Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Arch Public!

Arch Public’s algos continue to stay heated as the summer winds down. Just this week they added an additional 5% to client portfolios. The flagship SP500 Strategy hasn’t had a losing trade in more than three months. Check out the charts below! 24/7 liquidity and 2% stop-loss protection on every trade. Join us!

Try Arch Public now! You can even demo the platform, for free, to learn more.

In This Issue:

Get Your Head In The Game!

Bitcoin Thoughts And Analysis

Legacy Markets

Brace For Impact

Galois Capital Now Owes The SEC A Fine

North Korea is Targeting The Crypto Industry

Ripple Integrates With Ethereum

There’s A DeFi Story Brewing With Trump

The Interest Rate Cut Is Coming - Will It Boost Bitcoin? | Macro Monday

Get Your Head In The Game!

Before diving into today's intro, I want to mention a little hiccup we had yesterday regarding the timing of my new platform. In our excitement to share the news of the launch, I accidentally sent everyone to our platform a few hours before the actual launch—only for you to land on a countdown page… facepalm.

I encourage all of you to carry that excitement and enthusiasm over to today and check out the platform—there’s no longer a countdown in your way. You can sign up and start exploring right now! I hope you all enjoy it; we worked really hard on it and will continue to do so.

Once you're there, if you choose to subscribe, I highly recommend heading to “Into The Pack” and watching “HOW TO MAKE MONEY IN DEPIN TODAY.” Tom Dunleavy breaks down how to make $100 daily passively, with zero daily effort, by simply keeping a few websites open. It will pay for your membership for a year in just 4-5 days!

Now, for the newsletter…

The dirty truth behind bull markets is that they aren't easy...

If navigating bull markets were easy, everyone and their mother would be making money consistently. But that only happens at the tail end of a trend when it becomes more profitable to be contrarian and pull out.

During bull markets, and particularly right now, I am observing seasoned investors staying calm and buying the dips, frustrated but determined investors wrestling with their emotions while trying to hold on, and uninformed investors still scared of risk assets, sitting in money markets and collecting yield.

Chances are, most of you reading this newsletter fall into either category 1 or 2, or somewhere in between.

If you are in bucket #1 and are sitting back comfortably, congrats on achieving your mental fortitude. Keep reading so you know what to avoid and how to build stronger. For those in bucket #2, the remainder of this newsletter is for you—the frustrated and exhausted investors who know there is a light at the end of the tunnel but are struggling to stay the course.

The challenge right now is getting all of you to realize that bottom signals aren't reflections of reality but distractions from what's coming. First of all, we are still in a bull market, which has been the case since we bottomed in late 2022 post-FTX—we all know that Bitcoin peaked this year in March and has since trended sideways, weakening over time.

What we have forgotten is that last year, Bitcoin surged to $28,000 in March from the FTX lows around $16,000, attempted to break $30,000 in April, and didn't succeed until October. It took seven months of sideways price action before the market began to heat up again, eventually leading us to the all-time high Bitcoiners have once again been eagerly awaiting.

So far, 2024’s price action mirrors 2023 almost exactly, and it will be a perfect match if we see a strong Q4. I know I might sound crazy for saying this over and over again, but nothing about 2024’s price movement seems unusual to me. If anything, it’s following historical patterns to a ‘T.’

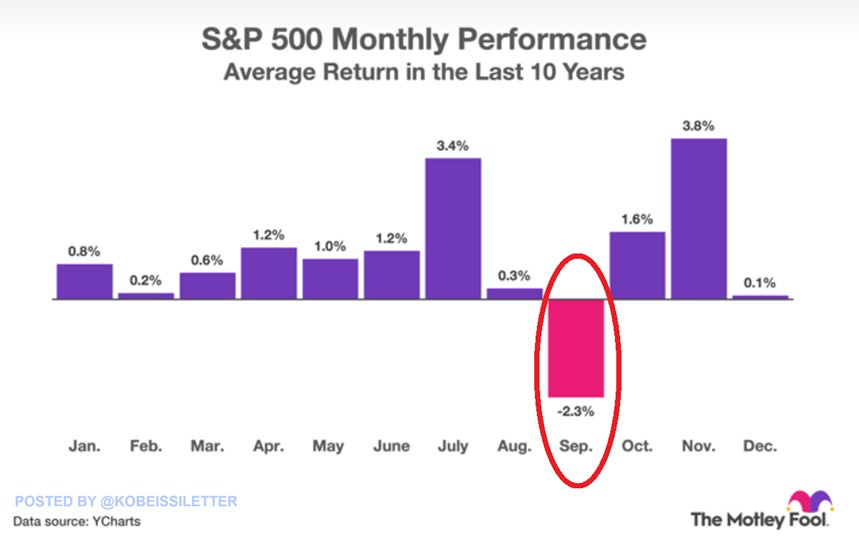

I will change my mind if these two things happen: Bitcoin begins to threaten retesting the $30,000 range, and the U.S. election outcome hurts crypto. Until then, I see no reason to panic because September is historically the worst month, and we are still following the same pattern of accumulation before a breakout move.

