The Wolf Den #1027 - Where Does Your Favorite Politician Stand On Crypto?

Do you even have a favorite politician?

Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Trading Alpha Releases A Brand New Product!

One of the partners of this newsletter, Trading Alpha, my trusted indicator and trading community, has launched their proprietary Indicator Search Engine for All Markets. This custom Indicator Screener scans crypto, stocks, and forex markets for Trading Alpha indicator setups, eliminating the need for time-consuming manual analysis. It can simultaneously screen for multiple indicators, enhancing confluence and providing advanced analysis capabilities across different markets. This is cutting-edge technology for serious traders.

Make sure to use my link HERE if you plan on giving it a try.

In This Issue:

Where Does Your Favorite Politician Stand On Crypto?

Bitcoin Thoughts And Analysis

Legacy Markets

Kamala Is Not Resetting On Crypto

Arthur Hayes Shares His Thoughts On Alt Szn

Mt. Gox Selling Is Almost Over

Pump.Fun Excitement Slows Down

Get Ready For The Bitcoin & Altcoin Explosion: Here Is When To Expect The Next Rally

Where Does Your Favorite Politician Stand On Crypto?

For my U.S. readers: do you know where your favorite politician stands on crypto? You probably do, as these major figures often dominate media coverage, making their positions widely known.

But what about your current senators and representative? Are you aware of where they stand on crypto? Do you even know the names of your state's senators and your district's representative?

If your answer is no, don't worry—I get it. It's easy to be frustrated or disillusioned with politics and to tune out the noise. But if you care about crypto, even on a superficial level (like prices going up), now is the most crucial time to ensure your vote makes a difference.

‘But Scott, I have to do all the research and put in the effort myself. It's overwhelming, and it feels impossible to know who to trust. I’m busy with work, family, and everything else going on—I just don't have the time or energy to figure all this out. It seems like too much to handle, especially when it's hard to see how my involvement will make a difference.’

If this is what you’re thinking or some variation of that, allow me to blow your mind. There's never been a more accessible time in history to learn everything you need to know about the intersection of politics and crypto—and how your vote can make a difference—all in one place.

Stand With Crypto

“The goal of the Stand With Crypto Alliance is to mobilize the 52 million American crypto owners into a powerful force.

Nearly nine in ten Americans believe the financial system is overdue for an update. Yet, US policymakers seem content on maintaining the status quo, rather than fulfilling their responsibilities. This inaction places our nation at risk of losing millions of jobs, and driving innovation and global leadership offshore.

The Stand With Crypto Alliance, a 501(c)(4) nonprofit, champions for clear, common-sense regulations for the crypto industry. We're mobilizing the 52 million crypto owners in the US - a demographic that is younger (60% Gen-Z and Millennials) and more diverse (41% identify as racial minorities) than the general US population - to unlock crypto's innovation potential and foster greater economic freedom.

Enough is enough. It's time for our policymakers to step up, embrace the future, and enact clear rules for crypto to thrive.”

Stand With Crypto is a nonprofit advocacy group started by Coinbase last year, gathering 1.3 million advocates dedicated to supporting and building a database that tracks U.S. politicians' stances on crypto. This tool is incredibly powerful—and easier to use than setting up a crypto wallet.

The website is organized into five major categories:

1. **Key Races**

2. **Politician Scores**

3. **Endorsed Candidates**

4. **Partners**

5. **Resources**

The 'Key Races' tab does exactly what its name suggests, allowing you to filter by state or browse through highlighted races selected by Stand With Crypto that demand the most attention. For example, Ohio is a major focus—not just because it's a Senate race, but because the outcome for crypto is all or nothing.

Bernie Moreno receives an 'A,' while Sherrod Brown scores a big fat 'F.'

The next tab, and my personal favorite, is "Politician Scores." Here, you can search for your favorite politician or use the provided filters to search by crypto stance, role, party, or state.

Each politician is assigned a score of A, B, C, D, F, or N/A if the information is pending. Clicking on a politician's name lets you view their voting history, with linked explanations of relevant bills, and a collection of their statements about crypto.

While writing this, I looked up Kamala Harris and was surprised to see her score listed as N/A, due to her not explicitly commenting on crypto. I find this to be inaccurate, given her work with anti-crypto groups and disregard for our demands. Perhaps this isn’t the fairest way to assess her stance, but it’s my opinion—you’re entitled to yours.

