Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Phemex!

Phemex is the most efficient crypto trading and investment platform. Phemex offers over 293 spot trading pairs, minimal fees, peer-to-peer trading, derivatives, up to 100x leverage, and $8,800 welcome rewards up for grabs! Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Make sure to check if Phemex is available in your jurisdiction.

In This Issue:

Stablecoins Are Eating The World

Bitcoin Thoughts And Analysis

Legacy Markets

This Is What The Insiders Are Betting On

This Is The Real Pivot

Blockworks Released A Solana Dashboard

Abra Settles With The SEC

Crypto And Conflict: How Will Escalating Global Tensions Affect Bitcoin? | Macro Monday

Stablecoins Are Eating The World

Stablecoins have never been a flashy topic to report on.

If speculators and everyday investors had a way to profit from the success of stablecoins, it would quickly become one of the hottest topics in the space. But stablecoins are designed to be stable, and stability just isn’t all that exciting.

Stablecoins have occasionally captured the attention of speculators. Tether in particular was in the spotlight during the FTX collapse, when Tether briefly lost its $1 peg. Investors were caught in a debate: was buying Tether an easy 7% gain or a risky bet on a potential unwind?

Those who bet on the former celebrated their 7% gains, but the excitement was short-lived. Since FTX (and SVB for USDC), Tether and the rest of the stablecoin market has been stable, and stable just isn't sexy.

But here's the issue with that perspective: stablecoins remain the standout innovation in this space. They are poised to disrupt outdated and predatory banking systems, represent a significant pool of sidelined capital, and serve as the gateway for onboarding the next billion users.

Did you know the Fed published a 26-page report in 2022 titled “Stablecoins: Growth Potential and Impact on Banking,” which examines the rise of stablecoins and credit disintermediation. I’ve included a brief screenshot from that report below.

Everyone—including those in the highest echelons of government—is paying attention to stablecoins because they’re a huge deal for both crypto and fiat.

Amid all these discussions, major news outlets reported this week that the stablecoin market cap has reached an all-time high. While exact figures vary among sources like DeFi Llama, CoinMarketCap, and RWA.xyz, the market cap is estimated to be somewhere within the ranges listed below.

DeFiLlama

CoinMarketCap

*Algorthimic stablecoins may explain why CoinMarketCap is higher.

RWA.xyz

Surpassing an all-time high is always a healthy sign, but here’s where things start to get crazy…

From the graphic above, you can see that a market cap of $170 billion represents 0.82% of the M2 money supply. In June of this year, the U.S. Money Supply M2 was reported at $21,024.700 billion, or $21.025 trillion. This means that the stablecoin market cap is not far from the 1% mark. To reach 1%, an additional $40 billion in stablecoin supply is needed.

For context, the stablecoin market cap was $128 billion at the beginning of the year—exactly $40 billion less than its current level. That said, I don’t expect it take 8-9 months to add another $40b. This isn’t a linear market. It’s cyclical and we are in a bull market. It might only take 3 to 4 months.

The fact that we’re only a few months away from capturing 1% of the U.S. M2 money supply is truly astonishing. To grasp the significance of this milestone, let’s quickly review what the M2 money supply is, so we can all appreciate the magnitude of this achievement.

The M2 money supply is a major player in the economic game, capturing a wide swath of financial assets. It’s not just about the cash in your wallet or the money sitting in checking accounts; it also covers savings accounts, smaller time deposits, and retail money market funds.

Essentially, M2 gives us a snapshot of all the cash that’s ready to flow into the economy for spending and investment. When we’re talking about hitting 1% of this massive figure, it’s like making a serious dent in a giant financial ocean. This is no small feat—it's a testament to just how impactful this milestone is!

While we are on this topic, we may as well discuss the M1 money supply. M1 money is like the VIP section of the financial world. It’s the most liquid form of cash—think of it as the currency you can access and spend right away. M1 includes physical cash, demand deposits (the money in your checking accounts), and other liquid assets that can be quickly turned into cash.

So, while M2 gives us a broader look at the money floating around the economy, M1 is all about the cash that’s ready to hit the ground running. It’s the cash you have on hand for immediate transactions and quick spending.

When comparing the stablecoin market cap to the M1 money supply, stablecoins account for just under 1% of M1, currently around 0.94%. This is based on the latest M1 calculation of $18.0634 trillion.

