Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Arch Public!

Arch Public’s Gateway Algorithm has been a relative safe haven over the past several months for investors. We’ve discussed annualized returns of nearly 140% over the past decade, but total returns don’t tell the full story. What happens when markets whipsaw lower, and volatility rules the day, month, or quarter?

Risk mitigation and liquidity become paramount when downside risk and volatility inevitably appear and reduce static investments to ‘tax loss’ strategies.

In the past 90 days Arch Public’s Gateway Algorithm (S&P500) has returned better than 20% for clients. At no point in that 90 days has it taken a trade that resulted in a loss larger than -1.93%. Programmatic decisions disallow our strategy to take unwise trades, and our 2% stop loss protection protects every position to the downside.

Try Arch Public now! You can even demo the platform, for free, to learn more.

In This Issue:

The Apex Asset

Bitcoin Thoughts And Analysis

Legacy Markets

Celsius Sues Tether

Operation Chokepoint 2.0 Is Still Alive

Trump And Musk - Tonight

Here’s Why It Is Insane To Be Against Bitcoin | Sheila Warren

The Apex Asset

I asked ChatGPT to provide the historical prices of Bitcoin on January 1st, dating back to 2012. The numbers might not be perfect, but they're accurate enough to illustrate my point.

- January 2012: $5.27

- January 2013: $13.30

- January 2014: $800.00

- January 2015: $313.00

- January 2016: $430.00

- January 2017: $1,000.00

- January 2018: $13,880.00

- January 2019: $3,809.00

- January 2020: $7,194.00

- January 2021: $29,374.00

- January 2022: $46,306.00

- January 2023: $16,558.00

- January 2024: $43,120

I did the same for NVDA. The numbers might be less accurate due to stock splits, but the logic still applies.

- January 2012: $13.48

- January 2013: $12.70

- January 2014: $17.31

- January 2015: $18.72

- January 2016: $20.48

- January 2017: $30.77

- January 2018: $31.55

- January 2019: $137.11

- January 2020: $238.48

- January 2021: $537.27 (including a 4-for-1 split)

- January 2022: $297.53

- January 2023: $179.64

- January 2024: $471.50 (including a 10-for-1 stock split)

The reason I shared these numbers is simple. Whenever I evaluate a potential investment—be it collectibles, real estate, stocks, bonds, cryptocurrencies, startups, art, precious metals, or alternative assets like private equity or venture capital—I always ask myself: How does this investment measure up against the best alternative?

In my case, my best alternative is Bitcoin. Your benchmark may be different, and that's perfectly okay. I mentioned NVDA as it might be a common benchmark for many. While it's not my reference point, it's a valid choice for those familiar with it.

For some of you, your benchmark might be something unique to your field. For instance, if you run a construction business and sell dirt, you likely know how to profit from dirt very well. While I don't know much about this business, I do know that dirt can be expensive, and reputable contractors can make substantial profits. If a dirt dealer sought my advice, I would suggest they evaluate every investment opportunity—even Bitcoin—against their dirt business's potential.

The same goes for other niche investment opportunities: shoe resellers, wine collectors, antique dealers, vintage car enthusiasts, exotic pet enthusiasts, toy collectors, and more. I'm referring to people who treat these passions as investments, not just hobbies.

At the Bitcoin conference, I met many interesting people who shared their backstories. My advice to them, and to you, is always the same: stick to what you know works.

Now that we've established this baseline, let's add some nuance.

Measuring an investment against Bitcoin, NVDA, or any other benchmark requires considering the following: risks, timeframe requirements, potential returns, market volatility, liquidity, and your level of expertise and familiarity with the asset. Each of these factors plays a crucial role in determining whether the investment aligns with your goals and benchmarks.

Of all these variables, I can't overstate the importance of expertise and familiarity with the asset.

Expertise and familiarity enable you to understand and manage the other components. For example, merely reading about Bitcoin’s risks, long-term returns, and volatility won’t prevent you from panic selling during extreme market swings. Expertise and familiarity create a moat that protects your thesis and everything inside it.

An asset doesn't qualify as a benchmark if it falls short in any of these categories—whether it's high risk, low returns, poor liquidity, extreme volatility, unreasonable long-term commitments, or simply a lack of familiarity or experience. This means I’m not recommending Bitcoin as a benchmark for an investor who doesn’t understand it or already has something that works for them.

Should the dirt dealer consider learning about Bitcoin? Absolutely, if they have the time and interest. However, if they’re already successful in their field, I understand their reluctance to try something new. As Bitcoiners, we need to recognize that we're not always at the forefront of everyone's mind.

