Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Arch Public!

Arch Public focuses on two guiding principles: liquidity and performance. Our customers have access to their funds 24/7. Our hands-free algorithmic portfolios produce alternative asset level returns (138% and 171% respectively). Take a look below and put a hedge fund in your pocket.

Try Arch Public now! You can even demo the platform, for free, to learn more.

In This Issue:

Why Do Gold Bugs Hate Us?

Bitcoin Thoughts And Analysis

Legacy Markets

Don’t Buy Bitcoin At An ATM

Franklin Templeton Files For Crypto Index ETF

Trump Picks A Bitcoin/Tether Bull

This Would Be The End Of Bitcoin Mining

God Bless Bitcoin: Watch This Movie To Understand Bitcoin! | Brian & Kelly Estes

Why Do Gold Bugs Hate Us?

I was on the hunt for news stories to fill the bottom half of the newsletter when I stumbled upon an article that caught my eye.

Initially, the headline led me to expect a compelling analysis—a piece that would argue why Bitcoin is poised to reach new all-time highs soon, possibly drawing parallels with gold’s recent record-breaking performance. But as I clicked through, I was taken aback to find it was, in fact, a full-blown hit piece on Bitcoin, penned from the perspective of a gold enthusiast. Naturally, this makes for some excellent target practice.

Of course, all of this is just my opinion; you're entitled to your own. None of this is financial advice—it's purely for entertainment and educational purposes only.

To me, this serves as further proof that we are, indeed, still early.

The article kicks off with this bold claim:

“Bitcoin’s best days are behind it. Gold’s best days are just beginning. This is the hard money rotation that libertarian crypto investors are going to miss.”

Now, I have to wonder if the author of this quote—who shall remain unnamed—is aware that gold’s significance dates back to ancient Egypt, around 3,000 BCE. Gold has been valued for over 5,000 years, and yet we’re now supposed to believe that its best days are still ahead in our post-modern era.

Moreover, at what point do we move past labeling participants in this space as “libertarian crypto investors”? For one, libertarianism is largely an American concept, though similar ideals exist within social democracy and traditional conservative ideologies worldwide. But the crucial point here is that Bitcoin transcends political labels. It’s a neutral technology, making a compelling case for support from individuals across the ideological spectrum.

Bitcoin is a neutral technology, and I will die on that hill.

The article then goes on to assert: “Satoshi modeled Bitcoin after gold. He even used the word ‘mining’ to describe the coinbase transaction (every bitcoin block begins with a miner reward). But there's a key difference: if all the gold miners ceased operations today, gold would still have value. If all the bitcoin miners went offline, the value of bitcoin goes to zero. Yes, zero. All bitcoin HODLers will own is an unspent transaction output on a defunct chain, which can never be transferred or spent.”

The critic is correct in noting that Bitcoin was modeled after gold. While I’d prefer to use the term inspired rather than modeled, the essence remains the same: Bitcoin mining does draw its concept from gold, and its capped supply is a principle directly borrowed from the precious metal.

But how can this analyst be so sure that Bitcoin would become worthless if all miners ceased operations? This scenario is purely theoretical and untested in reality (and ideally, it never will be). It’s crucial to recognize that such an outcome is based on assumptions rather than evidence.

Furthermore, I doubt many have fully considered what it would actually take for every miner in the world to go offline.

What kind of catastrophic event would lead to a total global miner shutdown? I imagine such a scenario would resemble something out of Mad Max. In such extreme conditions, would gold truly be more essential than food, water, and shelter? Would gold enthusiasts still be fixated on their precious metal in this dystopian world? I have my doubts.

Again, this is purely speculative, but as far as I know, if the entire Bitcoin network were to go offline, all transactions and block confirmations would simply halt. This would mean no new blocks could be added to the blockchain, and the system would be unable to process transactions.

If the network were to come back online, the blockchain would pick up where it left off, assuming the issues that caused the disruption were resolved. Miners would reconnect, and the blockchain would continue validating and processing transactions.

