Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Phemex!

Phemex is the most efficient crypto trading and investment platform. Phemex offers over 293 spot trading pairs, minimal fees, peer-to-peer trading, derivatives, up to 100x leverage, and $8,800 welcome rewards up for grabs! Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Make sure to check if Phemex is available in your jurisdiction.

In This Issue:

“Our Louisiana Purchase Moment”

Bitcoin Thoughts And Analysis

Legacy Markets

The SEC Backs Down On Multiple Tokens

Are Solana’s Metrics Honest?

BlackRock’s CIO Praises Bitcoin and Ethereum

This Is Why Trump Likes Bitcoin

Get Ready: Institutional Giants About to Pour Billions into Crypto!

“Our Louisiana Purchase Moment”

Today, I intend to thoroughly analyze Cynthia Lummis's speech, which followed immediately after Trump's at Bitcoin 2024. Her address may be considered even more critical as it introduced the "Bitcoin Reserve Bill." Without further ado, let's dive in.

For those who haven't seen the talk, the video is available below. Additionally, you'll find a transcript of her speech accompanied by my commentary on each significant point.

"You know, before you all leave, have we got a present for President Donald Trump. Here it is, this is the Bitcoin Reserve Bill.

I'm reading from the text: ‘In the Senate of the United States, to establish a Bitcoin strategic reserve, a network of secure storage vaults, a purchase program, and other programs to ensure the transparent management of Bitcoin holdings of the federal government.’

My name is Cynthia Lummis, and I'm the Bitcoin Senator. When Satoshi Nakamoto, in January of 2009, mined the first Bitcoin, he brought about an asset that will change the world, and this is our Louisiana Purchase moment.

This Bitcoin Reserve that we're going to create will start with the 200,000 Bitcoin that President Trump just mentioned and pool it into a reserve stored in geographically diverse vaults, and that's only the beginning. Over five years, the United States will assemble 1 million Bitcoin, 5% of the world's supply.

And it will be held for a minimum of 20 years and can be used for one purpose: to reduce our debt.

This Bitcoin is going to be transformative for this country. As President Trump just said, we are printing too much money. We are spending too much money. We printed in 22 months during COVID the same amount of money that had ever been printed in the history of the United States. Well, no more. With a strategic Bitcoin Reserve, we will have an asset that, in that period of time before 2045, can cut our debt in half. And as Michael Saylor said yesterday, if we put $3.3 million in a Bitcoin Reserve, we will eliminate the United States debt. We will be debt-free because of Bitcoin.

This asset is transforming not only our country but our world, and the United States needs to be the global leader, as President Trump just said. And you know what? We don't have to raise taxes to do it. We have the funds now. This bill provides that not only will the asset forfeiture money be transferred into this Reserve, fulfilling President Trump's promise that he won't sell any Bitcoin, but we will convert excess reserves at our 12 Federal Reserve Banks into Bitcoin over five years. We have the money now, but we'll no longer be holding it in U.S. dollars, an asset that is designed to debase at least 2% per year. We'll be holding it in an asset that will grow in value, that throughout its history has grown 55% per year. This is the solution. This is the answer. This is our Louisiana Purchase moment. Thank you, Bitcoin.

It's your love of freedom, your innovation, your thoughtful design, your keeping this asset alive, well, free, and in support of individual sovereignty that is going to save America. Let's make America free again, Bitcoin. This is our present to the United States of America. Thank you.”

For starters, it was unexpected for Cynthia Lummis to take the stage right after President Trump, as her appearance wasn't on the conference agenda. It seems peculiar that this surprise was kept from Trump himself. We know it was a surprise because she framed the bill as a present for him. Wouldn't it have been more effective for him to be briefed on the legislation before his speech? While Cynthia Lummis is excellent, having Trump announce the bill, even if he simply read from the text, would have been far more impactful than hearing about it from Lummis.

The promise of the bill is fourfold:

Establish a Bitcoin strategic reserve

Create a network of secure storage vaults

Initiate a purchase program

Implement other programs to ensure the transparent management of Bitcoin holdings by the federal government

If Donald Trump assumes office, the U.S. retains its current Bitcoin holdings, and the bill is passed as presented, the government plans to purchase around 800,000 BTC over five years. This translates to approximately 160,000 BTC per year and about 13,333 BTC per month, aiming to reach a goal of 1 million Bitcoin within that period. It's worth noting that 5% of the total 21 million Bitcoin supply is actually 1.05 million, not exactly 1 million.

