Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Arch Public!

Arch Public’s algorithms aren’t perfect. From time to time they will take losing trades. We’ve linked one below to prove it. The difference, though, is that 80% of our algorithms are coded with 2% stop loss protection. On any given day, in most of our algos, you can’t lose more than 2%. Join us!

Try Arch Public now! You can even demo the platform, for free, to learn more.

In This Issue:

Beating A Recession

Bitcoin Thoughts And Analysis

Legacy Markets

Day One Is In The Books (ETH ETF)

Ferrari Goes Full Crypto

Kamala Backed Out

Toyota Taps Ethereum

The Future Of Bitcoin & Why The Dollar Will Collapse | Lyn Alden

Beating A Recession

And that’s a wrap on Bitcoin 2024!

There's so much to discuss about the conference and Trump's speech, and tomorrow, I will deliver. I'm currently gathering my thoughts and getting my life back on track; this past week has been exhausting, to say the least. You may have noticed that I forgot to publish the newsletter I intended to release last week. That intro is below—it's still relevant, I assure you.

Before I share that intro, I want to thank everyone who took time out of their conference to say hi to me. Many of you shared personal stories, and I truly appreciate the connections made.

There is indisputable evidence that rate cuts in the past have preceded recessions. You don't even have to look back far to see this.

January 2001: The Federal Reserve began cutting interest rates in response to the economic slowdown following the burst of the dot-com bubble. Despite these cuts, the U.S. entered a recession in March 2001, which lasted until November 2001.

September 2007: The Federal Reserve started cutting rates due to initial signs of financial instability and a weakening housing market. Despite these preemptive cuts, the economy entered a recession in December 2007, which lasted until June 2009.

March 2020: The Federal Reserve made emergency rate cuts in response to the rapid economic slowdown caused by the COVID-19 pandemic. Despite these efforts, the economy entered a sharp recession in February 2020.

Without overthinking it, it’s not hard to sell the idea that a rate cut in September could lead to a recession shortly after. Of course, the past is not a perfect predictor of the future, but as Yogi Berra once famously said, “It's déjà vu all over again.”

In light of this, and with the stock market taking a hit yesterday, it's a good time to reel in the bullish hopium and address my go-to measures for beating a recession.

First Order of Business: Keep Investing for Retirement

Anyone who is not yet retired should maintain their pre-crisis strategy: passively investing and dollar-cost averaging into the stock market through tax-deferred funds like a 401K or IRA. While it’s scary to see your net worth drop, your retirement fund is focused on growing your capital over many decades. An economic crisis is more likely a buying opportunity than a selling opportunity when viewed with a long-time horizon. Just imagine, in 10 years, this downturn will likely be a blip, and the equities you purchased will have been obtained at a significant discount. Focus on the fact that stocks will recover, without worrying about when.

Second Order of Business: Increase Your Emergency Fund

Having emergency savings is always crucial. General financial guidance suggests having cash set aside to cover at least 3 to 12 months’ worth of living expenses in case one loses their job. Such a fund is even more essential during a global economic crisis. Assuming you still have income, it's a good idea to set aside some money to increase your cash savings for further emergencies.

Third Order of Business: Cash is King

As an investor and trader, I always keep at least 15% of my portfolio in cash—this is different from my emergency fund. Cash is an essential part of any portfolio and risk management strategy because its value increases during a downturn. If you have cash in your crypto portfolio and treat it as an asset, you will notice that the cash value of your portfolio rises when Bitcoin prices drop—because the cash is ‘beating’ Bitcoin. You need cash to be flexible and able to buy dips. Never be fully deployed.

In times of trouble, people want dollars. The dollar is still the only true safe-haven asset regardless of how many the Federal Reserve continues to print. It is the world’s reserve currency. This remains true even with record inflation, although it could change depending on that rate.

Fourth Order of Business: Buy Bitcoin

Any hedge fund manager or individual who performs a risk assessment of their portfolio should come to the same conclusion—buy Bitcoin. Bitcoin and crypto, in general, are arguably the only truly potentially uncorrelated assets in the world, meaning that their future value is not determined by the same underlying factors as everything else. This offers potential idiosyncratic risk in your portfolio, as opposed to the systematic risk from every other asset.