The platform isn't perfect, but if a politician has a score, it's likely accurate and backed by evidence. I suggest you search the politicians in your jurisdiction and dig into the information Stand With Crypto provides—it’s super easy.

In the screenshot below, I was curious and searched for anti-crypto politicians in all roles who are Democrats in California, just to show you how it works. That’s how specific this tool can get.

When using the tools, be sure to enter your address so you can familiarize yourself with the politicians who will be on your ballot. The last thing you want is to accidentally vote for someone in November who is anti-crypto simply because you weren’t informed.

As for endorsed candidates, partners, and resources, we can skip that.

I want to finish with this:

The upcoming general election in November is crucial. There are 34 out of 100 Senate seats and all 435 House seats up for grabs. Currently, Republicans hold the majority in the U.S. House, while Democrats and independents who caucus with Democrats have the majority in the U.S. Senate.

Beyond party lines, it's extremely critical for pro-crypto advocates to gain control of both the House and Senate. If we don’t show up, we risk being stuck in limbo or facing unfavorable outcomes for the industry for years to come. These smaller elections are often overlooked compared to the general election, which makes it even more important for us to pay closer attention—our votes will have an even larger impact.

Members of Congress will be the ones we elect to vote on the legislation we need, such as the Bitcoin Reserve Bill, unless it is enacted through an executive order by Donald Trump, should he be elected.

Don’t let this election pass without voting for crypto. Even if you’re voting primarily to protect your portfolio, it’s still worth your time. Stand With Crypto has made this complicated process mindlessly easy.

All we need to do is show up and vote.