Let us now evaluate the potential cost of acquiring these Bitcoins, recognizing that this will involve considerable conjecture.

If the price of Bitcoin remained constant over the next five years, acquiring 800,000 Bitcoins at the current price of $66,500 each would amount to a total expenditure of $53.2 billion. However, this figure is likely to vary significantly, as Bitcoin's price is unpredictable and will likely be influenced by a new market cycle during this period, potentially averaging higher than $66,500. It could easily cost the U.S. government over $100 billion to acquire these Bitcoins.

Unfortunately, we do not have access to the actual language of the bill, so the implementation details remain uncertain. While I am not an expert on how the government manages its balance sheet across various agencies and banks, some credible individuals have already raised concerns based on the available information.

George Selgin, director emeritus at the Center for Monetary & Financial Alternatives at the Cato Institute, has stated, based on his conversations with Lummis, “the legislation only ‘indirectly’ involves the Fed and is not related to ‘bank reserves’ in the slightest. Instead, it is essentially a plan to have the U.S. Treasury purchase 1 million Bitcoins, or about $64 billion worth at today’s price.”

If you're interested in the technical details of this plan, check out the thread above. Since we don’t have the definitive language yet, I won’t dive too deep into this for now. Next, I'd like to discuss the Michael Saylor reference made by Lummis and explore what Michael Saylor said during his keynote.

"The question is: What's the United States' Bitcoin strategy? We could be normies, or you could be a 10-center, which is like buying 500,000 Bitcoin. You could buy a million Bitcoin, or if you're a double Maxi, it's 2 million Bitcoin. A triple Maxi means buying 4 million Bitcoin and then starting to sweep the surplus of the nation into Bitcoin.

And the consequences? Well, if you're a normie and you have great productivity growth with brilliant technology, and robots do all the work for us, you might still end up in debt. It just won’t get much worse. We need that. If you're a Maxi, you’ll pay off half the debt. If you're a double Maxi, you have a surplus. And if you're a triple Maxi, instead of owing $30 trillion, the nation has $30 trillion.

Bitcoin is not the solution to all our problems, but it is the solution to half our problems. The important point is that the other half is very complicated and will require a lot of people and energy. This half is simple to solve. Bitcoin is like cyber Manhattan, with hundreds of trillions of dollars of capital moving there. We’ll demonetize Russian tundra, Chinese real estate, and everything in Africa, along with all the underperforming assets that people bought but didn’t need.

You buy a Bitcoin, you’re essentially buying value, whether it's an oil building, a boulevard, or an entire neighborhood. That's the scale we're looking at right now.

I’ll leave you with a quote: Satoshi Nakamoto launched the Bitcoin network on January 3, 2009. On January 17, 2009—just 14 days later—16 months before Pizza Day, when Bitcoin was worth nothing and wouldn’t be worth anything for a while, Satoshi Nakamoto said, "It might make sense just to get some in case it catches on. If enough people think the same way, it becomes a self-fulfilling prophecy."

Never have wiser words been spoken. You're staring at a trillion dollars of proof, but there’s still a thousand X to come. You have more information at your fingertips now. The writing is on the wall: Bitcoin is the future of capital and the future of money. It might make sense to get some because it has caught on."

Lummis referenced Saylor to emphasize the transformative potential of Bitcoin for the United States. Saylor's remarks highlight various strategic levels of Bitcoin acquisition, each with differing impacts on the national debt. His vision underscores the importance of Bitcoin as a means to shift from traditional underperforming assets to a more dynamic and appreciating form of value. This perspective aligns with the broader goal of the Bitcoin Reserve Bill to leverage Bitcoin's growth potential for national financial stability.

At the end of Saylor’s speech, he presented two graphics outlining various strategies the U.S. government might employ to acquire Bitcoin. I recreated the second graphic (it was blurry) because it incorporates details from the first and is more relevant. If you’re puzzled by the 10% figure (I was), this quote provides clarity: “You can be a normie (which is not owning Bitcoin) you can be a ten percenter, that's kind of like buying 500,000 BTC…”

According to Michael Saylor’s calculations, if the U.S. acquires 1 million Bitcoin, we will reach the “maxi” level and reduce the debt by half, as Senator Lummis mentioned. This suggests that Michael Saylor likely played a role in shaping the strategy.

