Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

You Need To Check Out TheWolfOfAllStreets.com!

It’s been a week since my brand-new platform launched, and I’m thrilled to share it with all of you. As a member of ‘The Wolf Pack,’ you’ll get immediate access to expert-level technical analysis, deep dives into complex Web3 projects, in-depth macro commentary, and daily content from me. Plus, we’ve added private comment sections for members to discuss and interact with the analysts. And we’ve just rolled out this brand-new section, too!

If you are interested in supporting, click HERE to join ‘The Wolf Pack.’

In This Issue:

Become A Better Investor

Bitcoin Thoughts And Analysis

Altcoin Charts

Legacy Markets

We Are Right On Track

Debunking False Claims

Sony Bank Is Launching A Stablecoin

ENS Continues To Expand

Bitcoin Surges Despite Crypto Chaos – Here's Why October Could Spark A Massive Bull Run

Become A Better Investor

I have an all-time favorite story to share today.

In 1995, a middle-aged man named McArthur Wheeler carried out two brazen bank robberies in Pittsburgh in broad daylight. What’s even more remarkable about the robbery is that Wheeler didn’t bother with a disguise; he simply walked into the banks, smiled at the surveillance cameras, and left with the stolen cash.

Wheeler wasn't without a plan though. He actually thought he was going to get away with it. Wheeler believed that rubbing lemon juice on his skin would render him invisible to the cameras. His reasoning was that since lemon juice can be used as invisible ink, it would have a similar effect on video recordings, as long as he avoided heat sources that could reveal him.

To nobody’s surprise except Wheeler’s, later that night, he was arrested by the police. When they showed him the surveillance footage from the robberies, he was stunned and confused. To his dismay, he could clearly see himself on the tape. What he witnessed was he wasn't in fact invisible to cameras with lemon juice rubbed on his face. The result of this incident wasn't just an arrest, but a notable example of the Dunny Krueger effect discussed in psychology and criminal studies.

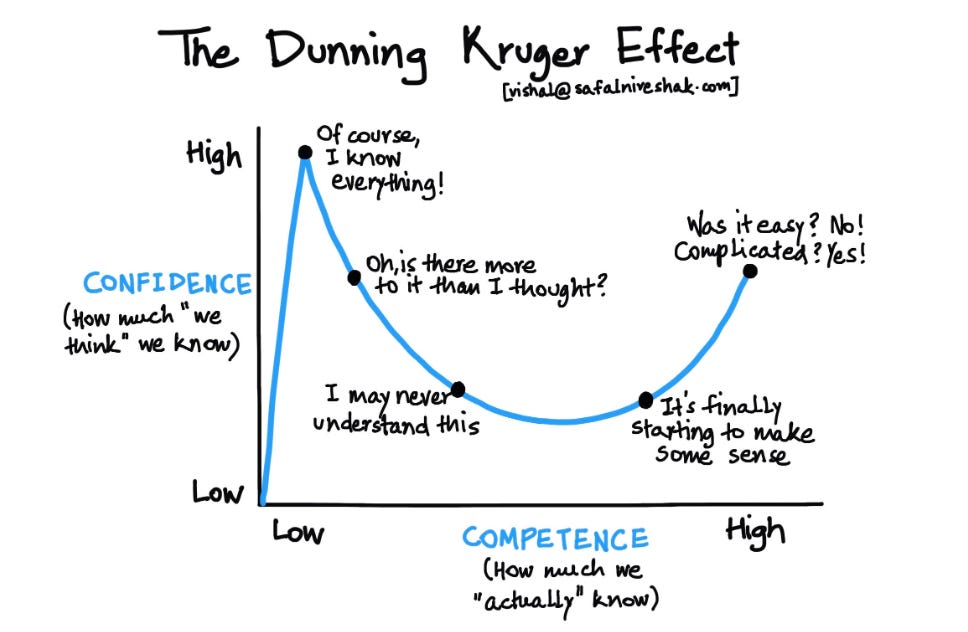

The Dunning-Kruger effect is a cognitive bias where individuals with low ability or knowledge in a particular area overestimate their own competence. Named after psychologists David Dunning and Justin Kruger, this effect occurs because people who lack expertise are often unaware of their own limitations and mistakes. As a result, they might make confident but incorrect decisions, believing they have a better understanding or skill level than they actually do.

In essence, the Dunning-Kruger effect highlights the gap between actual competence and perceived competence. Those affected are not only unaware of their deficiencies but also lack the metacognitive skills to recognize and correct their errors. This phenomenon explains why people sometimes make poor decisions or hold misguided beliefs despite lacking the necessary knowledge or skills.

This graphic encapsulates the effect beautifully.

Now, let’s connect this phenomenon to the crypto world. How many people do you know personally, or even within the upper echelons of the crypto influencer sphere, who seem to have a strong grasp on the space but actually know very little? And on a deeper level, how much do we ourselves overestimate our own knowledge about crypto, when in reality, we might know far less than we think?