If people were confident that the blockchain would resume operations once all nodes are back online, Bitcoin would likely retain some value during the downtime. By contrast, gold’s value would plummet if a method for manufacturing it was developed or if a massive new deposit were discovered.

Both of these ideas are speculative and not worth hinging any serious argument on. If I’m alive for the end of the world, Bitcoin and gold are the last of my concerns.

But let's refocus...

The article also claims that “Bitcoin mining is super capital-intensive, highly concentrated, and therefore, extremely vulnerable. Decentralization in Bitcoin is a myth. The Bitcoin network is very, very fragile and at the mercy of a few giants.”

This is one of the most commonly disputed arguments against Bitcoin.

While I’ve tackled this argument numerous times before, the core of my rebuttal remains: Mining, in relative terms, isn’t as capital-intensive as it’s often portrayed. It frequently utilizes wasted energy, can be beneficial for the power grid, and continues to demonstrate decentralization. The Bitcoin network has proven its resiliency and robustness, defying the notion that it’s fragile or overly dependent on a few large players. In fact, the Bitcoin network has never failed and has maintained a perfect track record since its inception.

Let’s not forget that Bitcoin is a global asset with over 18,000 public nodes and more than 460 million Bitcoin wallets. The image below illustrates a heat map of Bitcoin’s nodes distributed around the world, each maintaining a complete copy of the network's ledger and ensuring that every transaction is accurately recorded.

Nothing about this image conveys, “Bitcoin decentralization is a myth.”

And now, for the grand finale… let's examine this quote paired with the following chart:

