Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Phemex!

Phemex is the most efficient crypto trading and investment platform. Phemex offers over 293 spot trading pairs, minimal fees, peer-to-peer trading, derivatives, up to 100x leverage, and $8,800 welcome rewards up for grabs! Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Make sure to check if Phemex is available in your jurisdiction.

In This Issue:

OpenSea Vs. The SEC

Bitcoin Thoughts And Analysis

Legacy Markets

TON Blockchain Goes Down - Twice

Nvidia Had A Strong Quarter

Sony’s L2 Live On Testnet

Remembering Hal Finney

Stop Getting Liquidated, You Idiots! The Market Is About to Turn Bullish!

OpenSea Vs. The SEC

Well, there you have it, folks—if you had OpenSea receiving a Wells Notice on your 2024 bingo card, go ahead and mark it off.

OpenSea has officially joined the growing list of companies that have received a Wells Notice from the SEC, alongside Robinhood, ConsenSys, Uniswap, and others.

Does this paperwork even mean anything anymore?

Honestly, I’m not surprised. Once it became clear that all major crypto companies were receiving Wells Notices, it was only a matter of time before OpenSea was next. The delay probably came down to the SEC’s limited experience with NFTs—though it's not like they fully understand what they're dealing with anyway.

But it gets better. Of all times to issue a Wells Notice, they did it just one day after Trump dropped another series of NFTs—what a world we live in.

There’s a lot to discuss, so let’s get to it.

In case you haven’t heard, OpenSea is the leading online marketplace for buying, selling, and trading NFTs. It's a simple-to-use platform where users can explore a wide range of digital collectibles, artwork, and virtual goods, making it a central hub in the NFT space—think of it like eBay, but digital.

OpenSea's official response to the Wells Notice does a far better job of highlighting the hypocrisy and absurdity of the SEC than I ever could, so let’s start with that.

“Classifying NFTs as securities would not only misinterpret the law, but it would also jeopardize artists’ livelihoods, disempower collectors and gamers, and stifle innovation across the many promising use cases for NFTs.”

“This is a slippery slope: if NFTs like those displayed on OpenSea are classified as securities, where does it stop? What’s to prevent non-NFT collectibles, like, say, physical or digital baseball cards, from being lumped in as well? Or physical or digital fine art? As Mann and Frye’s complaint points out:”

“NFTs are often compared to physical art and collectibles, such as baseball cards, Pokémon cards, sneakers, or watches. Thus, as has been explicitly recognized by one Commissioner, the SEC’s broad interpretation of the Howey test threatens to not only sweep into its jurisdiction all digital art represented by NFTs regardless of the context in which they are offered and sold; it would also sweep into its scope all art and collectibles. Read broadly enough, all art and collectibles involve a person investing money in a common enterprise, with an expectation of profit if the artist becomes more famous or the value of the art increases on the resale market.”

I legitimately have a hard time understanding the counter argument, but let’s try anyways.

To better understand the SEC's perspective, let’s revisit a story from last year that you might recall: the SEC's enforcement action against Impact Theory. The company settled with the SEC because it had made claims about its NFTs that likely crossed regulatory lines. I personally know the CEO of Impact Theory, and he’s a great guy, but perhaps the marketing was a bit overly ambitious.

“If you’re paying 1.5 [ETH], you’re going to get some massive amount more than that. So no one is going to walk away saying, ‘Oh man, I don’t think I got value here.’ I’m freakishly bullish on that. I will do whatever it takes to make sure that that is true.”

“Now as we’re building out this IP, imagine that you could’ve gotten in on Disney when they were doing Steamboat Willie, and that’s how we think of the Legendary tier. That’s how we think of this whole first drop quite frankly.”

I can see why the SEC took action against Impact Theory, but what’s particularly interesting is the dissent issued by Commissioner Hester M. Peirce and Commissioner Mark T. Uyeda.