This is exactly why I spend so much time interviewing experts in the crypto space rather than just pointing the camera on myself. It’s also why I attend conferences—there’s no better central hub for expertise and knowledge than these events anywhere in the world. Call me crazy, but one thing I’m confident about is that I know far less compared to what’s objectively known and discovered in this field.

This is why I feel compelled to dive deeper each day—I’ve barely scratched the surface.

So, what can the common crypto investor do to make sure they don’t end up as confident as the bank robber who rubbed lemon juice all over his face?

If we follow David Dunning’s advice, we can start by seeking feedback from others. You might be surprised to learn that even our favorite crypto personalities often respond to tweets or DMs. I truly wish I could respond to all your DMs, it’s just not feasible. However, from my experience in this space, I know there are countless highly intelligent and qualified individuals eager to engage and provide feedback all the time. Finding them is the equivalent of finding buried treasure.

Next, we need to consistently compare our beliefs to the highest industry standards. This doesn’t mean we have to have all the data perfectly accurate all the time, but when companies like Coinbase, Grayscale, Fidelity, or BlackRock release research papers, we should line up our conclusions with theirs and search for differences and gaps. Then we need to ask ourselves: Am I right and this massive research team is wrong, or am I wrong, and this massive research team is right?

You with me so far? To achieve both of these goals requires serious, focused self-reflection. Asking for advice means listening carefully and questioning your own abilities. Challenging your views against the highest standards requires humility. It’s crazy to think all of these personal skills can make us better investors, but it’s 1,000% true. So, let’s finish it off with Dunning’s last two pieces of advice.

Keep learning and honing your skills—one of the best ways to do this is by diving into some of the fantastic books available in this space. A few years ago, there were only a handful of books I could recommend, but now there are literally hundreds. As for practicing your skills, it can be as simple as tweeting your ideas and writing blogs. Trust me, you’ll receive plenty of feedback, which ties back to the first piece of advice.

If you're serious about investing, you need to constantly assess your own abilities. Beating the market isn’t easy—only the overconfident investor would think otherwise. There will come a time when the market turns around and things seem easy. Just remember: A) it’s not as easy as it looks, and B) you earned it. If this intro was a lot to take in, just remember the following quote to jog your memory.

“Confidence is the prize given to the mediocre.” — Robert Hughes

Bitcoin Thoughts And Analysis

Bitcoin is retesting the old range lows as support, for the second day in a row. Bulls want to see this general level hold.

Many expected significant price action during the debate, which did not really happen. Bitcoin is clearly stuck in the mud in this part of the cycle, waiting for the next big move. The longer we trade sideways, the bigger the next move will be.

Legacy Markets

US stock futures declined while bond prices rose in anticipation of the US consumer price index (CPI) report, sparking concerns that the Federal Reserve might have waited too long to ease its monetary policy. Fears of slowing growth in major economies have resurfaced, with oil trading below $70 and global bond yields hitting a two-year low. Investors are watching for the CPI report, which is expected to show only modest inflation increases, possibly supporting calls for interest rate cuts. While traders anticipate a smaller interest rate cut, there’s still a chance of a larger 50 basis-point cut later in the year.

Market reaction to the recent debate between Vice President Kamala Harris and former President Donald Trump was muted, though Harris’ odds of winning the election slightly improved. Stocks in renewable energy gained strength from Harris' green energy policies, while Trump's support for crypto triggered a pullback in Bitcoin prices.

Tariffs are another concern, with potential trade wars posing risks to the markets, especially given Trump’s previous tariffs on Chinese goods. Meanwhile, oil prices rebounded after a significant drop, reflecting worries over weaker demand from the US and China.

Key events this week:

US CPI, Wednesday

Japan PPI, Thursday

ECB rate decision, Thursday

US initial jobless claims, PPI, Thursday

hsu industrial production, Friday

Japan industrial production, Friday

U. Michigan consumer sentiment, Friday

Some of the main moves in markets:

Stocks

S&P 500 futures fell 0.2% as of 7:36 a.m. New York time

Nasdaq 100 futures fell 0.3%

Futures on the Dow Jones Industrial Average fell 0.3%

The Stoxx Europe 600 rose 0.5%

The MSCI World Index was little changed

Currencies

The Bloomberg Dollar Spot Index fell 0.3%

The euro rose 0.3% to $1.1048

The British pound was little changed at $1.3086

The Japanese yen rose 0.5% to 141.76 per dollar

Cryptocurrencies

Bitcoin fell 1.4% to $56,785.53

Ether fell 2.2% to $2,325.47

Bonds

The yield on 10-year Treasuries declined two basis points to 3.62%

Germany’s 10-year yield was little changed at 2.12%

Britain’s 10-year yield declined four basis points to 3.78%

Commodities

West Texas Intermediate crude rose 2.5% to $67.41 a barrel

Spot gold rose 0.2% to $2,522.43 an ounce

We Are Right On Track

At Bitcoin’s current price of around $57K, we are nearly aligned with the historical average return for September. This doesn’t mean Bitcoin couldn’t dip lower throughout the month, but in terms of where it typically averages, we’re right on target. To me, this signals a buying opportunity. Keep in mind, greed works both ways—it’s not just about refusing to take profits at the top but also hesitating to buy at the bottom. Many traders will miss out on the dip in September because they’re waiting for a magical, much lower number that will never come. My guess is we finish the month around our current level unless something major changes in regard to the election, CPI, PPI, or the rate cut. If this signals to you that we’ll go lower, have at it. If it signals we’re close to a bottom, then act accordingly. I just wanted to point out, we are there in terms of meeting the September average.

Debunking False Claims

I briefly talked about the Bianco Research claims in yesterday’s newsletter, but wanted to add some more context here regarding a particular false claim.

Here are the Bianco claims that are about to be proven false:

“What about the adoption of investment (wealth) advisors? Small. BTC ETF holdings account for 9% of shares outstanding. Hedge funds add another ~12% (mostly basis trades, not directional bets). About 85% is NOT from tradfi institutions. Note that all are holding losses.”

“The SPOT BTC ETFs have NOT become a tool for tradfi or boomer adoption. Blackrock confirms this by saying that 80% of IBIT's inflows are from self-directed online accounts. Crypto-quant analysis suggests that most Spot BTC ETF inflows were from on-chain holders moving back to tradfi accounts— so very little ‘new’ money has entered the crypto space. So far, these instruments have NOT lived up to the hype of ‘here come the boomers.’ Very few have come, and those that have are holding losses and may now be leaving ($1B outflows over the last 8 days).”

Now for Matt Hougan’s response:

“Jim is wrong here: Investment advisors are adopting bitcoin ETFs faster than any new ETF in history. Let's look at his own data, focused on IBIT, the BlackRock ETF. Per his table, IBIT has attracted $1.45 billion in net flows from investment advisors. He calls this ‘small’ because it's a fraction of the $46 billion that has flowed into bitcoin ETFs in total.”

“But if you excluded all other flows, and just looked at the $1.45 billion linked to investment advisors, IBIT would be the 2nd fastest-growing ETF launched this year (excluding other BTC ETFs). Out of 300+ launches! The only ETF that ‘beats’ it on assets is KLMT, an ESG ETF that was seeded by a single investor with $2 billion and trades on average ~250 shares per day, with zero investment advisor adoption.”

“The truth is that investment advisors are adopting bitcoin ETFs faster than any other ETF in history. It is just that their historic flows are overshadowed by the even-more-historic purchases of other investors. It is accurate to say that investment managers represent a small fraction of buyers of bitcoin ETFs. But it is not accurate to say that investment manager purchases of bitcoin ETFs are ‘small.’”

Sony Bank Is Launching A Stablecoin

Sony is preparing to launch a yen-pegged stablecoin through Sony Bank, which is currently undergoing extensive testing to ensure compliance with Japan's regulatory framework. This move marks a significant step in the non-USD stablecoin market and could encourage other Web3 providers to explore similar ventures. Key partners in the project include Astar Network, Chainlink, Alchemy, Circle, and The Graph. Although there is speculation about a potential airdrop, no such campaign has been confirmed yet.

ENS Continues To Expand

Ethereum’s proprietary Ethereum Name Service (ENS) is making its way into major financial apps, with both PayPal and Venmo integrating the tech. Now, users can enter ENS names instead of complicated wallet addresses when sending crypto. This matters because, before this, users had to manually input or scan external wallet addresses—a real headache for mainstream users. The reason I am bullish on ENS is because it makes crypto transactions stupid easy by linking readable names to wallet addresses, taking the confusion and headaches out of the process.

Bitcoin Surges Despite Crypto Chaos – Here's Why October Could Spark A Massive Bull Run

Join James Butterfill, The Head Or Research at CoinShares, as we break down the latest in crypto!

My friend from The Arch Public, Andrew Parish, is joining in the second part of the stream to provide an update on the $10K algorithmic portfolio.

My Recommended Platforms And Tools

The Wolf Pack - A cutting-edge platform designed to transform your engagement with high-level content and industry leaders. Join The Wolf Pack now!

Phemex - Exclusive for new users, earn up to 8800 USDT. Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '10OFF' for a 10% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.

Scott, great read today. I see your regular updates mostly include only BTC and ETH. I feel SOL deserves a third entry in there on a regular basis. You mentioned that it is your second largest position after ETH in one of the videos. So more the reasons to include a raising star here

Scott, I recently read Adam Grant’s book, Think Again. It was a great read and learned much about the Dunning Krueger effect from his book and also a recent podcast episode where David Dunning was a guest on Grants show. I’d highly recommend this content to you if you haven’t read the book or listened to the podcast. In fact I think either of them would be great guests for you!