The Wolf Den #1034 - Are We In The Early Day Of The Internet?

Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Arch Public!

Don’t take our word for it; our client reviews say it for us. Uncorrelated returns, daily liquidity, stop loss protection on every trade.

“I joined Arch Public four months ago…based on the returns and experience, there’s not a better place to be.”

Try Arch Public now! You can even demo the platform, for free, to learn more.

In This Issue:

Are We In The Early Day Of The Internet?

Bitcoin Thoughts And Analysis

Altcoin Charts

Legacy Markets

Avalanche Is Gaining Institutional Traction

Prometheum Is Up To Something

Trump Endorsed This Crypto Project

McDonald's, Meme Coin Wars, ETFs & The Future Of Solana

MATIC Is Becoming POL

Are We In The Early Day Of The Internet?

It's been exactly one month since the Ethereum ETF launched.

Those who have read this letter from top to bottom know I've extensively covered the success of this launch. However, I haven't provided a long-form write-up on where Ethereum is headed in a while. Since there's been little news recently, today seems like the perfect time to dive into it.

First and foremost: one month as an ETF is just the beginning of a long journey. Did you know that the S&P 500 has been around since 1923? While the index itself dates back nearly a century, the ETFs tracking it and others—SPY, QQQ, IVV, and VOO—were launched in 1993, 1999, 2000, and 2010, respectively.

In terms of financial products, one month is like a baby's hair, a speck of dust, a fleeting moment—essentially, it's a ripple in a vast ocean.

To better understand how early Ethereum is in the grand scheme of things, think back to the early '90s, when the first iterations of the internet were going live. If you weren’t yet born or old enough to remember, fortunately, I’m a boomer and can guide you through this part.

Before computers became mainstream, if you didn't own one, you were out of luck. Since there wasn't one sitting in your pocket, you had to visit your rich friend’s house if you were a kid or wait until school if you were fortunate enough. As for adults, entry-level models were expensive and didn't do much unless you had a specific need.

There was no Google; instead, we had AltaVista, Lycos, and Yahoo. Yay. Instead of YouTube, there was VideoMelon and iFilm. Instead of Spotify, there was MP3.com, Napster, and Rhapsody a few years later. Instead of Facebook, there was AOL Instant Messenger, Friendster, and Myspace. A far cry from the functionality we enjoy today.

The irony of early internet applications is that non-developer users had little foresight about the innovations that were on the horizon. A first-time computer user in the mid-'90s often struggled to grasp the potential of the technology and how to navigate the rapidly evolving online landscape. This gap in understanding highlights how revolutionary and transformative this advancement was for everyday users.

Ethereum, in its current form, is much the same.

Most investors and users of Ethereum base their understanding of its future direction on the vision of developers, whose foresight is captured and disseminated through various channels such as this newsletter. It’s a murky process that doesn’t reveal much of what lies ahead, and that’s the beauty of it—the unknown.

The ways we try to conceptualize Ethereum are quite interesting:

- "An everything financial app"

- "An app store and operating system"

- "Digital oil"

- "Ultrasound money"

- "A tokenization platform"

- "An internet bond"

- "A global settlement layer"

What’s intriguing about these narratives is that some, like "ultrasound money" or "digital oil," don’t intuitively make sense, and the rest rely on outdated technological analogies that fail to fully capture what Ethereum could become. While the latter approach is more helpful, it still falls short of truly conveying Ethereum’s potential.

This may sound philosophical and obvious, but language doesn’t account for the future. I can’t describe Ethereum as a "cryptosymphotron" (a made-up word), and have everyone instantly understand what it means and be in complete agreement. To me, the word Ethereum reminds me of the first time I started using the word "internet" without fully understanding what that word would eventually come to mean.

We had no idea that this digital thing—the internet—we were all getting excited about would enable something called the World Wide Web. And when we thought we were beginning to understand the World Wide Web, well, we really had no clue.

