The Wolf Den #1039 - The Great Rebranding

Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Arch Public!

Arch Public’s algos continue to stay heated as the summer winds down. Just this week we added an additional 5% to client portfolios. Our flagship SP500 Strategy hasn’t had a losing trade in more than three months. Check out the charts below! 24/7 liquidity and 2% stop-loss protection on every trade. Join us!

Try Arch Public now! You can even demo the platform, for free, to learn more.

In This Issue:

The Great Rebranding

Bitcoin Thoughts And Analysis

Legacy Markets

Grayscale Does A Deep Dive Into Ethereum

PolyMarket Is Still A Gambling Site

Trump Teased His Crypto Project Again

A Crackdown Is Coming

Nvidia’s Record Earnings: What This Means for Bitcoin And Stocks - Market Mavericks

The Great Rebranding

El Salvador has to be one of the most fascinating countries on the planet—not just from a monetary and fiscal perspective, but also in how it has redefined its national identity and defied global expectations.

‘Redefined’—that’s the key.

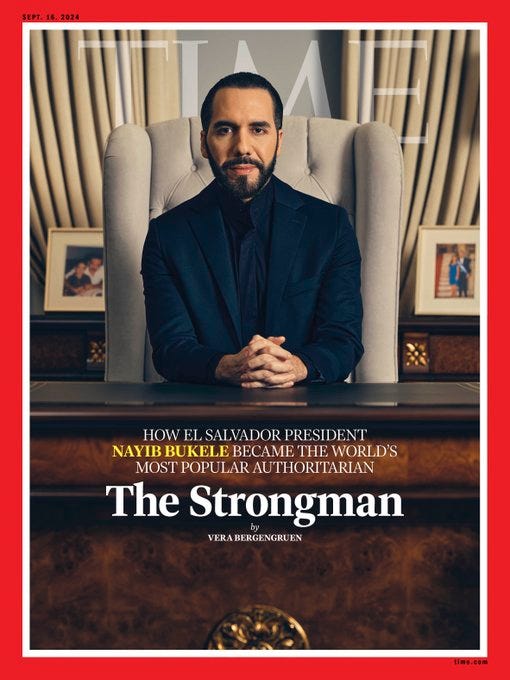

Despite facing mountains of criticism, opposition, and skepticism both domestically and internationally, Nayib Bukele has embarked on a bold mission to reshape how the world perceives El Salvador, with Bitcoin at the very heart of this transformation.

I’ve covered El Salvador numerous times before, but today I want to take a fresh perspective, celebrating Bukele’s feature in TIME Magazine and highlighting some of the commentary there.

I didn’t know this about Bukele, but apparently, before his rise to power, he was an adman: “Before he became arguably the most popular head of state in the world, Nayib Bukele was an adman. The President of El Salvador has branded himself the ‘world’s coolest dictator’ and a ‘philosopher king,’ but he is, perhaps above all, a former publicist attuned to the power of image—his own and his country’s.”

From Merriam-Webster: an ‘adman’ is a person who writes, solicits, or places advertisements.

Funny how the adman is now front and center in one of the most influential publications in the world—it all comes full circle—and the secret might just be Bitcoin.

Of course, there’s more to the El Salvador story than just Bitcoin, but the asset has undeniably been integral to the country’s transformation.

“To market his vision of a new El Salvador, Bukele still needed a modern pitch. In September 2021, he made the nation the first to use Bitcoin as legal tender, earning global headlines and the attention of the growing cryptocurrency community…Advisers admit it was a PR stunt. ‘We call it the Great Rebranding. It was genius,’ says Damian Merlo, a Miami-based lobbyist. ‘We could have paid millions to a PR firm to rebrand El Salvador. Instead, we just adopted Bitcoin.’”

‘We could have paid millions to a PR firm to rebrand El Salvador. Instead, we just adopted Bitcoin’—talk about a powerful statement.

“Today Bukele concedes that Bitcoin ‘has not had the widespread adoption we hoped’ among ordinary Salvadorans. Fewer than 12% have made a single transaction. But the move had the desired effect, putting El Salvador on the map for something other than its violence. ‘It gave us branding, it brought us investments, it brought us tourism,’ says Bukele.”

Bitcoin wasn’t just the solution to El Salvador's crumbling finances; it was also the distraction. Bitcoin was the Trojan horse—a clunky, odd, and curious new technology that diverted global attention from one of the largest modern-day crime crackdowns while simultaneously boosting the country's financial image and innovation profile.