And if you’re thinking, “But these money supplies are only relevant to the U.S.,” keep in mind that the entire stablecoin market cap (no exaggeration) is pegged to the U.S. dollar.

The stablecoin market hinges on the U.S. dollar, which is why it is crucial we elect a U.S. president that supports stablecoin growth—the gateway to our market.

And looking one step further, stablecoins are almost exclusively being issued on Ethereum and Tron. The next highest issuance chain, BSC, doesn’t capture 3% of the issuance.

Here’s another fact you might not be aware of: Ethereum is back to dominating stablecoin volume by a large margin.

Back in May, Solana was carrying the market and outpacing Ethereum with an unprecedented lead, but that dominance has since cooled off. At the time, Solana boasted $2.3 trillion in transfer volume, compared to Ethereum’s $669 million—a figure that has steadily grown since.

For reference, I’m using data from RWA.xyz, sorted by network and monthly volume.

In the image above, pink represents Solana, blue is Ethereum, and red is TRON. TRON has been and remains a serious competitor to Ethereum for the simple reason that it’s reliable and cheap. As long as a chain is functional and affordable, users tend to stick with what they know.

The moral of the story is that stablecoins are playing a crucial role in the evolution of this sector, and if we don’t pay attention, we’re missing out on a ton of alpha. Stablecoins are just months away from capturing 1% of the U.S. M1 and M2 money supplies and are driving the U.S. agenda of global dollar dominance—ironically, thanks to the crypto crowd.

Just a few years ago, the stablecoin market cap was only a few billion dollars. My guess is that we'll blink, and it will be in the trillions. The next billion crypto users are bound to interact with stablecoins in one way or another—it’s inevitable. And with the right legislation in place to encourage stablecoin issuers, this market is poised to EXPLODE.

Don’t stop paying attention to stablecoins, they set the backdrop of this entire space.

If they go up, everything will follow.

…

In other interesting news, look at this:

In the realm of things that are hard to grasp, Base’s growth is right up there with stablecoin expansion. Obviously, the latter is on a much larger scale, but you get the idea.

Bitcoin Thoughts And Analysis

Boring again. Bitcoin had a down day yesterday, losing the daily 200 MA as support, but still trading above the 50 MA. Price is trapped between the two for now, with both trending up, indicating a generally bullish market.

The death cross we recently saw (the 50 MA crossing below the 200 MA) will likely be reversed in a golden cross soon.

The summer chop continues.

Legacy Markets

Ahead of Nvidia Corp.'s earnings report, US equity futures, Treasuries, and the dollar remained relatively unchanged in thin trading. Nvidia, holding the second-largest weighting in the S&P 500 after Apple, is expected to cause significant market volatility. Options pricing indicates a potential 10% swing in Nvidia's stock post-earnings, which could translate to a roughly 0.8% move in the Nasdaq 100 Index. Investors are particularly focused on Nvidia's guidance to assess whether demand remains strong, especially after a lackluster earnings season for other major tech companies.

The market's cautious stance is also influenced by a heavy schedule of upcoming US economic data releases, including reports on economic growth, prices, personal spending, and jobs. Meanwhile, European stocks had mixed performances, with the Stoxx 600 Index erasing early gains as declines in retail stocks offset gains in carmakers and miners. Trading volumes across European markets were low, reflecting a broader wait-and-see attitude among investors.

Key events this week:

US Conference Board consumer confidence, Tuesday

Nvidia earnings, Wednesday

Fed’s Raphael Bostic and Christopher Waller speak, Wednesday

Eurozone consumer confidence, Thursday

US GDP, initial jobless claims, Thursday

Fed’s Raphael Bostic speaks, Thursday

Japan unemployment, Tokyo CPI, industrial production, retail sales, Friday

Eurozone CPI, unemployment, Friday

US personal income, spending, PCE; consumer sentiment, Friday

Some of the main moves in markets:

Stocks

S&P 500 futures fell 0.1% as of 7:05 a.m. New York time

Nasdaq 100 futures fell 0.1%

Futures on the Dow Jones Industrial Average were little changed

The Stoxx Europe 600 was little changed

The MSCI World Index was little changed

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro was little changed at $1.1165