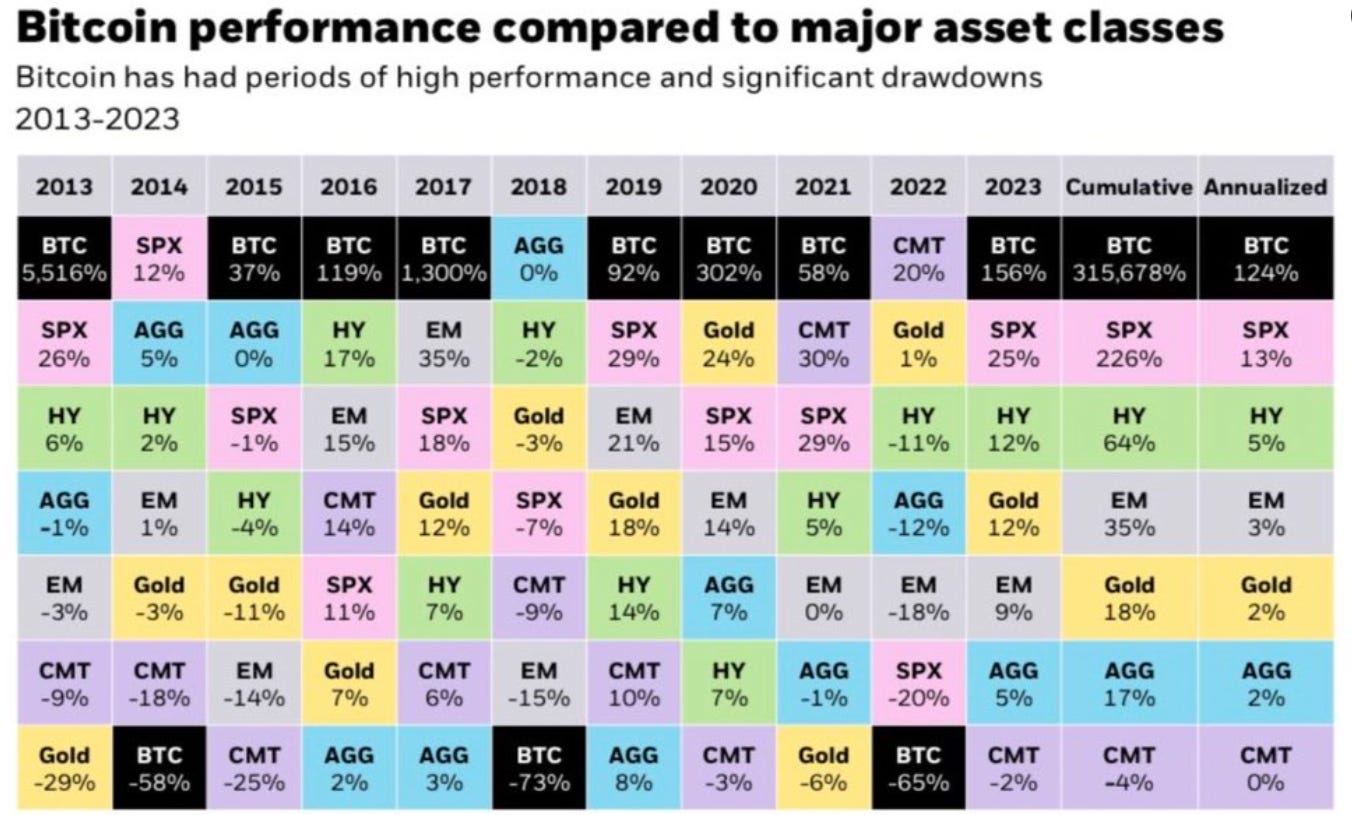

“Since 2013, BTC has outperformed the leading commodity in a distance that became tighter over time. Now, gold has finally surpassed the leading cryptocurrency in the comparative chart, challenging Bitcoin’s most chanted value proposition.”

What in God’s name is this chart? Take a look at the Y-axis for Bitcoin and then compare it to the Y-axis for gold—does this seem normal to you? Back in January 2013, Bitcoin was priced between $13 and $15, while gold was hovering around $1,660 to $1,680 per ounce. Fast forward to today, and Bitcoin is trading at $59,500, while gold sits at $2,546.20. This reflects an astronomical 4,249,571.43% gain for Bitcoin compared to a mere 52.45% gain for gold.

Most of the gains that gold has achieved over the past decade have barely kept pace with inflation, while Bitcoin operates in an entirely different league. Here are a couple of my favorite visuals to illustrate this.

And here’s a more accurate chart comparing Bitcoin to gold. Notice how the other assets are flatlined at the bottom. This is what the previous chart should have looked like.

Bitcoiners hold no animosity towards gold or gold investors. We recognize that Bitcoin was designed with gold’s principles in mind, but we believe Bitcoin surpasses its predecessor and is better suited to the changing times. The fact that these assets share many similarities, with Bitcoiners generally respecting gold, while the sentiment isn’t often reciprocated, suggests to me a hint of jealousy. But what do I know?

Given that opportunities to criticize Bitcoin are relatively rare for gold enthusiasts, I can’t entirely blame them for seizing the moment when they can. If the assumptions Bitcoiners hold about the world turn out to be true, gold will perform well over the next decade. But as for Bitcoin, its performance will be breathtaking, otherworldly—a total reimagining of the financial landscape in ways we can scarcely imagine.

The future is bright - orange skies lie ahead.

