Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Arch Public!

The Nasdaq is down, the S&P500 is down, the Dow is down, even Bitcoin is down.

Arch Public’s Gateway Algorithm is up +17.37% in the past 90 days.

Our algorithms perform exceptionally well in up or down markets. The proof is in the commitment to only take trades when the set up is ideal; patience is performance. These numbers, in a declining overall market are the real story.

Try Arch Public now! I've got a full write-up on its recent performance below!

In This Issue:

The ETH ETFs Could Be HUGE!

Bitcoin Thoughts And Analysis

Legacy Markets

Arch Public’s Gateway Strategy: Protection In Turbulent Markets

It Is Neck-And-Neck

Russia Legalizes Bitcoin Mining

Highlight From $HOOD

Crypto Shocker: XRP Skyrockets & FTX To Make Massive Multi-Billion Dollar Payouts

The ETH ETFs Could Be HUGE!

I really believe that crypto investors have the memory of a goldfish.

When the Bitcoin ETF debuted on January 11, it peaked at $48,969.37 that day. In the following two weeks, Bitcoin experienced a typical "buy the rumor, sell the news" decline as Grayscale investors offloaded billions of dollars' worth of GBTC, unwinding the carry trade and seeking lower-fee alternatives.

It took an entire month for Bitcoin to recover to its launch price and then begin its ascent to over $70,000.

You can see what I’m describing with the fancy artwork below. If someone makes an NFT of this, I want some of the $$$.

The lowest point following Bitcoin’s ETF launch was $38,521.89 on January 23, just 12 days after the launch—a 21.33% drop. However, by February 12, Bitcoin had rebounded from the selloff, closing at $49,958.22. This marked a new post-launch high before it began its epic run to roughly $75,000.

After a 21.33% drop and 32 days, Bitcoin was back and ready for action.

Why am I sharing this? Well, Ethereum is doing something very similar right now, and of course, everyone has forgotten the past.

The Ethereum ETF debuted on July 23, with a high of $3,539.53 on that day. Following the launch, investors anticipated outflows from Grayscale’s Ethereum Trust, but they didn’t expect Jump, Wintermute, and Flow Traders to offload hundreds of millions worth of ETH or the yen carry trade to unexpectedly collapse, adding further pressure.

Ethereum hit a low of $2,122.55 on August 5, during the height of the downturn and has since recovered to around the $2,600 area. I’ve included a side-by-side comparison of the charts below. While I don’t expect these charts to mirror each other exactly—since we’re at different points in the cycle and unique factors are in play—I anticipate a similar pattern over time. Once the forced selling from Grayscale and market makers subsides, I believe ETH will follow a trajectory similar to Bitcoin’s.

I could have waited for everything to unfold and then shared it afterward. However, I prefer to present this to you now so it’s on your radar and something you can watch for over the next couple of weeks. I have made this prediction before - even preceding the launch of these ETFs. With 2.5% fees for Grayscale’s ETHE, the selloff was nearly guaranteed. I fired off the following tweet one day before the ETH ETFs launched.

It’s been just 17 days since the ETH ETF launched, roughly the same point where Bitcoin began its turnaround post-launch. Ethereum has dropped 40% from its launch price to its recent low, assuming that low is in. Currently at $2,600, it's only 33% of the way back to its launch price, suggesting there's still significant room for recovery.

Further, the ETH ETFs have seen steady inflows of late, even in the face of a market downturn. For some reason, few are reporting this.

Where things could get particularly interesting is after Ethereum clears out the selling pressure. Following Bitcoin's return to its launch price of $49,000 in just one month, the price surged to a peak of $75,830 on March 14, 2024, marking a 54.75% increase.

If Ethereum climbs back to the $3,500 range within a similar timeframe, I will be watching for it to replicate the pattern Bitcoin followed after its launch. If it does, this move could push Ethereum past its all-time highs, potentially reaching around the $5,400 mark.

Of course, things rarely work out this neatly. A 40% drop is difficult to endure, but severe setbacks set the stage for significant comebacks. Solana investors, in particular, should be familiar with this concept from the post-FTX period. After the collapse of FTX and Alameda’s selling, Solana's price fell below $10. It was from this low that a new wave of investors emerged, leading to an extraordinary 20x run.

