Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Arch Public!

Arch Public’s Gateway Algorithm has been a safe haven over the past several months for investors. We’ve discussed annualized returns of nearly 140% over the past decade, but total returns don’t tell the full story. What happens when markets whipsaw lower, and volatility rules the day, month, or quarter?

Risk mitigation and liquidity become paramount when downside risk and volatility inevitably appear and reduce static investments to ‘tax loss’ strategies.

In the past 90 days Arch Public’s Gateway Algorithm (S&P500) has returned better than 20% for clients. At no point in that 90 days has it taken a trade that resulted in a loss larger than -1.93%. Programmatic decisions disallow our strategy to take unwise trades, and our 2% stop loss protection protects every position to the downside.

Try Arch Public now! You can even demo the platform, for free, to learn more.

In This Issue:

Pump.fun

Bitcoin Thoughts And Analysis

Legacy Markets

It’s Been A Relatively Quiet Quarter

Will There Be Demand For A Solana ETF?

There Is Now A Levered MSTR ETF

BlackRock Overtakes Grayscale

Pump.fun

I have to admit, I’d never actually visited Pump.fun before.

Despite covering the memecoin casino extensively across the newsletter, livestream, and podcast, I had never actually peaked under the hood. Here’s my unfiltered account of what it’s like to visit Pump.Fun for the first time - from a crypto Boomer’s perspective.

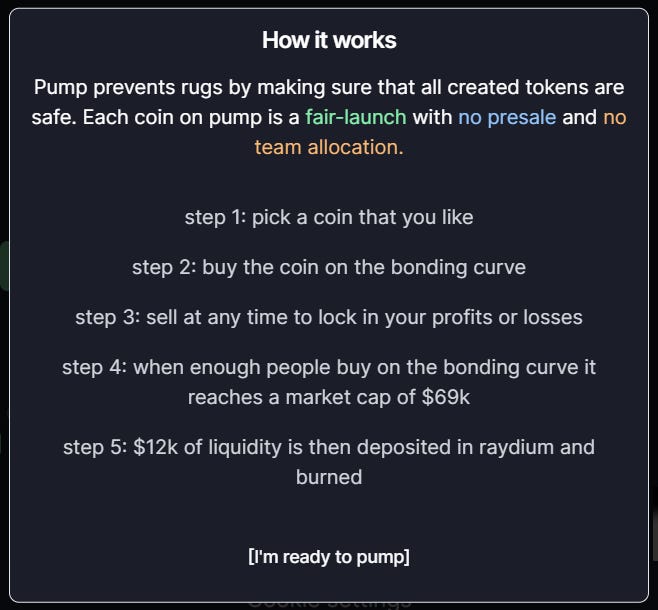

The first thing that greets you on the site is a brief pop-up explaining “How it works.” I couldn’t help but laugh at the infographic confidently stating that Pump.fun “prevents rugs by making sure that all created tokens are safe...” with a “fair launch with no presale and no team allocation.”

Step 2 wasn’t exactly clear because bonding curves can vary widely, and then there’s Step 4, which is clearly sexual innuendo (69). Step 5 left me equally puzzled—why would $12k of liquidity be deposited elsewhere and then burned?

This is clearly a casino built by degenerates, for degenerates.

I pushed aside the confusion for a second to take a glimpse at what the homepage is, and my initial thought is ‘what the actual f**k.’ I can’t even read what’s on the terminal page because everything is moving so fast without ever taking a pause.

After staring at the page for a solid minute, trying to make sense of whether it was a random shuffle of activity, I realized it’s just the same squares cycling across the screen at an unreadable speed from left to right, endlessly repeating. If I didn’t use the snipe tool, I wouldn’t have been able to read what these tiles were. I think the goal here is to give the illusion of flashing lights and fast-paced action i.e. a casino.

Here’s another screenshot for your viewing pleasure:

I just discovered that if you sort by market cap, you can actually pause the moving tiles and arrange them in ascending or descending order. This is real-time reporting.

