The Wolf Den #1008 - Bitcoin Doesn't Need Heroes

They Come And Go...

Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Arch Public!

Our new Atlas Algo is off to a phenomenal start, having generated two back to back winning trades in July. Over the past five years the Atlas Strategy has averaged greater than 102% per year. As always, our algos take both long and short positions and employ tight (2%) stop losses to protect your capital. With limited spots available, get access to Atlas today!

In This Issue:

Bitcoin Doesn't Need Heroes

Bitcoin Thoughts And Analysis

Legacy Markets

Larry Fink Praises Bitcoin

The ETH ETF Is In One Week

Trump Selects His VP

Bitcoin Rises Amid Chaos In The US - Will The Rally Continue?

Bitcoin Doesn't Need Heroes

The past few days have been historic for American politics.

The following image has etched itself into the collective memory of Americans and will be a topic of discussion for generations to come.

This photo has me thinking: is Donald Trump truly our crypto hero? And are heroes beneficial for Bitcoin in the first place? To address these questions, we should start by cataloging what Trump has said about Bitcoin over the years.

In 2019, Trump tweeted:

In 2021, Trump said, “Bitcoin, it just seems like a scam. I don't like it because it's another currency competing against the dollar.”

Fast forward a few years…

At the Mar-a-Lago dinner this year, “If you’re in favor of crypto you’re going to vote for Trump because they want to end it. We have some incredible things happening, I mean crypto, if you go back to crypto a couple years ago, people said it wasn’t gonna make it but now it's up in record numbers. I guess you could say it's a form of currency and I think I’m for that, more and more I’m for that.”

And the tone only improved…

“We will defend the right to mine Bitcoin, and ensure every American has the right to self-custody of their digital assets and transact free from government surveillance and control.”

From the Republican Party Platform:

“Republicans will end Democrats' unlawful and unAmerican Crypto crackdown and oppose the creation of a Central Bank Digital Currency. We will defend the right to mine Bitcoin, and ensure every American has the right to self-custody of their Digital Assets, and transact free from Government Surveillance and Control.”

If you want to call Trump a potential hero in the Bitcoin community, I have no issue with that. The logic should be simple: anyone who stands up for Bitcoin, crypto, and the industry (regardless of status or power) as a whole can be viewed as a hero in my book. The concern arises when Trump isn't merely viewed as a hero but as a savior - that's where things get dicey.

Over the past couple of months expectations regarding what Trump will accomplish have grown to massive proportions: win the election, overhaul the SEC, protect Bitcoin, end Operation Chokepoint, promote industry-wide innovation, and ultimately lead the crypto market to an unprecedented run. I want these outcomes to happen as much as anyone else, but this line of thinking is perilous, as it lays the groundwork for black swans and centralized disasters.

Consider some of the heroes we made, and then were forced to slay - Mark Karpeles, Roger Ver, Craig Wright, Do Kwon, Alex Mashinsky and SBF. These are just a few prominent examples, yet there are countless others of respected individuals who faltered in their character arcs, ultimately letting down the followers that built them and dragging down the market in their demise.

I fear that crypto investors aren’t really carefully considering the catch-22: the more we rest on the laurels of Trump, the more we unravel the safety net we've spent years weaving together.

For the record, this is NOT a criticism of Trump. It's evident he is running, whether genuinely or as a political maneuver, on a platform that this industry has patiently waited many years for. HOWEVER, Trump is NOT the sole hope for Bitcoin.

Nobody is.

Thinking so is a vulnerable mindset that should be avoided at all costs. And the more this ideology permeates the market and fuels the next surge, the greater the risk we build of setting ourselves back an entire cycle and then some.

If Trump does win the election, remains in good health, and fulfills his promises to our community, it could lead to something monumental—let’s just avoid holding our breath until then.

And this goes without saying, but the image above shouldn’t be associated with Bitcoin.

As for the heroes in this space, there are many millions.

Heroes gently teach what they know to the next generation. They run nodes and contribute to the code as developers. They stood up to SBF and are now fighting on behalf of creditors. Heroes are the miners who selflessly distribute power back to the grid. Those that resisted the hard fork in 2017 and built Bitcoin Beach in El Salvador. Heroes are those who held through the bear market and occasionally closed their eyes to hit the buy button when there were a million reasons not to.

Bitcoin cultivates heroes; believing Bitcoin is too good for heroes ignores all the history that got us here in the first place.

It's natural to feel excited about what lies ahead, especially given how tirelessly we've all worked to reach this point.

But it is important to remember - nobody is our savior. That is the entire point of Bitcoin - to opt out of the system.

