Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Phemex!

Phemex is the most efficient crypto trading and investment platform. Phemex offers over 293 spot trading pairs, minimal fees, peer-to-peer trading, derivatives, up to 100x leverage, and $8,800 welcome rewards up for grabs! Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Make sure to check if Phemex is available in your jurisdiction.

In This Issue:

These Predictions Are Spot On

Bitcoin Thoughts And Analysis

Altcoin Charts

Legacy Markets

Germany Continues To Sell

The GOP Includes Crypto In Its Platform

More Bottom Signals

BlackRock’s BUIDL is Nearing $500m

The Case for Bitcoin: Escaping Government Control with Jeff Booth

These Predictions Are Spot On

I've encountered a wide range of predictions regarding inflows the Ethereum ETF will attract post launch. NONE of the predictions have been as thorough as what I am about to share from Galaxy and their new report titled, “Sizing the Market for the Ethereum ETF.”

I've discussed the ETH ETF extensively, so I'll quickly cover the highlights. If the ETH is a significant part of your portfolio, I highly recommend reading this report in its entirety—it's the most nuanced and critical analysis of the facts I've seen yet.

The Overview:

“The Bitcoin ETFs received $15.1bn in net inflows between launch (Jan. 11, 2024) and June 15, 2024.

We expect the net inflows into ETH ETFs to be 20-50% of the net flows into BTC ETFs over the first 5 months, with 30% as our target, implying $1bn/month of net inflows.

In general, we believe ETHUSD is more price sensitive to ETF inflows than BTC due to significant portions of ETH total supply locked in staking, bridges and smart contracts, and a lower amount on centralized exchanges.”

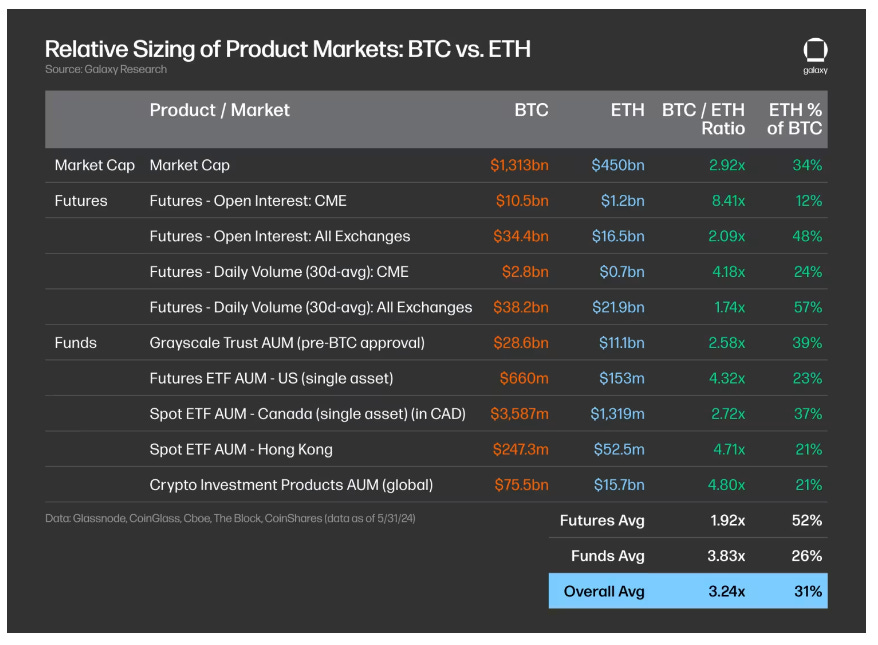

The basis of Galaxy’s prediction rests on various ratios of BTC/ETH.

From this chart, excluding the outlier where Bitcoin significantly surpasses Ethereum in “Futures - Open Interest: CME,” all ETH percentages of Bitcoin range between 21% and 57%. The market cap ratio sits at the sweet spot of 34%.

Another factor to consider is how supply will impact price appreciation.

“However, the actual market liquidity available to be purchased for ETFs is far less than the reported current supply. In our view, a better representation of the available market supply of each asset for ETFs would include adjustments for factors such as staked supply, dormant / lost supply, and supply held in bridges & smart contracts:”

“Applying discounted weightings to each of these factors to calculate an adjusted supply of BTC and ETH, we estimate that the available supply of BTC and ETH is respectively 8.7% and 14.4% less than their reported current supplies.”

Following this chart, Galaxy addresses the impact of staking not included in the launch, Grayscale’s ETHE outflows, and the basis trade before transitioning into a longer segment on price sensitivity. I skipped ahead to Galaxy’s conclusion on price sensitivity...

If Ethereum captures 30% of Bitcoin’s inflows, it should be considered a resounding success, given the unprecedented nature of Bitcoin’s ETF launch. Achieving similar or even slightly lower inflows should warrant comparable recognition and appreciation. What’s unique about Ethereum is the larger number of variables at play impacting inflows, not to mention market sentiment at launch, which is overlooked in just about every research report. Launching the ETH ETF amid a definitive market turnaround should not be underestimated.

