Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Phemex!

Phemex is the most efficient crypto trading and investment platform. Phemex offers over 293 spot trading pairs, minimal fees, peer-to-peer trading, derivatives, up to 100x leverage, and $8,800 welcome rewards up for grabs! Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Make sure to check if Phemex is available in your jurisdiction.

In This Issue:

HELL

Bitcoin Thoughts And Analysis

Altcoin Charts

Legacy Markets

This Is Why We Need DeFi

Rate Cuts Are Coming

This Is Fake News

Bitcoin Crashes Below $50K Amid Global Market Turmoil! Black Macro Monday.

HELL

Welcome to hell. You have arrived.

No matter what you own today, your net worth just took a significant hit.

In another world, this sector would be dedicated to orange juice instead of orange coin, and we would be filthy rich. Unfortunately, that’s not the case here.

Yesterday, it got so bad that the CEO of Intel posted a Bible verse on Twitter.

Jokes aside, everything in the market got wrecked—unless, of course, you happened to be long the Japanese yen. Somewhere out there, someone is very happy looking at their portfolio because an outrageous bet just paid off. As for the rest of us, we got f**ked.

If you're reading this newsletter expecting me to be an overnight expert on the Japanese market and its impact on global markets, I have news for you—this isn't the place. That said, I am familiar with what a carry trade is and will attempt to connect some of the dots unfolding right now. This isn't an expert guide by any means, but I hope it sheds some light on the situation.

Much of what I’m about to share comes from my Macro Monday session, which we recorded yesterday morning. Even if prices have changed significantly by the time you read this newsletter, the discussions we had in that episode remain relevant. You should watch it after reading this.

What is a carry trade?

A carry trade is a financial strategy where an investor borrows money in a currency with a low-interest rate and invests it in a currency or asset with a higher interest rate. The aim is to profit from the difference between the borrowing cost and the investment return. This strategy can be profitable if exchange rates remain stable, but it carries risks, especially if the borrowed currency appreciates sharply or if the interest rate differential narrows.

In our industry, the most common carry trade has been the Bitcoin carry trade, which involved borrowing funds at low-interest rates to purchase Bitcoin, which investors believed would offer higher returns. This strategy became popular during periods when Bitcoin's price was rising significantly. The aim was to profit from the appreciation of Bitcoin's value, which would outpace the cost of borrowing.

If you are following along, the Grayscale cash and carry trade was an arbitrage strategy where investors bought Bitcoin and deposited it into the Grayscale Bitcoin Trust in exchange for GBTC shares. Traders believed these shares would trade at a premium to the actual Bitcoin value, and after a six-month holding period, investors would sell the GBTC shares at this premium while hedging with Bitcoin futures to protect against price fluctuations. The profit came from the difference between the premium on GBTC shares and the costs involved in buying Bitcoin and hedging.

So, what is the Japanese carry trade?

It’s actually quite simple—simpler than the Grayscale example.

Somewhere north of $20 trillion in value has been borrowed in yen to buy other assets. This has become a tradition of sorts as Japanese people have learned they can borrow yen to reach for yield by purchasing higher-yielding investments. As this strategy popularized, hedge funds realized they could leverage this strategy: with a billion dollars, they could borrow $10 billion or $20 billion, amplify it, and earn a calculated number of basis points by buying higher-yielding assets, eventually including the dollar and U.S. bonds. Leveraging that 10x could result in 30% annual returns compared to the fee. The real risk isn't a small currency move but a sharp, sudden one, which could wipe out the entire position before you can react.

This strategy worked for a very long time because Japan has maintained very low interest rates, often close to zero, for several decades. The BoJ adopted a zero-interest rate policy in the late 1990s and has since kept rates extremely low to stimulate economic growth and combat deflation.

Due to the USD crashing against the yen, traders who had borrowed billions in yen to buy dollars were unable to cover their debts.

Taking it one step further

You can see from the chart below that the yen has been in a free fall against the USD until around July 10th. This decline has persisted for over a decade, dating back to 2012.

Six days ago, the Bank of Japan stunned global markets by raising its interest rate to 0.25% from the previous range of 0-0.1%, marking its highest level since 2008. This move boosted the yen's value against the USD, which was already squeezing due to a weak U.S. jobs report, fear of rate cuts, and ongoing recession concerns in the U.S.

Japan’s Nikkei 225, a major stock market index similar to the U.S. Dow Jones Industrial Average, experienced its worst day since 1987, plunging more than 10% and dragging all other markets down with it. And what happens when traditional markets are closed on weekends? Fear builds, and there’s no opportunity to sell. As a result, investors rush to the one market that is open 24/7—cryptocurrency—and sell to begin recouping losses, igniting a wave of panic.