Before the web became the World Wide Web, the programming language was simple HTML. User functionality was extremely limited. Older readers will likely remember the popularity of Geocities, which rose and fell in usage like a volatile shitcoin. No amount of flashy text was good enough to sustain the hype. More was needed.

HTML developers recognized that functionality was limited, so they optimized the HTML scripting language and added a “form feature.” The form feature was a positive step, but it didn’t bring in the masses. Adding forms to HTML was like building Colored Coins on Bitcoin. The vision was there, but the usability wasn’t.

The base layer was insufficient. Developers realized that they needed a new, universal language. JavaScript was the answer.

Many of you may not know this, but JavaScript was invented by Brendan Eich, who also founded Brave Browser. Brendan is an avid crypto builder—we have spoken before at Consensus, if you missed it. Funny how this all comes full circle.

JavaScript is now used universally—we don’t think twice about the technology powering Gmail, Facebook, Angry Birds, or even Bitcoin wallets, but it is always there. Most importantly, the developers were largely unconcerned with the platforms that would eventually be built. They were dedicated to building a sufficient base layer. They knew the world would do the rest.

Ethereum’s story is likely to unfold in a similar way. Developers are focused on strengthening the base layer because they know the world will eventually adopt this new shiny tool, and everything else will fall into place. Ethereum is the foundation of the new web we’re building—some call it Web3, and I think that’s a fitting narrative to embrace.

I know that not everyone will agree with this, but Ethereum is the most complete language we have in crypto, which is why most developers are choosing to build on top of it. If the price were higher, everyone would agree with me—until then, you’ll just have to take my word or find a better language.

In the grand scheme of things, Ethereum is still in its early days. Wall Street is just beginning to explore this technology, and while integrating it with treasuries is exciting and tangible, Ethereum’s potential goes far beyond that. Right now, Ethereum is where the internet was in 1998—just scratching the surface of what it will eventually become.

Our imaginations can’t fully grasp where Web3 is headed, and that’s a good thing. While we can speculate about what financial tokenization might look like in 5 or 10 years, it’s similar to late '90s internet users trying to predict what would emerge by 2010. Back then, no one could have foreseen the rise of Amazon, Spotify, Facebook, cloud computing, AI, VR, or crypto.

For the Solana lovers out there, I’m sure your chain will play an important role too, don’t fret.

I hope all of you have a fantastic weekend. Ethereum, along with a handful of other crypto platforms, will play profound roles in our future, and we are being gifted a once-in-a-lifetime opportunity to participate in real time.

As Raoul Pal always says, “Don’t F*** This Up.”