A lot of what I’m seeing on my timeline is people starting to speculate if the bull market is over—this is insanity at this point. What makes more sense: pulling out of the market right before Bitcoin’s strongest month or accumulating beforehand? I’ll be the first to say the bull market is over if the charts and fundamentals tell me so, but right now, it’s just crazy talk.

Bull markets are designed to make you feel anxious, but the reward is doubling, tripling, and even quadrupling your stack. Imagine if last year you had sold your Bitcoin in September around $27,000, just before it started knocking down the ten-thousand-dollar levels like bowling pins. The FOMO from missing that run would be intense, likely pushing you to buy back in at a higher price after probably selling for a loss in the high 20s.

Sure, we’re seeing plenty of mixed signals in the market, but how we interpret those signals is what really matters. Take altcoin casinos popping up on every chain, for example. Is that a sign that the speculative frenzy is reaching a dangerous peak, signaling a potential correction ahead? Or is it an indication that the memecoin craze is winding down and the market is shifting toward more serious projects?

How about the doom-and-gloom posts about Ethereum? Are they a sign that Ethereum's bull run is over, or could they actually be a contrarian indicator that the market is setting up for a strong rebound? The key is understanding the context and not jumping to conclusions based on surface-level signals.

What about the Solana vs. Ethereum bickering? Is that a sign one of these coins is going to dominate, and the other fails, or are both vying for the #2 spot? And what about wealth management firms not really adding significant exposure to Bitcoin ETFs due to a lack of new Q2 10-K reports? Is this a sign that Wall Street is just warming up to Bitcoin, or that the real interest was fickle and never really there?

Everything is always about perspective.

If you allow the idea of a bear market to creep into your head, the current market conditions are going to convince you it’s already over or rapidly approaching an end. If you look at the facts and recognize the bull market is still intact, you’ll appreciate the opportunity the market is offering us another chance to load up before Bitcoin’s strongest month.

I encourage everyone to think critically at all times—ask the hard questions and test your convictions. However, I draw the line when facts are lacking, and emotions start to dominate. It’s tough to see major indexes down, tech stocks down, and crypto down, but it’s important to maintain a wider, more nuanced, and convicted perspective.

Just about every market overhang has been eliminated at this point, and Wall Street is just beginning to take us seriously. A couple of years ago, we would have killed to be in this fundamental position, yet now everyone is focused on price and wishing things were better. Are you kidding me?

We literally have a presidential candidate singing our praises, and we’re acting like maybe Wall Street is bored, Bitcoin’s time isn’t now, Ethereum is dead, and Solana’s run is finished, just because prices have stalled for a few months? This is exactly what the bigger players want us to believe before they come home from summer break and pump the hell out of the market straight to +$100,000 per Bitcoin and convince us all once again that DeFi is the greatest financial innovation in the past century.

It’s all smoke and mirrors, psyops, conspiracy theories—whatever you want to call it—don’t fall for it.

Broaden your perspective, take a deep breath, stack some sats, and chill. We’re just getting started.

My team and I worked non-stop, day and night, to launch our new platform, TheWolfOfAllStreets.com. Sure, we launched on a rough day, but that’s just the way it goes. We’re incredibly excited to bring you brand-new content and have you join us from the ground floor. My team and I greatly appreciate the positive support we have received so far and are motivated to build on it. Keep it coming!

After you finish reading here, give it a visit, you won’t be disappointed.