Long story short…

Narratives follow price—it’s really that simple. If Ethereum jumped $1,000 today, people would be hailing it as ultrasound money again, even though nothing fundamentally changed. Solana didn't undergo a radical transformation between its late 2022 lows and early 2024 highs; it was the perception that shifted as the price climbed. While it did achieve some impressive milestones, the underlying technology was already in place.

Don’t get caught up in the drama. Bitcoin, Ethereum, and Solana are solid choices. Invest only what you can afford to lose and what lets you sleep soundly at night. This space will thrive with multiple chains, not just one.

Have a great weekend—I’m looking forward to returning Monday to see some recovered prices.

Bitcoin Thoughts And Analysis

Bitcoin had one of its largest bullish candles yesterday, which is not to be scoffed at. This was a significant move, but not on huge volume relative to the Monday sell-off.

The price recaptured the original range lows and broke above the $60,000 psychological level. All good news.

You will notice the impending “death cross” of the 50 and 200 MAs (moving averages). A death cross occurs when a shorter-term MA crosses down below a longer-term MA, viewed as a bearish signal. For me, these tend to be lagging indicators, reflecting past events. Moving averages are based on historical price action, so they are always behind.

That said, when you see the price actually interacting with the cross, it tends to act as resistance, at least in the short term. The fact that we have the death cross and price hitting those lines is worth noting, as most of these crosses happen far from the current price action.

Bulls want to see the range lows hold as support and these MAs broken.

