Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Phemex!

Phemex is the most efficient crypto trading and investment platform. Phemex offers over 293 spot trading pairs, minimal fees, peer-to-peer trading, derivatives, up to 100x leverage, and $8,800 welcome rewards up for grabs! Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Make sure to check if Phemex is available in your jurisdiction.

In This Issue:

Bottoms Up!

Bitcoin Thoughts And Analysis

Legacy Markets

Details Are Leaking On Trump’s Crypto Project

This Major Bank Launches BTC and ETH Trading

John Deaton Will Face Off Against Warren

I Will Tell You Why The Ethereum Bottom Is likely In! Bitcoin To Drop To $49K?

Bottoms Up!

It’s the start of day 3 for TheWolfOfAllStreets.com—which I’ll be calling exclusively the Wolf Pack as the name becomes more recognizable.

Yesterday, we released a comprehensive long form write-up on the current bull market, an all-new TA macro video, and, of course, I did my Everyday Howls—something I plan to do every day until I die. If you enjoy this newsletter and my YouTube, go and visit—‘The Wolf Pack’—and give it a glance.

Your support is what keeps this machine churning.

Now, on to our regular programming!

Yesterday on YouTube, I had one of my all-time favorite guests on, David Duong, Coinbase's Head of Institutional Research. I kicked off my conversation with him by saying, 'Ethereum is dead. It’s over. Bitcoin maxis are dancing on the grave. Vitalik is selling all of his Ethereum—he doesn’t believe in it anymore. He thinks DeFi is a joke. It’s dead. It’s over.’ I did this to see where his head is at.

[It was sarcasm]

If there's anyone in this space I trust to answer whether Ethereum is dead, it's David—THE INDIVIDUAL in charge of research at Coinbase, the largest exchange in the U.S. and second only to Binance globally. No one is more in touch with institutional clients, understands their interests, needs, and questions, and can cut through the noise to grasp the underlying themes, protocol risks, and macro trends.

If I had to draft a small team to build an elite crypto roster, with no access to any other sources, David would definitely make the cut. He’s a guaranteed starter in my fantasy crypto draft, consistently delivering solid performance season-after-season, cycle-after-cycle.

Now for the interview:

Me: Do you think Ethereum is dead David?

David: “No, I definitely don't think it's dead. I find it funny that every cycle, we see people talk about this—there's always some kind of narrative, like 'Is crypto dead? Is Bitcoin dead? Is Ethereum dead?' No, I don't think it's dead.”

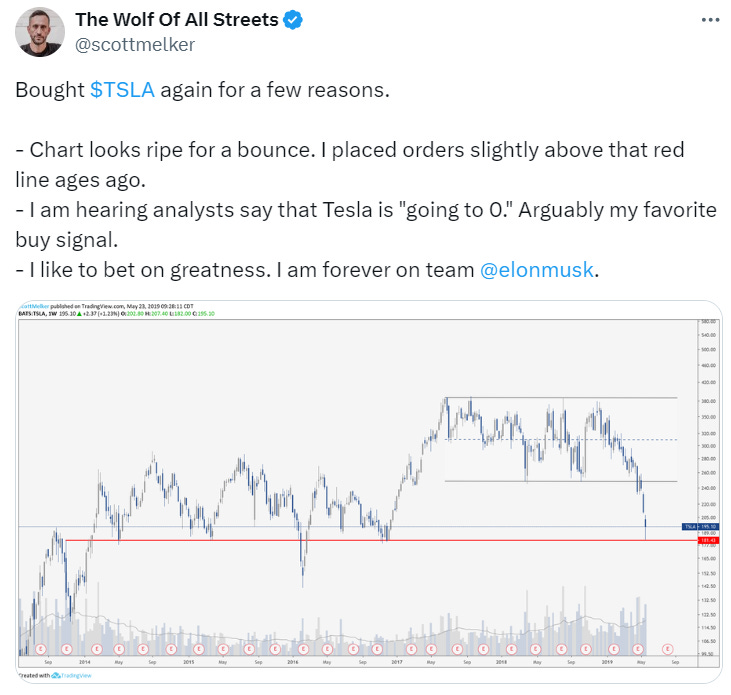

Following David’s comment, I pulled up my favorite bottom signal of the week to get David’s reaction:

Me: (I begin to discuss and quote the post), Ethereum is in a death spiral. ETH is doing 200k a day in fee revenue—that’s 73 million a year. He goes on to talk about why Ethereum is literally over, saying they’ll never be able to afford to continue, as if it’s a failed business that needs to go out and do a Series D, right? I mean, that's not really how this works. But we’ve been here before; these are not signals that it’s dead. Yet here we are—death spiral.

