Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s EPIC Newsletter Is Made Possible By Arch Public!

The Nasdaq is down, the S&P500 is down, the Dow is down, even Bitcoin is down.

Arch Public’s Gateway Algorithm is up +17.37% in the past 90 days.

Our algorithms perform exceptionally well in up or down markets. The proof is in the commitment to only take trades when the set up is ideal; patience is performance. These numbers, in a declining overall market are the real story.

Try Arch Public now! You can even demo the platform, for free, to learn more.

In This Issue:

The World Is Ending

Bitcoin Thoughts And Analysis

Altcoin Charts

Legacy Markets

MicroStrategy Plans To Buy A Lot More BTC

Coinbase Crushes Earnings

Be Careful Investing In Meme Coins

Bitcoin Will Dominate The Future Of Finance | Jurrien Timmer

The World Is Ending

It’s remarkable how fast things can turn around in crypto and markets in general.

It seems like just hours ago we were either glued to our screens or seated right in front of Trump, eagerly counting down the minutes until his announcement instantaneously materialized Bitcoin all-time highs.

Everything was going right at that moment. Elon Musk was supposed to return and revive his image within the crypto world. The Ethereum ETF was keeping a proportional pace, if not beating the Bitcoin ETF. Saylor sold us on the idea of a $49 million BTC price. Germany was out of Bitcoin, and Mt. Gox selling was slow.

Following that speech, a series of pivotal events unfolded: Senator Lummis introduced the Strategic Bitcoin Reserve bill, rumors emerged of Kamala Harris considering a crypto pivot, Morgan Stanley entered the scene, Coinbase reported strong earnings from a challenging quarter, MicroStrategy announced plans to acquire an additional $2 billion in Bitcoin, the SEC eased its stance on 11 tokens, Trump claimed we could eliminate the $35 trillion debt with a bit of crypto and Bitcoin, and Grayscale's ETHE outflows crossed the halfway mark.

Here’s the catch: none of this mattered—the market does what the market wants to do, and nothing is stopping it. Looking back on the timeline of our correction, it’s pretty easy to pinpoint when it all began.

As for equities, July 16th was just another day stock investors were spoiled with a new all-time high.

Then, July 17th rolled around, and out of nowhere, everything began to take a negative turn.

---

We were quickly hit with a triple whammy: a historically bad day for stocks, escalating geopolitical tensions, and a significant tech sector sell-off.

But it didn’t end there. In the following weeks, we saw a weak jobs report, Kamala Harris receiving her party’s endorsement and rapidly rising in the polls (markets hate uncertainty), increasing recession fears, weak earnings, falling treasury yields, a crashing yen, growing frustration with the Fed’s decision-making, and the expectation of multiple rate cuts by year-end.

And now we have Black Monday.

I'll emphasize this until it's crystal clear: if the Fed cuts rates out of necessity rather than favorable conditions, it will come at a cost. Continued sell-offs in stocks will accelerate the rates conversation with a pessimistic framing—not what we want to see.

Now it’s crypto time.

To start with, the sell-off we experienced this weekend was far from ordinary.

Arkham Intelligence revealed that Jump Trading was largely behind the sell-off, and at this point, very little is understood about the situation. Jump Trading knows that selling on a Sunday is generally a bad idea, as volumes and liquidity are typically at their lowest. However, it’s likely that Jump Trading didn't have that luxury. That said, Jump has now been selling for a couple of weeks.

As a kid, I was always told that nothing good happens after dark. As an adult, I’ve learned that nothing good happens in a crypto order book on a Sunday.

Setting the Jump situation aside, which I expect will quickly blow over, crypto is now caught in the crosscurrents of macro forces and no longer benefits from the tailwinds of a major Trump announcement. If you look at the Bitcoin chart, you will notice we were doing just fine right until the conference ended. And until the FOMC meeting. And until Japan started collapsing. And until oil prices began to drop.

Remember - almost all correlations go to 1 in a black swan event. The question becomes what asset you want to buy when markets bottom. In March 2020, Bitcoin bottomed and went up 17x, while stocks doubled.

Our hopes that Trump would mark a pivotal turning point for this industry were washed away, as he instead marked a short-term peak. As usual, nothing in this market is ever handed to us on a silver platter. For the record, the news from the conference was a huge step in the right direction, but I have my doubts that it will unfold as smoothly as it was presented. There’s too much time between now and when it might eventually unfold for there not to be a wide spectrum of variance and unaccounted-for changes to take place.