That said, I firmly believe that Bitcoin is the apex asset to use as a benchmark, and I hope that over time, everyone who cares about their financial future and well-being comes to realize this. Should our successful dirt dealer abandon their business for Bitcoin? Definitely not. They should continue to focus on what they know works for them. However, it would be wise for them to consider the longevity of their craft compared to the longevity of Bitcoin once they are ready to tackle that question.

Bitcoin is an apex asset, capable of withstanding economic collapse, geopolitical turmoil, and the test of time. While it can occasionally behave as a correlated, hyper-volatile, risk-on asset due to its relative infancy, its fundamental properties have sealed its value proposition like no other asset.

If you’re in this space and have done your homework, every current and future dollar spent on investments, both inside and outside this space, should be indexed against Bitcoin.

For investors not in this space, continue doing what you’re doing if you’re successful. The only way we’re going to win over Wall Street and the rest of the world is with a nonchalant attitude that is passionate but not overbearing, confident yet humble. We must demonstrate that Bitcoin is not just a trend but a fundamental shift in how we view and interact with money. Let our actions and results speak louder than any hype or promotion.

Bitcoin is the apex asset.

Up or down, let’s have a great week.

Bitcoin Thoughts And Analysis

The weekly view looks healthy. As you can see, we had a huge wick on last week’s candle and it closed grey, meaning higher than the week opened. This was the first test of the 50 MA as support since the break above in March, 2023. This is a beautiful mean reversion, a nice test of a line that should be touched in a bull run.

No worries here for now.

The “death cross” of the 50 and 200 MAs proved to be quite strong resistance. As I mentioned last week, I tend to ignore death crosses UNLESS they interact directly with price, which was the case here. Yesterday’s down candle was stifled exactly at the 50 MA before the drop.

That said, we had huge moves and volatility last week and have maintained most of the bounce. Not too worried for now, we always see some retracement after a sizable move.

I have no bold predictions - I think we will have an awkward August.

Legacy Markets

Global stocks struggled to maintain gains as traders prepared for a week of crucial US economic data, particularly Wednesday's inflation reading, which will influence Federal Reserve interest rate decisions. Europe's Stoxx 600 index and US futures declined, while BT Group Plc in London surged over 7% after Bharti Global acquired a 24.5% stake.

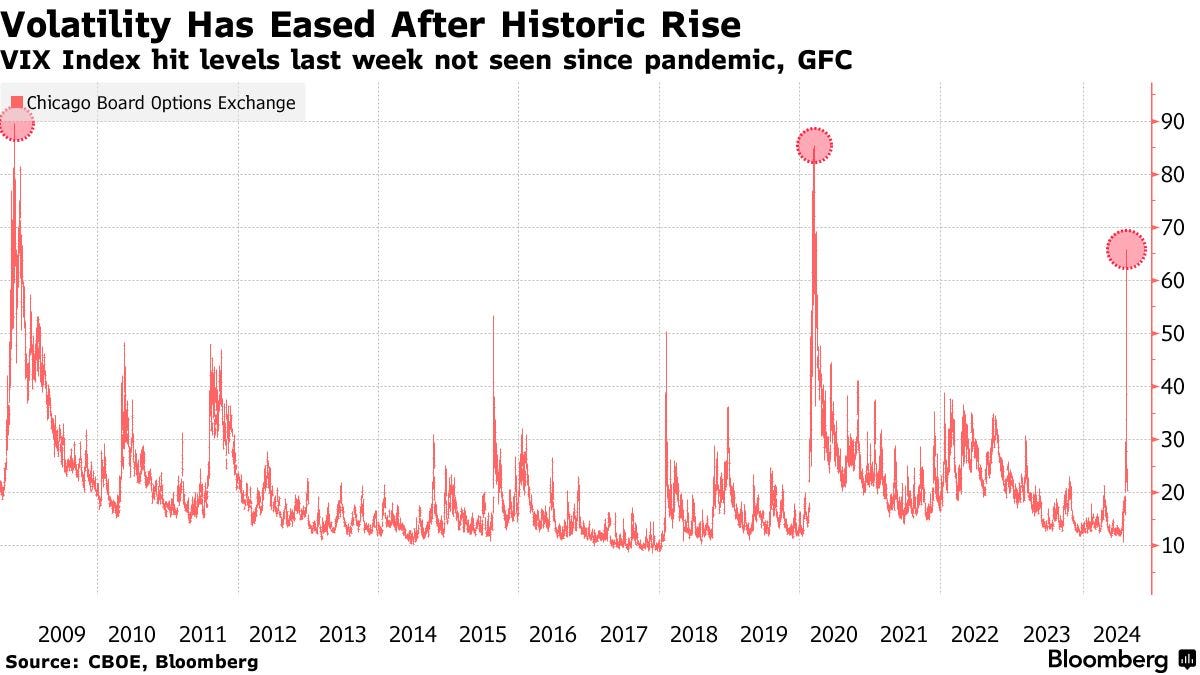

Despite last week's volatility concerns about delayed Fed rate cuts, the Cboe Volatility Index has decreased from its pandemic-era highs. Seema Shah from Principal Asset Management noted that strong household and corporate balance sheets might limit economic weakness.

