Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Phemex!

Phemex is the most efficient crypto trading and investment platform. Phemex offers over 293 spot trading pairs, minimal fees, peer-to-peer trading, derivatives, up to 100x leverage, and $8,800 welcome rewards up for grabs! Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Make sure to check if Phemex is available in your jurisdiction.

In This Issue:

Radio Silence

Bitcoin Thoughts And Analysis

Altcoin Charts

Legacy Markets

stETH Bridges To BNB

Ethereum Gas Fees Hit Historic Low

Better Safe Than Sorry

Is The Global Meltdown Over? Find Out If Black Monday Will Strike Again – And When!

Radio Silence

Do you hear that? It’s the sound of nothing.

The news to report on right now is abysmal—non-existent. Last night, Elon Musk had a sit-down interview with Donald Trump on X, but there was no mention of crypto. I’m choosing to take it as a sign we are still very early.

The longer this cycle stalls, the higher the price will climb. Before diving into today's main topic, I want to address the idea that as Bitcoin matures, the traditional 4-year cycle will probably lose its relevance—assuming efficient market theory plays out. Expecting Bitcoin to follow a strict 4-year pattern indefinitely is unrealistic. As institutions become more familiar with the supply dynamics that shift every four years, the impact that these cycles once had on the market should diminish.

Time will tell.

Since there isn't any major news to report on, I figured today would be a good day to drop all the prevailing narratives and find our way back to our roots. The popular phrase, ‘Bitcoin is a call option on a better future,’ is fitting where this newsletter is about to go.

"Bitcoin is a call option on a better future" is a metaphorical way of expressing the idea that investing in Bitcoin today represents a bet or speculation on the belief that the future will be significantly improved or different, thanks in part to the transformative potential of Bitcoin.

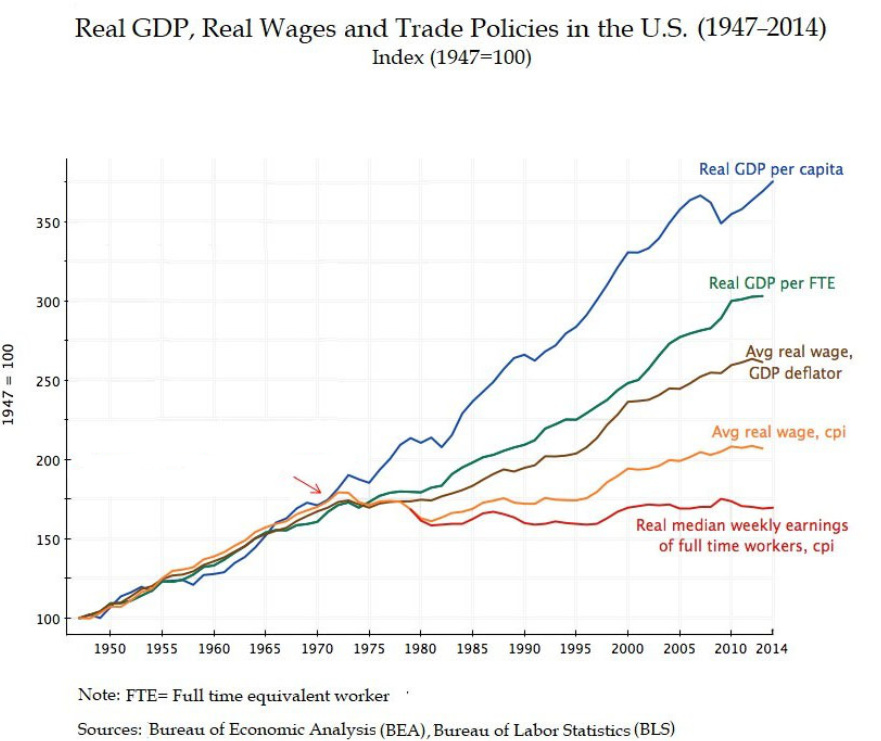

I’ve covered this topic before, but today I want to take a fresh perspective and revisit the effects of 1971, the year the United States officially abandoned the gold standard under President Richard Nixon. Unless you’re already well-versed in the rippling impact of this decision, I’m confident that what you’re about to learn will shock you.

To better understand how the world has evolved since abandoning the gold standard, I'm introducing you to a unique resource: WTFHappenedIn1971.com. This website, created by two Bitcoiners, tracks a wide range of social and economic trends that began after Nixon’s pivotal decision to end the gold standard.

Before I share its contents, I need to provide a balanced disclosure. It would be naive to claim that all of the societal and economic downfalls below are a direct result of Nixon’s suspension of the Gold Standard. Also, the end of Bretton Woods took place during this time, which is related but not exactly the same.