Additionally, there is growing fear that Kamala Harris's rising popularity will continue without her actively courting the crypto vote. If she manages to win the election without acknowledging the crypto community, we might as well pack it up and head home for four years—game over.

I like this perspective on what we're seeing right now:

I don’t have all the answers, but I think everything is going to be fine—it always is. I don’t want to see prices go any further down either, but a touch below $50,000 is not the end of the world and changes little for the future rise of Bitcoin.

What I find encouraging about our current situation is that the timeline is quickly filling up with FUD, and sentiment has sharply declined. You know you're getting close to a bottom when discussions rapidly shift from the current market structure to long-term doubts and debates about the 4-year cycle, super cycle, everything cycle, and Banana Zone.

For the record, I'm not suggesting we won't experience some fluctuations and bounces through the lows, but I do believe we are nearing the bottom of this correction in terms of depth. Of course, I could easily be wrong if the world lights on fire.

It’s easy to get caught up in the current price action and overlook everything we had going for us just a few weeks ago. Frankly, if we didn’t know the current price and were only considering the news, we’d probably be feeling quite optimistic. Given this, the best course of action right now is to keep dollar cost averaging and then close your portfolio, or simply step away for a few months and revisit later.

I hope this eases some of the pain. Pullbacks are normal and healthy.

The long-term arrow is still resolutely upward; nothing has changed that yet.

Bitcoin Thoughts And Analysis

Bitcoin went from $70,000 to $49,000 in 8 days. I guess it is still a volatile asset!

It's fair to say that Bitcoin is no longer simply ranging, which has been my base case since the top in March when I said this was likely to happen. Bitcoin has dropped 34% from the top to the current bottom—a real correction by any definition. We can no longer argue that we are having a far shallower correction in this cycle, and we certainly cannot count on the bottom being in.

Levels of support are drawn. You can see that on Binance, Bitcoin bounced right at a horizontal support level. If we lose this area, there’s not much support before $42,000 to $43,000.

The daily RSI is currently extremely oversold, so I will start looking for divergences. We have had them at most of the major tops and bottoms.

It's worth noting that today already has the highest volume since the all-time high, and it is only about 7 AM EST. This will be the highest volume day in recent memory—the sell-off is real.

*I think you all know that I have been generally hesitant to share charts as much as I used to. The upside is minimal, as we all know that they are just risk management tools to guide us on stop losses and making educated guesses. Being “wrong” is as likely as being right when doing technical analysis, so always take TA with a grain of salt. For 99% of people, simply dollar cost averaging with a long time horizon is the way to go.

Altcoin Charts

I have been saying for quite a while to simply avoid the altcoin market. The upside has largely been in Bitcoin, and any drop in Bitcoin clearly has disproportionate downside for alts. This is just not the right time in the cycle, although if you are looking to buy dips for the long term, I could not blame you for going shopping.

I know people want to be force fed charts, but that is not what I do.

Legacy Markets

Global stock markets experienced a significant selloff, with Japanese equities dropping 12% in a historic decline and Nasdaq 100 Index futures falling 4% (over 6% at one point). Concerns over a potential US economic slowdown intensified, prompting traders to bet on an emergency interest rate cut by the Federal Reserve, with the odds at 30% for a quarter-point reduction. The dollar weakened, the 10-year Treasury yield fell to its lowest in a year, and the CBOE Volatility Index reached its highest level since 2020. Major tech stocks like Nvidia, Apple, and Tesla fell over 7% in premarket trading, while Berkshire Hathaway slashed its stake in Apple by nearly 50%. This market turmoil followed a weak US jobs report and extended into Japan, where traders unwound carry trades, causing the yen to surge and the Topix index to suffer its largest three-day drop since 1959. Investors flocked to safe havens such as government bonds and the Swiss franc. Goldman Sachs raised the probability of a US recession to 25%, and traders now anticipate significant Fed rate cuts by year-end. The selloff impacted various risk assets, including an 8.4% drop in Taiwan's benchmark stock gauge, a decline in Brent futures to their lowest level since January, and a 10% drop in Bitcoin.