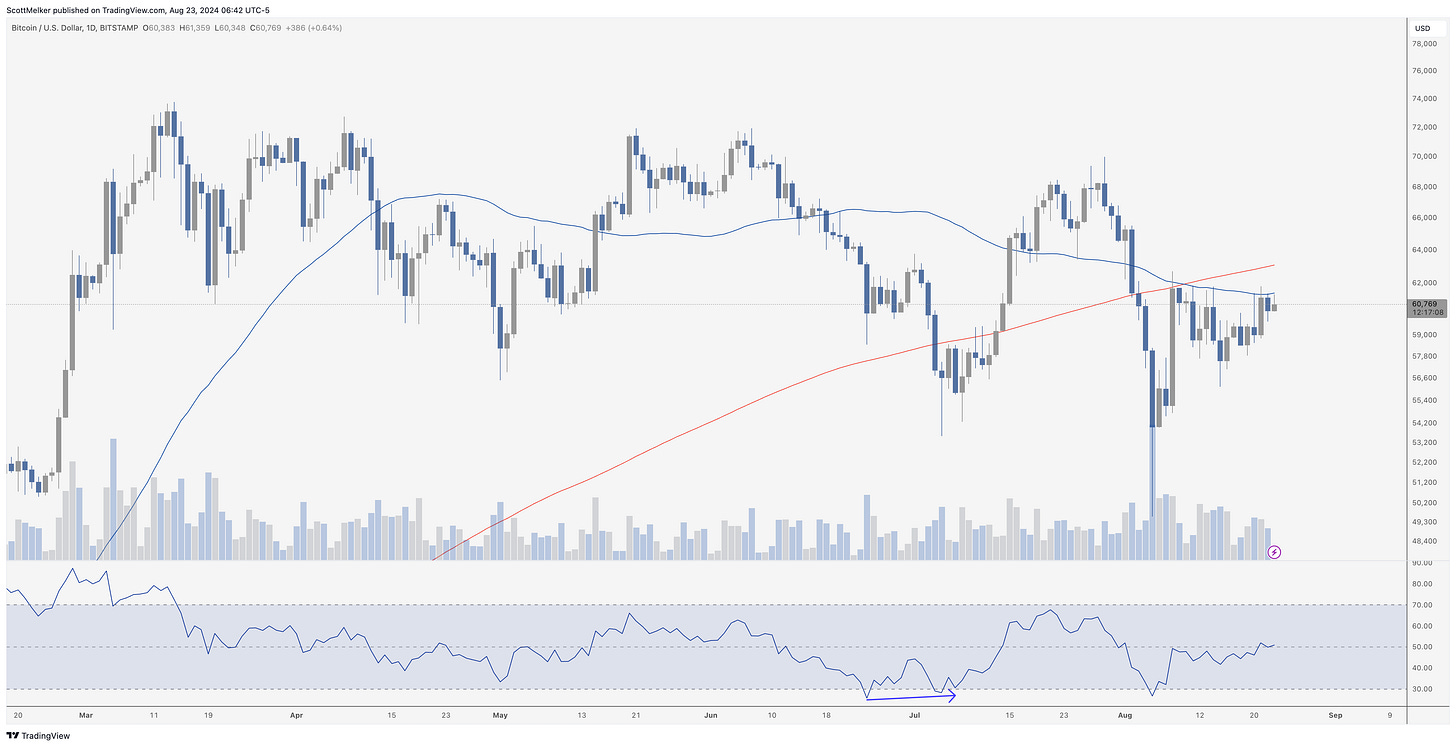

Bitcoin Thoughts And Analysis

Bitcoin has done nothing since yesterday. The 50 MA remains the story. The good news is that alts are moving up, which indicates some interest in crypto.

Altcoin Charts

Altcoins are starting to heat up… keep your eyes on your favorites and let’s see if we can get any follow through.

I found this using the Trading Alpha screener, which I cannot recommend enough. As you can see, this chart showed bullish divergence at the bottom, has yellow squeeze shading being followed by a small and then large grey arrow. These are clear long signals using this indicator.

There is a large looming descending blue resistance that I am watching, but this generally looks like it is bottoming and just getting started moving.

Remember - everything changes quickly for alts if Bitcoin move. Keep your risk managed.

Legacy Markets

Key events this week:

US new home sales, Friday

Jerome Powell speaks in Jackson Hole, Friday

Some of the main moves in markets:

Stocks

S&P 500 futures rose 0.6% as of 6:56 a.m. New York time

Nasdaq 100 futures rose 0.9%

Futures on the Dow Jones Industrial Average rose 0.4%

The Stoxx Europe 600 rose 0.3%

The MSCI World Index rose 0.1%

Currencies

The Bloomberg Dollar Spot Index fell 0.2%

The euro was little changed at $1.1120

The British pound rose 0.2% to $1.3121

The Japanese yen rose 0.2% to 146.02 per dollar

Cryptocurrencies

Bitcoin rose 0.7% to $61,111.94

Ether rose 1.6% to $2,668.64

Bonds

The yield on 10-year Treasuries declined one basis point to 3.84%

Germany’s 10-year yield was little changed at 2.24%

Britain’s 10-year yield declined one basis point to 3.95%

Commodities

West Texas Intermediate crude rose 1.2% to $73.87 a barrel

Spot gold rose 0.6% to $2,498.50 an ounce

Avalanche Is Gaining Institutional Traction

Two significant developments have emerged for Avalanche in the past 24 hours: Grayscale has launched an Avalanche Trust for accredited investors to gain exposure to AVAX, and Franklin Templeton has expanded its Franklin OnChain U.S. Government Money Fund to the Avalanche network.

