Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Phemex!

Phemex is the most efficient crypto trading and investment platform. Phemex offers over 293 spot trading pairs, minimal fees, peer-to-peer trading, derivatives, up to 100x leverage, and $8,800 welcome rewards up for grabs! Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Make sure to check if Phemex is available in your jurisdiction.

In This Issue:

Rate Cuts Are Coming

Bitcoin Thoughts And Analysis

Legacy Markets

$2 Billion Leaves ETHE

The Strategic Reserve Bill Is HERE!

An Inside Look At Backstage With Trump

EURC Launches On Base

Bitcoin Dumping As Battle For Control Of Crypto In The USA Rages On

Rate Cuts Are Coming

The Federal Reserve did nothing - again.

As widely anticipated, they made headlines by leaving interest rates unchanged, maintaining the target rate between 5.25% and 5.5%. Powell assured that any future rate cuts would be entirely unrelated to politics, stating, “We never use our tools to support or oppose a political party, a politician, or any political outcome.”

The question remains: what happens after the inevitable rate cut(s) later this year?

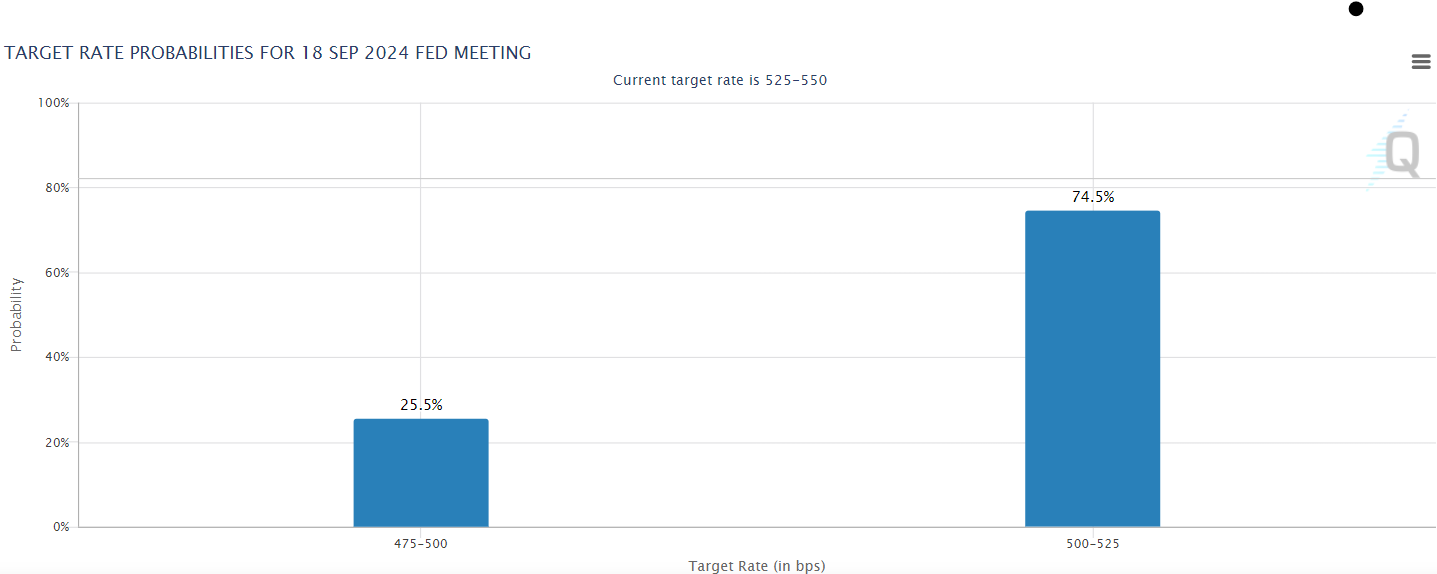

For starters, let’s examine what the market is predicting in terms of upcoming cuts..

September 18, 2024

November 7, 2024

December 18, 2024

And Polymarket, for good measure.

The market is quite sure that cuts are coming - and this time (unlike the past 18 months!), everyone is probably right.