Key events this week:

US ISM Services index, Monday

Chicago Fed President Austan Goolsbee speaks, Monday

San Francisco Fed President Mary Daly speaks, Monday

Australia rate decision, Tuesday

Japan cash earnings, Tuesday

Philippines CPI, trade, Tuesday

Eurozone retail sales, Tuesday

US trade, Tuesday

New Zealand unemployment, Wednesday

China trade, Wednesday

Chile copper exports, trade, Wednesday

US consumer credit, Wednesday

ECB Supervisory Board member Elizabeth McCaul speaks, Wednesday

RBA Governor Michele Bullock speaks, Thursday

Philippines GDP, Thursday

India rate decision, Thursday

US initial jobless claims, Thursday

Richmond Fed President Thomas Barkin speaks, Thursday

Chile CPI, Thursday

Colombia CPI, Thursday

Mexico CPI, rate decision Thursday

Peru rate decision, Thursday

China PPI, CPI, Friday

Germany CPI, Friday

Canada unemployment, Friday

Brazil CPI, Friday

Some of the main moves in markets:

Stocks

S&P 500 futures fell 2.4% as of 5:50 a.m. New York time

Nasdaq 100 futures fell 4.3%

Futures on the Dow Jones Industrial Average fell 1.4%

The Stoxx Europe 600 fell 2.7%

The MSCI World Index fell 1%

Currencies

The Bloomberg Dollar Spot Index fell 0.3%

The euro rose 0.4% to $1.0955

The British pound fell 0.3% to $1.2767

The Japanese yen rose 3.1% to 142.03 per dollar

Cryptocurrencies

Bitcoin fell 12% to $51,865.01

Ether fell 17% to $2,280.63

Bonds

The yield on 10-year Treasuries declined five basis points to 3.74%

Germany’s 10-year yield declined six basis points to 2.11%

Britain’s 10-year yield declined three basis points to 3.80%

Commodities

West Texas Intermediate crude fell 3% to $71.91 a barrel

Spot gold fell 0.7% to $2,425.81 an ounce

MicroStrategy Plans To Buy A Lot More BTC

Along with the release of MicroStrategy’s Q2 results, the world’s largest public Bitcoin holder, plans to raise up to $2 billion by selling its class A shares from an August 1st filing—cough, cough, a lot more BTC buying is coming. The funds will be used for general corporate purposes, including acquiring more Bitcoin, though the specific allocation for Bitcoin purchases has not been detailed. In Q2, MicroStrategy bought 12,222 BTC for over $805 million, increasing its total holdings to 226,500 BTC at a cumulative cost of $8.3 billion.

Coinbase Crushes Earnings

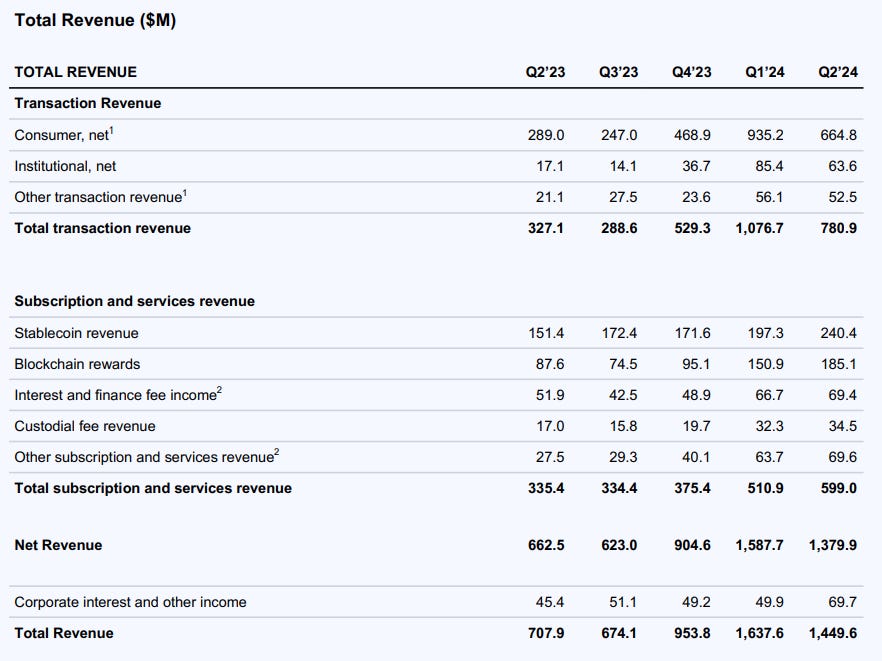

It's not difficult to understand why Coinbase performed worse in Q2 compared to Q1 with just a quick look at the Bitcoin chart. While Coinbase is a successful company, it remains significantly influenced by the market's performance, though perhaps slightly less so now then a couple of years ago. That said, don't let my caution mislead you; this is still a thriving company, and its numbers remain impressive despite the decline from Q1. I have below a side-by-side of Q1 to Q2 to help put the numbers in perspective.