That wraps up the Ethereum discussion. While strong sentiment leading up to and on launch day is ideal, the ETF's permanence is what truly matters. In six months or a year, the success of the launch will be a minor concern, mainly serving as just a benchmark for future ETFs.

Next, I'd like to analyze the majors to gauge how close they've come to completing a full round trip in terms of their prices since the beginning of the year. Do note that the current figures were taken yesterday afternoon.

Closing Prices On January 1, 2024—Current price (7/8/2024)—% Increase or Decrease

Bitcoin: $43,835—Today: $56,300 —Percent Increase: 28.4%

Ethereum: $2,352—Today: $2,996—Percent Increase: 27.3%

Solana: $109.5—Today: $138—Percent Increase: 65.29%

BNB: $314.4—Today: $506—Percent Increase: 60.9%

XRP: $0.6301—Today: $0.43—Percent Decrease: 31.7%

DOGE: $0.092—Today: $0.107—Percent Decrease: 16.3%

TON: $2.33—Today: $7.13—Percent Decrease: 206%

ADA: $0.62—Today: $0.37—Percent Decrease: 40.3%

LINK: $15.54—Today: $12.95—Percent Decrease: 16.7%

MATIC: $1.01—Today: $0.50—Percent Decrease: 50.5%

What you'll notice is that, apart from Bitcoin, Ethereum, Solana, and a few select winners, most altcoins have not only returned to their January 1st price levels but have fallen far below them—IN A BULL MARKET.

I could conduct more statistical analyses on previous bull market corrections and the relative strength of altcoins during these corrections, but to be honest, it wouldn't be worth our time. 99.95% of altcoins are unlikely to survive to the next cycle, and unless you're exceptionally lucky or skilled, your pick probably won't outperform Bitcoin, Ethereum, or Solana on any time frame.

Statistically, out of every 100 confident altcoin investors, about 95 will not see their expectations materialize.

If every altcoin investor were lined up shoulder-to-shoulder, and the five people on your left and the four on your right are just as confident as you. Out of all 10 of you, maybe one will succeed—or perhaps none. That's the nature of this game.

Lastly, before I sign off, I want to briefly expand on the concept of market bottoms being a process rather than an event. Bottoms are the result of gradual shift in investor sentiment, slow changes in key indicators like trading volume and on-chain metrics, and a period of price stabilization.

The key words here are gradual shift, slow changes, and a period. It takes time for the market to flush out leverage, absorb Germany's and Mt. Gox's Bitcoin (in our current case), and reach a price point that is finally attractive larger players. There has been plenty of positive news over the past few months, just not enough to outweigh the FUD. Since we are on the precipice of the market's biggest fears—Mt. Gox and Germany—it seems safe to say the market is attempting to form a bottom, it just hasn't yet found the strength to do so.

I promise I’ll return to more cohesive thought tomorrow.

Volatile markets create a volatile thought process.

Bitcoin Thoughts And Analysis

Bitcoin has bounced nicely off of the bottom, driven by oversold RSI and bullish divergence. I have showed this repeatedly, so it is not on today’s chart.

Now the question becomes whether this is simply a bounce or the beginning of a true reversal.

The 200 MA and previous range are all still above price as resistance, so I think it is too early to celebrate. But at least we have a nice start.

Most traders are really looking for a recapture of the range lows as support for “confirmation” that the correction is over.

From the all time high to the recent bottom, we STILL only have a 27% correction, nothing compared to even the average correction in previous bull markets. The difference for now is really the painful underperformance of altcoins, because they never really moved on the ETF approval. But that usually comes later in the cycle…

Altcoin Charts

For those who are new here, I share SETUPS and not SIGNALS. These are ideas that I am watching - if a certain thing happens, then the trade triggers. I am not telling you what to buy or when. I am showing you how I am watching certain charts and what has to happen for me to take a trade.

I am seeing a LOT of oversold coins with bullish divergence, all of which should recover nicely if Bitcoin continues to bounce. That said, not much out there for “confirmed” reversals. They are all still largely below resistance. For now, going to keep from sharing these charts.

Legacy Markets

US stocks are poised to reach another all-time high as investors look forward to Federal Reserve Chair Jerome Powell’s testimony to Congress on Tuesday for insights into future US interest-rate policy. Futures on the S&P 500 have risen following the benchmark's 35th record of the year, and Nasdaq 100 futures are also up ahead of Powell's address. Investors are particularly interested in any indications of when the Fed might cut interest rates, which would encourage those holding $6 trillion in money markets to invest in bonds and other assets.

Market sentiment is cautious, with skepticism about moving away from high-yield cash or money market investments. Markets are currently anticipating a 70% chance of two rate cuts this year, with the first expected in September. European stocks have slightly declined, with France’s CAC 40 underperforming due to concerns over increased government spending following recent elections.