The yen dropped significantly against the dollar following the Bank of Japan's rate hike on July 31, which disrupted global markets. Citigroup predicts the S&P 500 could move 1.2% in either direction upon the US inflation data release. Morgan Stanley's Michael Wilson highlighted that current equity multiples do not reflect the Fed's perceived lag, with economic growth being the primary concern.

Investors reduced their stock allocations at the fastest rate since the Covid-19 pandemic onset, with equity exposure now in the 31st percentile, according to Deutsche Bank. The US consumer price index is expected to rise by 0.2% from June, potentially insufficient to prevent a Fed rate cut next month. However, Fed Governor Michelle Bowman suggested she might not support a rate decrease due to inflation risks and a strong labor market.

The European Central Bank is projected to cut its deposit rate quarterly through next year, ending its easing cycle sooner than anticipated. Oil prices extended their weekly gain amid Iran's response to a Hamas leader's assassination, while gold prices edged higher as traders awaited key US data.

Some key events this week:

India CPI, industrial production, Monday

Australia consumer confidence, Tuesday

Japan PPI, Tuesday

South Africa unemployment, Tuesday

UK jobless claims, unemployment, Tuesday

Home Depot earnings, Tuesday

US PPI, Tuesday

Atlanta Fed President Raphael Bostic speaks, Tuesday

Eurozone GDP, industrial production, Wednesday

New Zealand rate decision, Wednesday

South Korea jobless rate, Wednesday

Poland CPI, Wednesday

UK CPI, Wednesday

US CPI, Wednesday

Australia unemployment, Thursday

Japan GDP, industrial production, Thursday

Philippines rate decision, Thursday

China home prices, retail sales, industrial production, Thursday

Norway rate decision, Thursday

UK industrial production, GDP, Thursday

US initial jobless claims, retail sales, industrial production, Thursday

St. Louis Fed President Alberto Musalem, Philadelphia Fed President Patrick Harker speak, Thursday

Alibaba Group, Walmart earnings, Thursday

Hong Kong jobless rate, GDP, Friday

Taiwan GDP, Friday

US housing starts, University of Michigan consumer sentiment, Friday

Chicago Fed President Austan Goolsbee speaks, Friday

Some of the main moves in markets:

Stocks

The Stoxx Europe 600 was little changed as of 10:35 a.m. London time

S&P 500 futures were little changed

Nasdaq 100 futures rose 0.2%

Futures on the Dow Jones Industrial Average were little changed

The MSCI Asia Pacific Index rose 0.1%

The MSCI Emerging Markets Index rose 0.5%

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro was little changed at $1.0925

The Japanese yen fell 0.5% to 147.32 per dollar

The offshore yuan fell 0.1% to 7.1820 per dollar

The British pound was little changed at $1.2755

Cryptocurrencies

Bitcoin fell 0.3% to $58,324.05

Ether rose 1.1% to $2,586.53

Bonds

The yield on 10-year Treasuries was little changed at 3.95%

Germany’s 10-year yield advanced two basis points to 2.24%

Britain’s 10-year yield was little changed at 3.95%

Commodities

Brent crude rose 0.7% to $80.22 a barrel

Spot gold rose 0.4% to $2,442.22 an ounce

Celsius Sues Tether

There are times when I try to take a middle ground on differences of opinion or perceptions of facts in the space, but this seems to be a time when picking a side is appropriate and right. Last Friday, we learned that Celsius, the bankrupt exchange that mismanaged about $5 billion worth of customers' funds, is now coming after Tether for a $2.4 billion shakedown.

Instead of just reading through the news articles, I skimmed through the complaint. If you have the time, I suggest you read it. You'll better understand the full-blown BS attack Celsius is leveraging against Tether. So far, all we have from Tether is a statement from Paolo Ardoino and a brief company news release dismissing the lawsuit as “baseless.” Over the coming weeks, there will be plenty more to come and probably new facts we aren't privy to now.

Anyway, the story goes that before Celsius went belly up—or was even on anyone’s radar—Celsius and Tether entered into an agreement where Tether loaned Celsius USDT in exchange for Bitcoin plus over-collateralization. The terms of that loan, referred to as the 'Token Agreement,' were negotiated between the executives and lawyers of both parties. So far, we have only seen Celsius present it in court.