Legacy Markets

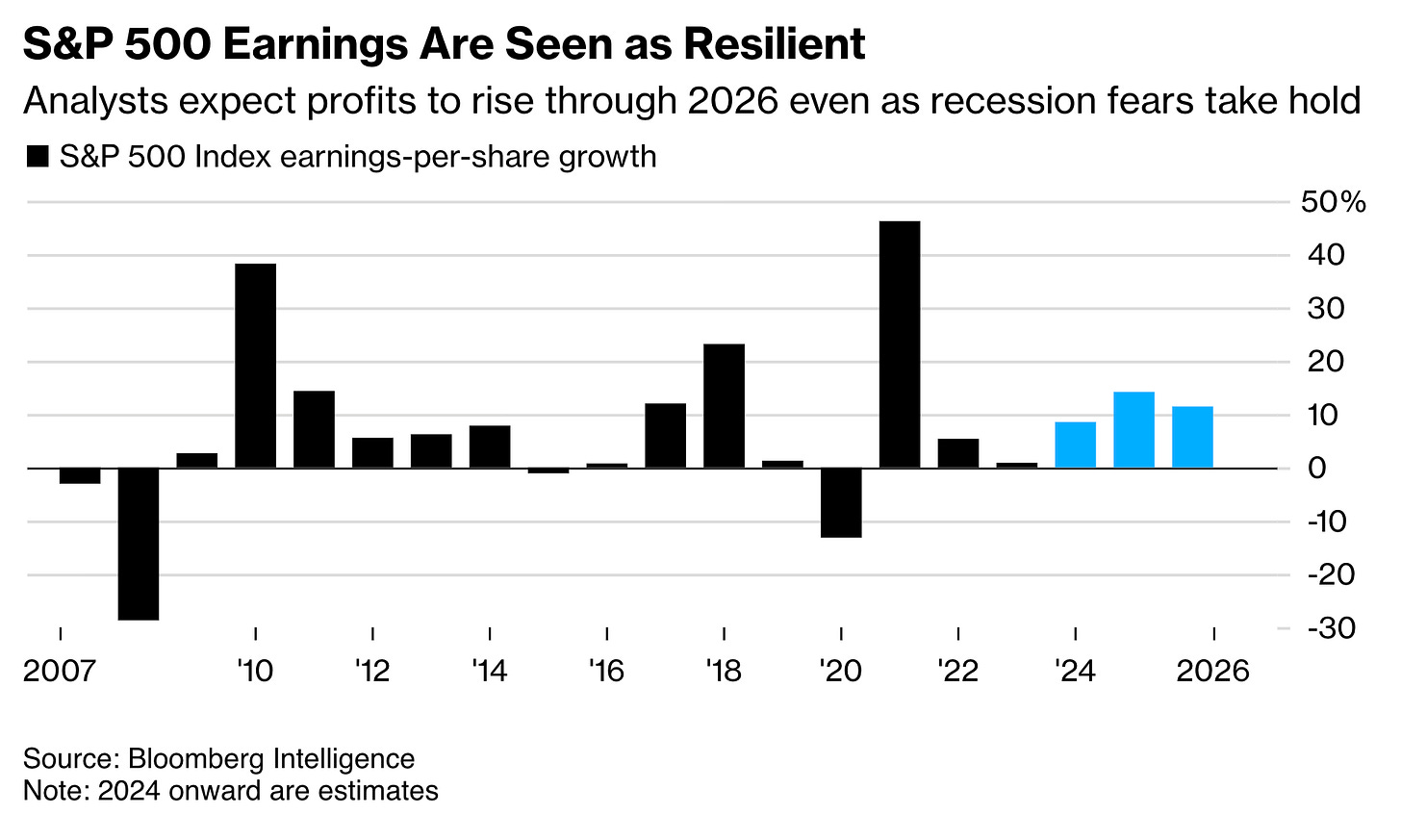

After a tumultuous week, stocks are making a comeback. US futures are edging higher following the S&P 500’s best day since 2022, with the S&P 500 futures indicating a 0.2% gain at the open, nearly wiping out losses from Monday's market meltdown. European stocks are positive, driven by bargain hunting. Treasury yields dipped, and the dollar weakened. Market volatility remains elevated, as noted by UBS Global Wealth Management’s CIO, Mark Haefele, who advises against overreacting to market sentiment swings. The S&P 500's loss for the week has narrowed to 0.5%, with investors eyeing upcoming US consumer inflation and retail sales data. In premarket trading, Expedia Group Inc. surged on strong Q2 results, while Paramount Global rose 7.1% after beating profit estimates. Mixed signals from US central bank officials and adjustments in interest-rate swap bets indicate caution. European stocks rose, led by real estate and miners, although trading volumes were below average. In Asia, the stock rally lost momentum, with Japan’s Topix index and Chinese shares turning flat. Unwinding of yen carry trades continues, with potential for the yen to strengthen further. Oil remained steady, and gold slipped amidst Middle Eastern tensions.

Some of the main moves in markets:

Stocks

S&P 500 futures rose 0.1% as of 6:17 a.m. New York time

Nasdaq 100 futures rose 0.3%

Futures on the Dow Jones Industrial Average were little changed

The Stoxx Europe 600 rose 0.7%

The MSCI World Index rose 0.2%

Currencies

The Bloomberg Dollar Spot Index fell 0.1%

The euro was little changed at $1.0920

The British pound was little changed at $1.2754

The Japanese yen was little changed at 147.17 per dollar

Cryptocurrencies

Bitcoin rose 2.1% to $60,783.56

Ether rose 3.4% to $2,657.91

Bonds

The yield on 10-year Treasuries declined three basis points to 3.96%

Germany’s 10-year yield declined three basis points to 2.24%

Britain’s 10-year yield declined three basis points to 3.94%

Commodities

West Texas Intermediate crude rose 0.2% to $76.32 a barrel

Spot gold fell 0.1% to $2,424.12 an ounce

Arch Public’s Gateway Strategy: Protection In Turbulent Markets

Arch Public’s Gateway Algorithm has been a relative safe haven over the past several months for investors. Yes, you read that correctly. We’ve discussed annualized returns of nearly 140% over the past decade, but total returns don’t tell the full story. What happens when markets whipsaw lower, and volatility rules the day, month, or quarter?

Risk mitigation and liquidity become paramount when downside risk and volatility inevitably appear and reduce static investments to ‘tax loss’ strategies.

In the past 90 days Arch Public’s Gateway Algorithm (S&P500) has returned better than 17% for clients. At no point in that 90 days has it taken a trade that resulted in a loss larger than -1.93%. Programmatic decisions disallow our strategy to take unwise trades, and our 2% stop loss protection protects every position to the downside.