I toggled off the NSFW option (not safe for work) and was still shown a tile promoting a coin called "MOTHER," accompanied by what I assume is a picture of Iggy Azalea’s ass. Nothing strange about that.

At this point, I got the gist of the site and figured it was time to dig a little deeper… not at MOTHER! I mean the actual mechanics behind the site.

I'll be frank: this site is clearly not designed for newcomers. There’s no white paper or documentation to refer to; instead, the top left only offers “Twitter,” “support,” and “Telegram”— links that both lead to Telegram channels I will not be joining and then “how it works” section which just re-displays the first graphic I shared.

If you click on a token, this is what you see - I chose the ticker ‘°o°’.

I’m not even joking; this coin had a 22.5% dip while I was working on this screenshot.

It’s almost as if just looking at a coin makes it drop 20%.

Honestly, there are no real explanations on this site for how it works, so I decided to leave. Sorry, but the fun’s over—I need to figure out how this thing actually operates.

Now for the facts.

Pump.fun launched in January of this year and relies on Solana and Blast for fast, low-cost transactions. What’s unique about the platform, as hinted at in the “how it works” popup, is that it allows users to create and trade tokens instantly without needing seed liquidity, making it accessible and cost-effective for a broad audience.

Here’s a primer on bonding curves.

From IQ.wiki, “A bonding curve represents a mathematical concept integrated into platforms and applications for computing a token's valuation based on its supply. It is a way of defining the relationship between the price and supply of a particular asset. The bonding curve procedure is about establishing the price of each newly minted token based on the existing supply of the token.”

Here’s another explanation from ChatGPT: A bonding curve model sets the price of a token using a mathematical formula based on its supply, with prices generally increasing as more tokens are issued and decreasing when tokens are redeemed. This model offers continuous liquidity and predictable pricing but differs from an order book model, where prices fluctuate according to real-time supply and demand dynamics determined by buyers and sellers.

The order book model is the standard used on platforms like Coinbase and Binance. It is known for its transparency, as prices are determined by actual trading activity and allow for price discovery through market interactions, ensuring that the price reflects the true value perceived by buyers and sellers.

Returning to Pump.fun, the platform is accurate in claiming that tokens are launched without a presale or team allocation. Just a week ago, there was a change to the launch structure, incentivizing even more token launches:

An honest improvement or a desperate attempt to generate more attention? You decide.

When a coin succeeds and its market capitalization reaches $69,000, $12,000 of liquidity is deposited into the Solana decentralized exchange Raydium and then burned. On Blast, the market cap requirement is $420,000, at which point $30,000 of liquidity is deposited into the Thruster DEX. Clever numbers.

There’s a lot of math behind the mechanics of the bonding curve, but I won’t bore you with it—it’s easy to find if you search on Google. What’s more interesting is this: “According to data from Dune analytics, only around 1.4% of tokens deployed on the platform have successfully reached Raydium.”

This starts to give you an idea of your odds of success in this casino. If you’re thinking, “Oh, I’ll just shop for coins on Raydium since they’ve already survived the first phase,” you’re in for a rude awakening. Early buyers from Pump.fun are taking profits on Raydium, and the cycle repeats on Blast, continuing all the way to major tier-1 exchanges.

Memecoins are called ‘shitcoins’ for a reason.

But how are these rugs possible if the whole point is to prevent insider advantages like team allocations and presales? The rule is easily skirted by influencer groups and other dubious insider tactics. Nothing stops a developer from using an alternative wallet to buy a large portion of their token, promoting it through a group, and then dumping it when they see fit. This tactic can be effective, but it’s equally costly if it fails to generate sufficient interest.

At the end of the day, these are memecoins, and while it might sound harsh, their only real use case is attracting new buyers and generating social media buzz. There is zero real utility. I assume this is obvious, but my gut tells me it might not be. To put Pump.fun into perspective, I actually think it is less of a casino and more of a large PvP battle among crypto-native degenerates trying to outsmart and con other crypto-native degenerates.