“We understand why the Commission was concerned about this NFT sale. Even though we believe strongly that adults should be able to spend their money as they choose, we share our colleagues’ worry about the type of hype that entices people to spend almost $30 million for NFTs seemingly without having a clear idea about how they will use, enjoy, or profit from them. This legitimate concern, however, is not a sufficient basis to pull the matter into our jurisdiction. The handful of company and purchaser statements cited by the order are not the kinds of promises that form an investment contract. We do not routinely bring enforcement actions against people that sell watches, paintings, or collectibles along with vague promises to build the brand and thus increase the resale value of those tangible items.”

If two of the five commissioners had reservations about the Impact Theory case, it’s likely to be even more challenging for the SEC to make headway against OpenSea. I’m not a legal expert, but putting 2+2 together, it seems pretty evident the SEC will have a harder time here.

And to address the counterargument, I’m not naive enough to believe that OpenSea has a flawless record and has never listed a project that has turned into a scam or disaster. The point is that the platform functions as a marketplace—similar to any other marketplace—that should be able to operate freely without fear of persecution or unfair legal treatment.

NFTs are no different from rare trading cards, stamps, art, antiques, collectible coins, vintage vinyl records, or exclusive concert tickets. It’s narrow-sighted and misguided for the SEC to think and treat them otherwise. The Wells Notice is just another piece of evidence that the current administration and SEC leadership don’t give two sh*ts about our industry. Do we really expect this to get better if Kamala wins the election?

I have serious doubts.

Speaking of presidents, let’s now shift our attention to Trump.

Is it not hilarious that, one day before the SEC starts their assault on NFTs, Trump drops a new series of his “Digital Trading Cards?”

When Trump first released his NFTs, they faced a lot of criticism; but they sold out, raised a few million dollars for him, and delivered on their promises—something that’s not common for a lot of NFT releases.

Sure, the images were gimmicky and still are, but do critics have any room to talk when other hyped NFT releases look like this?

and this…

If there’s anything the NFT market has taught us, it’s that the actual quality of the image is an afterthought, and everything else—such as scarcity, utility, provenance, and community engagement—plays a far more significant role in determining value.

Trump’s NFT team knows this, and the broader NFT community should take note.

The new offer is straightforward:

Buy 5 cards, and your order includes the gold Trump shoes.

Buy 15 digital cards, and you’ll receive a physical card with an authentic piece of the suit he wore during his Biden debate, which he calls “the knockout suit.” Additionally, 5 of these cards will be randomly autographed.

Buy 75 digital cards, and you’ll be invited to a gala dinner in Jupiter, Florida.

You’ll never see me wearing Trump shoes or trying to win a piece of his debate suit, but this is a very effective NFT strategy and one I expect to resonate well with his supporters. The last time Trump hosted a dinner for his cardholders at Mar-a-Lago, he made major promises to support our industry, met with Ryan Selkis, and directly engaged with industry participants who asked tough questions.

Trump delivered and I don’t think any holders left the event disappointed—I appreciate the idea of anyone engaging with our space in thoughtful ways.