The pits of crypto hell

At this moment, I can’t help but compare our current situation to the March 2020 COVID crash. While COVID was an act of God, what we're experiencing now feels similar—powerful bankers acting as God—manipulating us with money.

On March 16, 2020, the U.S. stock market experienced its worst day since the 2008 financial crisis, with the S&P 500 falling by nearly 12% and the Dow Jones Industrial Average dropping by over 2,997 points, or 12.9%. During this period, Bitcoin also fell to around $5,000, prompting fears that it might drop to three-digit levels. That hell, compared to our current ‘hell,’ makes our current hell look like we’re sipping margaritas on the beach. There are levels to this.

Let me test your memory: Do you remember what happened to Bitcoin a year after its lowest point during the COVID-19 crash?

A 2x return? Wrong. A 3x return? Wrong. A 5x return? Wrong. Try over a 10x return. By March 14, 2021, Bitcoin was trading over $59,000, just shy of $60,000.

This, my friends, is a proper pullback—a classic unwind and clean deleveraging.

All of the necessary ingredients for an epic run.

I have seen a lot of people bashing Bitcoin for not behaving like a ‘store of value,’ and I want to briefly touch on this—the memes are very funny.

If you’re a Bitcoin maxi and still defending the ‘store of value’ thesis, you clearly aren’t maxi enough because the new trend is calling Bitcoin ‘the ultimate safe haven asset.’

Flip-flopping between viewing Bitcoin as a ‘store of value’ based on its current price action is a fundamental misunderstanding of this asset. Bitcoin is the safest way for investors to gain exposure to the crypto market, and within that context, it remains an excellent store of value for this sector. Furthermore, Bitcoin serves as an alternative to a broken system—in other words, value flowing into Bitcoin from other markets still affirms its role as a ‘store of value.’ Where it currently fails as a ‘store of value’ is comparing its value to other assets outside this sector.

As soon as Bitcoin starts outperforming again, we'll all revert to calling it a perfect store of value.

Whether we like it or not, an argument can be made that Bitcoin is just a high-volatility speculative risk asset. That said, it is also an unrestrained, free-market money, unbound by the constraints and failures of traditional financial systems.

And for those who aren't Bitcoin maxis, take comfort in the fact that Bitcoin didn't act as a ‘store of value’ compared to other risk assets. Meaning now you have new justification for your positions in Ethereum and Solana. Frame it however you like, this dip is yours for the taking: all quality crypto assets are likely going much higher a year from now.

And on that note, I want to end this segment with one final point.

As an investor, there are only a few moments in your life when the market offers extraordinary opportunities during a bull run. How you respond in these moments defines your investment journey. Did you panic and sell? Did you double down? Did you choose to do nothing and hold tight?

In a world where money printers are just a few lever pulls away, trips to hell rarely last. As long as the ability to print liquidity remains unchecked, the darkest phases are usually fleeting. Stay resilient and keep your focus—hell is where legends are made.