David: “I mean, I don't know if this is the bottom. I think you have a lot more conviction about that than I do. But I do believe it's forming a bottom here. A big part of this, to be honest, has to do with the spot ETH ETFs versus what we're seeing with spot Bitcoin ETFs. They've had cumulative outflows since inception, compared to the $18 billion in inflows that spot Bitcoin ETFs have seen.

There are different reasons for this. One is the market environment, which was very different at the time of launch—spot Bitcoin ETFs were introduced in January this year, while spot ETH ETFs launched in July. I think that explains some of the difference.

Additionally, for many managers, there's relative difficulty in educating new investors on how Ethereum's supply schedule works. Bitcoin's supply cap is straightforward—21 million. But explaining smart contract utility and the absence of staking yields is more complex, even though it shouldn't be. I think these factors are contributing to the lack of appetite for ETH ETFs.”

I hope you are intrigued because it gets better from here…

After the Krueger post, I shared an old treasure with David that I'm willing to bet most people have forgotten about.

That Clubhouse chat was one of my all-time favorite bottom signals. I even showed David this, which is off topic from crypto, but the same story applies.

My point in bringing this up isn’t to claim I'm some kind of god-tier trader, but rather to highlight that some signals are simply more powerful than charts. Elon Musk smoking weed on Joe Rogan and the world losing its mind marked a generational bottom—just like the 'Death of ETH Party' and Fred Krueger treating Ethereum like a failing business.

All bottom signals are cut from the same cloth. That said, David does recognize some of the challenges Ethereum is facing…

David: “There are several themes specific to Ethereum that I recognize. For instance, the deflationary 'ultrasound money' thesis has somewhat deflated—not to play on words—but I never really liked it anyway. It hasn’t served Ethereum well in this cycle. Additionally, new technological competitors like Solana and other next-generation chains are also eating into its market share.”

Me: Do you think what's happening with Bitcoin is a result of this macroeconomic wobble, or is it more about its position in the cycle? What are your thoughts on what's happening with the market in general?

David: “Crypto is still being used as a proxy for many traditional assets. When there’s nothing else to trade, people turn to crypto, which feeds into the quasi-correlations we're seeing. We're still within a very narrow range, between 0.0 to 0.4, indicating a weak correlation or almost no relationship.

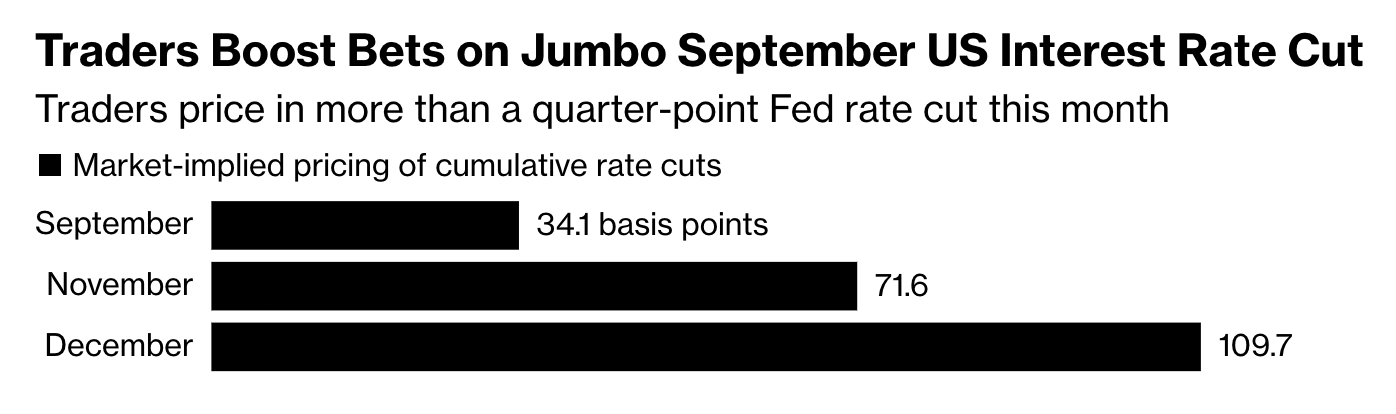

Markets seem to be getting edgy ahead of the labor data coming this week, including JOLTS and non-farm payrolls. It’s possible that investors are preemptively adjusting their positions in anticipation of this data, as there are ongoing concerns about a potential recession and the Federal Reserve's actions on September 17 and 18.”

What we discussed next was quite interesting.

