Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Phemex!

Phemex is the most efficient crypto trading and investment platform. Phemex offers over 293 spot trading pairs, minimal fees, peer-to-peer trading, derivatives, up to 100x leverage, and $8,800 welcome rewards up for grabs! Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Make sure to check if Phemex is available in your jurisdiction

In This Issue:

The Road To One Bitcoin

Bitcoin Thoughts And Analysis

Altcoin Charts

Legacy Markets

Don’t Let Them Fool You

Shaq Is In Hot Water

Coin Center Is Suing The U.S. Treasury And IRS

Tether Integrates With Aptos

Warning: Are Global Markets About To Collapse Again?

The Road To One Bitcoin

Here’s an excerpt I wrote some time ago on one of my favorite investment topics:

There’s a well-kept two-part secret in the investment community that everyone should know: compound interest is the cornerstone of investing, and reaching the initial $100,000 milestone is often the most challenging.

Mastering these two concepts can set almost anyone, with diligence and a modest income, on a path toward a millionaire’s retirement. The best part? It requires surprisingly little mental effort and no special skills.

Imagine an investor starting at age 25 with a clean slate and $0 in their investment account. If this investor aims to reach $100,000, they could save $1,000 monthly and invest it in an index fund with a steady average return of 7% APY, reinvesting the earnings.

When I was writing on this topic, I noted that if this investor follows this strategy, after 79 months (or 6.58 years) of consistent saving, their investment account would reach $100,000.

Today, I’d like to revisit this idea with a twist: What if the goal is whole coiner status instead of just $100,000? Given that Bitcoin is currently priced significantly under $100,000, achieving this goal might be more attainable—but the window for doing so could be closing soon.

Using the original parameters, an investor starting at age 25 with $0 invested and hoping to own a whole Bitcoin faces a unique set of challenges compared to an investor looking to hit an account balance of $100,000 in stocks.

As Bitcoin's price rises over time, the cost of acquiring a whole Bitcoin becomes increasingly prohibitive, meaning the investor ends up buying less Bitcoin with the same amount of money. This contrasts with the stock investor, who focuses on achieving a specific dollar amount and can steadily accumulate shares regardless of fluctuations in individual stock prices.

In this scenario, it’s harder to estimate the timeframe needed to reach 1 BTC, but the compounding effects will be stronger. Let’s use the historical prices of Bitcoin from each year, which we reviewed last week, to get started:

January 2012: $5.27

January 2013: $13.30

January 2014: $800.00

January 2015: $313.00

January 2016: $430.00

January 2017: $1,000.00

January 2018: $13,880.00

January 2019: $3,809.00

January 2020: $7,194.00

January 2021: $29,374.00

January 2022: $46,306.00

January 2023: $16,558.00

January 2024: $43,120

If you do the math, most sources indicate that Bitcoin has had a compound annual growth rate of slightly over 100%, depending on which data points are referenced and the accuracy of those figures.

Of course, most Bitcoin investors haven’t had the luxury of experiencing this kind of growth, as many bought in around late 2017 or late 2020 at a much higher average cost. However, when you consider Bitcoin’s average annualized return of roughly 63% over the last 10 years and 46% over the last 5 years, these figures start to feel more realistic and relatable.

I like to keep things simple: my theory is that over the next 5 to 10 years, Bitcoin’s returns will likely be 3 to 4 times the market average of around 7%. This suggests Bitcoin could see conservative annual returns in the range of 21% to 28%. While OG Bitcoiners might find these numbers underwhelming, they represent phenomenal returns for any asset over a sustained period of time.

And before anyone panics or calls off the bull market, let me clarify: I'm suggesting this range as an average after we go through the current cycle. This cycle should drive Bitcoin's price significantly higher before potentially stabilizing or adjusting downward. I have my own ideas on where Bitcoin might go this cycle, but there’s really no telling whether it will reach a conservative $125,000 or surpass $200,000. For all we know, Kamala wins, and the industry is sent back to the pits of hell—time will tell.

Getting back to our investor, you can now appreciate the complexity of estimating how much Bitcoin they would acquire over a given time frame, given Bitcoin's price volatility and cycle growth. To simplify, let's consider a different approach: what if our investor's goal is to buy a set amount of BTC every year?