I personally believe that everyone should have a small investment in Bitcoin because it offers insurance against inflationary currency and bad actors. This is crucial for proper risk management.

Fifth Order of Business: Consider Alternatives Beyond Bitcoin

Nobody should be 100% invested in anything. Period. Even the most hardcore Bitcoin maximalist should have a diversified portfolio with exposure to multiple assets. Diversification is key to managing risk and ensuring that your investment portfolio remains resilient in the face of economic turbulence.

Bitcoin Thoughts And Analysis

Bitcoin looks great.

Price appears ready to attack the all tim highs, now that it is trading back in the top half of the range. That obviously is far from guaranteed.

Trading Alpha shows nothing but grey dots and a green trackline that is rising. Everything look good.

At the end of the day - it is still ranging!

Altcoins also look decent, but I honestly don’t see much reason to look beyond Bitcoin at this moment.

Legacy Markets

Key events this week:

McDonald’s, Monday

Microsoft earnings, Tuesday

European inflation and growth data, Tuesday

Australia CPI, Wednesday

Bank of Japan policy decision, Wednesday

Meta Platforms earnings, Wednesday

Fed interest rate decision and news conference by Chair Jerome Powell, Wednesday

Bank of England sets official interest rate, Thursday

Amazon, Apple earnings, Thursday

US tariffs are due to increase on an array of Chinese imports on Thursday, including EVs, batteries, chips and medical products

South Korea CPI, Friday

US employment, factory orders, Friday

Some of the main moves in markets:

Stocks

S&P 500 futures rose 0.3% as of 6:13 a.m. New York time

Nasdaq 100 futures rose 0.5%

Futures on the Dow Jones Industrial Average rose 0.3%

The Stoxx Europe 600 rose 0.5%

The MSCI World Index rose 0.2%

Currencies

The Bloomberg Dollar Spot Index rose 0.1%

The euro fell 0.2% to $1.0833

The British pound fell 0.3% to $1.2830

The Japanese yen was little changed at 153.77 per dollar

Cryptocurrencies

Bitcoin rose 2.1% to $69,425.13

Ether rose 3.9% to $3,387.9

Bonds

The yield on 10-year Treasuries declined four basis points to 4.16%

Germany’s 10-year yield declined five basis points to 2.35%

Britain’s 10-year yield declined seven basis points to 4.03%

Commodities

West Texas Intermediate crude rose 0.1% to $77.26 a barrel

Spot gold rose 0.2% to $2,393.01 an ounce

Updates On The ETH ETF

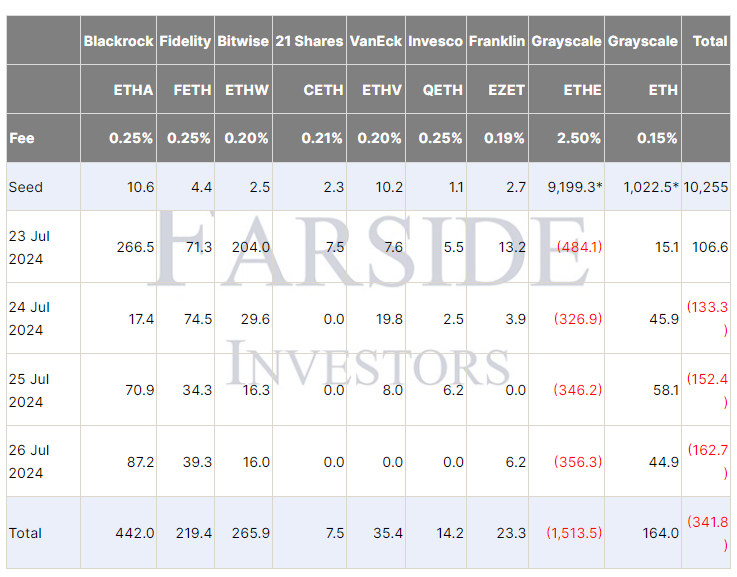

Despite being overshadowed by news from the Bitcoin conference, Ethereum had a remarkably successful week, even with significant attrition from Grayscale’s ETHE. On day one, $107 million in inflows might seem modest, but it’s significant considering Grayscale’s ETHE experienced $484 million in outflows. In contrast, GBTC saw only $95 million in outflows on the first day, as investors awaited the closing of the discount to NAV. Without outflows from ETHE, the total would have been $591.9 million, which compares favorably to Bitcoin’s $750.3 million if there were no GBTC outflows.

