECB) is expected to lower its key interest rate to 3.5%, but remains cautious due to lingering inflation concerns. In the US, traders no longer expect an outsized rate cut by the Federal Reserve after recent inflation data, with a quarter-point cut now anticipated.

In corporate news, OpenAI is reportedly seeking $6.5 billion in funding at a valuation of $150 billion, and Nvidia's CEO acknowledged supply shortages frustrating customers. Oil prices rose as Hurricane Francine affected production in the Gulf of Mexico, and gold traded above $2,515 per ounce.

Key events this week:

ECB rate decision, Thursday

US initial jobless claims, PPI, Thursday

Eurozone industrial production, Friday

Japan industrial production, Friday

U. Michigan consumer sentiment, Friday

Some of the main moves in markets:

Stocks

S&P 500 futures rose 0.1% as of 7:22 a.m. New York time

Nasdaq 100 futures were little changed

Futures on the Dow Jones Industrial Average rose 0.1%

The Stoxx Europe 600 rose 1%

The MSCI World Index rose 0.3%

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro was little changed at $1.1019

The British pound was little changed at $1.3048

The Japanese yen was little changed at 142.46 per dollar

Cryptocurrencies

Bitcoin rose 1% to $58,058.69

Ether was little changed at $2,346.91

Bonds

The yield on 10-year Treasuries advanced one basis point to 3.67%

Germany’s 10-year yield advanced two basis points to 2.13%

Britain’s 10-year yield advanced two basis points to 3.78%

Commodities

West Texas Intermediate crude rose 1.8% to $68.53 a barrel

Spot gold rose 0.2% to $2,516.83 an ounce

Stablecoins On Ethereum Continue To Grow

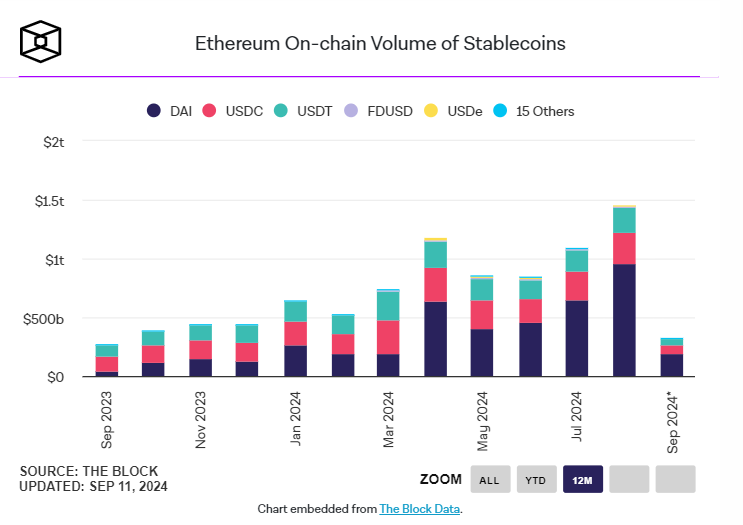

Ethereum's on-chain stablecoin volume has hit a record $1.46 trillion (for the month of August), more than doubling from $650 billion earlier this year. DAI leads with $960 billion, signaling strong demand for decentralized finance, though it ranks behind USDT and USDC when filtered for potential wash trading. PayPal's PYUSD has also seen rapid growth, increasing from $500 million to $2.4 billion, thanks to incentive programs.

Below, I compiled 3 charts for you to visualize this:

A look at all stablecoins across various networks.

Blue is Ethereum, purple is Solana, and red is Tron.

The original chart from the source shows that the second bar from the right, representing August, is the +$1 trillion month.

Brian Armstrong Is Improving His Base Pitch

It’s a welcome sight to see Brian Armstrong traveling the world, refining his BASE pitch at established conferences like the Goldman Sachs Tech & Comms Conference, where this one was delivered. What’s fascinating about the pitch is that Brian is lusting after a future product while making a strong case for today, arguing that Base is already faster, cheaper, and more global than what exists.

This is my favorite part of the pitch below, a really simple analogy made between text messages and payments.

“And so, if the world had a fast, cheap, global financial system that was decentralized, not controlled by any one country, I think a lot of friction would be taken out of the economy, and you'd see a lot of growth. Even small amounts of friction that are reduced lead to huge increases in adoption. Like for instance, text messages used to cost $0.25.”

“There were about 25 billion text messages a year at its peak. Today, with WhatsApp, iMessage, and similar services that are now free, there are hundreds of billions of messages sent every day. So, you can get an order of magnitude increase in activity just by removing a small amount of friction. And that happened in messaging; that's now going to happen in payments.”

I Never Saw This Coming…

In case you missed it, the title of this section is pure sarcasm. After Pump.fun, then SunPump, and later Ether Vista, it was clear to me that the meme craze was quickly heading for another crash and burn. Like everything else, memes have their cycles, and I’m sure they’ll make a comeback, but there's no telling which chain it’ll happen on or if platforms like these will even be part of it. Plus, there will be an all-new class of memes when they do come back, at most, a handful of current memes will make it until then.

“SunPump’s launch on Aug. 13 initially boosted Tron’s native TRX token, propelling its price up 33% to $0.16 by Aug. 21 and pushing the asset into the top 10 cryptocurrencies by market capitalization. However, Tron has since struggled to sustain the momentum. On Tuesday, TRX fell out of the top 10 and now trails The Open Network’s TON, valued at $13.3 billion, and sits just above Cardano’s ADA, which has a market cap of $12 billion.”

“Since Sept. 5, SunPump has seen a steep decline in daily activity, with fewer than 1,000 memecoins created each day. On Sept. 8, the platform recorded its lowest-ever activity, with just 766 new tokens launched, according to Dune data. SunPump hit its highest point on Aug. 21, minting 7,500 coins in a single day. In total, 80,863 tokens have been created on SunPump to date — far behind the 1.91 million tokens launched on Pump.Fun, the Solana-based memecoin launchpad. By comparison, Pump.Fun averages around 6,500 daily memecoin creations.”

Unlock Massive Profits In The Next Bull Market! Join The Wolf Pack And Win Big!

This is a very important livestream for me and my team! Please meet the team behind the Wolf Pack: Mark, Dave, and Phong. Together we are going to do an intro to the Wolf Pack and will answer your questions in the end of the stream!

Chris Inks will join us in the second part to share some interesting trades in crypto and beyond.

My Recommended Platforms And Tools

The Wolf Pack - A cutting-edge platform designed to transform your engagement with high-level content and industry leaders. Join The Wolf Pack now!

Phemex - Exclusive for new users, earn up to 8800 USDT. Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '10OFF' for a 10% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.