First Quarter Opening Paragraph

“Our financial performance in Q1 reflects our focused execution on product expansion, ongoing operational discipline, and strong crypto market conditions. We generated $1.6 billion of total revenue and $1.2 billion of net income*. Adjusted EBITDA was $1.0 billion – more than we generated in all of 2023.”

Second Quarter Opening Paragraph

“We generated $1.4 billion in total revenue and $36 million in net income* in Q2. Adjusted EBITDA was $596 million, and Q2 marked our 6th consecutive quarter of positive Adjusted EBITDA. We are making good progress on diversifying our revenues, as subscription and services revenue reached nearly $600 million. Lastly, our balance sheet strengthened to $7.8 billion in $USD resources, up $733 million Q/Q.”

This text accompanied the Q2 image above in fine print—it deserves more attention: “Net income included $319 million in pre-tax crypto asset losses on our crypto investment portfolio, the vast majority of which were unrealized. These losses were $248 million after reflecting the tax impact.”

One area where Coinbase excelled was in subscription and services revenue, which is remarkable given the current market performance. That said, retail participation has yet to materialize, as illustrated by the second chart.

Look at Q1 and Q2 2021 compared to Q1 and Q2 2024, consumer interest now is sharply lower than where it was.

Coinbase's glory days are not behind us; they are very much ahead.

Be Careful Investing In Meme Coins

I don't keep up with the BitBoy drama; it's entirely off my radar. However, there's an important takeaway from this story: investors and traders need to think long and hard on the risks of meme coins. Not only are you placing your money into a casino, but the game can end abruptly, taking all your money before the house even wins.

The key story is that the CFTC issued a subpoena to Hit Network and is now investigating potentially fraudulent crypto activities conducted by unknown individuals, involving 15 tokens, including BEN—hence BitBoy’s involvement. As the space matures, fraud will be crushed by all federal agencies, regardless of the SEC's waning influence.

Bitcoin Will Dominate The Future Of Finance | Jurrien Timmer

Join Jurrien Timmer as he explores the current financial landscape, discussing Bitcoin's place in portfolios and the economic factors shaping our future. Learn why he thinks Bitcoin deserves a spot alongside traditional assets and what that means for the upcoming bull market. This episode offers an insightful look at market trends, the Fed's role, and the potential for a new financial era.

My Recommended Platforms And Tools

Phemex - Exclusive for new users, earn up to 8800 USDT. Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '25OFF' for a 25% discount.

NGRAVE - ZERO is the most secure and user-friendly hardware wallet. If you aren't happy with your current crypto wallet, look no further than the ZERO.

Nord VPN - Get an exclusive NordVPN deal - 40% discount! It’s risk-free with Nord’s 30-day money-back guarantee. Protect your privacy.

Twitter - I spend most of my time on Twitter, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

TheWolfOfAllStreets.io - The most comprehensive collection of everything I have going on. Plus over 100 blogs and other exclusive content.

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.

I think that the last few weeks was great to learn one simple thing: to have a bitcoin strategy that clearly separates you holdings into two groups: what I would sovereign BTC, your coins in self custody, from BTC as an investment. ETF has one major problem, that we just have seen: you cannot trade on weekends.

For your BTC in self custody just HODL. Do not do anything maybe add on dips.

But the investment part should be free from any narratives, good news for BTC, impact of politics, nothing should affect you decisions except technical analysis. Everything else, as this week clearly showed, is bullshit and will make you poorer than you could be. I learned it in hard way and still have not recovered. But this is only thing that makes sense: not long term investment in ETFs, just trading on the basis of tec analysis, level of support etc.. Trade it like anything else.

if crypto needs a grifter like T to survive then it deserves to die. Did you buy your $2500 gold BTC sneakers yet?