Regarding the Grayscale news, the trust is straightforward, but a noteworthy aspect of the announcement is Grayscale’s acknowledgment that “Avalanche has facilitated the broader adoption of real-world asset (RWA) tokenization.”

Franklin Templeton’s OnChain U.S. Government Money Market Fund (FOBXX), a tokenized U.S. treasuries fund, has extended its reach to Avalanche, aiming to attract a broader investor base. The fund provides dividends from yields generated by treasury assets. The expansion marks the “first-of-its-kind on-chain money market fund” on the Avalanche layer-1 blockchain.

Prometheum Is Up To Something

Remember Prometheum? This virtually unknown name in the crypto sphere suddenly emerged as the first crypto-focused broker-dealer to register with the SEC. Adding to the oddity, this crypto startup was invited to Capitol Hill, where it echoed the SEC's messaging almost verbatim. From the start, I’ve suspected that Prometheum is being used as a Trojan horse by regulators, spreading misleading narratives within our industry.

As for the latest developments, Prometheum has now taken legal steps to custody UNI and ARB, effectively treating them as securities alongside ETH. What this means for the firm’s customers remains unclear, as does how they plan to manage these assets. Ironically, following the SEC’s guidance has created more opacity rather than clarity around classifying these tokens—though I’m sure Prometheum would disagree.

I’m curious to see how Prometheum will adapt if there’s a regime change at the SEC that renders their entire compliance infrastructure obsolete. That would be a day to watch.

Trump Endorsed This Crypto Project

Details about the Trump crypto project, dubbed “The Defiant Ones,” are still sparse, but Donald Trump has officially endorsed it on Truth Social, as shown above. His post links to a Telegram channel titled “The DeFiant Ones,” branded as the “Official Trump DeFi Channel,” which has already gathered nearly 26,000 subscribers since its launch on August 7. The channel teases upcoming updates and announcements about the project. If you plan to join the group, be sure to enable necessary security features to avoid spam invites and scam messages. With the project’s high-profile name, plenty of grifters will try to capitalize on the branding.

Even if this project flops, you can’t ask for a more pro-crypto candidate than this.

MATIC Is Becoming POL

Coinbase has announced its support for Polygon's planned token upgrade, transitioning from MATIC to the new Polygon Ecosystem Token (POL) on the Ethereum layer-2 network. According to the Polygon press release, “A new direction for Polygon as an aggregated blockchain network, the community reasoned, required an upgraded token—one that would come with expanded utility.”

“Polygon describes POL as a hyperproductive token designed to offer valuable services across all chains within the Polygon network, including AggLayer. The token will serve as the primary currency for gas fees and staking within the Proof-of-Stake (PoS) network which is fundamental to Polygon network security.”

My suggestion to everyone is to simply hold on Coinbase for a seamless transition. As for others, “Holders of MATIC on Ethereum, Polygon zkEVM and in CEXes may have to migrate (see below and look for communications from third parties). MATIC stakers and delegators on Ethereum do not need to take action.”

McDonald's, Meme Coin Wars, ETFs & The Future Of Solana

Join Austin Federa, the Head Of Strategy at Solana Foundation, as we discuss what the future holds for Solana.

My Recommended Platforms And Tools

Phemex - Exclusive for new users, earn up to 8800 USDT. Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '10OFF' for a 10% discount.

NGRAVE - ZERO is the most secure and user-friendly hardware wallet. If you aren't happy with your current crypto wallet, look no further than the ZERO.

Nord VPN - Get an exclusive NordVPN deal - 40% discount! It’s risk-free with Nord’s 30-day money-back guarantee. Protect your privacy.

Twitter - I spend most of my time on Twitter, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

TheWolfOfAllStreets.io - The most comprehensive collection of everything I have going on. Plus over 100 blogs and other exclusive content.

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.