This paragraph from TIME is interesting…

“As policy, the gimmick has flopped. Investing some of El Salvador’s national reserves into crypto was not well received by many foreign investors or the International Monetary Fund. Today Bukele concedes that Bitcoin ‘has not had the widespread adoption we hoped’ among ordinary Salvadorans. Fewer than 12% have made a single transaction. But the move had the desired effect, putting El Salvador on the map for something other than its violence. ‘It gave us branding, it brought us investments, it brought us tourism,’ says Bukele.”

Personally, I wouldn’t categorize El Salvador’s Bitcoin strategy as a flop. While the world's perception of this bold move is gradually improving, recognizing that it had the desired effect—‘putting El Salvador on the map for something other than violence’—represents fair reporting and a significant step forward compared to some of the previous external coverage of the country.

Just remember this: when non-Bitcoiners start praising El Salvador for adopting Bitcoin, the cycle will probably be approaching its peak. By this measure, there’s plenty of room left to go.

A quick Google search shows that El Salvador's average cost for Bitcoin is between $44,000 and $45,000. With Bitcoin trading at $60,000, the strategy might not seem particularly exciting right now, but you can bet your last Satoshi the world will be watching closely when Bitcoin’s price doubles what El Salvador paid for it.

And here’s where it gets really interesting: if Bitcoin starts to surge around the time the U.S. begins buying Bitcoin as part of a strategic reserve plan, you’ll have a world power and a developing nation both adopting Bitcoin simultaneously. This would transform the nation-state adoption theory from idea to reality.

El Salvador took a MASSIVE risk adopting Bitcoin, and there’s still a lot of ground to cover. But it’s very possible that in a few months, if a few dominoes fall in the right direction, everything could start to work out for the country, and the benefits could be tremendous. It’s already starting to happen, i.e., the TIME feature and Bitcoin’s rise.

Nothing will legitimize El Salvador’s risk more than if a neighboring Latin American country or the U.S. follows their lead, unwinding and rebranding the failing fiat systems we've relied on for far too long. Until then, I challenge all of you to consider how you can rebrand your life with Bitcoin.

Perhaps it's a rebranding of your retirement account to be more forward-thinking, or maybe it's a step further, a rebranding of your views on financial freedom, wealth creation, personal empowerment, political alignment, and financial inclusion. Whatever you choose, however far you climb down the rabbit hole, seize the opportunity, because Bitcoin is a once-in-a-generation opportunity.

In a few days, I’ll be making a major announcement that I’ve been working tirelessly on behind the scenes for the past few months. It’s not quite a rebrand, but a redefinition of all the content you’ve been supporting for years. Everything you already love will stay put, and so much more is going to be offered.

It’s designed, ‘for those who want it all.’

I wouldn’t be working this hard if I didn’t believe the world was teetering on the edge of profound change. Bitcoin and the rest of this space are our moment to redefine ourselves and our purpose—I won’t let the opportunity go to waste.

Mark your calendars.

Next Tuesday is the day.

Bitcoin Thoughts And Analysis

DAILY CHART

It has been exactly 5.5 months since Bitcoin hit $74,000 and I shared this tweet and idea in the newsletter.

Nothing has changed, but I do think we are getting closer. For now, we chop sideways.

Legacy Markets

Global stock markets are experiencing gains as signs of moderating inflation across developed economies increase expectations of interest rate cuts. The Stoxx Europe 600 index rose by 0.3% after data showed euro-area inflation easing to a three-year low, strengthening the case for the European Central Bank to reduce rates next month.

US equity futures also advanced, with the Nasdaq 100 and S&P 500 rising 0.6% and 0.4%, respectively. This comes as investors anticipate the Federal Reserve might begin its rate-cutting cycle as early as next month, following signs that inflation has been contained without pushing the US economy into recession. The core Personal Consumption Expenditures (PCE) price index, a key inflation measure for the Fed, is due for release soon.

Traders are closely monitoring upcoming US employment data, which could be more influential for monetary policy direction than inflation figures. The anticipation of rate cuts has led to significant inflows into global bond funds, while the US dollar has weakened against a basket of currencies, facing its worst monthly performance of the year.

In commodity markets, oil prices remained steady despite concerns about declining demand due to slowing economic growth, especially in China. Meanwhile, iron ore futures slightly decreased after a recent surge.