What gets interesting is that Senator Lummis made a reference that was botched, but we can infer her meaning. She mentioned that if we bought 3.3 million Bitcoin, we would eliminate the nation’s debt. To me, this suggests that decisions are still pending on the final draft of the bill and exactly how much Bitcoin the U.S. intends to buy. Perhaps the U.S. will aim to acquire 3.3 million BTC instead of 1 million. Who knows?

This may very well remain a secret until Trump is in office to avoid revealing the plans to other nations that might seek to front-run the U.S. There are many ‘what ifs’ involved, but I’d say we’ve never been closer to the U.S. buying Bitcoin, and that’s pretty damn cool.

As for the impact on Bitcoin's price, it’s very hard to say. Factors include competition from other countries, the FOMO generated among retail investors, and, of course, the direct effect of acquiring such a large amount of Bitcoin on its price. I don’t know what the end result will be, but at this point, it seems we can legitimately consider gold’s market cap to be threatened. According to Infinite Market Cap, this would require Bitcoin to exceed $800,000.

I believe these are likely outcomes for the next cycle, but things can change quickly, and nothing is set in stone. I hope this provides additional context to the most significant announcements from the conference. The world is evolving rapidly- I hope you are ready.

Bitcoin Thoughts And Analysis

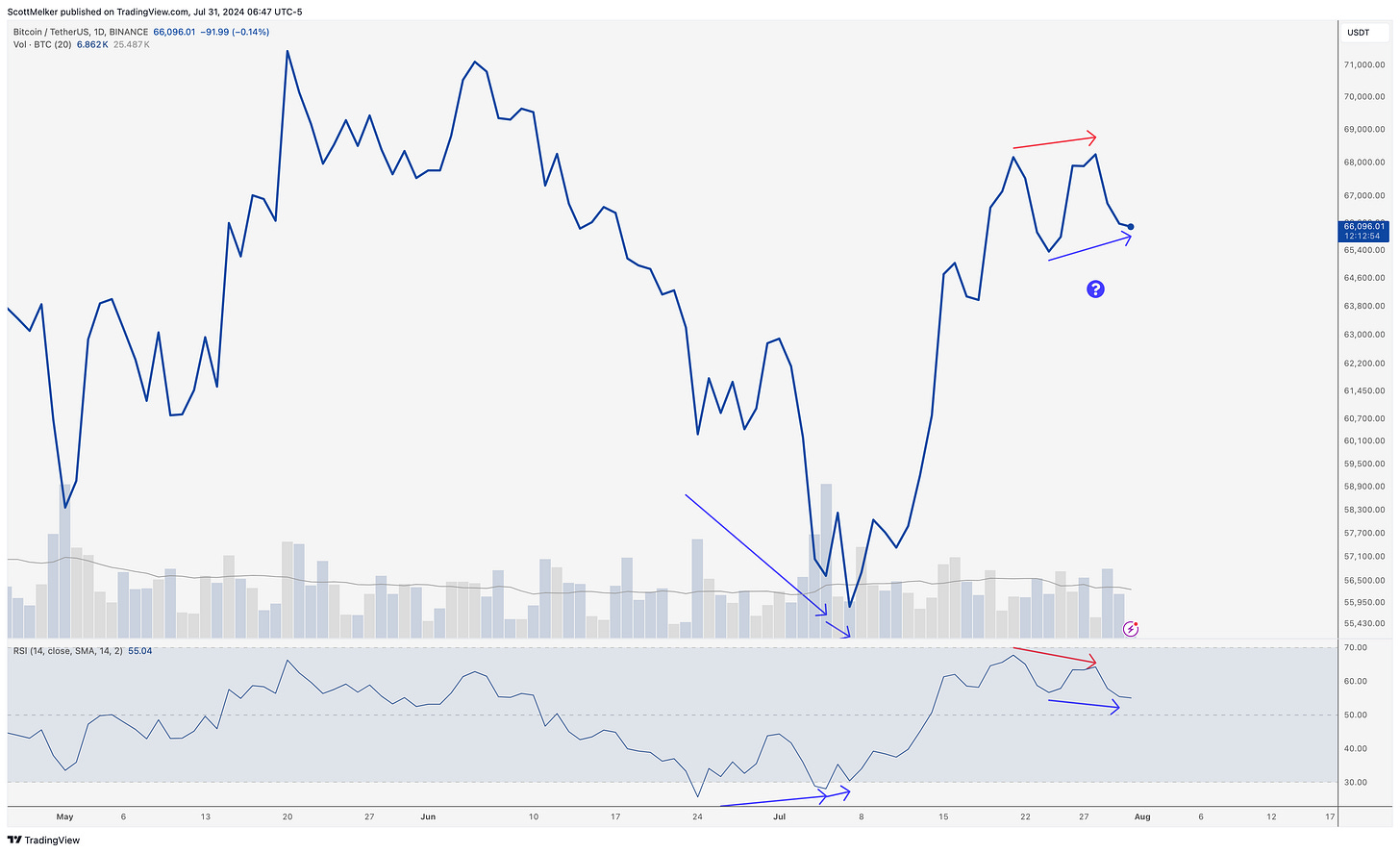

Bitcoin “could” confirm a hidden bullish divergence today, which I discussed yesterday, but we would need to see price rise and a clear elbow up on RSI. This would effectively “cancel” the bearish divergence.

Otherwise, we continue to chop around. Are you sick of me saying this yet?

Legacy Markets

Global stocks rallied, with Nasdaq 100 index futures jumping over 1%, driven by bullish news boosting technology stocks. ASML Holding NV surged 11% on reports of exemptions from US export restrictions for some countries. Advanced Micro Devices Inc. rose in pre-market trading on an optimistic revenue forecast, while Nvidia Corp. added 6% following a positive analysis from Morgan Stanley. Despite recent declines due to earnings not meeting high expectations and concerns about an AI bubble, tech stocks rebounded. The S&P 500 was set to open 0.9% higher, countering Tuesday’s decline. Federal Reserve Chair Jerome Powell is expected to signal a potential rate cut for September, and Meta Platforms Inc. will report earnings.