If the starting point is 0 BTC and year one begins this year, our investor is in a favorable position, as acquiring 0.2 BTC will cost a tidy $12,000. This breaks down to a monthly investment of $1,000.

1/5th of the way there in one year is ahead of schedule!

Let’s say next year the average annual price of Bitcoin is significantly higher, perhaps around $100,000. In that case, acquiring 0.2 BTC would cost $20,000 instead of $12,000—a nearly 2x increase in acquisition cost if the same plan is followed.

Assuming this, let’s say our investor works really hard and manages to buy 0.15 BTC in the second year and then sets a goal to buy 0.1 BTC in each of the subsequent years.

At the end of year 3, our investor might be almost halfway there!

As the years go on, depending on the amount our investor can save, the price of Bitcoin at the time of purchases, and any fluctuations in the investment strategy, it may take a decade or more in total to reach the goal of acquiring a full Bitcoin.

For some, the time commitment might seem frustrating, but the issue lies in the investor’s mindset. This relates back to unit bias—a common pitfall in investing. An investor who opts for stocks simply because they can buy more shares or prefers the idea of hitting a $100,000 milestone over owning a fraction of a Bitcoin should rethink their strategy. Ultimately, it’s not about owning one whole Bitcoin; it’s about consistently stacking sats in a way that aligns with your goals.

It may take longer to accumulate one full Bitcoin compared to reaching $100,000 in equities, but I’d wager that, over time, Bitcoin will see exponential growth far outpacing any combination of equities the investor could have chosen. The compounding effects will make it well worth the hustle.

Here’s an interesting stat: Let’s say you achieve whole coiner status, and Bitcoin is sitting at $100,000. If my prediction holds true that Bitcoin will outperform the market by 3x over the next decade, and you continue contributing $1,000 monthly to buy more BTC, your position would be worth $1,000,035.71. Even if you didn’t buy any additional Bitcoin, your original investment alone would still grow to $672,749.99.

Look at those juicy gains from year 8 to year 9 and year 9 to year 10:

$664,924—>$816,558—>$1,000,035.71

That pretty much sums up my long-term investing thesis: those who adopt this strategy sooner rather than later are likely to be the most rewarded. If Bitcoin reaches $1 million in a decade, achieving whole coiner status will be seen as legendary. The new generation of investors will seek ways to acquire 0.1 BTC or an equivalent 10 million Satoshis as they strive to participate in this asset class.

Compound interest is a potent force in all appreciating assets, not just stocks. Now that you have this insider knowledge, my advice is to shift your focus from millions of dollars and concentrate on accumulating your desired amount of Bitcoin. If you’re younger, aim for 0.1 BTC; if you’re more successful, consider targeting 1, 5, 10, or even more. The goal is to get off zero.

Augment your contribution whenever possible, stack sats as fast as possible, and let time handle the rest.

…

Also, did anyone else notice that a 3x multiple of the average 7% return is 21%? It’s a very fitting number for Bitcoin.