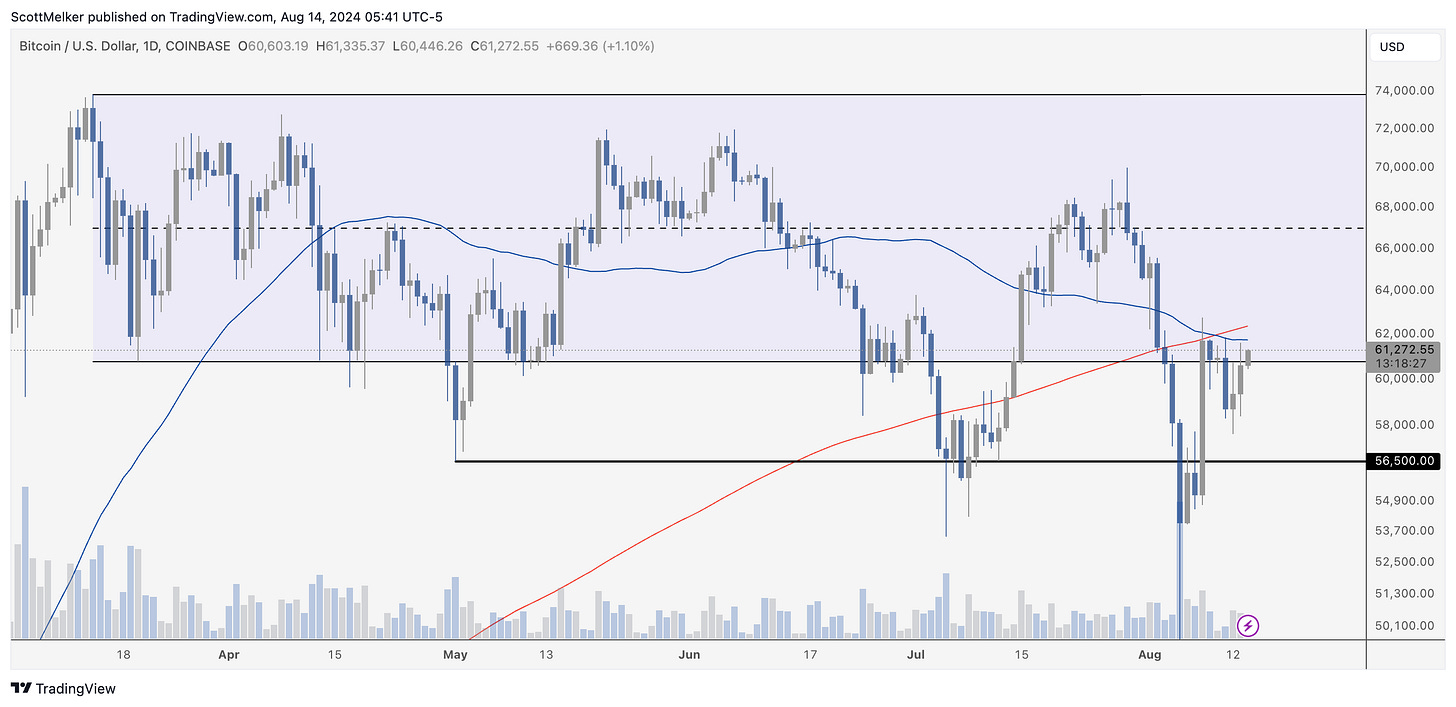

Bitcoin Thoughts And Analysis

I would love to report something exciting, but nothing has changed. Bitcoin is at least back in the bottom of the range, but I think we all know that this is annoying sideways chop. I know that I am annoyed reporting on it every day!

Legacy Markets

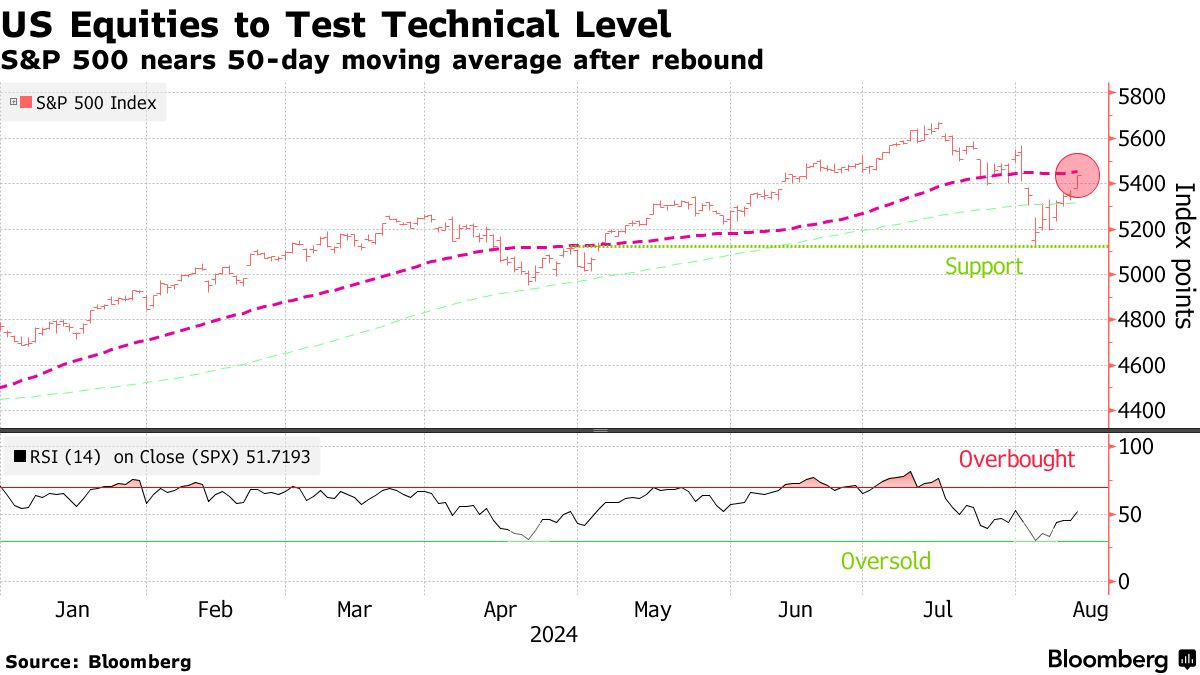

US equity futures remained steady ahead of the US consumer price report, which could influence the Federal Reserve's decision on interest rates. Alphabet Inc. shares dropped 1% premarket after news of a potential DOJ push to break up Google. Europe’s Stoxx 600 Index rose by 0.2%, driven by UBS's better-than-expected second-quarter profit, while miners fell due to a decline in iron ore prices.