Bitcoin Thoughts And Analysis

Let’s look at this daily range differently.

I happened to pull the range lows down to the $56,000 bottom, rather than the one above $60,000 that was first made. As you can see, we have multiple instances of resistance and support at the dashed equilibrium - right where price was rejected today.

Always take TA with a grain of salt - you can do exactly what I just did… move lines and change the narrative. Still, it is often worth taking a solid look again after there is new price action.

The lower red line is the bottom of the old range. The higher red line is the EQ of the old range, for reference.

Regardless, price is struggling at the blue 50 MA now, after a sizable move up. No big deal. We should be happy price is back in all ranges and trading up. Some retracement is nothing for now.

Legacy Markets

US Treasuries rallied as traders grew confident that the Federal Reserve would start easing interest rates in September. The 10-year benchmark yield traded near its lowest level since March, reflecting this sentiment. Meanwhile, S&P 500 contracts remained steady, with markets anticipating US retail sales data for further indications on inflation and growth. UniCredit SpA strategists forecast three Fed rate cuts this year, starting in September, and advised positioning for a steeper yield curve. Fed Chair Jerome Powell indicated that inflation is moving toward the 2% target.

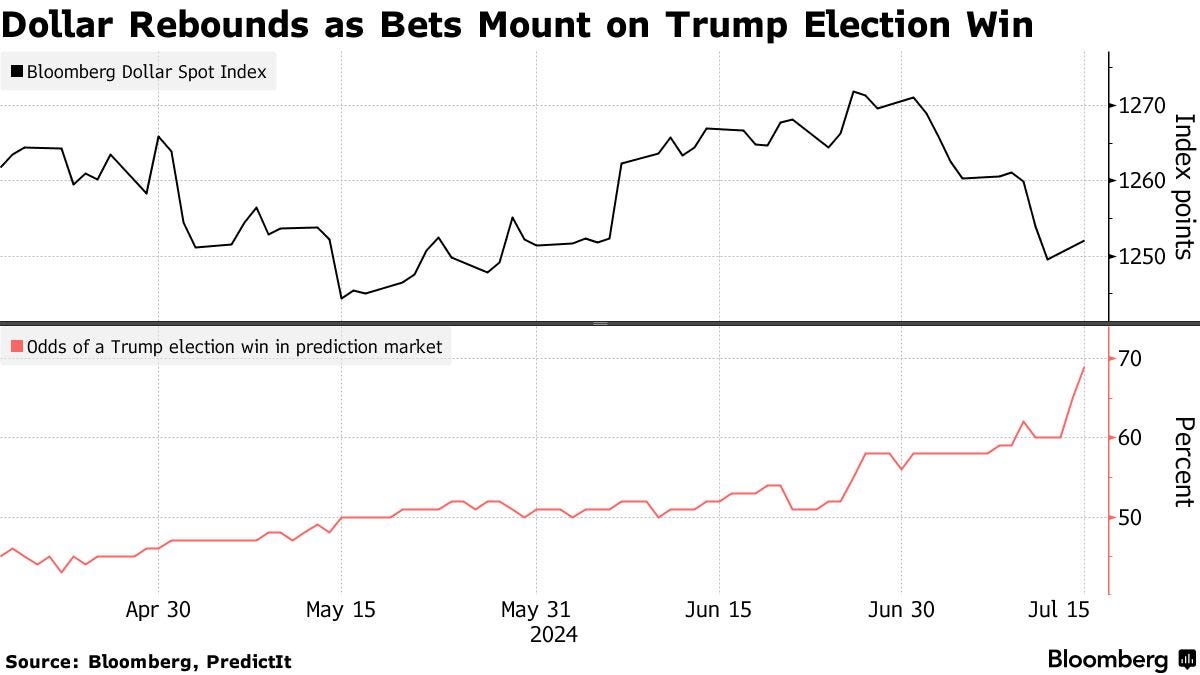

Additionally, earnings reports from Morgan Stanley and Bank of America Corp. are expected to impact market sentiment, following a strong performance by Goldman Sachs Group Inc. The dollar gained strength against most major currencies, influenced by speculation about Donald Trump's improved chances in the upcoming US presidential election, which also saw the yen weaken. China's markets dropped due to concerns over Trump's selection of JD Vance as his running mate and potential new tariffs on Chinese exports.

In Europe, equities fell as Hugo Boss revised its profit outlook downward due to weaker demand for luxury fashion. Miners, particularly Rio Tinto Group, also performed poorly after disappointing copper operation guidance.