In a casino, you can statistically calculate your odds of winning and losing from game to game. At Pump.fun, however, the social element of deception allows more skilled con artists to continually dominate unsuspecting participants. Additionally, you must connect a Solana wallet to participate, and if you know anything about crypto, this carries risks.

I’m sure there will be some Pump.fun enthusiasts reading this who might be bothered by my criticisms. They might argue that the site is very “clear,” and they are right—there are set governing rules for the basic functions that apply to everyone. But there is little to prevent individuals from gaming the system to secure profits at your expense.

Hot take: You have better odds of making money at a casino, even if you think you are a Pump.fun expert. If you want to get good at something that involves gambling, learn poker or card counting—not Pump.fun.

Personally, I have a hard time seeing this type of platform continue in its current state for much longer—i.e., years. For it to go mainstream beyond the crypto-native crowd, there’s a lot of work needed, starting with clearer disclosures and a more user-friendly interface.

We know humans like to gamble, but if there isn’t the right balance of winning, players won’t keep coming back. Traditional casinos have mastered this; I’m not convinced Pump.fun has. This might explain why some of the interest around Pump.fun has started to slow down over the past couple of weeks.

Crypto has so much more to offer than degeneracy.

If Pump.fun makes people happy, I don’t have much against it, but the scams and cons give the industry a bad look—especially when it’s us deceiving each other out of our holdings. Do you think a 50-year-old crypto noob, who is used to traditional finance and investing, is going to take this seriously? Not a chance.

Also, if it were as easy as everyone on Telegram and Twitter claims, everyone would be rich—and we know that’s not possible. Lastly, I wouldn’t be surprised in the least if the SEC found a way to come after this site and shut it down. If that happens, what does that mean for Solana? Not good.

Have a great weekend. I’m looking forward to sharing some HUGE news with you all very soon. Wolf, out.

Bitcoin Thoughts And Analysis

Bitcoin dropped to around $56,000. Bulls are hoping this sets a higher low after the recent dip below $50,000. We might be establishing a new range between $50,000 and $60,000. It will likely take a significant catalyst to provide more clarity in the coming weeks, but I don’t expect much movement for now. I'm still waiting to see what happens in September and October, when the halving cycle usually ramps up.

