Welcome to The Wolf Den! This is where I share the news, my ideas about the market, technical analysis, education and my random musings. The newsletter is released every weekday and is completely FREE. Subscribe!

Today’s Newsletter Is Made Possible By Phemex!

Phemex is the most efficient crypto trading and investment platform. Phemex offers over 293 spot trading pairs, minimal fees, peer-to-peer trading, derivatives, up to 100x leverage, and $8,800 welcome rewards up for grabs! Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Make sure to check if Phemex is available in your jurisdiction.

In This Issue:

Spending Like A Drunken Sailor

Bitcoin Thoughts And Analysis

Altcoin Charts

Legacy Markets

Putting Predictions Into Perspective

Robinhood Is Exploring Crypto Futures

This Could be Epic

Pump.fun Is A Monster

Bitcoin's Turning Point: Is The Bottom Finally Here

Spending Like A Drunken Sailor

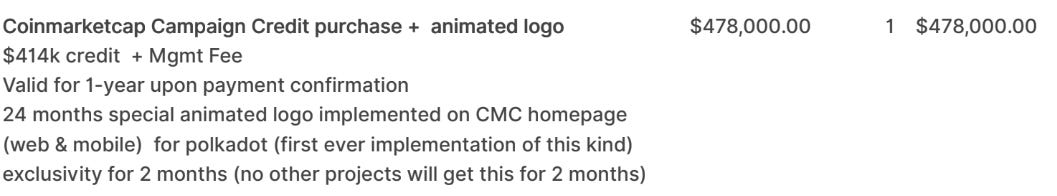

Polkadot released its financial report for the first half of the year, igniting a wave of anger in the community. The "2024-H1 Polkadot Treasury Report" revealed that $37 million, equivalent to 4.94 million DOT, was allocated to marketing expenses.

Here’s the breakdown of the spending that started the uproar:

From my point of view, this next image is actually more revealing.

Spending on outreach nearly doubled that of development.

Here’s some official text that explains the breakdown better:

"37m USD were spent on ‘outreach’. But what do we mean by that? Under outreach, we describe every spend that is intended to attract new users, developers, and businesses into the ecosystem. This spans from advertising and media, online and offline community building and events, to big conferences and business development."

Continued…

"In total, advertising makes up half (21m USD) of the outreach effort. Sponsorships (10m USD) include the 1m DOT (6.8m USD) sports sponsorship deal with a prestigious soccer club as well as sponsoring the race car driver Conor Daly (1.9m USD) and recently, a partnership with the e-sports tournament organizer HEROIC (1.3m USD). Influencers (4.9m USD) are covered through agencies such as EVOX (2.2m USD), Lunar Strategy (1.3m USD), Chainwire (490k USD), and Unchained (460k USD). Digital Ads (4m USD) are placed via CoinMarketCap (1m USD) and EVOX (900k USD)."

"Events add up to 7.9m USD, with 4.5m USD going to numerous conference attendances and side events (Polkadot Decoded China 560k, 540k for 3 {bash} parties, Token2049 side event 420k). The main events, Polkadot Decoded and Sub0 in total have been funded with 2.9m USD, although we need to consider that costs for those events should be summed up at the end of the year."

Polkadot, as shown in the chart below, sponsors a prestigious soccer club, a race car driver, and an e-sports organization, and has hosted three bash parties in the first half of the year.

Why wasn’t I invited?

Is the community right to be outraged?

Let’s examine the counterarguments.

First, it's crucial to note that the spending above is from the treasury, which is voted on by the community and has its own funding. The treasury holds $245 million, as shown below. This is not the only entity funding Polkadot; there is also the Web3 Foundation, though I couldn't find any of its disclosures.