In the complaint, Celsius details the terms as follows: “Celsius was entitled to ten hours to deposit additional collateral with Tether to fulfill that demand… Celsius posted collateral to Tether in Bitcoin, the value of the Bitcoin was initially required to be 140% of the value of the amount borrowed….Significantly, the Initial Token Agreement provided that no change or modification to the agreement would be valid unless made in writing and signed by the Parties—Celsius Network Limited and Tether Limited.”

Where things began to unravel is when Bitcoin’s price rapidly plummeted toward the end of 2022, triggered by news of Celsius's imminent bankruptcy. Celsius claimed that Tether breached their contract by demanding immediate collateral, which Celsius was in the process of providing. This action only intensified the pressure on the already strained exchange, as Tether prioritized its own interests.

I’m not a lawyer, but I have some thoughts on where this might lead once Tether presents its defense. The most apparent issue is that Tether, like others, discovered that Celsius was misleading its customers and operating more like a house of cards than a legitimate business. While I’m unsure of the legal grounds this provides Tether to justify breaking the contract, I suspect it could carry some weight in court—if not all the weight.

Tether likely feared that inaction would only exacerbate their means of recuperation. It seems to me that Tether made a preemptive move to avoid becoming just another creditor on Celsius’s bankruptcy list. Celsius pursuing Tether feels akin to bankrupt exchanges trying to claw back funds from individuals who acted in their own best interest in the final moments before the collapse—pure bullsh*t.

Additionally, I reviewed the 'Token Agreement' mentioned in the complaint and noticed specific thresholds that triggered liquidation. Was Tether obligated to give Celsius the full ten hours to possibly provide collateral on a loan that was rapidly falling below the agreed-upon amount? While this enters into the weeds, these are just some of the points I believe Tether will lean on for its defense.

Lastly, Paolo Ardoino said this on Twitter, and I want to emphasize it here: “When it comes to the safety of USDT users, without doubt our main priority and duty, Tether group has equity of nearly $12 billion. Even in the most remote scenario in which this baseless lawsuit will get somewhere, USDt token holders will not be impacted.”

Tether has faced far worse FUD than this and will be absolutely fine.

Operation Chokepoint 2.0 Is Still Alive

We have more proof that Operation Chokepoint 2.0 is still in full swing, driven by the Fed and the SEC. Customers Bank, known for working with prominent crypto firms like Galaxy Digital, Coinbase, and Circle, has come under fire from the Fed for allegedly failing to adequately monitor illicit activity, particularly with its digital asset clients. The Fed's enforcement agreement highlighted “significant deficiencies” in the bank's risk management and anti-money laundering practices.

Although Customers Bank only deals in U.S. dollars and does not directly engage in crypto transactions, it offers a blockchain-based payment platform, CBIT, to its crypto clients. This platform was scrutinized in the action. Essentially, the bank is catching heat for barely dipping its toes in crypto waters. The bank is now required to submit detailed compliance plans and notify the Fed of any new digital asset-related initiatives.

Trump And Musk - Tonight

The rumored interview in Nashville is confirmed for tonight. As of Sunday night, there hasn’t been an official release on the exact time or where to watch it. However, I’m sure links and details will be circulating soon, if not already by the time you’re reading this. While I don’t expect Bitcoin to be a major topic of discussion—if it’s mentioned at all—I wouldn’t be surprised to see some volatility leading up to and during the interview. This is Trump’s chance to reclaim some of the momentum Kamala has gained over the past couple of weeks. If the interview goes poorly, it could negatively impact equities and the crypto market.

Here’s Why It Is Insane To Be Against Bitcoin | Sheila Warren

Sheila Warren, CEO of the Crypto Council for Innovation, delves into how crypto shapes global politics and impacts the upcoming U.S. election. We discuss the challenges and opportunities in crypto regulation and why the U.S. must act quickly to remain a leader in this rapidly evolving industry. Discover what the future holds for Bitcoin, stablecoins, and central bank digital currencies as they become key players on the world stage.

My Recommended Platforms And Tools

Phemex - Exclusive for new users, earn up to 8800 USDT. Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '25OFF' for a 25% discount.

NGRAVE - ZERO is the most secure and user-friendly hardware wallet. If you aren't happy with your current crypto wallet, look no further than the ZERO.

Nord VPN - Get an exclusive NordVPN deal - 40% discount! It’s risk-free with Nord’s 30-day money-back guarantee. Protect your privacy.

Twitter - I spend most of my time on Twitter, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

TheWolfOfAllStreets.io - The most comprehensive collection of everything I have going on. Plus over 100 blogs and other exclusive content.

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.