Bitcoin Thoughts And Analysis

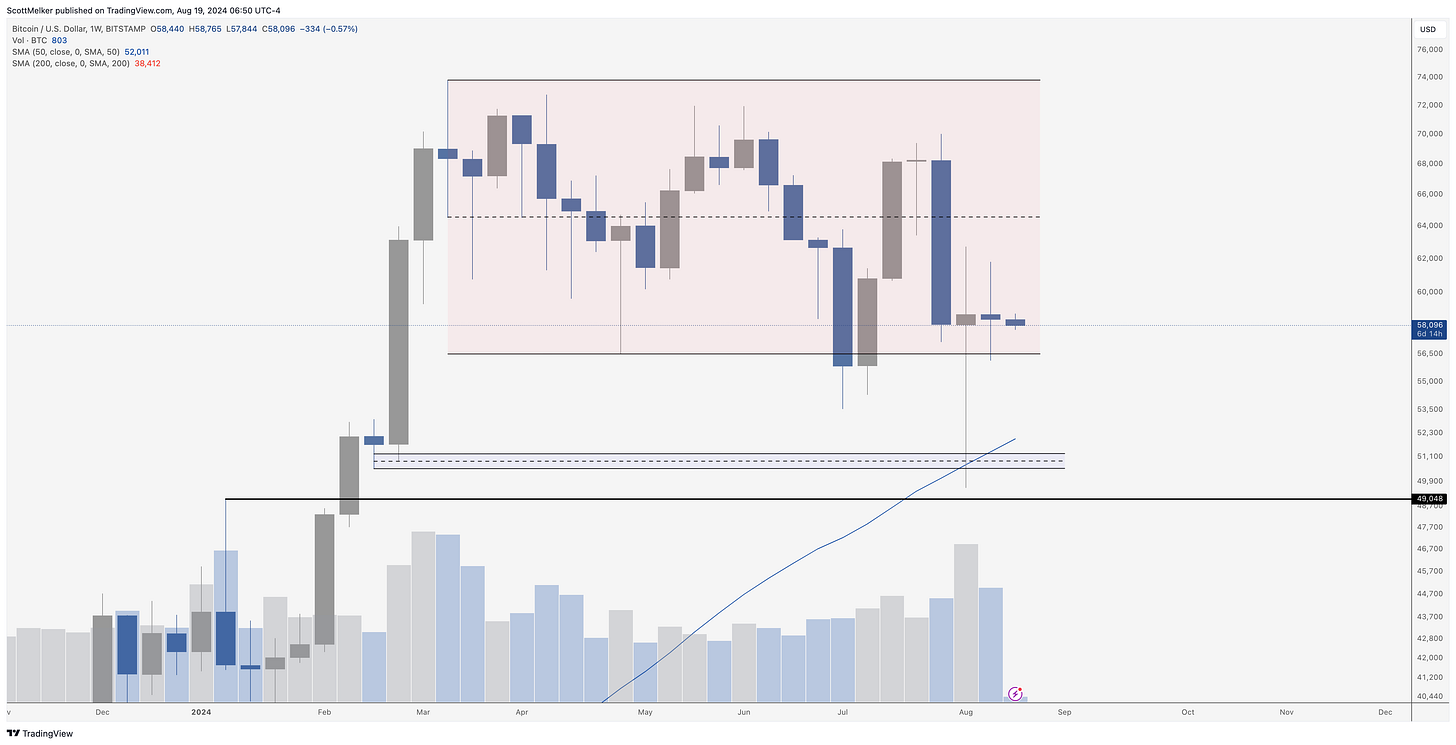

Want to see boring?

The last two weeks have had some volatility, with wicks up and down, but both have closed in a $600 range. The tiny candle bodies show that price has been almost exactly the same every Sunday. There is NOTHING to do here.

Legacy Markets

Stock markets posted minor movements after last week's rally, with traders awaiting signals on potential interest-rate cuts from the Federal Reserve, which will be discussed at the upcoming Jackson Hole symposium. The yen strengthened against the dollar, and European defense stocks, including Rheinmetall AG, fell due to reports that Germany plans to limit aid to Ukraine. Caution is prevailing in the markets as investors anticipate Fed Chair Jerome Powell's remarks on U.S. monetary policy. Meanwhile, Goldman Sachs reduced its U.S. recession probability for the next year to 20%, citing positive retail sales and jobless claims data. In Asia, the yen continued to rise, leading Group-of-10 currencies, amid expectations of further rate hikes in Japan. Oil prices declined as global conflicts in Gaza and Ukraine escalated.