I shared with David some data on Bitcoin's performance, noting that it has averaged a +30% gain in eight of the past nine Octobers and also mentioned that in a previous October, Bitcoin ridiculously jumped a few percentage points right at midnight on October 1st—literally on the dot.

I highlighted that this price behavior has led to a consensus that October and Q4 will be a pivotal moment for Bitcoin, which has become a bit unsettling and concerning. However, what’s considered consensus among crypto traders in our echo chamber might not align with broader market sentiment—ironically, this disconnect could still make the prediction come true.

David: “Yeah, I never want to be part of a club that would have me as a member, and that’s kind of how it feels right now. We’ve been advocating since at least early July that investors should be defensive in Q3 and constructive in Q4. It seems now that more people are aligning with this view. I share your concern, Scott; it’s unsettling when positioning becomes too crowded and everyone is leaning the same way. While it makes sense, given the circumstances, Bitcoin's performance over the last month has been fairly disappointing.”

From there, we discussed the $16–$17 billion set to be returned to FTX creditors, with a significant portion likely flowing back into the market. We also touched on how, despite our shared belief that Q4 will see improvement, maintaining that conviction is challenging after six months of decline. It’s human nature—time-based capitulation stems from this. People lose patience and inevitably sell at the lows.

David: “I do think that the elections are important for both crypto and Bitcoin. As we get closer to the elections—and I don’t think people are doing this right now, but as we approach, say, two to three weeks before the elections actually take place—I think you'll see a lot more investors examining their entire spectrum of investment options and asking themselves what they can use to play the election result. At that point, people may feel more confident using Bitcoin or cryptocurrencies more generally as a strategy.

Yes, we understand the dynamics of how Republicans versus Democrats view crypto, or at least how people think they view crypto. But ultimately, investors might realize that the situation is asymmetric. For example, if Democrats are in charge, we saw Chuck Schumer’s push for more crypto legislation, which could make conditions more favorable. Overall, there is now a more bipartisan view on crypto than there was a year ago. So even if you put your money in with the expectation of betting on a Bitcoin strategic reserve, for example, I think you’ll ultimately come to realize that it’s a better option than what you had previously. This makes it a pretty decent bet. I believe this is what we’ll see as we approach the elections.”

Moral of the story: If Trump wins and fulfills his promise, it would be ideal. If Kamala wins and targets crypto, Bitcoin could serve as a hedge and see a flight to value. This could potentially be a win-win situation. I expect this narrative will fluently evolve with price as needed.

Here’s one final quote from David I really enjoyed that wrapped up our segment, “As human beings, we're just really bad at predicting things. It’s a bit deflating for me because predicting outcomes is my job, and I don’t feel I’m great at it.”

Predictions are extremely difficult; we are all shooting in the dark. The point isn’t to nail the bull’s eye, but to allow us to stay on course, formulate an actionable plan, and patiently sit in positioning that makes the most amount of sense.

If October isn’t Uptober, and November isn’t Boomvember, it’s our job to stay the course as long as Bitcoin remains in a bull market, until the data proves otherwise.

I hope this helps. Give David a follow or shoutout on X, he is easily one of the most underrated analysts in the space.

Before you leave, we have already uploaded a bunch of brand-new content to ‘The Wolf Pack.’

We currently have a series going right now titled, “Has The Bullrun Even Started,” that answers that exact question. These articles are long, rich with content, and far more than I could manage here.

In this post, David Haslop delves into the key macroeconomic and geopolitical challenges affecting the crypto market. He analyzes crypto ETF flows, chart patterns, on-chain metrics, the Fed, gold, altcoins, $TRX, and reveals a surprising sleeper pick at the end that might just shock you.

This is just one example of the content available to members of The Wolf Pack, and there’s so much more on the way—we’re just getting started!

Bitcoin Thoughts And Analysis

Bitcoin remains at support, testing this level precisely today. Yesterday’s candle dipped below support with a long wick but closed above it, forming a potentially bullish candle. However, this type of candle needs confirmation, which would mean another bullish candle today. At the moment, we don't have that.

Once again, Bitcoin is sitting at support, and the bullish divergence on multiple time frames is still valid. For now, nothing has changed since yesterday, but we want to see some buying action today.

More importantly, this only matters if you are trading daily. For those dollar-cost averaging or holding long-term positions, this short-term analysis shouldn’t matter. I assume this applies to 99.9% of you.