There was some debate around the idea that the Treasury won’t just run out of money because funds come into it, but it doesn’t take a mathematician to understand that, at the current rate of spending, it can’t keep up. Polkadot’s head ambassador said the following in the report:

"At the current rate of spending, the Treasury has about 2 years of runway left, although the volatile nature of crypto-denominated treasuries makes it hard to predict with confidence. This has sparked discussions ranging from a stricter budgeting approach to a change in the inflation parameters of the system. Read the discussion at the end of this report to learn more."

It’s no longer a fire drill when the head ambassador is calling for a stricter budget.

I am trying to give Polkadot the benefit of the doubt on its spending, but it’s really a hard position to defend.

Let me be clear, I'm not arguing that marketing is a waste of resources and time. Major brands invest heavily in marketing for a reason—it's a proven method for achieving success. Polkadot is the 14th largest asset in this space and is not currently threatening Ethereum or Solana. Until it does, every last penny needs to be spent on innovation and development, not just getting the word out.

I often criticize tokenomics for failing their respective communities; what I didn’t know was that a community was this capable of failing itself.

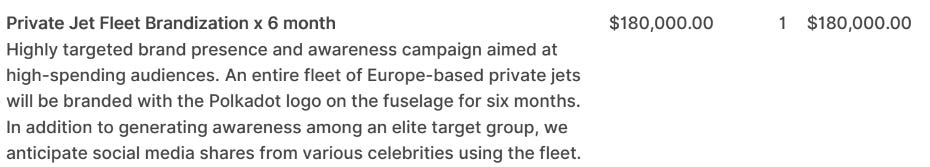

Before I’m criticized for this presentation, please keep in mind that the goal with this newsletter is simply to state the facts. Below are some additional facts regarding supply to consider.

As for Polkadot’s supply: 56.83% of the supply is unlocked while 43.17% is locked.

Compared to Solana: 89.47% of the supply is unlocked and 10.53% is locked.

That chart above is Polkadot’s unlock schedule, taken directly from CoinMarketCap. You can draw your own conclusions.

I feel like now would be the time to discuss all the innovation happening on Polkadot as a counter to some of the points addressed above. However, based on what I'm exposed to in the space, I don’t know much about it. Maybe that says something about the project, or maybe it means I need to find a guest to fill me in. I don’t know—again, come to your own conclusion.

On the bright side, I believe these conversations will spark dramatic change, hopefully for the better. Ironically, Polkadot is up almost 8% this week, and their spending release has generated a lot of free advertising, for better or worse. Additionally, I don't know of any other project or team as transparent as Polkadot with this release, which deserves high praise.

I visited the Ethereum Foundation and clicked on ‘report’, only to find one PDF dated back to 2022 with about a quarter of the spending disclosures that Polkadot provided us.

As for Solana, the Foundation page has some info on grants and funding, but the marketing budget is behind closed doors.

This might be a hot take, but I wouldn’t be surprised if Polkadot has better spending habits than many other projects out there. We simply won’t know because nobody else bothers to disclose this type of information.

Hope is not lost if Polkadot doesn’t spend like a drunken sailor in the second half of this year and an epic alt season arrives. In that case, maybe Polkadot needs to spend more.