I found an article titled “The Impact of Fed Rate Cuts on Stocks, Bonds & Cash” by Ben Carlson, which outlines his thoughts on the effects of the Fed rate cuts. Spoiler alert, I like his perspective, which I am about to share.

“The reason for the Fed rate cut probably matters more than the rate cut itself.”

If Jerome Powell steps on stage and signals that rate cuts are a response to economic weakness, it’s going to be bearish and the market will dump. The Fed often pivots because something is “broken,” leading to a stock market dive. We saw this in 2001 and 2007. Conversely, if rate cuts are framed as proactive measures to stimulate growth resulting from a successful soft landing, markets will likely react positively, indicating confidence in future economic improvement.

Here are two major scenarios to consider:

Rate cuts + Trump elected + lowered inflation + economic strength = BOOM

Rate cuts + not Trump elected + persistent inflation + economic weakness = BUST

Of course, many possible outcomes exist between these extremes, but these are the two major prevailing sentiments I’m observing.

Next, I want to highlight a chart from the article. Study it; it’s enlightening.

At a quick glance, you'll notice a lot of green in this chart, which really makes you stop and think. Of the 18 cuts dating back to 1970, there have only been a handful of periods where the market wasn’t up over 1 or 3-year periods, and it has never been down over a 5-year period.

This is including 11 recessions in the 18 cuts!

Look at the win ratios in the data above. A 64%-win rate in the 1-year period following a recession, as the lowest figure, is very impressive. So far, these two tables are mind blowing, and it only gets better from here.

The difference in returns after a Fed cut with a recession versus without a recession is negligible over 1-year, 3-year, and 5-year periods. While each rate cut comes under unique conditions, the overall trend is consistent: markets thrive on certainty. I believe the upcoming election and its potential turmoil will introduce more uncertainty to the market than a rate cut.

The takeaway? Markets generally trend upward. However, yields on various financial instruments are likely to trend downward. This doesn't refer to staking yields, but rather yields on money market funds, treasuries, CDs, corporate bonds, municipal bonds, and savings accounts.

Investors who gained exposure to these instruments when rates began to rise made a smart move, but yield-chasing investors missed out on significant gains in the stock market. The speed and extent of yield declines will depend on the rate of Fed cuts. The charts above suggest that the Fed might implement multiple cuts quickly.

When rate cuts occur, the stock market's direction could influence the crypto market. This will be especially true if we enter a recession, which I expect to be relatively short-lived.

In my opinion, conditions are set for crypto to finish this year explosively:

- ETFs are trading strongly.

- Wall Street is warming up to crypto.

- The halving is behind us.

- Inflation fears are subsiding.

- One political party is considering a crypto pivot, while the other is heavily invested.

- Strategic Bitcoin reserves are growing.

- The money printer is ready to turn on.

- Wire houses will finally unlock access to ETFs

How could you not be bullish?

Sure, uncertainties lie ahead, but if they play out favorably, significant moves are forming on the horizon. I believe the previous cycle was stunted by the China ban, so this cycle might be extended by favorable conditions in the U.S.

Patience will pay off: W—I—D—E—N Y—O—U—R H—O—R—I—Z—O—N.

Bitcoin Thoughts And Analysis

Bitcoin has been quite volatile over the past few weeks. As you know, it bottomed a month ago, hitting $53,485 on Binance. In a matter of weeks, it bounced aggressively and rose to $70,115 just days ago. Now, we are hovering around $64,000.

Are you not entertained?

Pulling Fibonacci levels for the move up from the lows, we see a healthy retracement, not even hitting the Dow level at 50% or the golden pocket around 61.8% yet. If we bounce here, this is a shallow correction on the recent move.

Long story short, I still see sideways chop and nothing to worry about.

Altcoins, however, continue to look awful and untouchable. I won’t force charts in that environment.

Legacy Markets

The global stock selloff has intensified, with Nasdaq 100 Index futures dropping 1.8% as concerns mount that the Federal Reserve has been too slow in cutting interest rates, coupled with disappointing earnings from major technology firms. The next significant market indicator is the monthly jobs report, anticipated to reveal slower job growth, which adds to the market's nervousness. Fed Chair Jerome Powell has indicated that rate cuts are likely in September, but some investors argue for more immediate action to prevent a deeper economic slowdown.