Legacy Markets

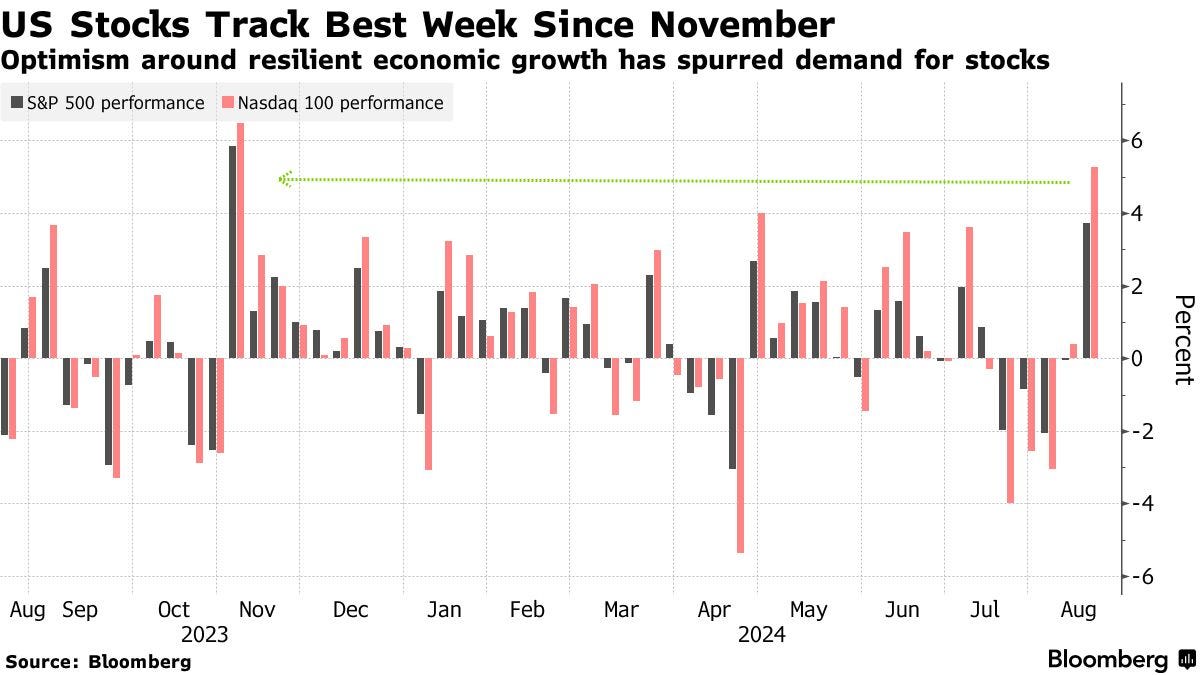

U.S. stocks are on track for their strongest week of the year, buoyed by a series of positive economic data indicating the resilience of the American economy. Key indicators, including inflation, jobless claims, and retail sales, have bolstered investor confidence, leading to hopes of a "Goldilocks" scenario where price pressures remain contained alongside steady growth. The S&P 500 and Nasdaq 100 have both posted significant gains, with the latter seeing its best performance since November. Globally, stock markets have largely recovered from last week’s losses, while U.S. equity funds have seen a sustained inflow of investments. The dollar has experienced a third consecutive week of declines, and Treasury yields have dipped as traders scaled back expectations for a large Federal Reserve rate cut in September. Asian markets, particularly Japan, have also surged, marking their best weekly performance in over a year. Meanwhile, commodities saw mixed results, with gold gaining and oil prices dropping amid geopolitical concerns and weak Chinese demand.

Key events this week:

US housing starts, University of Michigan consumer sentiment, Friday

Fed’s Austan Goolsbee speaks, Friday

Canada housing starts, Friday

Some of the main moves in markets:

Stocks

S&P 500 futures were little changed as of 6:14 a.m. New York time

Nasdaq 100 futures were little changed

Futures on the Dow Jones Industrial Average were little changed

The Stoxx Europe 600 rose 0.3%

The MSCI World Index rose 0.3%

Currencies

The Bloomberg Dollar Spot Index fell 0.2%

The euro rose 0.1% to $1.0988

The British pound rose 0.4% to $1.2905

The Japanese yen rose 0.5% to 148.54 per dollar

Cryptocurrencies

Bitcoin rose 3% to $58,388.89

Ether rose 2.5% to $2,613.99

Bonds

The yield on 10-year Treasuries declined three basis points to 3.88%

Germany’s 10-year yield declined three basis points to 2.23%

Britain’s 10-year yield declined two basis points to 3.90%

Commodities

West Texas Intermediate crude fell 1.9% to $76.70 a barrel

Spot gold rose 0.3% to $2,464.98 an ounce

It’s Been A Relatively Quiet Quarter

Do you remember when 13-F filings first started making waves on crypto Twitter, with everyone excitedly sharing which institutions and firms were taking Bitcoin positions? As a reminder, these filings are quarterly reports required by the SEC that disclose the equity holdings of institutional investment managers, offering valuable insights into the investment strategies and positions of large funds.

This quarter, you may have noticed there’s been little buzz—mainly because there wasn’t much to report. That said, there is a silver lining, and Matt Hougan has the scoop:

“1) The Institutions Are Still Coming; Total Filings Are Up: I count 1,924 holder<>ETF pairs across all 10 ETFs, up from 1,479 in Q1. That's a 30% increase; not bad considering prices fell in Q2.