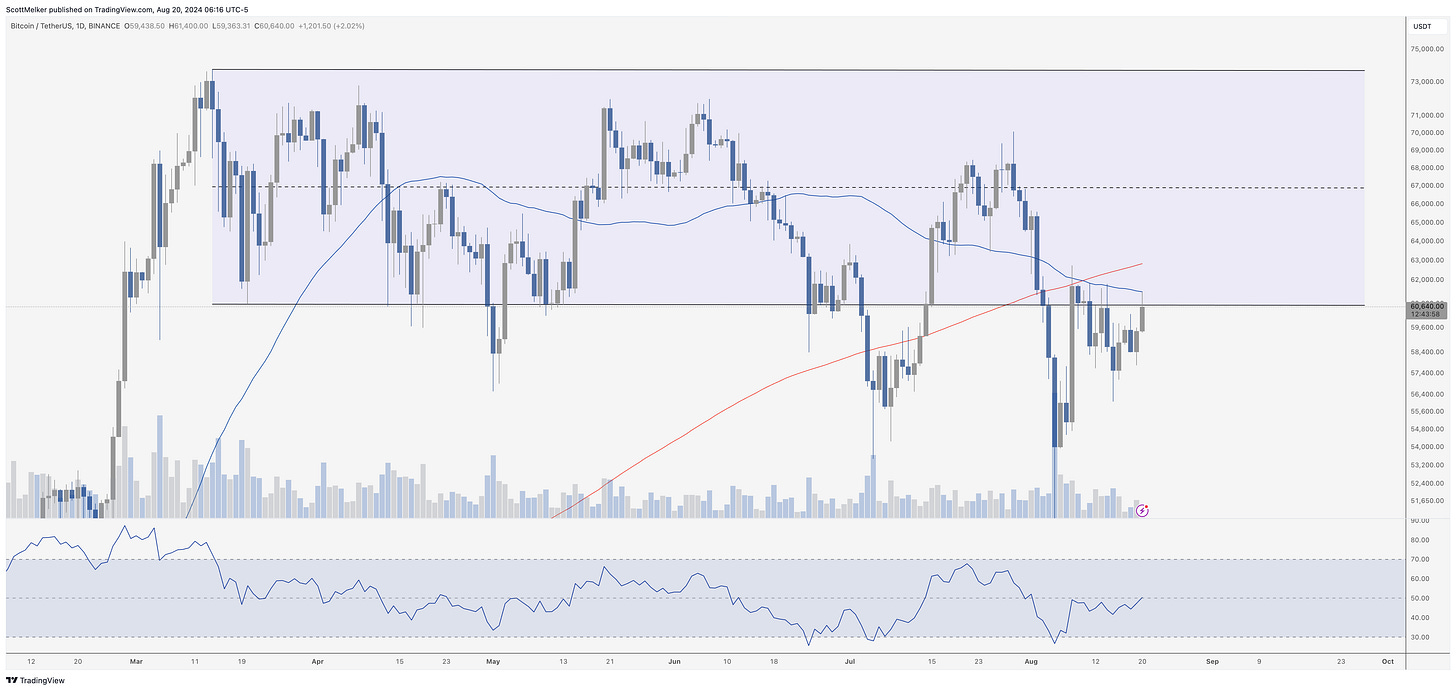

Bitcoin Thoughts And Analysis

Bitcoin has made a small move up today, but nothing major to report. You can see that the old range lows and the blue 50 MA are acting as resistance. Price trading above these and breaking on increased volume could be a signal of more upside to come. For now, this remains part of the never ending sideways.

Legacy Markets

Global stocks are on track for their longest winning streak of 2024, with MSCI's all-country stock index heading for its ninth consecutive day of gains. Traders are cautiously optimistic, anticipating that the Federal Reserve may soon signal an interest rate cut. U.S. futures and Europe's Stoxx 600 remained steady, while Treasury 10-year yields held firm. Investors are awaiting Fed Chair Jerome Powell's speech at the upcoming Jackson Hole economic symposium for further policy guidance. Meanwhile, corporate moves such as Alimentation Couche-Tard's potential acquisition of Seven & i Holdings and Hawaiian Holdings' rise following the DOJ's approval of its merger with Alaska Air also made headlines. Additionally, gold topped $2,500 an ounce as expectations grew for a Fed rate cut.

Key events this week:

US Fed minutes, BLS preliminary annual payrolls revision, Wednesday

Eurozone HCOB PMI, consumer confidence, Thursday

ECB publishes account of July rate decision, Thursday

US initial jobless claims, existing home sales, S&P Global PMI, Thursday

Japan CPI, Friday

Bank of Japan Governor Kazuo Ueda to attend special session at Japan’s parliament to discuss July 31 rate hike, Friday

US new home sales, Friday

Fed Chair Jerome Powell speaks at Jackson Hole symposium in Wyoming, Friday

Some of the main moves in markets:

Stocks

S&P 500 futures were little changed as of 6:09 a.m. New York time

Nasdaq 100 futures rose 0.1%

Futures on the Dow Jones Industrial Average were little changed

The Stoxx Europe 600 was little changed

The MSCI World Index was little changed

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro was little changed at $1.1076

