Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Arch Public!

Don’t take our word for it; our client reviews say it for us. Uncorrelated returns, daily liquidity, stop loss protection on every trade.

“I joined Arch Public four months ago…based on the returns and experience, there’s not a better place to be.”

Try Arch Public now! You can even demo the platform, for free, to learn more.

In This Issue:

What Do Americans Really Care About

Bitcoin Thoughts And Analysis

Legacy Markets

Pavel Durov Is Ross Ulbricht 2.0

RFK JR. Endorses Trump

Sony Will Launch An Ethereum Layer 2

The End of Gold? Lawrence Lepard on Why Bitcoin Will Take Over

What Do Americans Really Care About?

Since Bitcoin's inception, there have been four U.S. presidential elections. In none of these elections did Bitcoin play a significant role for any candidate; it wasn't even a minor topic. When it was occasionally mentioned by past presidents, the remarks were seldom positive.

Direct quotes from Obama, Trump, and Biden about Bitcoin over these election cycles are few and far between. In contrast, there is a long history of actions taken against the crypto industry, which is well-documented.

For those of us in the crypto space, it seems clear that the 2024 election could represent a generational shift for our industry and global finance. But how clear is this to the average voter? Do crypto and financial issues genuinely matter to most people, or is this just an idea we've imagined?

Today, I aim to explore this complex question.

To begin with, it's challenging to determine how many Americans actually own crypto and what percentage of them are motivated enough by this issue to let it influence their vote.

Coinbase has claimed since 2023 that there are 52 million American crypto owners. However, a more recent study by Security.org suggests that as many as 40% of American adults own crypto, potentially doubling Coinbase’s estimate to 100 million Americans.

Other (less-friendly sources), the Fed have reported that, “Overall, 7 percent of adults held or used cryptocurrency in 2023, down 3 percentage points from 2022 and down 5 percentage points from 2021 (table 21).”

With the U.S. population at 335 million as of January this year, percentages of 7%, 20%, and 40% are all quite significant. Arguing over the exact amount might not matter as much when you see the data that’s coming next.

What matters is that voters are starting to notice and become concerned with the issues crypto investors have been talking about for years. See below!