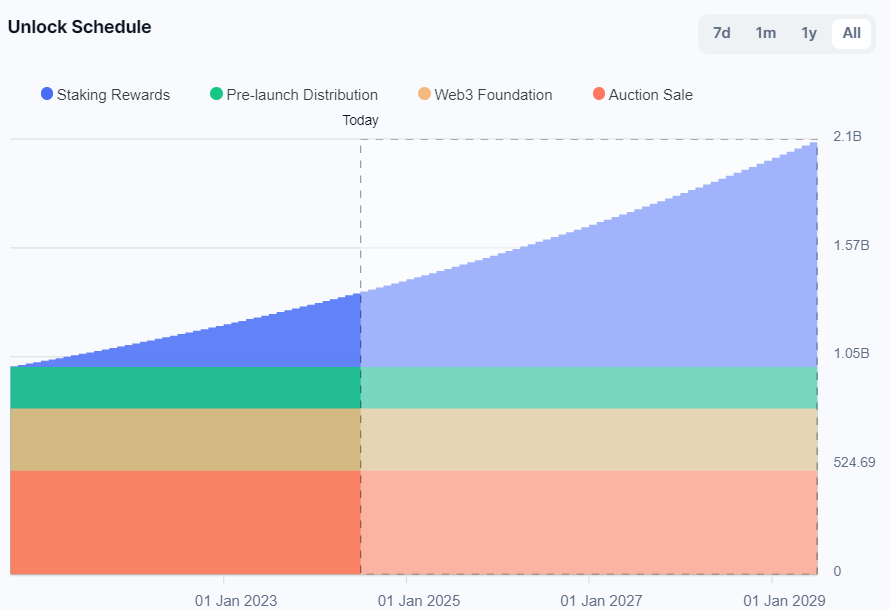

Bitcoin Thoughts And Analysis

We are close to the signal I have been watching for. If a daily candle closes below ~$60,300, we will likely get bullish divergence with RSI coming out of oversold on the daily. That would mean a lower low on price with a higher low on RSI.

RSI hit oversold for the first time since last August, when price was around $26,000.

Would need the close below and then a clear move up on RSI without making a lower low. It would take a hell of a move down (possible) for RSI to go lower than it did on June 24th.

This still looks like price is bottoming, which is a process.

Altcoin Charts

For those who are new here, I share SETUPS and not SIGNALS. These are ideas that I am watching - if a certain thing happens, then the trade triggers. I am not telling you what to buy or when. I am showing you how I am watching certain charts and what has to happen for me to take a trade.

I pointed out that a lot of alts looked liked they were bottoming yesterday and shared RUNE as an example. As I said, I wanted to see a close above $4.30 to confirm any sort of trade idea, which did not happen. Important that you always have a trigger and do not jump too early.

That said, this still looks the same, as do most alts. This drop is “scary,” but appears to be building more potential bullish divergence on a number of coins, if they make lower lows in price, and sending some further oversold. For now, I remain cautiously optimistic or at least interested in looking for some bottom signals on alts.

Nothing to do yet.

Legacy Markets

Key events this week:

Eurozone S&P Global Eurozone Services PMI, PPI, Wednesday

US Fed minutes, ADP employment, ISM Services, factory orders, initial jobless claims, durable goods, Wednesday

Fed’s John Williams speaks, Wednesday

UK general election, Thursday

US Independence Day holiday, Thursday

Eurozone retail sales, Friday

US jobs report, Friday

Fed’s John Williams speaks, Friday

Some of the main moves in markets:

Stocks

S&P 500 futures were little changed as of 7:04 a.m. New York time

Nasdaq 100 futures were little changed

Futures on the Dow Jones Industrial Average rose 0.1%

The Stoxx Europe 600 rose 0.9%

The MSCI World Index rose 0.2%

Currencies

The Bloomberg Dollar Spot Index was little changed

The euro rose 0.1% to $1.0761

The British pound rose 0.1% to $1.2702

The Japanese yen fell 0.3% to 161.95 per dollar

Cryptocurrencies

Bitcoin fell 2.8% to $60,210.05

Ether fell 3.2% to $3,304.6

Bonds

The yield on 10-year Treasuries was little changed at 4.43%

Germany’s 10-year yield advanced three basis points to 2.63%

Britain’s 10-year yield declined two basis points to 4.23%

Commodities

West Texas Intermediate crude was little changed

Spot gold rose 0.7% to $2,346.16 an ounce

Putting Predictions Into Perspective

The image is pretty self-explanatory. CAGR stands for compound annual growth rate. Some of those numbers are a little high, but a strong finish this year and an even better year next year could make some of those targets more feasible. For 2030, I think the third row is quite achievable. What do you think?