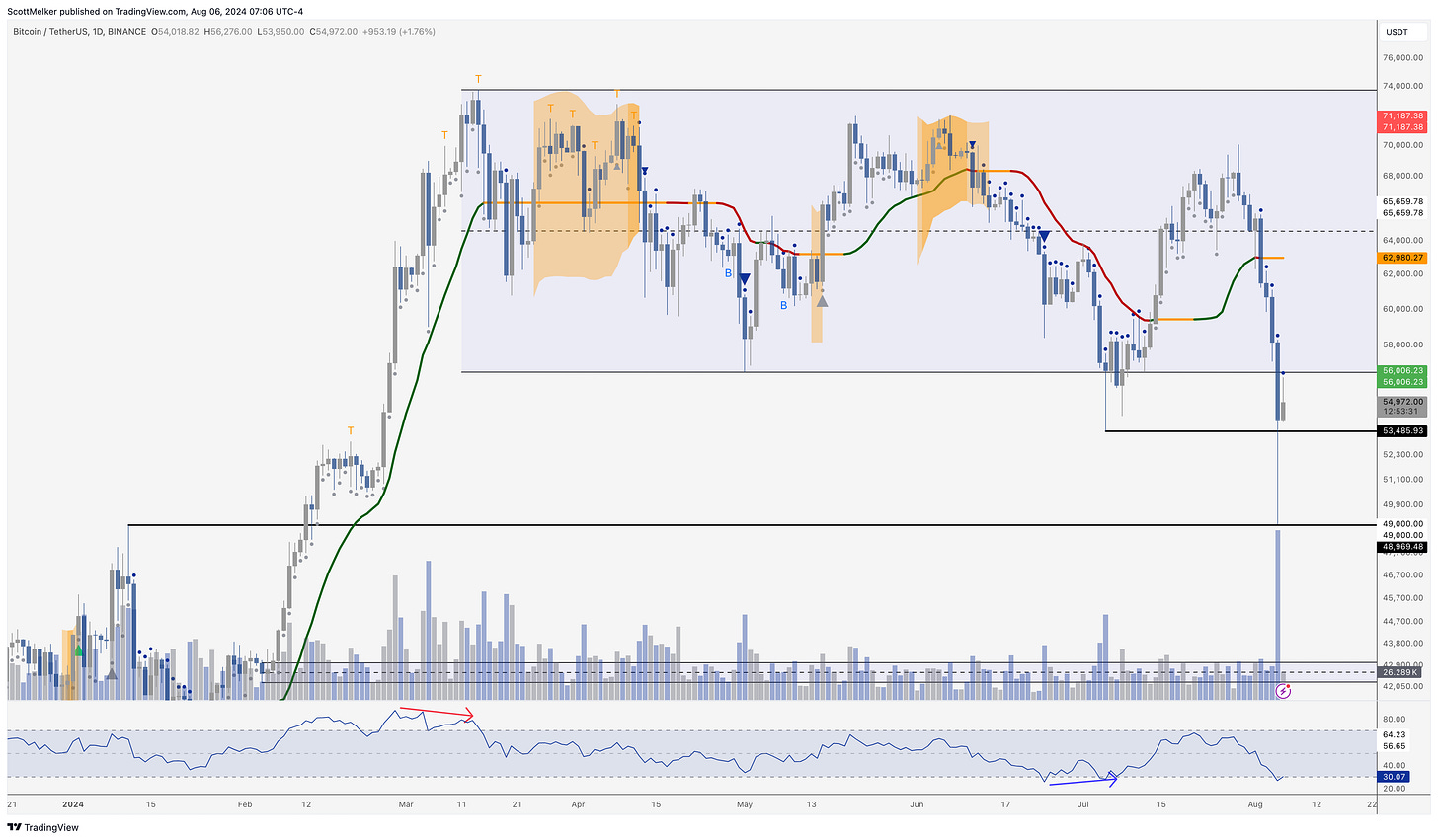

Bitcoin Thoughts And Analysis

We all saw the carnage yesterday. The range lows are lost, no matter how you draw them. We saw a decent bounce, but you almost always expect a 50% retracement of any dump as an immediate impulsive reaction. We are far from out of the woods.

On the flip side, the price bounced nicely off support around $49,000, almost to the dollar on Binance. The wick down also swept the previous lows at $53,845 from the early July drop. Closing above that line was a decent sign, but it needs to maintain as support. The RSI hit oversold on the daily, and lower time frames were very oversold. Another close lower on those time frames will inevitably give us bullish divergence with oversold RSI.

I think this is all going to take some time to shake out. The world is trembling, and we are not watching Bitcoin in a vacuum. Be patient.

Altcoin Charts

For those who are new here, I share SETUPS and not SIGNALS. These are ideas that I am watching - if a certain thing happens, then the trade triggers. I am not telling you what to buy or when. I am showing you how I am watching certain charts and what has to happen for me to take a trade.

This is NOT a suggestion to buy Solana, but rather an observation.

Solana once again bounced the hardest and led the recovery. This is important to note, because if you are being selective, you want to be in the strongest assets. Solana is currently trading higher than before the dump yesterday, which is quite impressive. It also never lost the range lows on a candle close, but rather swept them.

I do not think that every token will do well this cycle, so it is important to seek the best names. This is likely to continue to outperform throughout the next bull market.