Key events this week:

Eurozone unemployment, Friday

US personal income, spending, PCE; consumer sentiment, Friday

Some of the main moves in markets:

Stocks

S&P 500 futures rose 0.4% as of 6:02 a.m. New York time

Nasdaq 100 futures rose 0.7%

Futures on the Dow Jones Industrial Average rose 0.2%

The Stoxx Europe 600 rose 0.3%

The MSCI World Index rose 0.1%

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro was little changed at $1.1083

The British pound rose 0.1% to $1.3182

The Japanese yen fell 0.1% to 145.15 per dollar

Cryptocurrencies

Bitcoin was little changed at $59,491.42

Ether fell 0.8% to $2,521.38

Bonds

The yield on 10-year Treasuries was little changed at 3.85%

Germany’s 10-year yield declined two basis points to 2.26%

Britain’s 10-year yield declined four basis points to 3.98%

Commodities

West Texas Intermediate crude was little changed

Spot gold rose 0.1% to $2,524.14 an ounce

Grayscale Does A Deep Dive Into Ethereum

Grayscale released an in-depth report on the Ethereum ecosystem, highlighting how Ethereum-based tokens have performed relative to the underlying asset. Their findings reveal that in previous bull markets, exposure to Ethereum-related tokens provided amplified returns. However, this strategy carries increased risks, necessitating robust risk management and careful foresight. Below, I’ve summarized the report’s most interesting findings, which essentially argue that if you want exposure to Ethereum, just buy Ethereum itself. Eventually, there will be a time when certain ecosystems outperform, but predicting when and which ones will be a crapshoot.

“Year to date, ETH tends to outperform its ecosystem tokens on both average and median bases. However, ETH can be outpaced by a few standout performers from the ecosystem (Exhibit 4). This analysis suggests that while ecosystem tokens can offer opportunities for significant gains, these opportunities are not evenly distributed. ETH has historically provided more consistent performance over longer timeframes…This is because most alternative tokens lag behind ETH, with only a few outpacing it. Another approach involves diversifying across multiple promising projects instead of focusing on a single alternative token.”

PolyMarket Is Still A Gambling Site

I appreciate PolyMarket as much as anyone—it's definitely one of the standout innovations in the industry. However, it's important to remember that it remains very much a gambling platform and should be treated as such. The unexpected early release of Pavel Durov, CEO of Telegram, by French authorities has taken bettors on PolyMarket by surprise, leading to significant losses for those who anticipated a longer detention. PolyMarket was pricing in the odds of a release before the end of August at the mid 30% level. This outcome has now led to the creation of a new market to predict whether Durov will flee France by September 15th. Please be cautious and avoid risking significant amounts of your crypto on PolyMarket bets related to unpredictable global events.

Trump Teased His Crypto Project Again

Yesterday morning, Trump released a video on Twitter claiming he would announce a major plan that afternoon, but nothing followed. In the video, he stated, “This afternoon I’m laying out my plan to ensure the United States is the crypto capital of the planet. They want to choke you, they want to choke you of business, we’re not going to let that happen.”

Maybe there was a delay, but it’s odd that after all the buildup—especially with the teaser being just a clip of him from the Bitcoin conference—there was still no announcement by the end of the day. We still have no idea what World Liberty Finance is, but perhaps we’ll find out very soon.

A Crackdown Is Coming

A crackdown is coming, but this time, it’s focused on ‘them,’ the regulators, instead of ‘us,’ the good guys. The U.S. House Financial Services Committee, led by Rep. Patrick McHenry, is gearing up for a series of crypto-focused hearings in September. These hearings will dive into DeFi, the SEC's oversight of digital assets, and 'pig butchering' scams. McHenry, who is set to retire at the end of the year, is pushing to establish tailored federal rules for crypto before he steps down. Key dates include a subcommittee examination of DeFi on September 10, two sessions on September 18 addressing SEC enforcement, pig butchering scams, and a full committee hearing on September 23, where SEC Chair Gary Gensler is expected to testify—the grand finale. Anytime Rep. McHenry has the chance to grill Gary, you know it’s going to be a good.

Nvidia’s Record Earnings: What This Means for Bitcoin And Stocks - Market Mavericks

Welcome to the 'Market Mavericks' Show, where action-packed analysis meets profitable trade setups, led by three of the world's foremost chart technicians. This is your front-row seat to the fast-paced world of trading and investing, stocks, crypto, commodities, and more.

Meet the Maverick Traders:

Gareth Soloway, Mike McGlone, and Scott Melker, three trading legends with a combined wealth of knowledge spanning over half a century in the world of trading. Their unique trading strategies, diverse perspectives, and unparalleled knowledge are coming together to create a one-of-a-kind investing show that's set to transform your financial journey.

My Recommended Platforms And Tools

Phemex - Exclusive for new users, earn up to 8800 USDT. Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '10OFF' for a 10% discount.

NGRAVE - ZERO is the most secure and user-friendly hardware wallet. If you aren't happy with your current crypto wallet, look no further than the ZERO.

Nord VPN - Get an exclusive NordVPN deal - 40% discount! It’s risk-free with Nord’s 30-day money-back guarantee. Protect your privacy.

Twitter - I spend most of my time on Twitter, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

TheWolfOfAllStreets.io - The most comprehensive collection of everything I have going on. Plus over 100 blogs and other exclusive content.

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.