In line with this segment, Geoffrey Kendrick, the head of forex and digital assets research at Standard Chartered Bank, predicted that Bitcoin could hit $100,000 in November following a favorable election outcome and good news for miners. Standard Chartered loves their predictions, but I’m kind of on board with this idea if the election turns out favorable for crypto.

Robinhood Is Exploring Crypto Futures

Robinhood is ready to go all in on crypto. Following its recent acquisition of Bitstamp Ltd., the brokerage is now exploring crypto futures in both the U.S. and Europe for Bitcoin and other assets. For reference, the crypto futures market is far bigger than the spot market, with $3.69 trillion in May 2024 compared to $1.57 trillion in spot trading volumes. Robinhood is also considering launching CME-based futures for Bitcoin and Ether in the U.S.

All of this suggests that Robinhood doesn’t care about the Wells Notice—in a good way—and is determined to capture retail interest by any means necessary. If retail shows up as expected, Robinhood is going to soar.

This Could Be Epic

A handful of names are being considered as potential replacements for Gary Gensler if he resigns following a Trump election. The most obvious and favorable candidate has long been Hester Peirce. However, there is also speculation from those close to Trump that Dan Gallagher is in the running. Trump has not yet mentioned any names, likely waiting until after selecting his VP. Given Trump's stance that the SEC is “standing in the way of innovation,” it's expected that his pick will be very favorable. Dan Gallagher is currently the chief legal officer at Robinhood.

Pump.fun Is A Monster

The sheer magnitude of Solana’s memecoin explosion is hard to fathom. Yesterday, 11,500 tokens were deployed on Pump.fun, bringing the total number of tokens to a whopping 1.2 million. It feels like just yesterday the consensus was that the space had about 10,000 coins. Also impressive is that Pump.fun reached $1.99 million in revenue over the past 24 hours, surpassing the Ethereum network's daily revenue of $1.91 million. If you decide to participate, treat it like a casino.

Bitcoin's Turning Point: Is The Bottom Finally Here

Despite the upcoming massive distribution of 140,000 Bitcoins to Mt. Gox creditors, some analysts believe that the Bitcoin price has already hit the bottom and won't fall further. James Butterfill, the Head of Research at CoinShares joins me today to discuss this and more!

My friends from The Arch Public, Andrew Parish, and Tillman Holloway, are joining in the second part of the stream to provide an update on the $10K algorithmic portfolio.

My Recommended Platforms And Tools

Phemex - Exclusive for new users, earn up to 8800 USDT. Also for a limited time, if you mint your soul pass you will pay no gas fees and enjoy VIP benefits. Use MY LINK to get the rewards!

Arch Public - It’s a hedge fund in your pocket. Built for retail traders, designed to outperform Wall Street. Try emotionless algorithmic trading at Arch Public today.

Trading Alpha - Trade With Confidence! My new go-to indicator site and trading community. Use code '25OFF' for a 25% discount.

NGRAVE - ZERO is the most secure and user-friendly hardware wallet. If you aren't happy with your current crypto wallet, look no further than the ZERO.

Nord VPN - Get an exclusive NordVPN deal - 40% discount! It’s risk-free with Nord’s 30-day money-back guarantee. Protect your privacy.

Twitter - I spend most of my time on Twitter, contributing to CryptoTownHall every weekday morning, sharing random charts, and responding to as many of you as I can.

YouTube - Home of the Wolf Of All Streets Podcast and daily livestreams. Market updates, charts, and analysis! Sit down, strap in, and get ready—we’re going deep

TheWolfOfAllStreets.io - The most comprehensive collection of everything I have going on. Plus over 100 blogs and other exclusive content.

The views and opinions expressed here are solely my own and should in no way be interpreted as financial advice. Every investment and trading move involves risk. You should conduct your own research when making a decision. I am not a financial advisor. Nothing contained in this e-mail constitutes or shall be construed as an offering of financial instruments or as investment advice or recommendations of an investment strategy or whether or not to "Buy," "Sell," or "Hold" an investment.