Lower US price pressures have increased confidence that the Fed may cut rates, with expectations of a modest 0.2% increase in the consumer price index. UK inflation rose less than expected, causing the pound to weaken and UK government bonds to jump. Treasuries were stable, and the dollar traded near a four-month low.

Oil prices rose on reports of a significant drop in US crude stockpiles, and gold approached a record high. Iron ore prices fell further due to concerns about China’s steel industry facing a severe downturn. The S&P 500 experienced its largest four-day rally of the year, supported by positive earnings reports.

In Asia, regional stocks climbed for a fourth session, with New Zealand cutting rates by 25 basis points. The yen and Japanese stocks fluctuated following news that Prime Minister Fumio Kishida will not seek a second term as leader of the Liberal Democratic Party.

Key events this week:

US CPI, Wednesday

China home prices, retail sales, industrial production, Thursday

US initial jobless claims, retail sales, industrial production, Thursday

Fed’s Alberto Musalem and Patrick Harker speak, Thursday

US housing starts, University of Michigan consumer sentiment, Friday

Fed’s Austan Goolsbee speaks, Friday

Some of the main moves in markets:

Stocks

S&P 500 futures were little changed as of 6:19 a.m. New York time

Nasdaq 100 futures were little changed

Futures on the Dow Jones Industrial Average were little changed

The Stoxx Europe 600 rose 0.2%

The MSCI World Index rose 0.2%

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro rose 0.2% to $1.1020

The British pound fell 0.2% to $1.2839

The Japanese yen fell 0.1% to 147.01 per dollar

Cryptocurrencies

Bitcoin rose 0.9% to $61,119.02

Ether rose 1.5% to $2,739.22

Bonds

The yield on 10-year Treasuries was little changed at 3.84%

Germany’s 10-year yield advanced two basis points to 2.20%

Britain’s 10-year yield declined four basis points to 3.85%

Commodities

West Texas Intermediate crude was little changed

Spot gold rose 0.3% to $2,471.66 an ounce

Kamala Is Not Resetting On Crypto

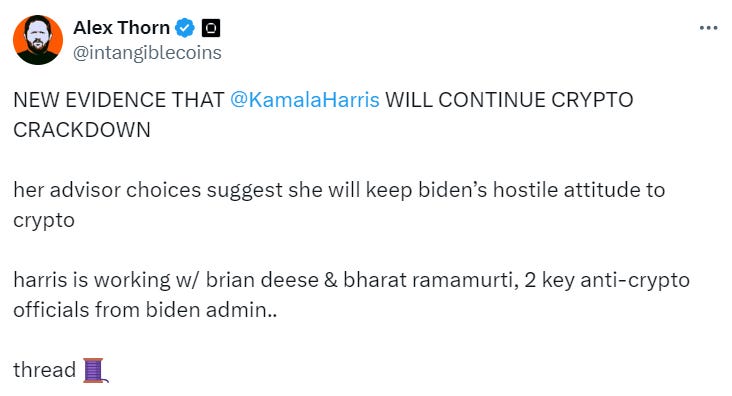

For a brief moment, rumors circulated that Kamala's team was considering crypto and a potential reset. I heard this firsthand from credible sources at Bitcoin 2024. However, actions speak louder than words, and the evidence suggests the opposite—a continuation of the status quo from the past four years.

As mentioned at the top of this tweet, Kamala is collaborating with "two key anti-crypto officials from the Biden administration" who have been orchestrating Operation Chokepoint 2.0 directly from the White House. Alex Thorn notes that on the same day Brian Deese published his anti-crypto blog, “The Administration’s Roadmap to Mitigating Cryptocurrency’s Risks,” the Fed rejected Custodia Bank’s membership and master account, extended bank restrictions on crypto activities, and the Senate majority whip criticized firms working with crypto at the following meeting.

As for Bharat Ramamurti, another key figure Kamala is collaborating with, he worked under Deese at the National Economic Council and has close ties to Elizabeth Warren. Finance.Yahoo described him as “the White House’s top crypto critic.” He even intervened to block the bipartisan stablecoin compromise between Patrick McHenry and Maxine Waters in July 2023. There is a growing list of Democrat advisors Kamala could handpick that are pro-crypto, yet she is refusing to do so. Here are a few great options: Ro Khanna, Ritchie Torres, Wiley Nickel, Darren Soto, and Kirsten Gillibrand.