S&P 500 contracts fell 1.1%, while Japan's Topix experienced its worst day since 2016. A rally in Treasuries extended into a seventh consecutive day, with the two-year yield plummeting to its lowest in 14 months. Concurrently, the dollar weakened. Daniela Hathorn, a senior market analyst at Capital.com, noted, “The data is really starting to show signs of concern and that is what’s coming back to bite the Fed. They kept signaling they’d wait for the data, and that was fine until Wednesday, but yesterday’s data has investors fearing whether it waited for too long.”

Amazon.com Inc. slid 8.7% in premarket trading over concerns about rising costs to meet AI service demand. Intel Corp. plunged more than 22% following a grim growth forecast and plans to cut 15,000 jobs. Snap Inc. dropped 17% as its revenue fell short of estimates.

Forecasters expect the monthly US jobs report to show moderating job and wage growth in July, reflecting further softening in the labor market. According to a Bloomberg survey, payrolls likely rose by 175,000 last month, down from June’s 206,000 increase. Gary Dugan, CEO of the Global CIO Office, commented, “In coming days there may be even a discussion about whether the Fed will have to cut by 50 basis points at the next meeting in order to catch up with the loss of momentum in the economy.”

Risk assets have also been affected by lackluster earnings from companies like Microsoft Corp. and Amazon.com Inc., concerns over the sluggish Chinese economy, and reduced euphoria over artificial intelligence. Additionally, Middle East tensions have escalated following the assassination of Hamas’ political chief in Tehran.

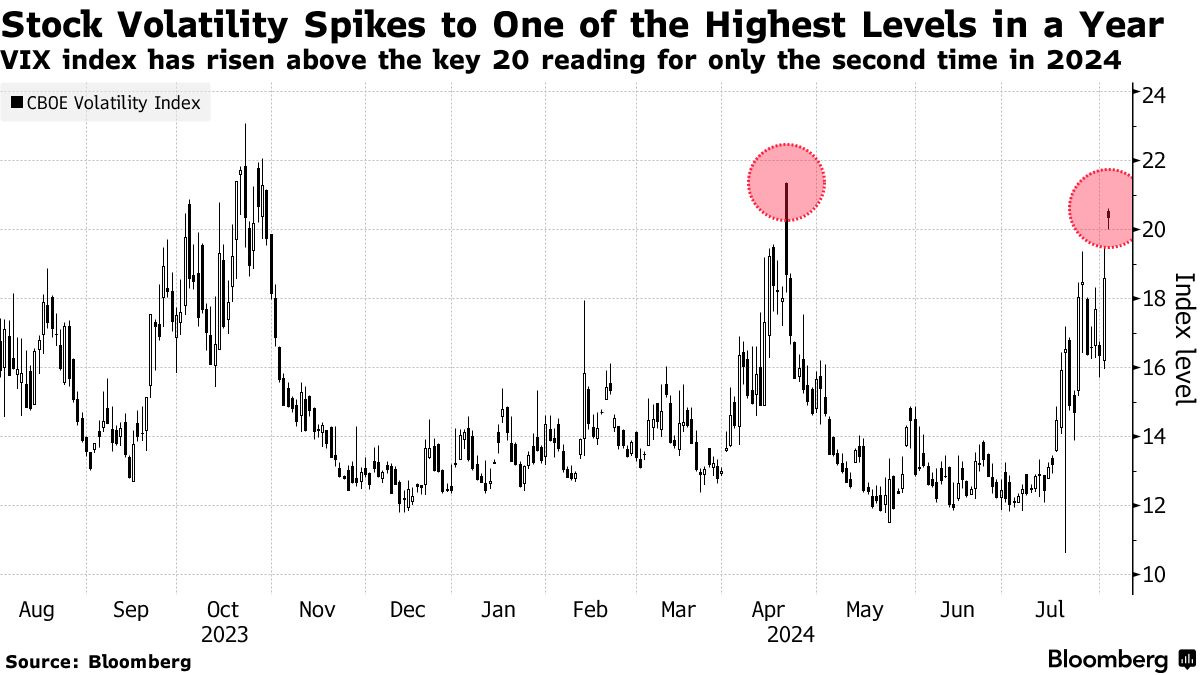

Markets are now anticipating the Fed to implement three consecutive quarter-point rate cuts in September, November, and December, with traders pricing in more than a 30% chance that one of these reductions will be 50 basis points. This has resulted in a volatile week for markets, with the VIX Index heading towards its highest closing level in nine months. The Nasdaq 100 has seen swings of at least 1.4% over the past three days. A gauge for the Magnificent Seven big tech companies was up 0.3% for the week through Thursday.

