Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Trading Alpha Releases A Brand New Product!

One of the partners of this newsletter, Trading Alpha, my trusted indicator and trading community, has launched their proprietary Indicator Search Engine for All Markets. This custom Indicator Screener scans crypto, stocks, and forex markets for Trading Alpha indicator setups, eliminating the need for time-consuming manual analysis. It can simultaneously screen for multiple indicators, enhancing confluence and providing advanced analysis capabilities across different markets. This is cutting-edge technology for serious traders.

Make sure to use my link HERE if you plan on giving it a try.

In This Issue:

If Bitcoin Was A City

Bitcoin Thoughts And Analysis

Legacy Markets

Tether Is Still Earning Billions

21Shares Teams Up With Chainlink

Bitcoin ETF Goes Global

This $13.2 Billion Asset Manager Is A Fan Of Bitcoin

$49,000,000 Per Bitcoin!?

If Bitcoin Was A City

In almost any city in the world, it is easy to tell that you're approaching a rough part of town: unkempt streets, dim lighting, and unsettling sights like public drug use.

Conversely, you can also tell when you're entering the nicer parts of town: well-maintained sidewalks, inviting architecture, and pristine storefronts.

Investing in crypto, much like navigating a city, isn't that different if you know what to look for and how to “read the room.”

If Bitcoin were a city, its architecture would be meticulously designed, characterized by symmetry, order, and precision. The metro system would operate with flawless regularity and reliability, never missing a stop. Each station would be impeccably maintained, reflecting the city’s commitment to cleanliness and efficiency.

Public services would function seamlessly, with every process and transaction carried out with mathematical exactness and top-tier security. In this city, every detail—from the street layout to the operation of essential services—would embody Bitcoin’s core values: stability, integrity, and meticulous design.

Now, consider Ethereum as a city.

Standing at the edge of an Ethereum city, you see a vibrant, ever-evolving metropolis defined by innovation and dynamism. The eclectic architecture blends futuristic designs with creative experimentation. Buildings of all shapes and sizes reach skyward, showcasing the latest in technological and architectural advancements.

The transportation system is swift and adaptive, with a network of high-speed trains and flexible routes that keep pace with the city’s rapid expansion. The streets are bustling with activity, filled with diverse crowds of builders, investors, and creators, all engaged in a constant flow of ideas and projects.

In terms of safety, Ethereum is generally secure, though occasional chaos erupts on the cutting edge of innovation. These moments often result in discovering improved paths forward.

But what about altcoins and shitcoins as cities? What would these look like?

Some altcoins, though few in number, would resemble small cities. Imagine Ethereum, but moving at an accelerated pace, with more dazzling lights and a higher degree of day-to-day unpredictability. These cities feature cutting-edge innovation clashing with both legitimate and illegitimate kingpins capitalizing on the daily activities of its inhabitants.

Other altcoins might initially seem like vast, bustling cities, but a closer inspection would reveal a totalitarian ghost town. Its inhabitants are drones, endlessly echoing the same superficial ideas, with no substance beyond the city's surface. The entire budget is spent on outward appearances, with no character or sense of identity—the city is a façade.

For the remaining 99% of altcoins, calling them cities would be far too generous. These communities resemble mini-apocalyptic wastelands, with radiation in the air, lead in the water, and scraps of food scarcely found amid mountains of trash. Inhabitants resemble a mix of religious zealots and early-form humans, with fighting as commonplace as conversations with inanimate objects.

The new inhabitants of these communities were sold a blatant lie: a brochure depicting paradise and endless riches. The original settlers, too emotionally blinded to see the truth and escape, aggressively convince newcomers to stay in a desperate attempt to salvage what little is left. Life in these 'cities' can persist for a long time, but eventually, everything of value becomes buried.

As investors, our most important job is to become experts at selecting which cities we settle into and ensuring we see them for what they truly are. This means critically assessing each opportunity, discerning between genuine prospects and deceptive facades, and making difficult judgments with limited information.

We can’t just settle for the first city that looks nice. We must enter each city with an open mind, remain critical, ask tough questions, and inspect the foundation. Are new ideas silenced? Are you threatened for leaving? Is there transparency in how things are run? Are the leaders accountable? Are visitors treated well or pushed aside for their diversity? Is it generally safe?

Investing isn’t as simple as finding a city that works; it also means understanding everything else out there to put yours into context. It requires maintaining a discerning perspective on the pride you begin to form and a willingness to settle down even amid constant advertisements for a better life just down the road.

My point: channel your life experiences into investing—it might just improve your decision-making by a small margin.