Key events this week:

US retail sales, Tuesday

Morgan Stanley, Bank of America earnings, Tuesday

Fed’s Adriana Kugler speaks, Tuesday

Eurozone CPI, Wednesday

US housing starts, industrial production, Wednesday

Fed Beige Book, Wednesday

Fed’s Thomas Barkin speaks, Wednesday

ECB rate decision, Thursday

US initial jobless claims, Philadelphia Fed manufacturing, Conference Board LEI, Thursday

Fed’s Mary Daly, Lorie Logan and Michelle Bowman speak, Thursday

Fed’s John Williams, Raphael Bostic speak, Friday

Some of the main moves in markets:

Stocks

S&P 500 futures were little changed as of 5:33 a.m. New York time

Nasdaq 100 futures were little changed

Futures on the Dow Jones Industrial Average were little changed

The Stoxx Europe 600 fell 0.4%

The MSCI World Index fell 0.1%

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro was little changed at $1.0897

The British pound was little changed at $1.2960

The Japanese yen fell 0.2% to 158.44 per dollar

Cryptocurrencies

Bitcoin fell 1.3% to $62,969.75

Ether fell 1.4% to $3,388.53

Bonds

The yield on 10-year Treasuries declined five basis points to 4.18%

Germany’s 10-year yield declined three basis points to 2.44%

Britain’s 10-year yield declined four basis points to 4.06%

Commodities

West Texas Intermediate crude fell 1% to $81.13 a barrel

Spot gold rose 0.7% to $2,439.17 an ounce

Larry Fink Praises Bitcoin

Jim Cramer: I know you have been a leader and willing to embrace crypto. You have made it so people can be in Bitcoin. We hear you are thinking about Ethereum. BlackRock isn't known as a gunslinger by any means; you obviously must believe this is an alternative…

Larry Fink: Absolutely. As you know, I was a skeptic—I was a proud skeptic. I studied it, learned about it, and came away saying my opinion of 5 years ago was wrong. This is what I believe in today. I believe in the opportunity today. I believe Bitcoin is legitimate. I'm not trying to say there aren't issues—like everything else. It is a legitimate financial instrument that allows you to have uncorrelated returns. It is an instrument you invest in when you are more frightened. It is an instrument you invest in when countries are debasing their currency through excess deficits. Bitcoin is an opportunity to invest in something outside your country's control to give you more financial control. I believe there is a role for Bitcoin in portfolios. I believe it will be one of the asset classes we all look at. It is digital gold. There is a real need for everyone to look at it as one alternative to the optimism I have in the world. Bitcoin is not an instrument for hope, unless you are hopeful you will make a lot of money on it. I look at it as a vehicle for expressing your financial acumen regarding your fears about the world and existence. And there is a great industrial use for it, and a lot of people are missing that.

The ETH ETF Is In One Week!

I don’t want to jinx anything, knock on wood, but an Ethereum ETF launch during the market rebound is the ideal scenario. This means the launch would occur just two days before the Bitcoin conference, potentially uniting the two communities. In the past, there was strict guidance against discussing anything beyond Bitcoin, but with figures like Michael Saylor shifting towards Ethereum and other headliners getting involved, the landscape has changed. Next week is shaping up to be monumental across the board.

Trump Selects His VP

The crypto community seems pleased with Trump’s VP selection, U.S. Senator J.D. Vance from Ohio. Just a brief background on J.D. Vance: he is a Marine, author, venture capitalist with a background in tech and finance, and, best of all, a Bitcoin owner.

Some of the notable contributions J.D. Vance has made to this space include voting for SAB121 repeal, openly criticizing Gensler in open letters, backing Peter Thiel, and owning $250,000 worth of Bitcoin in 2022.

Once again, this is not a political endorsement - merely a statement on an individual’s crypto position.

Also, credit to PolyMarket for pricing this in before it was announced.

Bitcoin Rises Amid Chaos In The US - Will The Rally Continue?

Join Dave Weisberger, Mike McGlone, and James Lavish as we break down what's happening in macro and crypto!

My Recommended Platforms And Tools

Phemex - Exclusive for new users, earn up to 8800 USDT. Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '25OFF' for a 25% discount.

NGRAVE - ZERO is the most secure and user-friendly hardware wallet. If you aren't happy with your current crypto wallet, look no further than the ZERO.

Nord VPN - Get an exclusive NordVPN deal - 40% discount! It’s risk-free with Nord’s 30-day money-back guarantee. Protect your privacy.

Twitter - I spend most of my time on Twitter, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

TheWolfOfAllStreets.io - The most comprehensive collection of everything I have going on. Plus over 100 blogs and other exclusive content.

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.