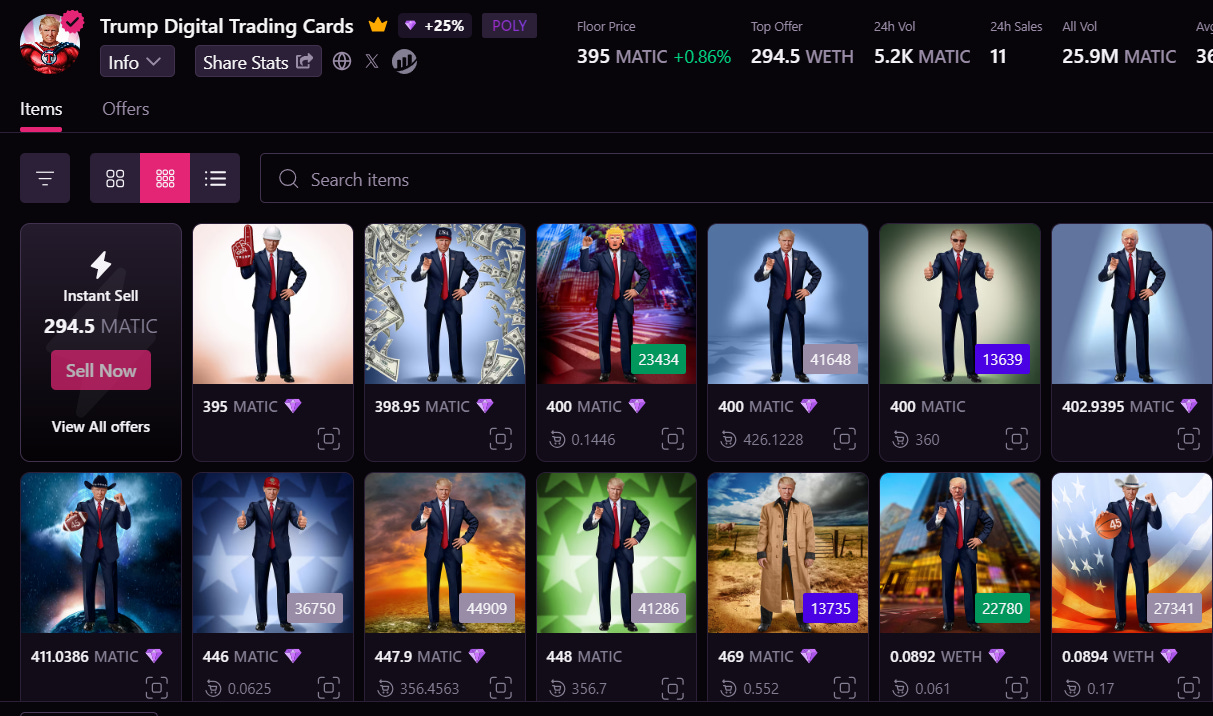

One other thing worth mentioning is that Trump’s trading cards are not available for trading on OpenSea. An OpenSea source said the following to Newsweek earlier this year, “This collection, Trump Digital Trading Cards, is non-transferable until December 31, 2024. This means the collection is disabled for secondary market buying and selling until that date. Because this is enforced by the creator, we're unable to override this.”

If you care to know why this happened, it’s because of this…

Trump is all about the $$$ and will sell wherever it benefits him the most, hence them being listed on Magic Eden.

The SEC is in for a rude awakening when facing off against OpenSea, and it will only get worse if the President of the United States is an NFT enthusiast determined to protect the technology that benefits him financially. The SEC has struggled to prevail against this industry even with the backing of powerful politicians, so I can only imagine they will be wrecked if Trump is elected.

As for NFTs, they continue to navigate a tough gauntlet, but this struggle won’t last forever; OpenSea will emerge victorious, and the tech will evolve far beyond its current status as cheap art. Last point: it’s clear the market doesn’t want to budge until the election, so brace for a potentially shitty September before things take off later this year.

Side note - big things are coming next week I can’t wait to share more about.

Details are coming soon!

Bitcoin Thoughts And Analysis

There’s no reason to share another chart today - Bitcoin remains choppy! Are you sick of me saying it yet?

Legacy Markets

Tech stocks rebounded after an initial selloff triggered by Nvidia's earnings report, which showed that revenue doubled in the quarter, reinforcing the strong earnings potential of artificial intelligence. The Nasdaq 100 Index futures gained 0.2%, and the S&P 500 contracts also rose. Despite Nvidia's stock drop of nearly 4% in pre-market trading, the results were seen as positive overall, with revenue projections exceeding most analysts' expectations.

The markets' attention is shifting back to the macroeconomic environment, with speculation on potential rate cuts by the Federal Reserve by the end of the year. European markets also saw gains, with Germany's DAX Index reaching a new record high, boosted by expectations of a European Central Bank rate cut following positive Spanish inflation data.

Meanwhile, other stocks such as Dollar General Corp. and Crowdstrike Inc. fell pre-market due to lowered forecasts and guidance.