Kamala will send crypto back to the pits of hell if she gets the chance. Her rise in the polls, whether real or fabricated, has created an overhang for this market that won’t be settled until November. Given how late it already is, it’s becoming less and less likely that a reset is coming. This is why voting matters come November.

Arthur Hayes Shares His Thoughts On Alt Szn

I’ve compiled Arthur Hayes' thoughts on alt season, the U.S. election, his buying and selling strategies, and his long-term price predictions below. It’s a quick read and entirely spoils the rest of his blog, which you should read if you have the time. Enjoy.

Wen Alt Szn?

Shitcoins are higher beta Bitcoin crypto plays. But during this cycle, Bitcoin and now Ether have structural bids in the form of net inflows into US-listed exchange-traded funds (ETF). While Bitcoin and Ether have corrected since April, they escaped the carnage experienced in the shitcoin markets. Alt szn will return only after Bitcoin and Ether decidedly break through $70,000 and $4,000, respectively. Solana will also climb over $250, but the crypto market-wide wealth effect of a Solana pump is nowhere near as potent as with Bitcoin and Ether, given the relative market caps. The combination of a dollar liquidity-inspired Bitcoin and Ether rally into year-end will create a strong foundation for the return of a sexy shitcoin soiree.

In any case, I expect that crypto will exit its sideways-to-downward trajectory starting in September. As such, I will take advantage of this late northern hemispheric summer weakness to load up on crypto risk.

The election is a coin toss, and I would rather watch the chaos from the sidelines and step back into the markets AFTER the US debt ceiling is raised. I expect that to happen sometime in January or February.

Once the US debt ceiling charade is over, liquidity will gush from the Treasury and possibly the Fed to get markets back on track. Then, the bull market will begin for realz. $1 million Bitcoin is still my base case.”

Mt. Gox Selling Is Almost Over

We are approaching the final lap of Mt. Gox distributions. BitGo is the last remaining distribution partner approved for creditor repayments and appears to be preparing approximately $2 billion worth of Bitcoin for distribution soon. Typically, the market reacts positively when these lingering issues are resolved, leading to reduced selling pressure and improved sentiment as the news spreads and fears subside. In a couple of weeks, I anticipate Mt. Gox will be fully resolved, bringing us closer to Arthur Hayes's prediction that the market will move beyond its “sideways-to-downward trajectory.”

Pump.Fun Excitement Slows Down

It’s definitely not the end of Pump.Fun, but if Ethereum starts to rally, expect interest in Pump.Fun to fade and negative sentiment to pile up. Here’s an excerpt from the linked article with some key stats: “During the week ending August 12, Pump.Fun recorded 33,333 new addresses on its platform, a significant decline from the previous week, which saw 212,699 new addresses. Looking at the bigger picture, the number of weekly new addresses on the platform has been declining since the week ending June 17, when it peaked at 349,032.”

It’s no secret that Pump.Fun is the main driver behind Solana’s current run. The memecoin casino has maintained its popularity much longer than anyone anticipated. It might be in a temporary slump before interest picks up again, but if it continues to slow down, expect a slowdown for Solana overall. Alt season won’t truly kick off until Bitcoin and Ethereum gain momentum—that’s where the real spillover will happen.

Get Ready For The Bitcoin & Altcoins Explosion: Here Is When To Expect The Next Rally

Will the upcoming US elections trigger a massive crypto rally? Dan Gunsberg from Hxro Network joins me today to discuss this and more!

My friends from The Arch Public, Andrew Parish, and Tillman Holloway, are joining in the second part of the stream to provide an update on the $10K algorithmic portfolio.

My Recommended Platforms And Tools

Phemex - Exclusive for new users, earn up to 8800 USDT. Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '10OFF' for a 10% discount.

NGRAVE - ZERO is the most secure and user-friendly hardware wallet. If you aren't happy with your current crypto wallet, look no further than the ZERO.

Nord VPN - Get an exclusive NordVPN deal - 40% discount! It’s risk-free with Nord’s 30-day money-back guarantee. Protect your privacy.

Twitter - I spend most of my time on Twitter, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

TheWolfOfAllStreets.io - The most comprehensive collection of everything I have going on. Plus over 100 blogs and other exclusive content.

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.