Legacy Markets

Stocks experienced choppy trading as nerves remained high following Monday’s historic selloff. US equity futures pared gains while European stocks fell into the red, and the 10-year Treasury yield rose for the first time in nearly two weeks. Traders reduced expectations of early interest rate cuts from the Federal Reserve. Investor anxiety was evident as many rushed to insure their portfolios against a potential market crash, with the VIX index at its highest level in almost two years. In Japan, the Topix index surged 9.3% after a 12% drop on Monday, reflecting ongoing volatility. JPMorgan Chase & Co. indicated that the unwinding of the yen carry trade is only halfway complete, likely leading to more margin calls and losses. Despite the turbulence, some calm appeared to return to markets, and Goldman Sachs strategists noted that buying the S&P 500 after a 5% decline has historically been profitable. Jefferies' chief economist for Europe, Mohit Kumar, suggested that the recent market moves present a buying opportunity. In premarket trading, Palantir Technologies Inc. saw a significant stock increase after raising its annual outlook. Meanwhile, oil held near a seven-month low due to halted production in Libya, and gold steadied after being pulled into Monday’s selloff.

Key events this week:

China trade, forex reserves, Wednesday

US consumer credit, Wednesday

Germany industrial production, Thursday

US initial jobless claims, Thursday

Fed’s Thomas Barkin speaks, Thursday

China PPI, CPI, Friday

Some of the main moves in markets:

Stocks

S&P 500 futures rose 0.6% as of 6:29 a.m. New York time

Nasdaq 100 futures rose 0.7%

Futures on the Dow Jones Industrial Average rose 0.3%

The Stoxx Europe 600 was little changed

The MSCI World Index rose 0.3%

Currencies

The Bloomberg Dollar Spot Index rose 0.4%

The euro fell 0.4% to $1.0910

The British pound fell 0.6% to $1.2703

The Japanese yen fell 0.5% to 144.86 per dollar

Cryptocurrencies

Bitcoin rose 1.5% to $55,234.51

Ether rose 1.1% to $2,464.95

Bonds

The yield on 10-year Treasuries advanced five basis points to 3.84%

Germany’s 10-year yield declined three basis points to 2.16%

Britain’s 10-year yield advanced one basis point to 3.88%

Commodities

West Texas Intermediate crude rose 0.5% to $73.33 a barrel

Spot gold rose 0.1% to $2,413.85 an ounce

This Is Why We Need DeFi

Isn't it absurd that major brokers can go offline for hours during the most critical trading hours of the year without providing any explanation to their customers, and we're expected to accept this as normal? Yesterday morning, Charles Schwab, Fidelity, and Vanguard went down for several hours within an hour of the market opening, blocking tens of thousands of traders from accessing their accounts and possibly adding funds to prevent margin calls.

I understand that DeFi experiences its fair share of issues and blackouts, particularly during times of congestion, but the only real solution to address the problems in centralized systems is to innovate and push for more resilient, decentralized alternatives. Bitcoin, Ethereum, Solana, Bonk, and HarryPotterObamaSonic10Inu all continued trading just fine. The future is crypto.

Rate Cuts Are Really Coming!

I shared the following image in my Friday newsletter last week.

Now look at this screenshot, taken yesterday afternoon, of the same September 18, 2024 meeting.

Now look at this screenshot from PolyMarket.

As of now, I don’t see enough evidence for there to be consideration of an emergency rate cut. That said, rate cuts are most definitely on the horizon.

This Is Fake News

I can understand how easy it is for someone unfamiliar with the details to fall for this misinformation. What’s frustrating is that the major accounts pushing this narrative likely know better but choose to ignore the truth for the sake of clicks. It will be interesting to see the flow numbers when they are released for these products. Additionally, the Bitcoin ETF, the largest ETF launch in history, is now underwater on average, and all ETH ETF holders are also in the red. Yesterday, the combined volume of Bitcoin ETFs reached $5.68 billion, nearly $1 billion more than their launch volume of $4.66 billion.

Bitcoin Crashes Below $50K Amid Global Market Turmoil! Black Macro Monday.

Join Dave Weisberger, Mike McGlone, and James Lavish as we break down what's happening in macro and crypto!

My Recommended Platforms And Tools

Phemex - Exclusive for new users, earn up to 8800 USDT. Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '25OFF' for a 25% discount.

NGRAVE - ZERO is the most secure and user-friendly hardware wallet. If you aren't happy with your current crypto wallet, look no further than the ZERO.

Nord VPN - Get an exclusive NordVPN deal - 40% discount! It’s risk-free with Nord’s 30-day money-back guarantee. Protect your privacy.

Twitter - I spend most of my time on Twitter, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

TheWolfOfAllStreets.io - The most comprehensive collection of everything I have going on. Plus over 100 blogs and other exclusive content.

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.

Your excellent work..so well written and concise..which is FREE to all of us!, is a tremendous asset and comfort. Every time I read your newsletter I feel the same sense of deep gratitude. Thank you Scott!🙏🙏

Please consider adding Solana to your Crypto stats