Mark Hafele, chief investment officer at UBS Global Wealth Management, advised, “We suggest investors brace for renewed volatility, but avoid overreacting to short-term shifts in market sentiment.”

Key events this week:

US employment, factory orders, Friday

Some of the main moves in markets:

Stocks

The Stoxx Europe 600 fell 1.5% as of 10:25 a.m. London time

S&P 500 futures fell 1.1%

Nasdaq 100 futures fell 1.7%

Futures on the Dow Jones Industrial Average fell 0.7%

The MSCI Asia Pacific Index fell 3.4%

The MSCI Emerging Markets Index fell 2.2%

Currencies

The Bloomberg Dollar Spot Index fell 0.1%

The euro rose 0.3% to $1.0824

The Japanese yen rose 0.3% to 148.95 per dollar

The offshore yuan rose 0.6% to 7.2073 per dollar

The British pound was little changed at $1.2735

Cryptocurrencies

Bitcoin fell 0.4% to $64,422.06

Ether fell 0.6% to $3,150.6

Bonds

The yield on 10-year Treasuries declined three basis points to 3.95%

Germany’s 10-year yield declined three basis points to 2.22%

Britain’s 10-year yield declined two basis points to 3.86%

Commodities

Brent crude rose 0.6% to $79.96 a barrel

Spot gold rose 0.6% to $2,461.67 an ounce

$2 Billion Leaves ETHE

I've calculated the total outflows from the Grayscale Ethereum Trust, which are just shy of $2 billion at the time of writing and are likely to have surpassed that mark by the time you read this. Initially, the Grayscale Ethereum Trust held approximately $10 billion worth of assets (2.9 million ETH) before conversion. Due to outflows and the drop in ETH’s price, the trust’s assets under management (AUM, non-GAAP) are currently around $6.7 billion. Considering the $1 billion seed for the Grayscale Ethereum ETF funded by the trust, along with the outflows, it's reasonable to conclude that we are more than halfway through the amount that needs to be sold.

The Grayscale Bitcoin Trust now holds nearly exactly half of the Bitcoin it had at launch, while the Ethereum Trust currently has 2,070,848 ETH compared to approximately 2,667,606 ETH at the start. I calculated these figures since I couldn't find the exact numbers online (don’t come after me if they are slightly off). Assuming my figures are close to the actual starting point, approximately 22.33% of the ETH has been sold—about halfway to the 50% mark where GBTC currently stands.

**TL;DR:** The ETH selling is already halfway over.

The Strategic Reserve Bill Is HERE!

I love the opening line of the Strategic Bitcoin Reserve Bill: “This Act may be cited as the ‘Boosting Innovation, Technology, and Competitiveness through Optimized Investment Nationwide Act of 2024’ or the ‘BITCOIN Act of 2024.’”

I thought this statement was interesting: “Prohibition on Immediate Sale.—No digital asset stored in the Strategic Bitcoin Reserve that is the result of a fork or airdrop may be sold or otherwise disposed of during the 5-year period beginning on the date of the fork or airdrop, unless explicitly authorized by law.”

I can imagine that Bitcoiners would prefer if anything other than Bitcoin were to end up in the vault, it would be sold immediately for Bitcoin. Based on my understanding of the bill's text, it seems that the reserve will take into account the 200,000 BTC already owned by the U.S.

“In General.—The Secretary shall establish a Bitcoin Purchase Program which shall: (A) purchase up to 200,000 Bitcoins per year over a 5-year period, for a total acquisition of 1,000,000 Bitcoins.”