Legacy Markets

Key events this week:

US initial jobless claims, ADP employment, ISM services index, Thursday

Eurozone GDP, Friday

US nonfarm payrolls, Friday

Fed’s John Williams speaks, Friday

Some of the main moves in markets:

Stocks

S&P 500 futures were little changed as of 7:10 a.m. New York time

Nasdaq 100 futures were little changed

Futures on the Dow Jones Industrial Average were little changed

The Stoxx Europe 600 fell 0.3%

The MSCI World Index was little changed

Currencies

The Bloomberg Dollar Spot Index fell 0.1%

The euro rose 0.2% to $1.1100

The British pound rose 0.2% to $1.3168

The Japanese yen rose 0.2% to 143.46 per dollar

Cryptocurrencies

Bitcoin fell 2.3% to $56,700.44

Ether fell 2.7% to $2,388.96

Bonds

The yield on 10-year Treasuries advanced one basis point to 3.77%

Germany’s 10-year yield was little changed at 2.23%

Britain’s 10-year yield was little changed at 3.94%

Commodities

West Texas Intermediate crude rose 0.6% to $69.63 a barrel

Spot gold rose 0.8% to $2,515.50 an ounce

Details Are Leaking On Trump’s Crypto Project

The situation with World Liberty Financial is currently unclear, as only a few major news outlets have access to the white paper. The rest of us are left relying on secondhand reports, which isn't ideal, but it's the only way to cover the story right now.

Reportedly, the project will be built on Ethereum and Aave, which is promising. However, there’s a significant downside highlighted in the CoinDesk article: “a whopping 70% of Trump-backed World Liberty Financial's WLFI tokens will be reserved for the project's insiders.”

In the past, we have seen tokenomics change due to bad press. Frankly, these numbers aren't surprising given the missteps of some DeFi releases, but keeping 70% of tokens away from the public and retail investors is quite extreme. World Liberty Financial will need to address this.

“World Liberty Financial, the new crypto lending platform promoted by former U.S. President Donald Trump and his sons, advertises itself as a way of 'putting the power of finance back in the hands of the people' and a solution to the 'rigged' traditional finance system.”

“CoinDesk has obtained a draft white paper for the project. It reveals that the vast majority of the power promised by World Liberty Financial will be concentrated in the hands of a select few insiders: 70% of WLFI, the project's 'governance' crypto token, will be 'held by the founders, team, and service providers.'”

“The remaining 30%, according to the white paper, will be distributed ‘via public sale,’ with some of the money raised from that also going to project insiders – though some will be reserved in a treasury 'to support World Liberty Financial's operations.'”

In response to these leaks, World Liberty Financial released a thread on X to address and clarify some of these claims...

There wasn’t any mention of the team allocation, but there was mention of the Aave claims: “Let's be clear: we’re not just another hostile fork of Aave. History shows those don't work. We’re working with Aave, collaborating to create a platform that sets new standards and pushes all of DeFi forward. This is a partnership to build something truly transformative.”

This Major Bank Launches BTC and ETH Trading

You can tell me Bitcoin and Ethereum are dead as many times as you want—I’m not buying it when news like this comes out. Zurich Cantonal Bank, one of Switzerland's largest banks, has just started offering crypto trading and custody services for Bitcoin and Ether. Announced on September 4, this service is seamlessly integrated into their existing channels and is available to both their customers and third-party banks. Known as Zürcher Kantonalbank (ZKB), it is the largest cantonal bank and the fourth-largest bank in Switzerland, with assets totaling 200 billion Swiss francs ($235 billion).

John Deaton Will Face Off Against Warren

Crypto advocate John Deaton has won the U.S. primary in Massachusetts, setting the stage for a potential showdown with crypto critic Elizabeth Warren. Although Deaton, a Republican, faces an uphill battle in this heavily Democratic state, his efforts are far from futile. To challenge Warren and her anti-crypto allies, Deaton will need to mount relentless media campaigns, and his pushback could potentially weaken her influence—leaving room for an upset. Interestingly, Deaton hasn’t yet pledged support for Trump, a factor that could affect his chances in the race, though its impact remains uncertain. For context, Warren faced a tough race in 2012 when she defeated Republican incumbent Scott Brown, secured over 60% of the vote in 2018, and President Biden carried the state with 66% of the vote in 2020.

I Will Tell You Why The Ethereum Bottom Is likely In! Bitcoin To Drop To $49K?

What's going on with the crypto market? David Duong, The Head Of Institutional Research at Coinbase, is joining me to discuss the latest developments. Chris Inks will join us in the second part to share some interesting trades in crypto and beyond.

My Recommended Platforms And Tools

The Wolf Pack - A cutting-edge platform designed to transform your engagement with high-level content and industry leaders. Join The Wolf Pack now!

Phemex - Exclusive for new users, earn up to 8800 USDT. Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '10OFF' for a 10% discount.

X - I spend most of my time on X, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.