The Bank of Japan raised its benchmark interest rate, strengthening the yen and boosting bank stocks. The dollar declined against most G-10 currencies, while Treasuries remained steady. Oil prices rose following tensions in the Middle East, impacting Israel’s shekel and bonds. Corporate highlights include HSBC Holdings Plc's 4.1% gain following a $3 billion share buyback announcement, Starbucks Corp.'s 3% pre-market rise after strong earnings, and Microsoft Corp.'s early trading drop due to slower Azure growth. Uber Technologies Inc. announced a partnership with BYD Co. to introduce 100,000 electric vehicles to its platform.

Key events this week:

US ADP employment change, Wednesday

Fed rate decision, Wednesday

Meta Platforms earnings, Wednesday

Eurozone S&P Global Eurozone Manufacturing PMI, unemployment, Thursday

US initial jobless claims, ISM Manufacturing, Thursday

Amazon, Apple earnings, Thursday

Bank of England rate decision, Thursday

US employment, factory orders, Friday

Some of the main moves in markets:

Stocks

S&P 500 futures rose 0.9% as of 7:13 a.m. New York time

Nasdaq 100 futures rose 1.5%

Futures on the Dow Jones Industrial Average rose 0.2%

The Stoxx Europe 600 rose 0.9%

The MSCI World Index rose 0.5%

Currencies

The Bloomberg Dollar Spot Index fell 0.4%

The euro rose 0.2% to $1.0837

The British pound was little changed at $1.2844

The Japanese yen rose 1.5% to 150.49 per dollar

Cryptocurrencies

Bitcoin fell 0.2% to $66,059.51

Ether rose 1% to $3,312.72

Bonds

The yield on 10-year Treasuries was little changed at 4.13%

Germany’s 10-year yield declined two basis points to 2.32%

Britain’s 10-year yield declined three basis points to 4.01%

Commodities

West Texas Intermediate crude rose 3% to $76.94 a barrel

Spot gold rose 0.4% to $2,420.75 an ounce

The SEC Backs Down On Multiple Tokens

The market didn’t seem to react to this news, go figure, but it’s a significant step toward reforming U.S. securities law interpretations as they apply to cryptocurrencies. The image below explains the situation, though it’s quite technical. Essentially, the SEC is no longer asking the court to rule on whether the tokens named in its lawsuit against crypto exchange Binance are considered securities. The tokens in question are: $SOL, $ADA, $BNB, $BUSD, $MATIC, $ATOM, $SAND, $MANA, $ALGO, $AXS, and $COTI. This development is undoubtedly significant, yet the market isn’t pricing it in. Is this the direct result of Donald Trump’s speech? I don’t know. But it certainly helps to have him on stage declaring that Gary Gensler will be fired on day one.