Couple the above truths with 24/7 liquidity and you have an alternative asset that performs better than most.

The history of this strategy goes back a decade and has proven itself to be remarkably wise and resilient in tough market environments. This past week (and month) nearly every asset class has taken a hit; some more than others. Our Gateway Algorithm has not participated in the pain.

S&P500, Nasdaq, Dow, and Bitcoin are all flat to negative in the past month. Our Gateway Algorithm is up +17.37%. Join us.

Russia Legalizes Bitcoin Mining

Russian news agency TASS has reported that Vladimir Putin has signed a law legalizing cryptocurrency mining—which basically means Bitcoin mining—in the country. The law introduces key concepts such as “digital currency mining, mining pools, and mining infrastructure operators,” indicating a significant shift in Russia’s stance on crypto.

According to the legislation, only legal entities and individual entrepreneurs registered with the government are allowed to engage in mining. However, individuals can participate without registration if their energy consumption stays within government-set limits. Putin emphasized that Russia needs to “seize the moment.”

The law will go into effect in ten days—I am sure China is watching closely.

It Is Neck And Neck

People often forget that Polymarket is NOT available in the U.S. While I’m not certain how easy it is to access with a VPN, it has definitely become more challenging to use these tools to access blocked websites. It's important to consider that crypto users tend to lean right politically, but most Polymarket users are likely outside the U.S. and therefore not directly influenced by our political sphere.

My guess is that if Kamala rises in the polls on Polymarket, there will be speculation about a Democratic psyop, whereas if Trump pulls ahead, people might argue that the users are predominantly right-leaning. Given Kamala’s rapid ascent on the site, it’s becoming harder to argue that all users are blindly pro-Trump.

Highlights From $HOOD

This isn't a full breakdown of Robinhood’s earnings, but I have a few key crypto-related points to share.

Robinhood in Q2 did $21.5 billion in volume and $81 million in revenue.

Coinbase in Q2 did $37 billion in volume and $664.8 million in revenue!!!

There isn't a single component of the business that fully explains this gap, but it does highlight the unique models these companies have built. Coinbase is designed for profitability, while Robinhood currently remains in growth mode. Also, Robinhood isn't only crypto-focused, which is a very lucrative business.

As for the crypto arm of the business:

“Transaction-based revenues increased 69% year-over-year to $327 million, primarily driven by options revenue of $182 million, up 43%, cryptocurrencies revenue of $81 million, up 161%, and equities revenue of $40 million, up 60%.”

“Assets Under Custody (AUC) increased 57% year-over-year to $139.7 billion, driven by continued Net Deposits and higher equity and cryptocurrency valuations.”

“Crypto Notional Trading Volumes increased 137% year-over-year to $21.5 billion.”

Don’t forget, Robinhood recently acquired Bitstamp, though it will take some time before that generates revenue. Essentially, Robinhood is a bet on both an equities-driven bull market and a crypto bull market. If either materializes, I fully expect HOOD to rise significantly. Given how the stock reacted negatively to this week's sell-off, it could just as easily respond positively to a strong rebound—Robinhood is highly sensitive to market conditions. Additionally, major asset managers likely view Robinhood's weekly growth of one billion in net deposits as a threat. One last point, interpret it how you please: Cathie Wood likes HOOD.

Crypto Shocker: XRP Skyrockets & FTX To Make Massive Multi-Billion Dollar Payouts

Yesterday's court decision looks like a victory for Ripple, but Is the Ripple case finally over? I am joined by James Murphy aka MetaLawMan to discuss the implications of one of the most important cases in crypto.

In the second part of the show, Dan from The Chart Guys will share his market analysis and some trades.

My Recommended Platforms And Tools

Phemex - Exclusive for new users, earn up to 8800 USDT. Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '10OFF' for a 10% discount.

NGRAVE - ZERO is the most secure and user-friendly hardware wallet. If you aren't happy with your current crypto wallet, look no further than the ZERO.

Twitter - I spend most of my time on Twitter, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

TheWolfOfAllStreets.io - The most comprehensive collection of everything I have going on. Plus over 100 blogs and other exclusive content.

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.