Bitcoin Thoughts And Analysis

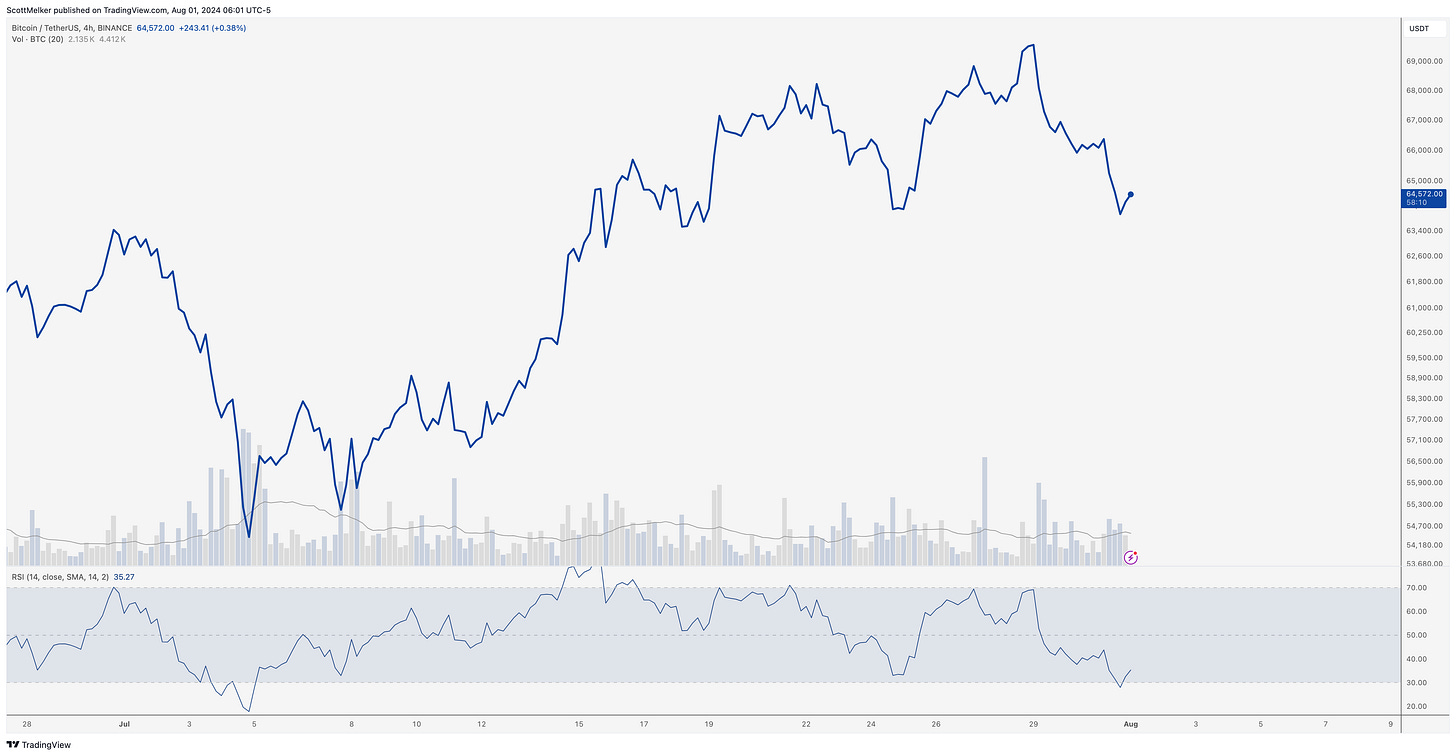

August is historically the worst month for markets. Bitcoin continues to chop, with little direction clear on charts and no particular reason to expect meaningful moves to either side. We have been watching this since March, so no surprises.

The 4-hour chat is oversold now, which usually means we watch for a bounce or bullish divergence.

Call me in September.

Legacy Markets

European stocks fell on Thursday, driven by disappointing earnings from automakers and financial institutions like BMW AG, Volkswagen AG, and Societe Generale SA. The Stoxx 600 index dropped 0.4% as these companies struggled with weak demand in China and internal challenges. Societe Generale's stock plummeted 7% due to poor retail unit performance, dragging down other banks such as HSBC and UniCredit. This decline highlighted the ongoing pressure on European companies amidst a challenging macroeconomic environment. Despite the downturn in Europe, US equity futures rose on dovish signals from the Federal Reserve and strong sales from Meta Platforms Inc. The market also anticipated jobless claims data and earnings reports from Amazon and Apple for further insights. Meanwhile, the Bank of England was expected to cut interest rates by 25 basis points. The dollar strengthened, Treasury yields increased, and oil prices rose following geopolitical tensions in the Middle East. Key corporate highlights included Societe Generale's trading revenue surge, Shell's earnings beat, Rolls-Royce's profit guidance increase, Barclays' share buyback plan, and Anheuser-Busch's sales decline.