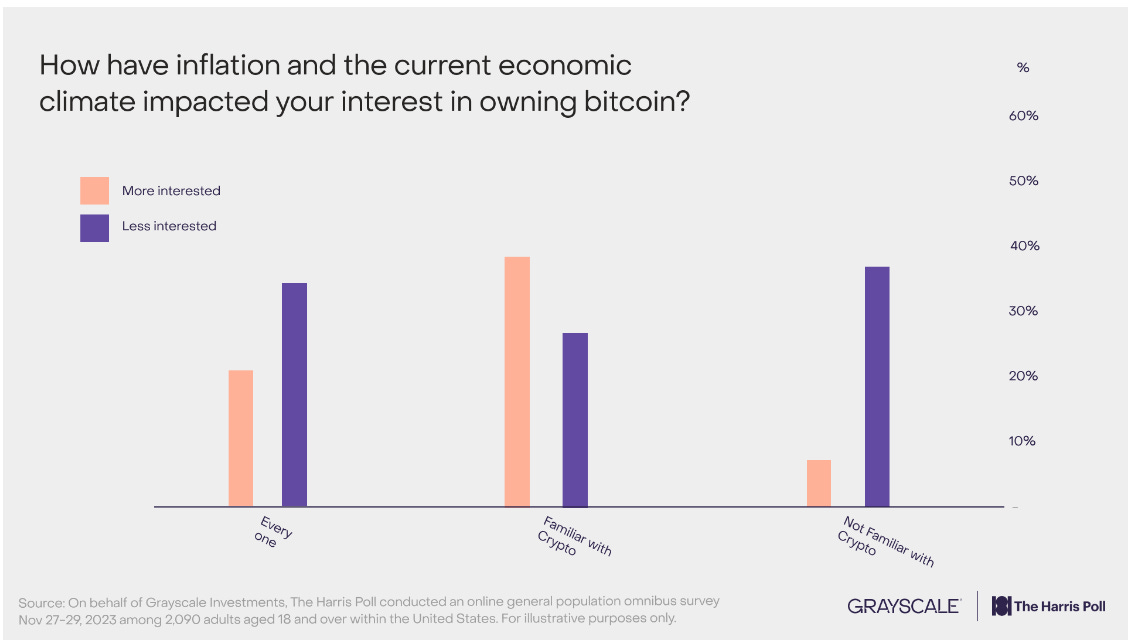

The charts above, developed in collaboration between Grayscale and The Harris Poll (not related to Kamala Harris), tell a compelling story about how seriously American voters are considering financial stability, inflation concerns, and their familiarity with crypto. Here’s the best part: the data was collected in late November 2023, providing a snapshot of attitudes THEN—imagine how it has evolved to NOW.

Well, I have good news. Grayscale conducted a follow-up survey from April 30th to May 2, 2024, to better understand American sentiment ahead of the upcoming election. The findings are overwhelmingly positive and consistent.

“As in Phase 1 of polling this year, respondents ranked inflation as the top issue in the election (28%), again underscoring the potential value of assets like Bitcoin with a transparent and hard-capped supply.”

Grayscale has a lot of great content on this topic, but Coinbase makes the most compelling case, “Nearly nine in ten (87%) Americans believe the financial system needs changing and half (51%) of Americans believe that America’s financial system does not work fairly for everyone. Most perceive the system as benefiting anyone but people like themselves, and only 14% are optimistic about the future of the financial system.”

The data indicates that when people worry about their financial security or experience inflation, they often start searching for solutions. While this quest for answers may take years, Bitcoin is poised to emerge as a leading viable option—there is no dead end as long as Bitcoin exists.

Unfortunately, the Biden administration and Harris campaign aren’t viewing Bitcoin or crypto as viable solutions to address voter concerns, whereas the Trump campaign is giving it some consideration. The market is clearly hyper focusing on this shift come November.

That said, both campaigns are doing us the favor of making inflation a major talking point this election and opening up the rabbit hole that only leads to one true solution—Bitcoin. Let’s look at some commentary directly from the most primary sources:

The 2024 Democratic Party Platform mentions the word ‘inflation’ 16 times. The Democratic party wants you to believe they have made progress, brought it down, and Trump will only worsen it. Do Democrats genuinely believe they are making a positive difference, or are they simply trying to convince you of that idea for a vote?

“While too many families still feel the pain of inflation at the grocery store, or around the kitchen table when they sit down to pay their bills, we're making progress. Wages are rising faster than prices, and inflation today is down nearly two-thirds from its peak…Trump wants to reward them with a massive tax cut. Independent analysts say his MAGA tax and tariff plans will increase inflation.”

In the 2024 Republican Party Platform, ‘inflation’ is mentioned 15 times, and crypto, as you know, has its own dedicated section. The Republican tone on inflation is noticeably more serious—whether it’s driven by genuine concern or simply a strategy to criticize the incumbents—again, it’s up to you to decide.

“The Republican Party will reverse the worst Inflation crisis in four decades that has crushed the middle class, devastated family budgets, and pushed the dream of homeownership out of reach for millions. We will defeat Inflation, tackle the cost-of-living crisis, improve fiscal sanity, restore price stability, and quickly bring down prices.”

Regardless of the reasons, motivations, or incentives for discussing inflation, any mention of it should be welcomed. Conversations centered on inflation naturally lead to discussions about financial instability and, ultimately, Bitcoin. The Trump campaign is close to connecting these dots but hasn’t quite done so yet. Trump isn’t adopting a Bitcoin strategy to combat inflation; instead, he’s approaching Bitcoin and inflation as two separate issues.

I dug back into the speech given at Bitcoin 2024 speech to confirm this:

“The Bitcoiners...and I say to you that you recognize the dangers of inflation long before most others did. You understood inflation, frankly, better than anybody else. You know that, don't you? If only they had listened, they didn't listen to you. They didn't listen to you. The trillions of dollars in ridiculous waste approved by our opponents resulted in the very inflation disaster that Bitcoiners had always predicted.”