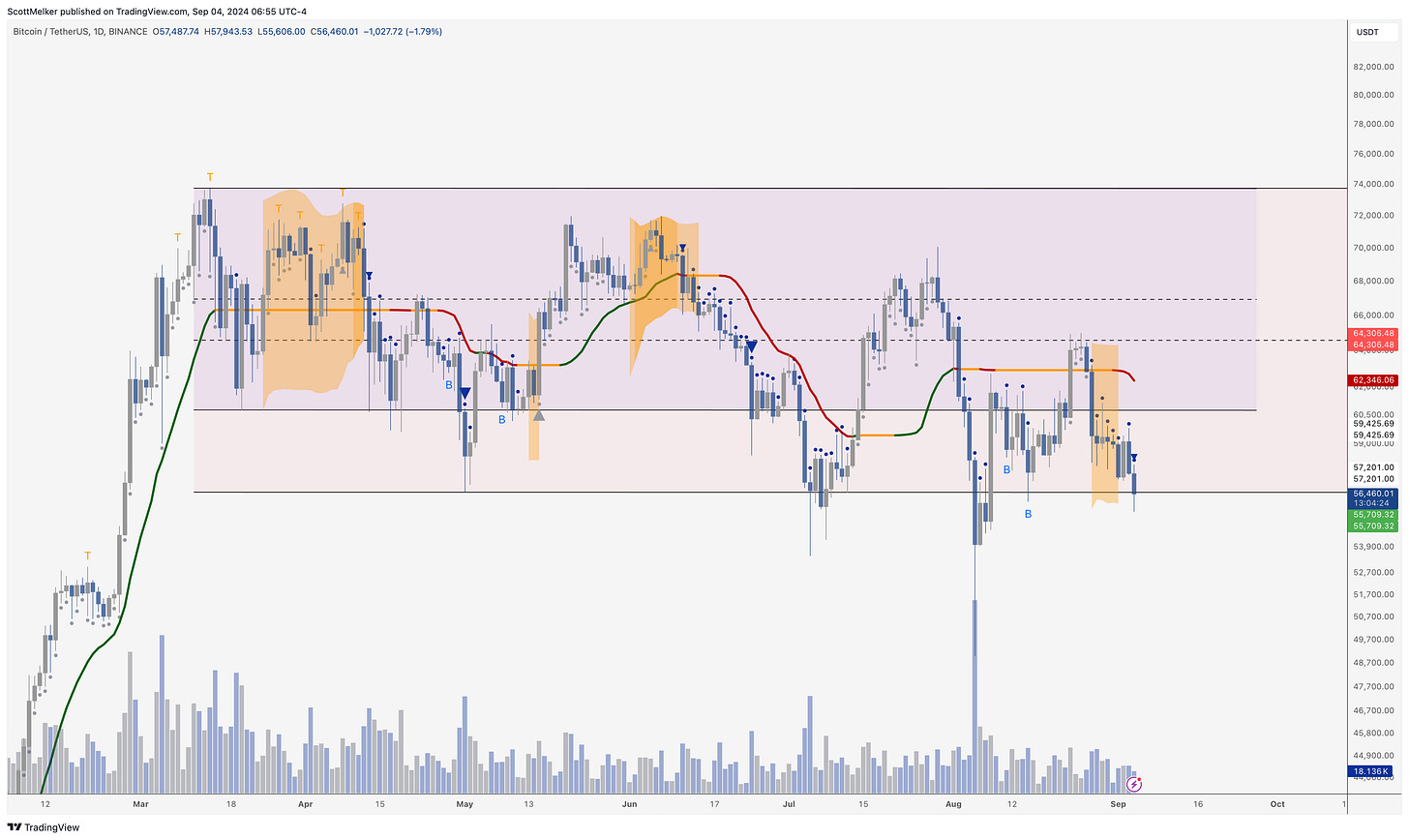

Bitcoin Thoughts And Analysis

Bitcoin is sitting at the lows of the larger range, right on a key area of support. Things look predictably shaky, not much for bulls to hang their hats on at the moment, as price continues to drift down.

Does that mean new lows are coming? No. It means we have the crappy price action that we tend to see at this part of the cycle, and little else.

That said, if you are the type to buy support as a trader, the risk reward here is decent for a quick trade. I won’t be taking it… unless we confirm the bullish divergence below. I will just keep dollar cost averaging.

Fun price action here. Bullish divergence, followed by hidden bearish divergence… and maybe more bullish divergence? We need to see a clear elbow up on RSI with a higher low on RSI. If that happens, the bottom of this move should be in.