And this…

“Beginning on the date of enactment of this Act, any Bitcoin under the control of any Federal agency, including the United States Marshals Service, shall—(1) not be sold, swapped, auctioned, or otherwise encumbered; and (2) upon the acquisition of legal title to such Bitcoin be transferred by the head of such Federal agency to the Strategic Bitcoin Reserve.”

As for the details on selling: “In General.—On the date that is one year before the end of the minimum holding period under paragraph (1), the Secretary shall submit to Congress recommendations on whether to continue to voluntarily hold or to allow for the gradual and controlled release of a portion of the holdings of the Strategic Bitcoin Reserve.”

This is immediately followed by a statement specifying that no more than 10% of the reserve can be sold in any 2-year period.

Now, for the finale: how the Bitcoin will be financed. Several methods are proposed in section 9, aimed at “offsetting the cost of the Strategic Bitcoin Reserve.”

These methods include reducing the discretionary surplus funds of Federal Reserve banks to $2.4 billion from $6.825 billion, Federal Reserve banks remitting earnings to the U.S. Treasury, and the revaluation of Federal Reserve banks' gold certificates to reflect their fair market value.

Coindesk describes the revaluation plan as follows: “Under the plan, within six months of enactment of the legislation, Federal Reserve banks would tender all of their outstanding gold certificates to the Treasury Secretary. Within 90 days after that, the Treasury Secretary would issue ‘new gold certificates to the Federal Reserve banks that reflect the fair market value price of the gold.’”

At this stage of the bill's progress, the focus should be on securing co-sponsors and building momentum ahead of the election. An endorsement from Trump before the election would create a significant boost in traction and visibility.

An Inside Look At Backstage With Trump

Gary Cardone, an up-and-coming figure in the crypto space, detailed his backstage experience with Trump on X, right before the speech. While the public only saw what happened on stage, Gary now offers us a glimpse into what took place behind the scenes.

“For one hour Trump listened to a group of 15 highly engaged Bitcoin investors, just prior to his speech in Nashville, asking us what we wanted and then Trump assured us he could deliver if we could; he would form a digital-focused committee empowered to make America the leader of innovation across the DAI (digital asset industry).

He further agreed not to sell the 210k BTC USA holds, would slap down and muffle draconian regulators/regulations, will focus on taxation related to Bitcoin, safeguard Self-Custody, and promised to never launch a CBDC. We have a seat at the table, people, with a collection of diverse and significant contributors to Bitcoin, from individuals to major corporations, all supporting Trump and his empowerment of this industry.

We have his attention and now due to his catalytic character, the world is listening, and he has promised personally to these 15 and the entire world last Saturday that he will deliver us what we want if we deliver the votes.”

It’s clear that the backstage meeting was highly productive and possibly one of the first instances where Trump received detailed insights from experts prepared to outline the needs of the crypto community.

EURC Launches On Base

Stablecoin issuer Circle has launched its euro-backed stablecoin, EURC, on the Base network, extending its reach beyond Avalanche, Ethereum, Solana, and Stellar. This marks the first time EURC is available on an Ethereum layer 2. Circle's strategic move aims to enhance e-commerce by simplifying global trade and facilitating forex transactions between euros and dollars. Notably, the Base versions of EURC and USDC Coin are the first stablecoins on Base to comply with the new Markets in Crypto-Assets (MiCA) regulation.

Bitcoin Dumping As Battle For Control Of Crypto In The USA Rages On

Why is Bitcoin falling? Who should be the next SEC chair? How to defeat Elizabeth Warren and why John E. Deaton should be the Senator of Massachusetts? James Murphy, aka MetaLawMan joins me today to discuss this and more.

My Recommended Platforms And Tools

Phemex - Exclusive for new users, earn up to 8800 USDT. Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '25OFF' for a 25% discount.

NGRAVE - ZERO is the most secure and user-friendly hardware wallet. If you aren't happy with your current crypto wallet, look no further than the ZERO.

Nord VPN - Get an exclusive NordVPN deal - 40% discount! It’s risk-free with Nord’s 30-day money-back guarantee. Protect your privacy.

Twitter - I spend most of my time on Twitter, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

TheWolfOfAllStreets.io - The most comprehensive collection of everything I have going on. Plus over 100 blogs and other exclusive content.

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.

چه عالی نقطه برگشت چندخواهدبود؟