In specific stock news, BP Plc saw a drop of over 3% after announcing a $2 billion impairment hit in second-quarter results, and Dassault Systemes SE fell after lowering its full-year earnings forecast. The US corporate earnings season starts on Friday with JPMorgan Chase & Co.'s results.

Key events this week:

China aggregate financing, money supply, new yuan loans, from Tuesday

Jerome Powell delivers semi-annual testimony to the Senate Banking Committee, Tuesday

US Treasury Secretary Janet Yellen testifies to the House Financial Services Committee, Tuesday

Fed’s Michael Barr and Michelle Bowman speak, Tuesday

China PPI, CPI, Wednesday

Jerome Powell testifies to the House Financial Services Committee, Wednesday

Fed’s Austan Goolsbee, Michelle Bowman and Lisa Cook speak, Wednesday

US CPI, initial jobless claims, Thursday

Fed’s Raphael Bostic and Alberto Musalem speak, Thursday

China trade, Friday

University of Michigan consumer sentiment, US PPI, Friday

Citigroup, JPMorgan and Wells Fargo’s earnings, Friday

Some of the main moves in markets:

Stocks

S&P 500 futures rose 0.2% as of 6:07 a.m. New York time

Nasdaq 100 futures rose 0.4%

Futures on the Dow Jones Industrial Average rose 0.1%

The Stoxx Europe 600 fell 0.1%

The MSCI World Index was little changed

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro was little changed at $1.0822

The British pound was little changed at $1.2810

The Japanese yen fell 0.1% to 161.01 per dollar

Cryptocurrencies

Bitcoin rose 2.5% to $57,640.01

Ether rose 3.3% to $3,095.83

Bonds

The yield on 10-year Treasuries was little changed at 4.28%

Germany’s 10-year yield advanced three basis points to 2.57%

Britain’s 10-year yield advanced three basis points to 4.15%

Commodities

West Texas Intermediate crude fell 0.5% to $81.89 a barrel

Spot gold rose 0.2% to $2,364.08 an ounce

Germany Continues To Sell

The decision-making among German officials who control the country’s Bitcoin holdings makes little to no sense. Two days ago, it was reported that Germany repurchased $111.5 million worth of Bitcoin. Now, I’m here covering the news that the country is back to selling, having sold 5,200 BTC ($297.3 million) on major exchanges just yesterday. In total, the German government now holds 23,787.7 BTC ($1.35 billion), which is less than half of the Bitcoin originally seized from Movie2k. I can’t wait for the German government to commence selling along with the Mt. Gox creditors and for the price of Bitcoin to revenge pump right after.

The GOP Includes Crypto In Its Platform

The Republican Party unveiled its 2024 policy platform titled “To the Forgotten Men and Women of America,” where cryptocurrency was explicitly highlighted under the category “Build The Greatest Economy In History.” While these two sentences are just a starting point, they mark an incredible beginning. The release was intended not as a comprehensive statement, but rather as a brief overview of key issues.

More Bottom Signals

Golem Network, one of the early Ethereum projects that offers a marketplace for decentralized computing power, has transferred $115 million worth (equivalent to 36,000 ETH) to major exchanges over the last 37 days. Golem has held this ETH since its 2016 ICO and has decided to sell now, eight years later, at what seems to be a very inopportune time. The project initially raised 820,000 ETH in November 2016 when ETH was priced at $10.20. Despite the recent sale, Golem still holds a significant amount of ETH, with various news outlets estimating their remaining balance between 231,400 and 126,000 ETH. Large entities selling means we are inching closer to a bottom.

BlackRock’s BUIDL is Nearing $500m

With only 16 holders, BlackRock’s premier tokenized treasury product, BUIDL, is just $9 million shy of crossing the $500 million mark. The minimum investment required to gain access to the fund is $5 million, and approximately three-fourths of the fund is owned by just five entities. Notably, Ondo Finance owns about 44.8% of the BUIDL fund. You can see some side-by-side comparisons below.

The Case for Bitcoin: Escaping Government Control with Jeff Booth

Jeff Booth, Entrepreneur and the Author of the bestseller The Price of Tomorrow, discusses the future of Bitcoin, and explains why he decided to quit fiat money and go all in into Bitcoin.

My Recommended Platforms And Tools

Phemex - Exclusive for new users, earn up to 8800 USDT. Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '25OFF' for a 25% discount.

NGRAVE - ZERO is the most secure and user-friendly hardware wallet. If you aren't happy with your current crypto wallet, look no further than the ZERO.

Nord VPN - Get an exclusive NordVPN deal - 40% discount! It’s risk-free with Nord’s 30-day money-back guarantee. Protect your privacy.

Twitter - I spend most of my time on Twitter, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

TheWolfOfAllStreets.io - The most comprehensive collection of everything I have going on. Plus over 100 blogs and other exclusive content.

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.