Here’s what’s coming up:

US Democratic National Convention takes place Aug. 22, Monday

Start of annual US-South Korea joint military exercise, Monday

China loan prime rates, Canada and euro area CPI, Tuesday

Sweden and Turkey interest rate decisions, Tuesday

Indonesia and Thailand interest rate decisions, Wednesday

US FOMC minutes of of July 30-31 policy meeting, BLS preliminary annual payrolls revision, Wednesday

European Central Bank Governing Council member Fabio Panetta speaks in Rimini, Wednesday

South Korea central bank rate decision, Thursday

US Vice President Kamala Harris delivers acceptance speech on the final night of Democratic National Convention, Thursday

Mexico’s central bank, National Bank of Poland issues monetary policy minutes

Malaysia CPI data, while Mexico and Norway publish GDP data

Japan CPI data due, and Bank of Japan Governor Kazuo Ueda to attend special session at Japan’s parliament to discuss July 31 rate hike, Friday

Federal Reserve Chair Jerome Powell and Bank of England Governor Andrew Bailey speak at Kansas City Fed’s annual Jackson Hole symposium, Friday

Some of the main moves in markets:

Stocks

S&P 500 futures were little changed as of 5:16 a.m. New York time

Nasdaq 100 futures fell 0.3%

Futures on the Dow Jones Industrial Average were little changed

The Stoxx Europe 600 rose 0.1%

The MSCI World Index rose 0.1%

Currencies

The Bloomberg Dollar Spot Index fell 0.3%

The euro was little changed at $1.1036

The British pound rose 0.1% to $1.2963

The Japanese yen rose 1% to 146.16 per dollar

Cryptocurrencies

Bitcoin fell 2% to $58,652.73

Ether fell 1.8% to $2,619.53

Bonds

The yield on 10-year Treasuries declined two basis points to 3.86%

Germany’s 10-year yield declined three basis points to 2.22%

Britain’s 10-year yield declined three basis points to 3.90%

Commodities

West Texas Intermediate crude fell 0.8% to $76.05 a barrel

Spot gold fell 0.2% to $2,502.28 an ounce

Don't Buy Bitcoin At An ATM

Buying Bitcoin at an ATM is, by far, the worst way to purchase it. These machines charge exorbitant fees, leading to significantly higher prices compared to other methods. While I was already aware of this, I was still shocked this weekend when I saw just how high the costs are firsthand. I was at a gas station with a crypto ATM, and purchasing one Bitcoin would have cost around $78,000—about $18,000 more than the standard price, representing a staggering 30% premium for the convenience. Don’t buy Bitcoin from an ATM. Plus, it doesn’t seem safe.

Franklin Templeton Files For Crypto Index ETF

Franklin Templeton is aiming to compete with Hashdex, which is also seeking SEC approval for a crypto index, by filing for a Bitcoin and Ethereum ETF. In contrast, Hashdex’s proposal includes a broader index covering 10 cryptocurrencies. If approved, either ETF would be the first crypto index ETF. Indexes are a logical next step for broader crypto exposure, but the challenge is that only Bitcoin and Ethereum currently meet Wall Street’s criteria for suitability and appeal, with perhaps a few exceptions like Solana. Eventually, index ETFs are likely to become a popular and natural way for investors to enter the space. To be frank, it’s surprising that more issuers haven’t filed already, likely due to the Ethereum ETF still being relatively new.

Bitcoin and Ethereum are uniquely positioned this cycle to attract Wall Street’s capital when it is truly ready to invest in this space.

Trump Picks A Bitcoin/Tether Bull

Even if Trump never fully comes around to grasping Bitcoin, if he has the right people around him who do, how much more could we ask for? Last Friday, we learned that Trump has appointed Howard Lutnick, CEO of Cantor Fitzgerald, as co-chair of his transition team ahead of the November election. Lutnick is a well-known Bitcoin advocate who recently spoke for 21 and a half minutes at the Bitcoin 2024 conference, extolling both Bitcoin and Tether. He is particularly enthusiastic about Tether, stating, “I'm a big fan of this stablecoin called Tether.”

Having a balanced team of crypto experts is going to be crucial if we want to see Trump take a balanced approach with this industry.