Key events this week:

Eurozone consumer confidence, Thursday

US GDP, initial jobless claims, Thursday

Fed’s Raphael Bostic speaks, Thursday

Japan unemployment, Tokyo CPI, industrial production, retail sales, Friday

Eurozone CPI, unemployment, Friday

US personal income, spending, PCE; consumer sentiment, Friday

Some of the main moves in markets:

Stocks

The Stoxx Europe 600 rose 0.7% as of 12:36 p.m. London time

S&P 500 futures rose 0.2%

Nasdaq 100 futures rose 0.1%

Futures on the Dow Jones Industrial Average rose 0.6%

The MSCI Asia Pacific Index was little changed

The MSCI Emerging Markets Index fell 0.1%

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro fell 0.2% to $1.1093

The Japanese yen was little changed at 144.60 per dollar

The offshore yuan rose 0.6% to 7.0895 per dollar

The British pound was little changed at $1.3186

Cryptocurrencies

Bitcoin rose 1.4% to $60,166.34

Ether rose 0.9% to $2,560.25

Bonds

The yield on 10-year Treasuries was little changed at 3.83%

Germany’s 10-year yield declined two basis points to 2.25%

Britain’s 10-year yield declined one basis point to 3.99%

Commodities

Brent crude rose 0.4% to $78.93 a barrel

Spot gold rose 0.6% to $2,520.80 an ounce

TON Blockchain Goes Down - Twice

It's been a tough week for everyone in the Telegram world. Pavel Durov was arrested and officially charged with a range of crimes, TON coin took a significant hit, and the blockchain is now experiencing multi-hour outages due to a memecoin airdrop that halted block production.

Despite this, TON investors remain in high spirits. The community has rallied behind the DOGS memecoin—the second-largest coin on the blockchain after NOT—to show their support for Durov, resist privacy infringements, and protect free speech.

It’s pretty easy to keep an angry crowd happy with a memecoin that is performing well.

Nvidia Had A Strong Quarter

We may not be far from the day when NVIDIA overtakes Apple to become the largest company in the world by market cap. Yesterday afternoon, NVIDIA reported earnings that exceeded Wall Street’s expectations, yet the stock dropped slightly—reflecting the paradoxical nature of today’s market. Despite the fluctuations in the chart, NVDA investors should remain optimistic, as all of NVIDIA’s earnings have been highly volatile. A few strong days for the chip manufacturer could be all it takes for Apple to be dethroned.

If it doesn’t happen soon, the next crypto bull run could make it happen, simply because miners need chips.

Sony’s L2 Live On Testnet

Sony’s L2 is now live as a testnet, just days after the official announcement, and there are incentives up for grabs. Sony's upcoming incubator program, Soneium Spark, aims to help developers turn their Web3 ideas into marketable products by offering marketing, business, technical, and financial support, along with the chance to win up to $100,000 in investments. The program, which will support builders across various Web3 sectors, including DEX and gaming, is set to begin on October 10, with applications expected to open in a few weeks. The program will be primarily online, with some offline events.

Remembering Hal Finney

Yesterday marked the tenth anniversary of Hal Finney's passing. Finney was a distinguished cryptographer and computer scientist who played a crucial role in Bitcoin's early development before succumbing to ALS. If you ever have the opportunity to read through the original mailing list, it's fascinating to see the exchange of emails between Satoshi Nakamoto and Finney as Finney begins to grasp the potential of Bitcoin, piece by piece, directly from its creator. Notably, Finney was the first person to receive a Bitcoin transaction and was a pioneer in the development of proof-of-work technology even before Bitcoin's creation. If you have the time, I encourage you to read the linked article to learn more about Hal Finney’s invaluable contributions to Bitcoin’s beginnings.

Stop Getting Liquidated, You Idiots! The Market Is About to Turn Bullish!

Joshua Frank, Co-Founder & CEO of The Tie, joins me to discuss the latest in crypto! He has the best insight in the industry.

Chris Inks will join us in the second part to share some interesting trades in crypto and beyond.

My Recommended Platforms And Tools

Phemex - Exclusive for new users, earn up to 8800 USDT. Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '10OFF' for a 10% discount.

NGRAVE - ZERO is the most secure and user-friendly hardware wallet. If you aren't happy with your current crypto wallet, look no further than the ZERO.

Nord VPN - Get an exclusive NordVPN deal - 40% discount! It’s risk-free with Nord’s 30-day money-back guarantee. Protect your privacy.

Twitter - I spend most of my time on Twitter, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

TheWolfOfAllStreets.io - The most comprehensive collection of everything I have going on. Plus over 100 blogs and other exclusive content.

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.