The British pound was little changed at $1.3003

The Japanese yen rose 0.1% to 146.39 per dollar

Cryptocurrencies

Bitcoin rose 2.9% to $60,810.87

Ether rose 1.6% to $2,657.94

Bonds

The yield on 10-year Treasuries was little changed at 3.87%

Germany’s 10-year yield was little changed at 2.24%

Britain’s 10-year yield advanced two basis points to 3.94%

Commodities

West Texas Intermediate crude fell 0.6% to $73.96 a barrel

Spot gold rose 0.7% to $2,522.67 an ounce

Don’t Let Them Fool You

Democrats have released their 2024 party platform as the DNC (Democratic National Convention) kicks off, and it doesn’t contain a single mention of crypto, blockchain, Bitcoin, or anything even hinting at our industry. I’ve seen some people on Twitter interpret this as a ‘pivot,’ arguing that no mention suggests they won’t crack down on our space, but I don’t buy that for a second. I looked back at the 2020 democrat party platform, and unsurprisingly, our industry wasn’t mentioned there either. Sure, you could argue it all started after FTX, but it’s clear this industry has had a target on its back for a while—until recently, when Republicans and select Democrats began paying attention. In my view, this silence leaves the door wide open for anti-crypto Democrats to come after our industry whenever it suits their interests and agenda, which is now.

Here’s a refresher on what the Republican party platform stated this year:

Shaq Is In Hot Water

I do believe that a good number of celebrities who got caught up in NFT scams likely had genuine intentions but were exploited by unscrupulous actors. However, there’s still a degree of responsibility that falls on them because influencers like Shaq probably didn’t conduct thorough due diligence to vet the teams they partnered with or hired. While I’m not deeply familiar with the specifics of Shaq’s involvement in the Astrals project, it's been reported that he told the community on Discord, “I'm not f***ing leaving,” referencing The Wolf of Wall Street, only to later abandon the project. It’s understandable that influencers who realize they’ve been used for their fame might want to distance themselves as quickly as possible once they see the scam for what it is. As for Shaq and the Astrals project, they’re expected to respond to the allegations by September 12, 2024.

Coin Center Is Suing The U.S. Treasury And IRS

Crypto think tank Coin Center will have another opportunity to challenge the U.S. Treasury and the IRS over an amendment to the tax code that it claims is unconstitutional. The amendment in question was part of the 2021 Infrastructure Investments and Jobs Act, which requires Americans to report details of crypto transactions over $10,000 to the IRS, including personal information like names and Social Security numbers. A U.S. Court of Appeals overturned a previous ruling that dismissed Coin Center’s lawsuit, allowing three of their claims, involving the Fourth Amendment, First Amendment, and government overreach, to proceed in court.

Tether Integrates With Aptos

Yesterday, Tether announced plans to launch USD₮ on the Aptos Network, a popular layer-1 blockchain known for its exceptional speed and scalability. Developed by former Facebook engineers, Aptos has experienced significant growth in recent months, reaching 170K users in July and processing a record-breaking 157 million transactions in a single day in May. The goal is for USD₮ on Aptos to offer low gas fees, making transactions affordable for a wide range of users and applications.

Warning: Are Global Markets About To Collapse Again?

Join Dave Weisberger, Mike McGlone, and James Lavish as we break down what's happening in macro and crypto!

My Recommended Platforms And Tools

Phemex - Exclusive for new users, earn up to 8800 USDT. Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '10OFF' for a 10% discount.

NGRAVE - ZERO is the most secure and user-friendly hardware wallet. If you aren't happy with your current crypto wallet, look no further than the ZERO.

Nord VPN - Get an exclusive NordVPN deal - 40% discount! It’s risk-free with Nord’s 30-day money-back guarantee. Protect your privacy.

Twitter - I spend most of my time on Twitter, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

TheWolfOfAllStreets.io - The most comprehensive collection of everything I have going on. Plus over 100 blogs and other exclusive content.

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.

Great post. And even if you used a much more conservative growth rate, where BTC only beat "the market" by 50% on average in the coming decade this strategy would still be great.