This Would Be The End Of Bitcoin Mining

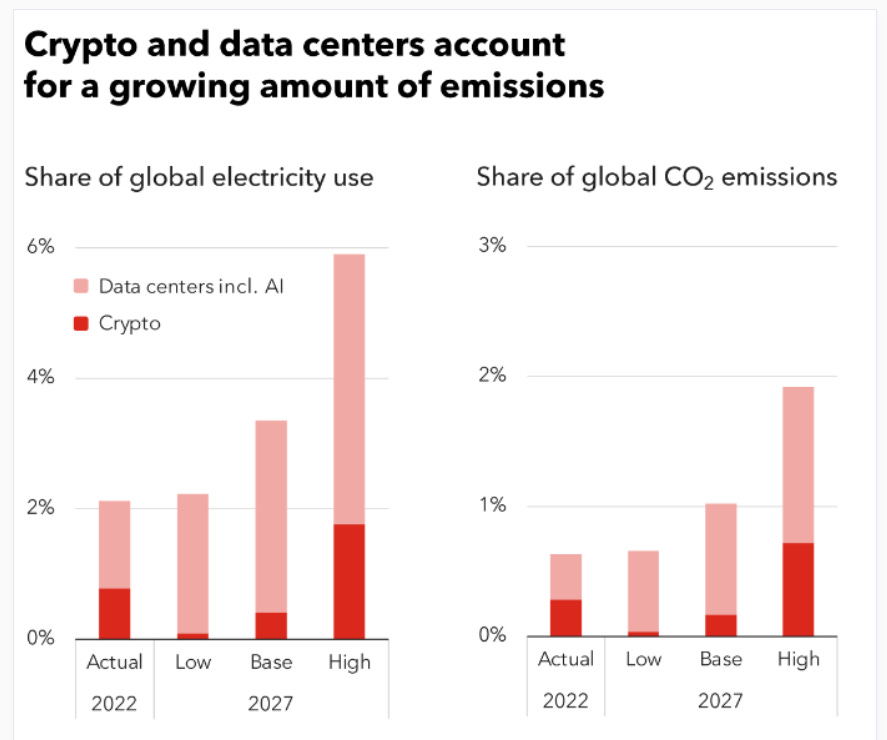

This hit piece aligns perfectly with the introduction above. Ironically, the IMF is proposing an 85% increase in electricity taxes for crypto miners and a 50% increase for data centers, while simultaneously acknowledging that AI consumes more electricity and produces more CO2 than mining. Isn't that a bit strange? Additionally, the IMF aims to prevent the relocation of miners and data centers to regions with cheaper energy, as if this would deter them or somehow have a negative impact.

What the IMF fails to grasp is that when Bitcoin miners seek out cheap energy, it can actually benefit a region by attracting investment, creating jobs, and boosting the local economy. Moreover, this demand helps utilize surplus or renewable energy resources that might otherwise go to waste. The increased energy consumption also drives improvements in energy infrastructure and efficiency, contributing to the region's overall economic and technological advancement.

God Bless Bitcoin: Watch This Movie To Understand Bitcoin! | Brian & Kelly Estes

Curious about how Bitcoin can change your life and the world? In this interview, Brian and Kelly Estes share the story behind their eye-opening film "God Bless Bitcoin," exploring why Bitcoin is the most ethical and powerful form of money. Watch it now! The link to the full movie is below!

My Recommended Platforms And Tools

Phemex - Exclusive for new users, earn up to 8800 USDT. Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '10OFF' for a 10% discount.

NGRAVE - ZERO is the most secure and user-friendly hardware wallet. If you aren't happy with your current crypto wallet, look no further than the ZERO.

Nord VPN - Get an exclusive NordVPN deal - 40% discount! It’s risk-free with Nord’s 30-day money-back guarantee. Protect your privacy.

Twitter - I spend most of my time on Twitter, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

TheWolfOfAllStreets.io - The most comprehensive collection of everything I have going on. Plus over 100 blogs and other exclusive content.

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.