Since 1971, the world has undergone a complex interplay of factors, including geopolitical shifts, technological advancements, and changes in economic policies, all contributing to the wide-ranging effects we observe today. Also, not everyone is going to agree with the stats, even if they come from reputable sources.

That said, when you look back at changes over time, 1971 stands out as a particularly suspicious year. So, without further ado, enjoy.

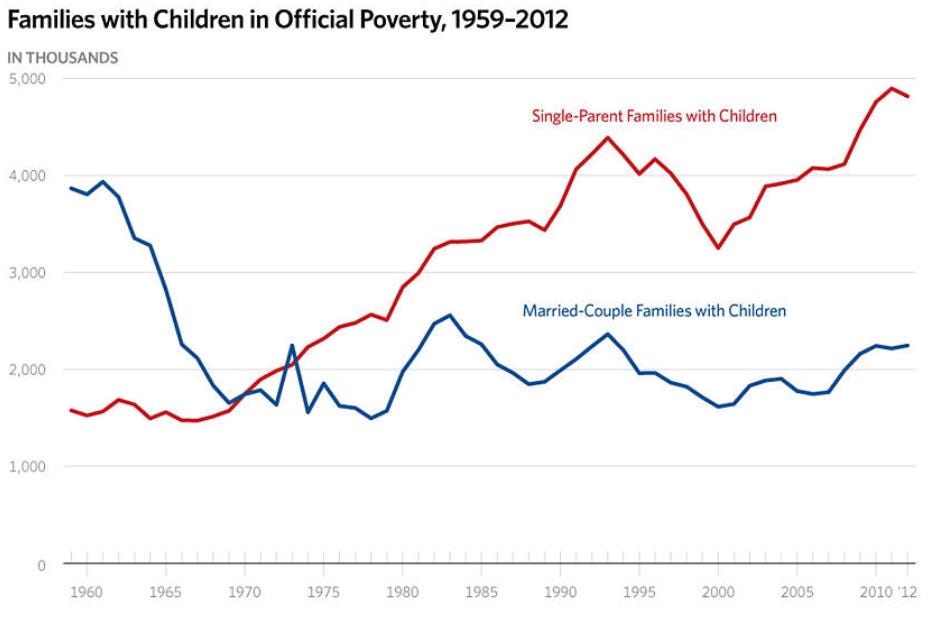

Charts from wtfhappenedin1971.com.

This quote sits at the bottom of the page:

“I don’t believe we shall ever have a good money again before we take the thing out of the hands of government, that is, we can’t take it violently out of the hands of government, all we can do is by some sly roundabout way introduce something that they can’t stop.” – F.A. Hayek 1984

Bitcoin is that ‘something’ that they can’t stop.

The images above are only a fraction of the charts compiled on this website, each deserving its own in-depth analysis. While some charts may not be updated through 2024, their foundational insights remain relevant. Additionally, a few charts may not extend very far back historically, but they still provide valuable context for understanding long-term trends.

If this is your first time encountering these stats, you might be questioning their accuracy or wondering how this is all possible in the first place. I encourage you to scrutinize and verify these images for yourself, but for now, if you're skeptical, sit tight until I share my closing thoughts. For those curious how this is possible, here's the straightforward explanation.

The end of the gold standard in 1971 allowed for greater flexibility in monetary policy, leading to increased money creation without the constraints of gold reserves. While money printing existed long before 1971, it took on a more insidious form following this policy shift.

Money printing led to inflation, which contributed to financial inequality. This inequality, in turn, fostered economic disparities and social tensions, exacerbating instability and undermining societal well-being.

As a result, young people are struggling to buy their first homes, while older generations are falling short in saving for retirement. Couples are taking on additional jobs to make ends meet, and single individuals face financial pressures that hinder their ability to find a partner and establish long-term stability.

Groceries are more expensive than ever, and student debt burdens individuals for decades. Insurance has become increasingly complex and costly, adding another layer of financial strain. To make matters worse, the political divide has never been wider in our history. Just look at our current options—I believe we can do better.

The government is addicted to printing money, relying on it as a temporary 'fix' that only deepens the dependency. However, if the U.S. government takes Bitcoin seriously, it could spark interest from other nations and begin to address the issues that have persisted since the changes initiated in 1971.

Bitcoin is our 21st-century chance to recapture what was once possible under the gold standard. While it doesn’t solve every problem, I believe Bitcoin can serve as a healthy counterbalance to the core issues within our broken monetary system.