Key events this week:

Eurozone S&P Global Eurozone Manufacturing PMI, unemployment, Thursday

US initial jobless claims, ISM Manufacturing, Thursday

Amazon, Apple earnings, Thursday

Bank of England rate decision, Thursday

US employment, factory orders, Friday

Some of the main moves in markets:

Stocks

The Stoxx Europe 600 fell 0.4% as of 10:51 a.m. London time

S&P 500 futures rose 0.3%

Nasdaq 100 futures rose 0.4%

Futures on the Dow Jones Industrial Average were little changed

The MSCI Asia Pacific Index fell 0.6%

The MSCI Emerging Markets Index rose 0.4%

Currencies

The Bloomberg Dollar Spot Index rose 0.3%

The euro fell 0.4% to $1.0783

The Japanese yen was little changed at 149.87 per dollar

The offshore yuan fell 0.3% to 7.2507 per dollar

The British pound fell 0.7% to $1.2764

Cryptocurrencies

Bitcoin fell 0.1% to $64,467.46

Ether fell 1.2% to $3,181.36

Bonds

The yield on 10-year Treasuries advanced two basis points to 4.05%

Germany’s 10-year yield declined two basis points to 2.29%

Britain’s 10-year yield declined three basis points to 3.94%

Commodities

Brent crude rose 0.8% to $81.49 a barrel

Spot gold fell 0.7% to $2,431.44 an ounce

Tether Is Still Earning Billions

Despite a sideways crypto market, Tether continues to impress. It released its Q2 attestation report, announcing a net operating profit of $1.3 billion for the quarter and a record net profit of $5.2 billion for the first half of the year. Also impressive is Tether's holdings of U.S. treasuries, which have surpassed $97.6 billion—a new all-time high for the company—making Tether the 18th largest holder of U.S. debt.

Paolo Ardoinio, Tether’s CEO released this statement in regard to the excess funds earned from the first half of this year, “Tether's management, in fact, decided to keep $5.33 billion in Excess Reserves as part of the stablecoin reserves (on top of the 100% reserves that are backing all issued tokens) to further protect USDt's global user base, accounting for hundreds of millions of people globally, with deep concentration in emerging markets and developing countries.”

Here are three other interesting facts I liked:

“Furthermore, as part of its steadfast dedication to transparency, the Group unveiled its consolidated net equity revealing an impressive $11.9 billion as of June 30, 2024.”

“In the second quarter, over $8.3 billion in USDt was issued.”

“Tether also ranks 3rd in purchases of 3-month U.S. Treasuries after the United Kingdom and the Cayman Islands. Given the trajectory of USDt adoption, it sees the potential of becoming 1st in the next year.”

21Shares Teams Up With Chainlink

21Shares US LLC, the recent ETH ETF issuer, is collaborating with Chainlink, a decentralized oracle network, to integrate Chainlink Proof of Reserve (PoR) for the 21Shares Core Ethereum ETF (CETH). This partnership aims to offer investors transparency into the reserves: “Through the integration of Chainlink's industry-standard Proof of Reserve solution, 21Shares offers clear visibility into the underlying ETH reserves of CETH, providing investors with increased assurances and confidence that CETH is backed by underlying ETH holdings.”

Further reading from the official press release, “21Shares selected Chainlink as the firm’s preferred decentralized computing platform due to Chainlink’s proven history enabling over $12tn in total value for onchain markets. Chainlink Proof of Reserve makes the real-time reserve data and reserve history publicly available through an offchain reserves feed that pulls reserves data directly from Coinbase – ensuring holdings are transparent yet secure, maintaining asset integrity, and building investor trust.”

The Bitcoin ETF Goes Global

Fidelity International has introduced the Fidelity Physical Bitcoin Exchange Traded Product (ETP) on the London Stock Exchange, becoming the latest asset manager to offer a digital asset product in the UK. Similar to Fidelity's U.S. Bitcoin ETF (FBTC), this ETP has a higher expense ratio of 0.35% compared to 0.25%. Available exclusively to professional investors, it joins other UK market offerings from 21Shares, WisdomTree, and Global X.

This $13.2 Billion Asset Manager Is A Fan Of Bitcoin

Just another multi-billion-dollar asset manager praising Bitcoin.

“Cantor Fitzgerald and all of its partners are a fan of Bitcoin. Does Cantor Fitzgerald own Bitcoin? A shitload of Bitcoin. My view is Bitcoin, like gold, should be free to trade everywhere in the world, and as the largest wholesaler in the world, we are going to do everything in our power to make it so. Bitcoin is the same as gold, and Bitcoin should trade the same as gold everywhere in the world without exception and without limitation” —Howard W. Lutnick, (billionaire) Chairman and CEO of Cantor Fitzgerald.

$49,000,000 Per Bitcoin!?

$49 million for Bitcoin - is it too much? What do you think? My guests, Zack Guzman, the founder of the Web3 media company Trustless Media and host of Coinage, Alex Tapscott, Managing Director of the Digital Assets Group at Ninepoint Partners are here to discuss this and more.

My Recommended Platforms And Tools

Phemex - Exclusive for new users, earn up to 8800 USDT. Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '25OFF' for a 25% discount.

NGRAVE - ZERO is the most secure and user-friendly hardware wallet. If you aren't happy with your current crypto wallet, look no further than the ZERO.

Nord VPN - Get an exclusive NordVPN deal - 40% discount! It’s risk-free with Nord’s 30-day money-back guarantee. Protect your privacy.

Twitter - I spend most of my time on Twitter, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

TheWolfOfAllStreets.io - The most comprehensive collection of everything I have going on. Plus over 100 blogs and other exclusive content.

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.