Legacy Markets

Key events this week:

Eurozone HCOB services PMI, PPI, Wednesday

Canada rate decision, Wednesday

US job openings, factory orders, Beige Book, Wednesday

Eurozone retail sales, Thursday

US initial jobless claims, ADP employment, ISM services index, Thursday

Eurozone GDP, Friday

US nonfarm payrolls, Friday

Fed’s John Williams speaks, Friday

Some of the main moves in markets:

Stocks

S&P 500 futures fell 0.3% as of 6:33 a.m. New York time

Nasdaq 100 futures fell 0.5%

Futures on the Dow Jones Industrial Average fell 0.2%

The Stoxx Europe 600 fell 1%

The MSCI World Index fell 0.4%

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro was little changed at $1.1054

The British pound was little changed at $1.3118

The Japanese yen rose 0.2% to 145.12 per dollar

Cryptocurrencies

Bitcoin fell 2.7% to $56,631.62

Ether fell 2.7% to $2,397.4

Bonds

The yield on 10-year Treasuries declined two basis points to 3.82%

Germany’s 10-year yield declined four basis points to 2.23%

Britain’s 10-year yield declined three basis points to 3.96%

Commodities

West Texas Intermediate crude rose 0.3% to $70.46 a barrel

Spot gold fell 0.3% to $2,486.19 an ounce

Brace For Impact

The S&P 500 dropped 2.12% yesterday, the Dow Jones Industrial Average fell 1.51%, and the NASDAQ tumbled 3.26%. While past performance isn't a guarantee of future results, it often has a way of repeating itself. September might be the final opportunity to buy the dip for a while, particularly in crypto. Historically, Q4 has shown strong performance, and altcoins tend to trend positively in Q1.

Galois Capital Now Owes The SEC A Fine

Galois Capital, the crypto hedge fund that gained notoriety for warning about Terra's LUNA and UST before their 2022 collapse, has been charged by the SEC for misleading investors and failing to safeguard customer funds. The firm, which shut down in early 2023 due to FTX's collapse, settled with the SEC and agreed to pay a $225,000 civil penalty. The SEC's order highlighted that Galois Capital “failed to ensure that certain crypto assets... were maintained with a qualified custodian,” and held assets on platforms like FTX that were “not qualified custodians.” The SEC also found that Galois Capital misled investors about redemption policies while allowing others to redeem with fewer days' notice. It’s absolute bullshit that the SEC is issuing a fine to an investment firm for holding money in FTX, while regulators failed to protect us and snuggled up with SBF.

North Korea Is Targeting The Crypto Industry

Yesterday afternoon, the FBI released a public service announcement warning that North Korea is running advanced social engineering attacks targeting employees in DeFi and cryptocurrency businesses to deploy malware and steal funds. In the warning, it was detailed that these schemes are highly sophisticated, making even experienced cybersecurity professionals vulnerable.

While reading through the PSA, I was a bit taken aback to see crypto ETFs included in the warning. It seems like getting direct access to ETF funds would be tough, but impersonation and social engineering are definitely possibilities. The FBI also pointed out that DeFi remains a popular target for attacks.

“The actors usually attempt to initiate prolonged conversations with prospective victims to build rapport and deliver malware in situations that may appear natural and non-alerting.”

“North Korean malicious cyber actors conducted research on a variety of targets connected to cryptocurrency exchange-traded funds (ETFs) over the last several months. This research included pre-operational preparations suggesting North Korean actors may attempt malicious cyber activities against companies associated with cryptocurrency ETFs or other cryptocurrency-related financial products.”

Ripple Integrates With Ethereum

Ripple is expanding the XRP Ledger’s capabilities by introducing Ethereum-compatible smart contracts via a new sidechain. This upgrade will enable more advanced applications, such as decentralized exchanges and token issuance, beyond basic transactions. The sidechain, called XRPL EVM, utilizes the Axelar network for cross-chain token transfers, with Wrapped XRP (eXRP) serving as the primary token, enhancing interoperability and engaging developers. By integrating Ethereum Virtual Machine (EVM) compatibility, the XRP Ledger aims to attract a broader developer community by supporting familiar tools and programming languages.

There’s A DeFi Story Brewing With Trump

I'm holding off on sharing too much about this story for now, as there are a lot of moving parts and it’s easy to misinterpret the facts. Currently, there are allegations that Trump’s DeFi platform, World Liberty Financial, looks strikingly similar to a platform that was hacked earlier this summer. I’m not sure if this is a coincidence, a case of plagiarism, or something more intentional. I’ll be diving deeper into the details and providing a thorough analysis once I have a clearer picture. Stay put.

The Interest Rate Cut Is Coming - Will It Boost Bitcoin? | Macro Monday

Join Dave Weisberger, Mike McGlone, and James Lavish as we break down what's happening in macro and crypto!

My Recommended Platforms And Tools

The Wolf Pack - A cutting-edge platform designed to transform your engagement with high-level content and industry leaders. Join The Wolf Pack now!

Phemex - Exclusive for new users, earn up to 8800 USDT. Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '10OFF' for a 10% discount.

Twitter - I spend most of my time on Twitter, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.