It’s exciting to see Bitcoin still in its early stages and advancing rapidly, but the challenges we face are likely to take decades, if not longer, to address and improve. I remain hopeful, but I know it will require a collective effort. Don’t be discouraged by brief moments when it seems like nothing is happening; the bigger picture is far more significant.

We're still coming off the flood of news from the conference, but sooner or later, we'll face the reality of whether we're merely kicking the can further down the road with money printing or heading into a recession that will prompt the Fed to pull a different set of levers that turn on the same money printer. Bitcoin can be the fix to what happened in 1971; it’s going to take time for the world to realize this, but it can happen. My bet is that it will.

Radio silence is only loud if you let it bother you. Enjoy the peace and quiet; the winds of change are near.

Bitcoin Thoughts And Analysis

Watching this chart is less exciting than watching paint dry.

Altcoin Charts

For those who are new here, I share SETUPS and not SIGNALS. These are ideas that I am watching - if a certain thing happens, then the trade triggers. I am not telling you what to buy or when. I am showing you how I am watching certain charts and what has to happen for me to take a trade.

Legacy Markets

US equity futures rose as investors awaited key inflation data to guide the Federal Reserve’s policy decisions. Contracts on the S&P 500 and Nasdaq 100 indicated a strong open on Wall Street. European stocks wavered as German investor expectations fell sharply. Brent crude oil held near $82 a barrel amid rising US concerns about a potential Iranian attack on Israel.

The British pound strengthened, and the FTSE 100 underperformed Europe's benchmark after UK unemployment unexpectedly fell, complicating the Bank of England’s interest rate decisions. US Treasuries and the dollar remained steady.

Markets are focusing on Wednesday’s US consumer price index to gauge the Fed's next moves. The recent rise in crude oil prices highlights producer-price data as an inflation risk indicator. Traders are also monitoring geopolitical tensions in the Middle East, with Fitch Ratings downgrading Israel’s sovereign debt due to ongoing conflict.

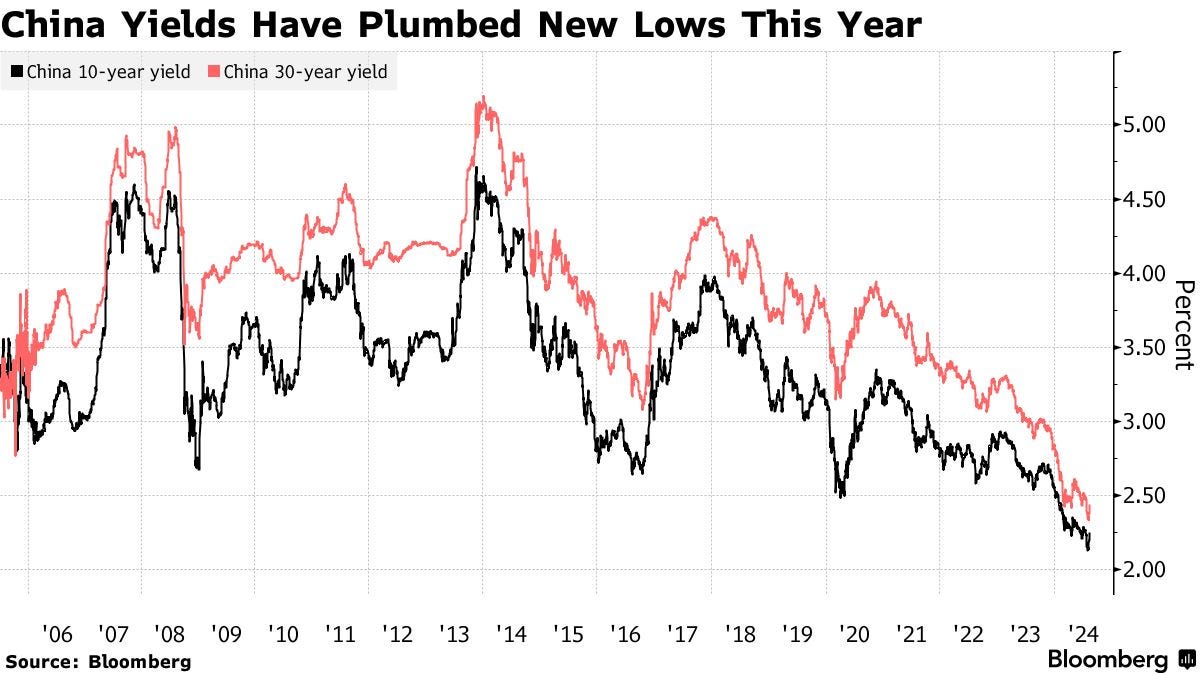

In Asia, Japanese equities gained after a holiday, supported by a weaker yen, while China saw regulators taking measures to cool a government bond market rally, impacting corporate debt markets.