Are Solana’s Metrics Honest?

This isn’t the first time I’ve encountered thorough research suggesting that Solana’s metrics may not be as they appear. Before dismissing this as mere ETH cope or attributing it solely to how the Solana ‘casino’ operates, I encourage you to consider an alternative perspective. Ethereum experienced its own meme cycle in the last cycle, and Solana seems to be going through a more intense version of that phenomenon.

“Considering both the abnormally high transaction-to-user ratio, and amount of wash trades/rugs onchain, it appears that the vast majority of trades are non-organic. The highest daily txn to user ratio on a major ETH L2 is 15.0x, on Blast (where fees are similarly low, plus users are farming Blast S2). As a crude comparison, if we assume the real SOL txn-user ratio is similar to Blast, that would imply that over 93% of the trades (and by extension, fees) on Solana are non-organic.”

“Objectively, it appears that retail is getting rekt to the tune of millions per day, by scammers, devs, insiders, MEV, KOL's, and that's before considering most of what they're trading on Solana are simply memes with no material backing. Its hard to argue against the fact that most memes will ultimately go the same way as $boden.”

“As usual, it's the guys selling the picks and shovels who are profiting from the Solana memecoin boom, while the speculators are getting rinsed, often unknowingly.”

“I believe that the commonly cited SOL metrics are significantly overstated. Furthermore, the vast majority of organic users are losing money onchain to bad actors at a rapid pace. We are currently in the mania phase, where retail inflows are still outpacing outflows to these sophisticated players, allowing for positive optics. Once users are fatigued from ongoing losses, many of these metrics will collapse quickly.”

BlackRock’s CIO Praises Bitcoin and Ethereum

Interviewer: “These big wire houses—Morgan Stanley, Wells Fargo, UBS—they’ve got trillions in advisor assets. Where are they in terms of onboarding these ETFs and even soliciting them?”

BlackRock CIO: “That is exactly what I think will be the story of this year and next year. They are doing their jobs, conducting risk analytics and due diligence, and really examining these ETFs. They look at them very differently, of course. What will happen towards the end of this year and into next year is that we will see allocations made in model portfolios, which will give us much more of a steer in how investors are using them.”

Interviewer: “Are we going to see a BlackRock Solana ETF?”

BlackRock CIO: “Not in the near term. We look at the investability to see what meets the criteria and the bar to be included in an ETF. Right now, in terms of investability and also based on what we hear from our clients, Bitcoin and Ethereum definitely meet that bar. But, it will be a while before we see anything else.”

This Is Why Trump Likes Bitcoin

Prior to the start of the conference, Trump had raised $4 million from crypto donations. However, during the conference, his total surged to $25 million, thanks to a private event that offered some highly expensive opportunities. According to the reservation RSVP, attending a “roundtable” with the former president cost $844,600 per person, while a photo was priced at a minimum of $60,000. Although these amounts might sound extravagant, this event turned out to be Trump’s second-highest fundraiser ever. Additionally, Trump was gifted a collectible Bitcoin at the conference by David Bailey, on behalf of the conference. Thus, the president is now officially a Bitcoiner.

Get Ready: Institutional Giants About to Pour Billions into Crypto!

Matt Hougan, the Chief Investment Officer of Bitwise, joins me today to provide his insights into what's going on with Ethereum ETFs.

My friends from The Arch Public, Andrew Parish, and Tillman Holloway, are joining in the second part of the stream to provide an update on the $10K algorithmic portfolio.

My Recommended Platforms And Tools

Phemex - Exclusive for new users, earn up to 8800 USDT. Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '25OFF' for a 25% discount.

NGRAVE - ZERO is the most secure and user-friendly hardware wallet. If you aren't happy with your current crypto wallet, look no further than the ZERO.

Nord VPN - Get an exclusive NordVPN deal - 40% discount! It’s risk-free with Nord’s 30-day money-back guarantee. Protect your privacy.

Twitter - I spend most of my time on Twitter, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

TheWolfOfAllStreets.io - The most comprehensive collection of everything I have going on. Plus over 100 blogs and other exclusive content.

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.