Of course, this does not mean 1,924 institutions own bitcoin ETFs; some investors report positions in multiple ETFs. But that ‘double-counting’ aspect is equally true of the Q1 and Q2 numbers, so the percentage increase is still telling.

My takeaway: Institutional investors continued to adopt bitcoin ETFs in Q2. The trend is intact.

2) Institutions Have (Mostly) Diamond Hands: Most institutional investors who allocated in Q1 either held or bought more shares this spring. Among Q1 filers, 44% increased their position in bitcoin ETFs in Q2, 22% held steady, 21% decreased their position, and 13% exited. That's a pretty good result, on par with other ETFs.

My takeaway: If you thought institutional investors would panic at the first sign of volatility, the data suggest otherwise. They're pretty steady.

3) Hedge Funds Remain Big Players: A look at the top holders of most ETFs reveals a lot of major hedge funds: Millennium, Schonfeld, Boothbay, Capula, etc. But there are a large number of advisors, family offices, and select institutional investors too.

My takeaway: ETFs are a big tent that attract a wide variety of investors. It's kind of great to see Millennium nestled up against the State of Wisconsin in these ETF filings. Over time, I'd like to see wealth managers and pensions account for a growing share.

I'll share more as the data is finalized. I'd be wary of AUM reports until tomorrow, as there are some large investors that still need to file.”

Will There Be Demand For A Solana ETF?

Katalin Tischhauser, head of investment research at crypto bank Sygnum, told CoinTelegraph that Grayscale’s Solana ETF (GSOL) has “minuscule” investor flow, so I did some digging to verify this claim. It turns out the statement appears accurate. GSOL has $69.8 million in AUM, whereas Grayscale’s GBTC had $30 billion prior to conversion, and ETHE had $10 billion. What stands out about GSOL is that while its total AUM is low, it trades at an unusually high premium—7x. Tischhauser explained that “the high premium suggests some demand, but it’s not the kind of demand that will significantly impact the market.” Additionally, BlackRock has stated that there is “very little interest” from its clients regarding a Solana ETF.

This suggests two things: First, Solana’s recent run-up is likely driven entirely by the crypto-native community. If institutional interest picks up as expected, Bitcoin and Ethereum will likely be the primary beneficiaries. However, it’s important not to underestimate what a crypto darling like Solana can achieve, particularly with its smaller market cap. Second, if a Solana ETF does gain traction, there likely won’t be outflows simply because there aren’t significant inflows right now—a situation that can be both a blessing and a curse.

There Is Now A Levered MSTR ETF

If MSTR wasn't already volatile enough, the SEC has now approved MSTX, the first single-stock leveraged ETF for MicroStrategy in the United States, issued by Defiance. MSTX began trading yesterday and offers 175% daily targeted exposure to MSTR, which is going to be absolutely wild once Bitcoin begins to rise again. This ETF is not for the faint of heart—if you're not a professional and don't understand risk management and volatility decay, stay away from this stock. Spot Bitcoin is just fine.

BlackRock Overtakes Grayscale

For years, Grayscale Investments was the leading crypto asset manager, but BlackRock has now usurped the throne, claiming the title thanks to IBIT and the recent launch of ETHA. Last Thursday, BlackRock surpassed Grayscale in assets under management (AUM) for publicly listed crypto products, with its spot ETFs accumulating $22 billion, while Grayscale's funds, which include a variety of cryptocurrencies, hold about $20.7 billion.

My Recommended Platforms And Tools

Phemex - Exclusive for new users, earn up to 8800 USDT. Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '10OFF' for a 10% discount.

NGRAVE - ZERO is the most secure and user-friendly hardware wallet. If you aren't happy with your current crypto wallet, look no further than the ZERO.

Nord VPN - Get an exclusive NordVPN deal - 40% discount! It’s risk-free with Nord’s 30-day money-back guarantee. Protect your privacy.

Twitter - I spend most of my time on Twitter, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

TheWolfOfAllStreets.io - The most comprehensive collection of everything I have going on. Plus over 100 blogs and other exclusive content.

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.