Key events this week:

US PPI, Tuesday

Fed’s Raphael Bostic speaks, Tuesday

Eurozone GDP, industrial production, Wednesday

US CPI, Wednesday

China home prices, retail sales, industrial production, Thursday

US initial jobless claims, retail sales, industrial production, Thursday

Fed’s Alberto Musalem and Patrick Harker speak, Thursday

US housing starts, University of Michigan consumer sentiment, Friday

Fed’s Austan Goolsbee speaks, Friday

Some of the main moves in markets:

Stocks

S&P 500 futures rose 0.4% as of 6:05 a.m. New York time

Nasdaq 100 futures rose 0.5%

Futures on the Dow Jones Industrial Average were little changed

The Stoxx Europe 600 was little changed

The MSCI World Index rose 0.2%

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro fell 0.1% to $1.0920

The British pound rose 0.2% to $1.2793

The Japanese yen fell 0.5% to 147.89 per dollar

Cryptocurrencies

Bitcoin rose 0.2% to $58,961.51

Ether fell 1.5% to $2,640.22

Bonds

The yield on 10-year Treasuries advanced two basis points to 3.92%

Germany’s 10-year yield was little changed at 2.22%

Britain’s 10-year yield was little changed at 3.92%

Commodities

West Texas Intermediate crude was little changed

Spot gold fell 0.5% to $2,460.98 an ounce

stETH Bridges To BNB

The Lido Finance community has recently voted to bridge Lido Staked ETH (stETH) to the BNB Chain using Axelar and Wormhole. Axelar is a decentralized blockchain designed for interoperability between different chains, while Wormhole is a cross-chain application that facilitates communication across blockchains.

This integration of stETH and BNB marks a historic milestone as it represents the first time Lido has connected to a layer-1 blockchain outside the Ethereum ecosystem. This move opens up new opportunities for users to leverage their stETH within Binance's DeFi ecosystem.

Currently, Lido holds the top spot in DeFi with $26.4 billion in total value locked (TVL), more than double the $12.9 billion held by Eigen Layer, the second-largest protocol. Lido’s liquid staking alone accounts for $25.9 billion of the total $84.4 billion TVL across the DeFi landscape, representing a staggering 28.2% of net Ether deposits.

Ethereum Gas Fees Hit Historic Low

Reflecting on past newsletters, I often discussed the fluctuations of Ethereum gas fees—warning readers when costs were high and advising them to take advantage when fees were low. With the arrival of EIP-4844 (Dencun), those days now seem to be over. On August 10, Ethereum gas fees hit an all-time low of 1.9 gwei, marking a 98% decrease from the peak of 83.1 gwei in March. Low-priority transactions are now as cheap as 1 gwei, or about seven cents. This decline coincides with a surge in activity on Ethereum’s Layer 2 networks, which enable more transactions at reduced costs.

Critics have labeled this trend as cannibalization, yet ironically, they were the same voices condemning Ethereum when it was 'too expensive' to use. If Ethereum weren’t underperforming pricewise, the noise would be much quieter.

Better Safe Than Sorry

I don’t have any more information than you do about whether there’s something happening at Swan or if it’s just a baseless attack, but I always believe it's better to be safe than sorry. I'll never forget when a few weeks before Celsius collapsed, we only had the word of a few large accounts suggesting something was amiss.

I try my best to avoid spreading rumors, as they can be very damaging when false. However, when it comes to safeguarding your own funds, I firmly believe there is no better custodian for your Bitcoin than yourself, if you're capable. Swan agrees! They tell people to self-custody.

In the spirit of fair reporting, Swan CEO Corey Klippsten has responded as follows:

Is The Global Meltdown Over? Find Out If Black Monday Will Strike Again – And When!

Join Dave Weisberger, Mike McGlone, and James Lavish as we break down what's happening in macro and crypto!

My Recommended Platforms And Tools

Phemex - Exclusive for new users, earn up to 8800 USDT. Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '10OFF' for a 10% discount.

NGRAVE - ZERO is the most secure and user-friendly hardware wallet. If you aren't happy with your current crypto wallet, look no further than the ZERO.

Nord VPN - Get an exclusive NordVPN deal - 40% discount! It’s risk-free with Nord’s 30-day money-back guarantee. Protect your privacy.

Twitter - I spend most of my time on Twitter, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

TheWolfOfAllStreets.io - The most comprehensive collection of everything I have going on. Plus over 100 blogs and other exclusive content.

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.

Another great article. Learned some new history about Gold. Interesting.