The British pound rose 0.2% to $1.3216

The Japanese yen fell 0.2% to 144.86 per dollar

Cryptocurrencies

Bitcoin fell 1.8% to $62,328.22

Ether fell 2.2% to $2,629.34

Bonds

The yield on 10-year Treasuries advanced three basis points to 3.85%

Germany’s 10-year yield advanced four basis points to 2.29%

Britain’s 10-year yield advanced 10 basis points to 4.01%

Commodities

West Texas Intermediate crude fell 0.6% to $76.94 a barrel

Spot gold fell 0.3% to $2,510.03 an ounce

This Is What The Insiders Are Betting On

Ever wondered who’s betting on what on Polymarket? For instance, you might hear about a user who makes a fortune on an obscure bet, but then we’re left in the dark about their other wagers. A popular X user, Luke Martin, has designed a tool called the Polymarket Trade Scanner, which lets you track individuals who’ve made large profits and see all their trades. Sure, some of these users might just be lucky, but there are likely individuals on the platform betting with real insider knowledge. This tool might be the closest we can get to identifying them and tracking where their money is going.

Don’t sleep on this.

This Is The Real Pivot

I didn’t get a chance to highlight this quote from Jerome Powell last week, but it’s importance can’t be understated: “The time has come for policy to adjust. The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.” While this shift was expected, what stood out in Powell’s Jackson Hole speech was the Fed’s subtle pivot from focusing on inflation to employment: “The upside risks to inflation have diminished, and the downside risks to employment have increased. As we highlighted in our last FOMC statement, we are attentive to the risks on both sides of our dual mandate.” As of right now, the image below is what the market is preparing for in 22 days.

Blockworks Released A Solana Dashboard

Blockworks' new Solana dashboard is a dream for analysts and investors seeking a clear, in-depth view of the numbers. In the top right, you can toggle between time frames and choose to view the data in USD or SOL. A quick glance at the graphs reveals a drop in burn rates, transaction fees, and tips since mid-July, but shows a strong recovery in the number of Solana accounts created and solid growth in fiat stablecoin supply. My favorite graphic (below) aggregates blockspace profitability into quarterly segments for easy comparison.

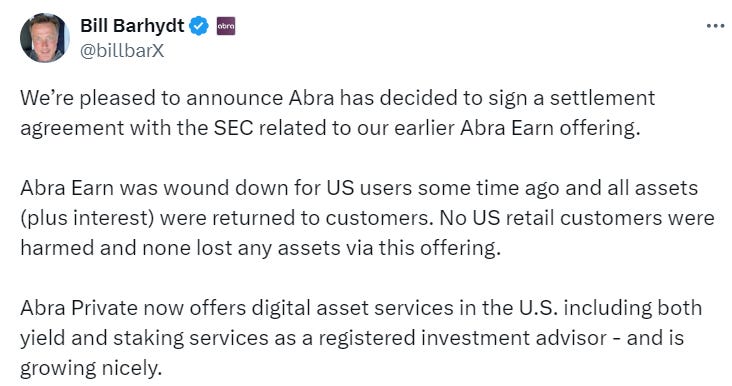

Abra Settles With The SEC

Bill Barhydt, CEO of Abra, cleared up some confusion caused by misleading headlines from major outlets. The accurate statement is above, while the misleading statement is below. I personally know Bill—he’s a great guy. Unfortunately, the SEC is crooked and this is just the same story on a different day.

Crypto And Conflict: How Will Escalating Global Tensions Affect Bitcoin? | Macro Monday

Join Dave Weisberger, Mike McGlone, and James Lavish as we break down what's happening in macro and crypto!

My Recommended Platforms And Tools

Phemex - Exclusive for new users, earn up to 8800 USDT. Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '10OFF' for a 10% discount.

NGRAVE - ZERO is the most secure and user-friendly hardware wallet. If you aren't happy with your current crypto wallet, look no further than the ZERO.

Nord VPN - Get an exclusive NordVPN deal - 40% discount! It’s risk-free with Nord’s 30-day money-back guarantee. Protect your privacy.

Twitter - I spend most of my time on Twitter, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

TheWolfOfAllStreets.io - The most comprehensive collection of everything I have going on. Plus over 100 blogs and other exclusive content.

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.

Scott - just a thought - the present sideways movement in the price it seems to me would make sense as all the ETF owners would make decent profits by increasing their spot holdings before the rush comes in early Q4 from the RIAs - don’t know but would seem to make sense.

دست خوش