Here, Trump is close to acknowledging that the “inflation disaster” directly benefits Bitcoin and that Bitcoin could help address it, but he hasn’t explicitly made this connection.

“Bitcoin is not threatening the dollar. The behavior of the current U.S. government is really threatening the dollar. The danger to our financial future does not come from crypto. It comes from Washington, D.C. It comes from trillions of dollars in waste, rampant inflation…”

In this part, Trump correctly acknowledges that the behavior of the U.S. government threatens the dollar but falls short in mentioning it bolsters Bitcoin.

While Bitcoiners would celebrate if these connections were made, it wouldn’t necessarily win over new voters. The reality is that most voters (outside our bubble) are far from making these kinds of connections. As we return to the core issues, it’s clear that voters are primarily concerned with broader financial problems, and many lack even basic knowledge of Bitcoin.

As a side point, let’s be honest for a moment, both candidates are going to crank up the money printer and Bitcoin will be the benefactor of that. We all know it’s coming.

That said, I can’t recall an election in recent history where financial security, money, the economy, and inflation have been this deeply considered by both voters and the candidates. As these topics are discussed our informed voices will gain traction and influence, as we have already seen play out the past few months.

The world is in urgent need of an updated financial system, and even if a voter knows nothing about Bitcoin, they’ll gravitate toward the candidate who seems most capable of making positive financial change. One final point I'll continue to emphasize through Election Day—and possibly beyond—is that if Trump appoints the right people to key decision-making positions, the rest will fall into place. The same goes for Harris, if she is elected and sees the light.

America is waking up to its problems, and it’s up to us to showcase what truly matters before November 5th. The conversation has been started—it’s our job to finish it.

Bitcoin Thoughts And Analysis

Bitcoin looks great. As you can see, we had two indecisive weekly candles before a huge candle to the upside, putting price squarely back in the range. Bitcoin held the weekly 50 MA as support a few weeks ago on that wick, which now looks like a very likely bottom.

August is historically a terrible month… but now price is about $600 below where the month started.

Not bad!

Back above the 50 MA… and the 200 MA. Bitcoin is looking very strong, and showing the strength we want to see coming out of the summer. Fingers crossed that we have a good September.

Legacy Markets

US futures slightly increased on Monday as investors considered the Federal Reserve's potential easing of interest rates following Chair Jerome Powell’s recent dovish comments. S&P 500 and Nasdaq 100 futures rose by about 0.2% after significant gains last Friday. Powell's speech hinted at a likely interest-rate cut next month, prompting traders to speculate on the size of the cut and its implications for the economy.

Crude oil prices rose more than 1% following an Israeli strike on Hezbollah targets, leading to concerns about escalating conflict in the Middle East. European stocks remained steady with low trading volumes due to a UK holiday, and Germany’s business outlook stayed pessimistic.

The European Central Bank is expected to reduce borrowing costs again in September, following a previous cut in June. Meanwhile, the People's Bank of China maintained its one-year policy loan rate at 2.3% after a recent cut, reflecting caution in economic support amidst weak demand.

In commodities, iron ore prices rebounded, and gold continued its rally, exceeding $2,500 an ounce.

Key events this week:

US durable goods, Monday

China industrial profits, Tuesday

Germany GDP, Tuesday

Hong Kong trade, Tuesday

Australia CPI, Wednesday,

Nvidia Corp. earnings, Wednesday

US GDP, Initial Jobless Claims Thursday

US personal income, spending, PCE price data, Friday

Some of the main moves in markets:

Stocks

S&P 500 futures rose 0.2% as of 6 a.m. New York time

Nasdaq 100 futures rose 0.2%

Futures on the Dow Jones Industrial Average were little changed

The Stoxx Europe 600 was little changed

The MSCI World Index was little changed

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro fell 0.2% to $1.1174

The British pound fell 0.2% to $1.3188

The Japanese yen rose 0.3% to 143.99 per dollar

Cryptocurrencies

Bitcoin fell 0.6% to $63,840.49

Ether fell 1.2% to $2,739.02

Bonds

The yield on 10-year Treasuries declined two basis points to 3.78%

Germany’s 10-year yield was little changed at 2.23%

Britain’s 10-year yield declined five basis points to 3.91%

Commodities

West Texas Intermediate crude rose 0.9% to $75.54 a barrel

Spot gold rose 0.5% to $2,525.02 an ounce

Pavel Durov Is Ross Ulbricht 2.0

Telegram’s CEO and founder, Pavel Durov, was arrested by French authorities on Saturday after landing near Paris, sparking outrage from the crypto community, the people of Moscow, and free speech advocates worldwide. Reportedly, the arrest was based on a warrant in France tied to a vague list of alleged crimes:

“Durov, who has dual French and United Arab Emirates citizenship, was arrested as part of a preliminary police investigation into allegedly allowing a wide range of crimes due to a lack of moderators on Telegram and a lack of cooperation with police, a third French police source said.”

“A cybersecurity gendarmerie unit and France's national anti-fraud police unit are leading the investigation, that source said, adding that the investigative judge was specialized in organized crime.”

Telegram and its founder, Pavel Durov, have been under scrutiny for some time, as the platform navigates a virtual battlefield of government pressure for increased access. Durov has been searching for a safe haven for his company, and despite a tumultuous past, Russia now seems interested in welcoming him back.

Former Russian president Medvedev said the following, “He miscalculated. For all our common enemies now, he is Russian – and therefore unpredictable and dangerous.”

RFK JR. Endorses Trump

I've seen a lot of confusion and misinformation about RFK Jr.'s role in the presidential race, so let’s set the record straight: RFK Jr. is indeed endorsing Trump, but he’s still staying in the race. How is that possible? His endorsement aims to avoid hurting Trump’s chances by removing himself from the ballot in key battleground states where he might siphon votes from the former president. The only way RFK Jr. stands to actually win is in the event of a tie. Of the 10 battleground states where RFK Jr. intended to withdraw, election officials ruled it was already too late in Michigan, Nevada, and Wisconsin. I don't think this matters all too much.

While it’s hard to predict how many RFK Jr. supporters will now back Trump, this move should give Trump a slight boost. RFK Jr. has stayed in the race longer than many expected, showing he’s a formidable contender, not just with crypto voters.

Sony Will Launch An Ethereum Layer 2

Sony Block Solutions Labs, a joint venture between Sony Group and Startale Labs, has announced the development of a new layer-2 blockchain called “Soneium.” The blockchain aims to attract app developers across sectors like entertainment, gaming, and finance. The technology behind Soneium will leverage optimistic rollup technology built on the OP Stack, developed by the Optimism ecosystem. Critics can bash Ethereum all they want, but major brand names are continuing to choose it for building, that’s pretty telling.

“We believe that Sony Group's launch of an Ethereum Layer 2 in collaboration with Startale is a pivotal moment for the entire industry. The industry has been making something web3 people want because of the lack of general user touchpoints and their feedback. Sony Group has strong distribution channels in multiple industries and existing users in our daily lives. Through Soneium, we will make something people want and go mainstream beyond web3.” - Sota Watanabe, Director of Sony Block Solutions Labs.

The End of Gold? Lawrence Lepard on Why Bitcoin Will Take Over

In this episode, Lawrence Lepard, a veteran investor and sound money advocate, shares his insights on the critical role of Bitcoin in the global financial system, comparing its future potential to traditional assets like gold and silver. We delve into the challenges of the U.S. financial system, the impact of zero interest rates, and the importance of adopting sound money principles to ensure a stable economic future.

My Recommended Platforms And Tools

Phemex - Exclusive for new users, earn up to 8800 USDT. Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '10OFF' for a 10% discount.

NGRAVE - ZERO is the most secure and user-friendly hardware wallet. If you aren't happy with your current crypto wallet, look no further than the ZERO.

Nord VPN - Get an exclusive NordVPN deal - 40% discount! It’s risk-free with Nord’s 30-day money-back guarantee. Protect your privacy.

Twitter - I spend most of my time on Twitter, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

TheWolfOfAllStreets.io - The most comprehensive collection of everything I have going on. Plus over 100 blogs and other exclusive content.

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.

عالی بود