For the rest of the week, BlackRock’s ETHA continued to put up large numbers, and Grayscale isn’t taking its foot off the gas. Regarding trading volume, day one saw $1.05 billion, day two had $950 million, day three recorded $850 million, and day four matched day three.

Ethereum demand is real—so far—so let’s see if it lasts. Additionally, it appears we are going to get the outflows out of the way faster since ETHE closed its discount already, meaning investors don’t have to wait.

Ferrari Goes Full Crypto

Building on the success of Ferrari’s 2023 partnership with BitPay to enable crypto payments in the U.S., Ferrari is now extending this system to Europe starting this July. According to Ferrari.com, “By the end of 2024, Ferrari will expand cryptocurrency transactions to other countries in its international dealer network, where cryptocurrencies are legally accepted.”

Here’s how the partnership works: if customers pay in crypto, BitPay will automatically and immediately convert the crypto to fiat, meaning Ferrari won’t hold any crypto. While I don’t expect this to have any significant impact, it’s a cool step and a glimpse into the future of global crypto payments.

Kamala Backed Out

The Bitcoin Conference planners played Kamala Harris like a fiddle.

They effectively invited her to a conference that was likely never on her radar during the busiest week of her life, and then used it against her when she was unable to attend.

Even if she could attend… was it a wise move on her part to decline? Perhaps. Being booed off stage wouldn't reflect well, and it doesn’t seem like Kamala would have taken the opportunity seriously - not that Trump did in retrospect. There’s a lot to be said about Trump’s speech, but I doubt she would have considered the crypto community’s demands prior to her appearance at the conference: dropping the SEC cases, ending Operation Choke Point 2.0, firing Gensler, and pardoning Ross Ulbricht, to name a few. Considering the damage this administration has caused, it likely wouldn't have been a good look for Kamala to simply show up and hope to win a few votes.

Toyota Taps Ethereum

Toyota's Blockchain Lab is said to be considering the Ethereum blockchain to develop what it is call a Mobility as a Service (MOA) for its vehicles. As for what we know so far, “Toyota Blockchain Labs emphasized that mobility is recognized by integrating various information including ‘vehicle type, color, license plate, emblem, driving style, and driver’s expression.’” Although the news isn’t confirmed yet, Toyota seems to favor Ethereum among all other options, “We are excited about new proposals from the Ethereum community, including EIP-7702. While there are many challenges to the mass adoption of practical smart accounts, we are pleased to contribute to their use cases as a mobility company.”

The Future Of Bitcoin & Why The Dollar Will Collapse | Lyn Alden

In this must-watch episode, Lyn Alden unravels the mysteries of fiscal dominance, revealing how the Federal Reserve's policies could shape the future of the U.S. economy and Bitcoin. Dive into her riveting analysis of potential inflation waves and the looming challenges for both traditional and crypto investors. Discover Alden's visionary insights on Bitcoin's role as a future global reserve currency and the groundbreaking technologies driving its adoption.

My Recommended Platforms And Tools

Phemex - Exclusive for new users, earn up to 8800 USDT. Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '25OFF' for a 25% discount.

NGRAVE - ZERO is the most secure and user-friendly hardware wallet. If you aren't happy with your current crypto wallet, look no further than the ZERO.

Nord VPN - Get an exclusive NordVPN deal - 40% discount! It’s risk-free with Nord’s 30-day money-back guarantee. Protect your privacy.

Twitter - I spend most of my time on Twitter, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

TheWolfOfAllStreets.io - The most comprehensive collection of everything I have going on. Plus over 100 blogs and other exclusive content.

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.